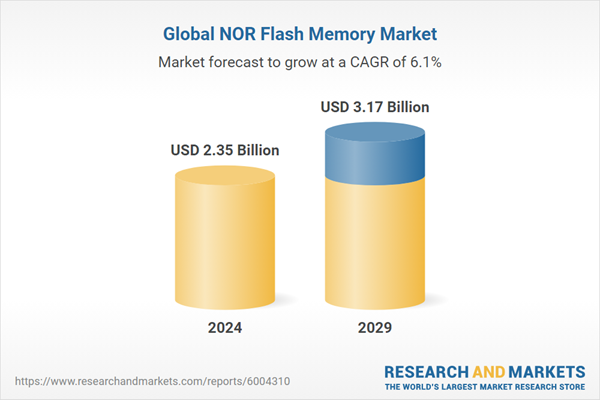

The global NOR flash memory market is projected to witness a compound annual growth rate of 6.14% to grow to US$3.173 billion by 2029, from US$2.355 billion in 2024.

NOR flash memory is a type of non-volatile memory used to store data for a range of applications like consumer electronics, automotive, and other similar segments requiring memory storage. Non-volatile memory devices do not require power to retain data in them.NOR flash memory has a wide range of applications. It is used in low-end embedded code storage applications like dashboard instrument clusters and advanced driver assistance (ADAS) systems in automotive segments. NOR flash memory is also highly used in applications where higher reliability is needed, like medical devices, which require remote monitoring in addition to diagnosis.

Driven by the increase in the demand for IoT devices, it is anticipated that the demand for NOR flash memory will increase in the coming years. Furthermore, the world witnessed a significant increase in consumer IoT demand, including AI home speakers like Alexa. According to Amazon, the company sold about half a billion Amazon Alexa devices worldwide till 2023 and recorded an increase of 35% in year-on-year sales. The governments of various countries like India are introducing various policies and schemes to invite major players and industry leaders to invest in their consumer electronics sector.

The increase in the sales of smartphones and other smart devices, including wearables, is also predicted to push the demand for the NOR flash memory forward. Generally, a smartphone uses a combination of both NAND and NOR flash memory systems for safe and faster memory transfer. In 2022, Macroniox International Co. Ltd.’s annual data revealed that the flash sales of the company encompassed 66.69% of their total sales, of which NOR flash accounted for about 55% of the total sales.

The low code storage applications are projected to propel the market growth of NOR flash memory in the forecast period. Growing technological advancements in the semiconductor industry are also projected to enhance the market lucrativeness of the NOR flash memory market. However, the high-density code storage application compatibility issues, along with higher costs compared to alternative solutions in the market, are projected to hinder the market growth during the predictive period.

NOR flash memory market growth can be restrained by various factors, including low storage density and the cost of the product. NOR flash memory offers lower storage density as compared to NAND flash memory. It also has a limited erase cycle, which generally affects the long-term reliability of devices that need frequent write operations.

Market Driver:

An increase in the demand for IoT devices is anticipated to boost the sales of the NOR flash memory.

Globally, the IoT industry witnessed significant growth in recent years. The IoT technology is integrated into various sectors, from the automotive to consumer electronics. In such devices, NOR flash memory is ideally installed for storing codes and firmware, as these are reliable.The governments of various countries are pushing for the development of IoT and IoT-enabled devices. For instance, the government of India aimed to fund about 80% of the total cost of research and development to about 1000 SMEs that are contributing to the IoT development. These policies will push the growth and development of the IoT industry in the nations, simultaneously creating an increase in the demand for the NOR flash memory system worldwide.

The demand for high-density code and memory storage, with low-cost alternatives, is anticipated to push the demand for NOR flash memory forward.

According to the March 2021 Technical Brief by KIOXIA corporation, 256 MB of NOR flash memory sells for about US$4.00 as compared to the 1 GB NAND flash memory, which sells for US$1.00. This leads to 4X cost savings and 4X larger capacities when NAND flash memory is used in place of NOR flash.Further, the release by KIOXIA Corporation stated that software with intelligent applications, advanced IoT devices, and faster communication protocols are driving the demand for cost-effective storage with higher-density code storage. The current requirements for application code storage have reached 1 gigabit or even more in capacity, which is also anticipated to fuel the market.

Asia Pacific is anticipated to hold a significant share of the global NOR flash memory market.

Asia Pacific region is anticipated to hold a significant market share in global NOR flash memory. This region is projected to witness high growth during the forecast period owing to the growing initiatives by the governments of various countries to push technological advancements in the nation.The Indian government launched a PLI scheme to boost the production of smartphones in the nation. According to the press release by the Indian government, this initiative made the nation the second biggest smartphone manufacturer in the world, with about 320 million smartphones manufactured in 2021-2022. The introduction of such policies from the government boosts the foreign direct investments in the country in the smartphone manufacturing landscape, introducing various new key players like TATA, Foxconn, and Samsung to invest and set up their manufacturing plants in the nation.

Similarly, the Indian government has also planned to invest heavily in the IoT-specific industry to boost the IoT landscape in the nation; under the ‘International IoT Research Collaboration Scheme’, the government will initiate and collaborate with other countries to generate a joint IoT research and development projects on 50% contribution basis. Such initiatives are also taken by various countries, like Vietnam, Taiwan, and China, in the region to boost their consumer electronics industry, which creates an increase in the demand for parts and components included in the manufacturing of such devices as smartphones and wearables.

Market Restraints:

Limited storage capability.

NOR flash memory accommodates code storage with 64 megabits (MB), 128 MB, 256 MB, and 512 MB capacities. This has led device designers to shift from embedded NOR, as SLC NAND is the only flash memory available that is cost-effective and supports many high-density code storage applications. Moreover, the high memory storage requirements by various end-user industries for code and memory are projected to replace NOR flash with NAND flash memory type.Market Developments:

- In April 2024, Macronix International Co. Ltd. introduced OctaFlash, which provides high-performance memory. The STM32H7R/S device is embedded with hexa-SPI and Octa-SPI, which comprises OctaFlash 8 I/O NOR and OctaRAM memories.

- In March 2024, Winbond launched a new extension of its TrustMe secure flash W77Q series, with 256MB, 512MB, and 1GB devices, that uses NOR flash drop-in replacement system.

Segmentation:

By Type

- Serial Nor Flash

- Parallel Nor Flash

By Industry Vertical

- Communication

- Consumer Electronics

- Automotive

- Manufacturing

By Geography

- North Americas

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe Middle East & Africa

- Germany

- France

- UK

- Spain

- Italy

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Taiwan

- Thailand

- India

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Infineon Technologies AG

- Micron Technology Inc.

- GigaDevice Semiconductor Inc.

- Macronix International Co., Ltd.

- Winbond

- Toshiba Corp.

- Intel Corporation

- SAMSUNG

- Seagate Technology LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | August 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 2.35 Billion |

| Forecasted Market Value ( USD | $ 3.17 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |