Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

India's robust agricultural sector stands as a cornerstone of the nation's economic growth trajectory, propelled by government initiatives aimed at promoting fertilizer use. Endowed with diverse climatic conditions and vast expanses of arable land, India boasts an agricultural landscape conducive to cultivating a wide array of crops, thereby driving significant demand for fertilizers. Central to India's agricultural strategy is the vision for self-sufficiency, underscored by initiatives like the 'Make in India' campaign, which actively promotes domestic production across various sectors, including fertilizers. In response, fertilizer companies are strategically aligning their operations to bolster domestic manufacturing capabilities.

A key strategy in this regard is the adoption of backward integration, wherein companies assume control over the entire production cycle, from raw material sourcing to final product manufacturing. This integrated approach empowers fertilizer manufacturers to optimize efficiency, quality, and cost-effectiveness across the production chain. By vertically integrating their operations, companies mitigate supply chain risks, reduce dependency on external suppliers, and ensure greater control over production processes. Moreover, backward integration fosters innovation and flexibility, enabling companies to adapt swiftly to changing market dynamics and consumer preferences.

The Indian fertilizer market is witnessing a sustained growth trajectory, buoyed by the country's steadfast commitment to agricultural self-sufficiency and the rising demand for food. As India continues to bolster its agricultural sector, fertilizers emerge as a linchpin in driving sustainable growth and ensuring food security. Against the backdrop of evolving agricultural practices and increasing environmental concerns, the fertilizer industry is poised to play an increasingly pivotal role in shaping India's agricultural landscape. The emphasis on domestic production not only strengthens India's economic resilience but also fosters job creation, technological innovation, and infrastructural development within the fertilizer sector. By nurturing a robust domestic manufacturing ecosystem, India endeavors to reduce import dependency, enhance competitiveness, and bolster its position as a global leader in agriculture.

In the current budget, the allocation for the Fertilisers Department stands at ₹1,64,150.81 crore, compared to ₹1,75,148.48 crore in the previous budget. However, in the Revised Estimates of the last financial year, it was ₹1,88,947.29 crore. Notably, the actual expenditure in 2022-23 amounted to ₹2,51,369.18 crore, with a significant portion attributed to payments for indigenous and imported urea. India's Fertilizer Policy remains pivotal in the nation's economic landscape, especially since the implementation of the New Economic Policy in 1991. Recent initiatives, such as the approval of a new DAP Subsidy amidst a rise in DAP prices, underscore the government's commitment to supporting agriculture, a cornerstone of India's economy. With India being the world's second-largest consumer of fertilizers, the sector plays a critical role in ensuring agricultural success and food security, further emphasized by policies like the City Compost Policy and the Nutrient Based Subsidy Scheme for Phosphatic & Potassic fertilizers.

In this paradigm, collaborations between government agencies, private enterprises, and research institutions are paramount. Strategic partnerships facilitate knowledge exchange, technology transfer, and capacity-building initiatives, thereby fostering an environment conducive to sustainable agricultural development. By harnessing the collective expertise and resources of stakeholders, India endeavors to overcome challenges, leverage opportunities, and chart a path towards agricultural prosperity. India's fertilizer market stands at the nexus of agricultural growth, economic development, and food security. With a concerted focus on domestic production, innovation, and sustainability, the fertilizer industry is poised to emerge as a cornerstone of India's agricultural resurgence, driving inclusive growth and prosperity across the nation.

Key Market Drivers

Growth in Agriculture Industry

Agriculture holds a pivotal position in India's economic landscape, serving as a cornerstone for employment generation and contributing significantly to the nation's GDP. Endowed with diverse climatic conditions and expansive arable land, India possesses immense potential for cultivating a wide variety of crops, driving the demand for fertilizers and propelling the growth of the industry. One of the primary catalysts fueling the India fertilizers market is the alarming decline in soil fertility. Decades of intensive farming practices have led to significant nutrient depletion in the soil, necessitating the application of fertilizers to replenish essential elements and enhance overall soil health.This pressing concern for maintaining soil fertility has spurred a robust demand for fertilizers, thereby driving market expansion. India's steadfast pursuit of achieving self-sufficiency in food production stands as another pivotal factor driving the fertilizers market's growth trajectory. The government has rolled out a slew of initiatives, including fertilizer promotion campaigns and farmer subsidy programs, to incentivize fertilizer usage and bolster the agricultural sector. These strategic interventions have not only galvanized market growth but also underscored India's commitment to fortifying its agricultural industry.

The agriculture sector in India is poised for continued growth, with promising progress seen in Rabi sowing, surpassing last year's figures. Exports of cereals and milled products surged, reflecting a 35.71% increase from April to December 2021 to the same period in 2022. Fiscal projections indicate a 3.5% growth for the Indian agriculture sector in FY 2022-23, further boosted by the country's emergence as a net exporter of agricultural products, with exports reaching $50.2 billion in FY 2022-23. Forecasts for 2023-24 show promising estimates across various crops, including Kharif Nutri/coarse cereals, rice, maize, pulses, oilseeds, sugarcane, cotton, and jute. Additionally, horticulture production is estimated to reach approximately 355.25 million tonnes, indicating a positive outlook for India's agriculture industry in the coming year.

Rapid technological advancements have ushered in a new era of agricultural innovation in India. The advent of agricultural technology (agtech) has opened avenues for enhancing productivity and efficiency within the sector. Precision farming techniques, enabled by Agtech solutions, optimize the judicious application of fertilizers, further amplifying demand for these essential inputs.

The robust expansion of India's agricultural sector serves as a linchpin propelling the fertilizers market's growth. The pressing issue of declining soil fertility, coupled with India's steadfast drive for food self-sufficiency, the transformative impact of Agtech solutions, and the escalating demand for food, collectively contribute to the market's remarkable trajectory. As India continues to prioritize agricultural development and invest in sustainable farming practices, the fertilizers market is poised for sustained and prosperous growth in the foreseeable future.

Surge in Technological Advancements

Technological advancements have fundamentally transformed the fertilizer industry, ushering in highly efficient and cost-effective methods for extraction and processing. As future projections indicate heightened competition for essential feedstock like ammonia, the industry is proactively devising new strategies to ensure sustainability and meet growing demand. A notable innovation in this realm is the emergence of smart fertilizers. These cutting-edge products possess the unique ability to release nutrients in response to the specific nutritional requirements of individual crops. By tailoring nutrient release to match crop needs, smart fertilizers significantly enhance nutrient utilization efficiency while minimizing losses.This targeted approach not only leads to improved yields but also reduces environmental impact, promoting sustainable agricultural practices. The adoption of smart fertilizers is driving significant growth in the Indian fertilizer market. As farmers increasingly prioritize high-quality and sustainable agricultural inputs, the demand for these innovative fertilizers continues to surge. This trend underscores the industry's potential for further expansion and innovation.

To capitalize on this opportunity, fertilizer companies are investing in research and development to enhance product offerings and meet evolving market needs. By leveraging technological advancements, such as precision agriculture techniques and data analytics, manufacturers can develop tailored fertilizer solutions that optimize crop nutrition and enhance overall agricultural productivity. Partnerships and collaborations between industry stakeholders, research institutions, and government agencies are fostering innovation and driving market growth.

These collaborative efforts aim to address key challenges facing the agricultural sector while promoting sustainable and environmentally friendly practices. Hence, technological innovations, particularly in the form of smart fertilizers, are driving significant advancements in the Indian fertilizer market. As the industry continues to evolve, fueled by growing demand for sustainable agricultural solutions, opportunities abound for further expansion and innovation. By leveraging technology and fostering collaboration, the fertilizer industry can play a crucial role in ensuring food security, promoting environmental sustainability, and driving economic growth in India..

Key Market Challenges

Complexities Associated with Soil Health and Nutrient Management

Soil health is paramount in agriculture as it directly impacts crop yield and quality. However, soil degradation caused by human activities poses a significant threat to soil health in India. This degradation stems from improper agricultural practices, industrial effluent mismanagement, and deforestation. A notable concern is the excessive use of chemical fertilizers, leading to nitrogen loss, adversely affecting air, soil, and water quality. This poses a considerable challenge to sustainable agriculture. The unbalanced application of fertilizers, common in South Asia, exacerbates the problem.Effective nutrient management presents another challenge for the Indian fertilizer market. Ongoing research aims to develop practices enhancing soil health and reducing nutrient loss. Yet, implementing these practices on a large scale remains challenging. Research indicates that site-specific nutrient management, tailoring fertilizer application to individual field needs, faces scaling challenges in Indian agriculture. Implementing personalized strategies at scale is complex and daunting, hindering nutrient management efforts. Sustainable soil management practices are imperative in India to ensure long-term agricultural productivity. Addressing soil degradation, nutrient management challenges, and scaling personalized strategies necessitates collaborative efforts among researchers, policymakers, and agricultural stakeholders.

Key Market Trends

Growing Demand of Organic and Bio-Fertilizers

The surge in organic and bio-fertilizers stems from their widespread adoption in both organic and conventional farming practices, fueled by heightened awareness of synthetic fertilizers' detrimental impacts on soil health and the environment. The prolonged use of chemical fertilizers has depleted soil fertility, prompting farmers to explore alternatives like organic and bio-fertilizers. Secondly, increasing consumer preference for organic produce encourages farmers to embrace organic farming methods reliant on such fertilizers. Thirdly, government initiatives advocating sustainable farming practices further drive demand for organic and bio-fertilizers.The escalating demand for these alternatives constitutes a significant and ongoing trend in India's fertilizer market. As the nation prioritizes sustainable agriculture, this trend is poised to strengthen, reshaping the sector toward greater environmental friendliness and sustainability..

Segmental Insights

Mode of Application Insights

The foliar spraying segment is projected to experience rapid growth during the forecast period. Foliar sprays are highly regarded for their exceptional responsiveness and remarkable ability to enhance crop yield and quality. By delivering essential nutrients directly to the plant through the leaves, bypassing the soil, these sprays facilitate faster absorption, resulting in rapid nutrient uptake. This expedited nutrient assimilation not only addresses deficiencies promptly but also promotes the cultivation of healthier crops, ultimately leading to higher yields.In addition to their nutritional benefits, foliar sprays have proven to be an effective means of disease control. They can be formulated with fungicides or other disease control agents, providing a dual advantage of nourishment and protection. This dual action makes foliar sprays an appealing choice for farmers who seek to optimize both the health and productivity of their crops. The escalating focus on sustainable agricultural practices, driven by increasing environmental consciousness, has heightened the demand for environmentally friendly solutions. Foliar fertilizers play a significant role in these sustainable practices by minimizing soil erosion and reducing nutrient runoff. Their targeted approach to fertilization helps reduce the likelihood of over-application and environmental contamination, further contributing to the preservation of our ecosystem.

Regional Insights

West India emerged as the dominated region in the India Fertilizers Market in 2024, holding the largest market share in terms of value. West India, with states like Maharashtra and Gujarat, is renowned for its rich and diverse agricultural practices, encompassing a wide range of crops. These include staple cereal crops such as rice and wheat, which form the backbone of the region's food production. Additionally, cash crops like cotton and sugarcane thrive in the fertile lands of West India, contributing significantly to the region's economy.In addition to cereal and cash crops, the region is also a hub for horticultural activities. The favorable climate and fertile soil support the cultivation of a variety of fruits, vegetables, and ornamental plants. From juicy mangoes to vibrant roses, West India offers a kaleidoscope of horticultural delights. The diversity and intensity of farming in West India create a strong demand for fertilizers, making it as prominent region in the fertilizer market. To meet this demand, the region hosts several major fertilizer manufacturing units that cater not only to the local needs but also contribute to the national fertilizer production.

Furthermore, West India's well-developed infrastructure plays a vital role in the efficient distribution and usage of fertilizers. The region's extensive network of roads, railways, and ports ensures seamless transportation and accessibility of fertilizers to farmers across the region.

Recognizing the importance of agricultural productivity, the government has been actively implementing initiatives to support farmers in West India. In a significant move, the Indian government revived five fertilizer manufacturing units in 2019, aiming to maximize domestic production and reduce dependence on imports. Such proactive measures not only boost the region's fertilizer market but also contribute to the overall growth and development of agriculture in West India. Thus, the West India stands as a powerhouse of agricultural and horticultural activities, driven by its diverse crop cultivation, robust fertilizer industry, efficient infrastructure, and government support. The region's contribution to the agricultural sector is instrumental in ensuring food security, economic growth, and sustainable development.

Key Market Players

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Rashtriya Chemicals and Fertilizers Limited

- Coromandel International Limited

- Tata Chemicals Limited

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

Report Scope:

In this report, the India Fertilizers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Fertilizers Market, By Crop Type:

- Grains & Cereals

- Pulses & Oilseeds

- Commercial Crops

- Fruits & Vegetables

- Others

India Fertilizers Market, By Mode of Application:

- Foliar Spraying

- Fertigation

- Sowing

- Drip Method

- Others

India Fertilizers Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Fertilizers Market.Available Customizations:

India Fertilizers Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Rashtriya Chemicals and Fertilizers Limited

- Coromandel International Limited

- Tata Chemicals Limited

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2024 |

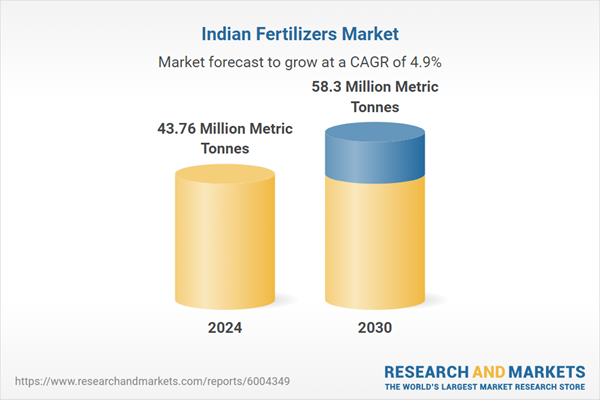

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 43.76 Million Metric Tonnes |

| Forecasted Market Value by 2030 | 58.3 Million Metric Tonnes |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 5 |