Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The United States Oil & Gas Infrastructure refers to the comprehensive network of facilities and systems designed to support the exploration, extraction, transportation, refining, and distribution of oil and gas resources. This infrastructure includes pipelines, storage tanks, refineries, and distribution networks that ensure the efficient movement and processing of petroleum products from production sites to end-users. The market for this infrastructure is poised to rise significantly due to several driving factors.

Firstly, the ongoing surge in domestic oil and gas production, driven by technological advancements such as hydraulic fracturing and horizontal drilling, has increased the demand for enhanced and expanded infrastructure to accommodate the growing volumes of hydrocarbons. Secondly, the aging infrastructure necessitates substantial investments in modernization and upgrades to meet safety, environmental, and efficiency standards.

Additionally, geopolitical and economic factors, including shifts in global energy markets and energy security concerns, are prompting increased investments in domestic infrastructure to reduce reliance on foreign energy sources and ensure reliable supply chains. Furthermore, legislative and regulatory support aimed at boosting energy independence and supporting sustainable energy practices contributes to the market's growth by encouraging investment in both new projects and the retrofitting of existing assets. As a result, the United States Oil & Gas Infrastructure Market is set to experience robust growth, driven by a combination of increasing production needs, infrastructure aging, and policy support aimed at strengthening the energy sector.

Key Market Drivers

Surge in Domestic Oil and Gas Production

The surge in domestic oil and gas production is a primary driver of growth in the United States Oil and Gas Infrastructure Market. The advent of advanced extraction technologies, particularly hydraulic fracturing and horizontal drilling has revolutionized the energy sector by unlocking previously inaccessible reserves. This technological evolution has resulted in a significant increase in the volume of oil and natural gas being extracted within the United States, thereby creating a heightened demand for infrastructure that can support and facilitate this expanded production.New production sites require robust and efficient infrastructure systems, including pipelines, storage facilities, and processing plants, to ensure the effective transportation, storage, and processing of extracted resources. Additionally, the increased production levels necessitate the development of new infrastructure projects and the expansion of existing facilities to handle the greater throughput and to mitigate potential bottlenecks in the supply chain. As domestic production continues to rise, driven by both technological advancements and favorable geological conditions, the need for comprehensive and modernized infrastructure becomes even more critical. This surge in production, therefore, directly propels the growth of the oil and gas infrastructure market, as stakeholders invest in the necessary physical assets to support and sustain high levels of output.

Aging Infrastructure and the Need for Modernization

The aging infrastructure within the United States is a significant driver for the oil and gas infrastructure market. Much of the existing infrastructure, including pipelines, refineries, and storage facilities, was constructed several decades ago and has since undergone considerable wear and tear. This aging infrastructure poses substantial challenges in terms of safety, efficiency, and environmental compliance. Consequently, there is a pressing need for modernization and replacement to meet contemporary standards and regulations.Upgrading infrastructure involves substantial investment in new technologies and materials to enhance operational efficiency, reduce maintenance costs, and improve safety standards. Modernization efforts also address environmental concerns by incorporating advanced systems that minimize leaks and emissions, aligning with stringent regulatory requirements. The need to upgrade aging infrastructure is therefore a key driver for market growth, as it stimulates investment in new projects and the refurbishment of existing assets. By prioritizing modernization, the industry not only enhances the reliability and efficiency of infrastructure but also ensures compliance with evolving environmental and safety standards, thereby driving market expansion.

Geopolitical and Economic Factors

Geopolitical and economic factors play a crucial role in influencing the growth of the United States Oil and Gas Infrastructure Market. Fluctuations in global energy markets, including changes in oil prices and shifts in supply and demand dynamics, impact the strategic priorities of energy infrastructure investments. For instance, periods of high energy prices often lead to increased investments in infrastructure to capitalize on profitable production opportunities, while lower prices may prompt a focus on efficiency and cost management.Additionally, geopolitical tensions and international trade policies can affect the stability and security of energy supplies, prompting a heightened emphasis on strengthening domestic infrastructure to mitigate risks associated with foreign dependencies. Economic factors such as government incentives, subsidies, and tax policies also play a significant role in shaping infrastructure investments. Legislative and regulatory frameworks that support energy independence and infrastructure development create a favorable environment for market growth. As the geopolitical landscape evolves and economic conditions fluctuate, the need for resilient and adaptable infrastructure becomes increasingly apparent, driving continued investment and expansion in the oil and gas infrastructure market.

Key Market Challenges

Environmental and Safety Regulations

The environmental and safety regulations pose a significant challenge for the United States Oil and Gas Infrastructure Market. As the industry expands and modernizes, it faces stringent regulatory requirements aimed at mitigating environmental impacts and ensuring safety standards. Regulatory bodies at both federal and state levels impose comprehensive guidelines to address issues such as emissions control, spill prevention, and waste management. Compliance with these regulations often requires substantial investments in advanced technologies and practices.For instance, infrastructure projects must incorporate systems designed to minimize greenhouse gas emissions and prevent leaks, which can lead to increased costs and longer project timelines. Additionally, regulatory changes and the introduction of new standards can create uncertainties and challenges for stakeholders. Companies must continuously adapt to evolving regulations, which may involve revising operational procedures, conducting extensive environmental impact assessments, and obtaining numerous permits. The complexity and cost of adhering to these regulatory requirements can hinder the pace of infrastructure development and increase the financial burden on industry participants. As the regulatory landscape becomes more stringent, the challenge of balancing operational efficiency with compliance becomes increasingly pronounced, affecting the overall growth and stability of the oil and gas infrastructure market.

Infrastructure Capacity and Technological Constraints

Infrastructure capacity and technological constraints present notable challenges for the United States Oil and Gas Infrastructure Market. The existing infrastructure network, including pipelines, storage facilities, and processing plants, may be insufficient to meet the growing demands of increased production and consumption. This mismatch between capacity and demand can lead to bottlenecks and operational inefficiencies, affecting the overall performance of the infrastructure system. Furthermore, technological constraints can limit the ability to upgrade or expand infrastructure effectively. The integration of new technologies, such as advanced monitoring and automation systems, requires significant investment and expertise.In some cases, outdated infrastructure may not be compatible with modern technologies, necessitating extensive retrofitting or replacement. Additionally, the development of new infrastructure projects is often hampered by logistical challenges, such as securing land, navigating regulatory approvals, and managing construction timelines. These factors can lead to delays and increased costs, impacting the market's ability to respond promptly to changing demands and technological advancements. Addressing these constraints requires a coordinated effort to enhance infrastructure capacity, invest in cutting-edge technologies, and streamline project execution processes to ensure the efficient functioning of the oil and gas infrastructure network.

Key Market Trends

Adoption of Advanced Technologies

The adoption of advanced technologies is a prominent trend in the United States Oil and Gas Infrastructure Market. Industry is increasingly integrating sophisticated technologies to enhance the efficiency, safety, and environmental performance of infrastructure systems. Innovations such as digital monitoring and control systems, automation, and predictive maintenance are becoming integral components of modern infrastructure projects. These technologies enable real-time monitoring of infrastructure health, allowing for early detection of issues and reducing the likelihood of costly failures.For example, advanced sensors and data analytics are used to monitor pipeline conditions and predict potential leaks or corrosion, thereby enhancing the reliability of transportation networks. Additionally, automation technologies streamline operations and reduce the need for manual interventions, improving overall efficiency and safety. The integration of advanced technologies also supports regulatory compliance by facilitating better emissions management and environmental monitoring. As the industry continues to embrace digital transformation, the adoption of these technologies is expected to drive significant improvements in infrastructure performance and sustainability, positioning the market for continued growth and innovation.

Increased Focus on Sustainability

An increased focus on sustainability is shaping the United States Oil and Gas Infrastructure Market. There is a growing emphasis on reducing the environmental impact of oil and gas operations and enhancing the sustainability of infrastructure systems. This trend is driven by regulatory pressures, investor expectations, and public demand for environmentally responsible practices. Companies are investing in technologies and practices that minimize carbon emissions, improve energy efficiency, and reduce waste. For instance, there is a shift towards using cleaner energy sources and incorporating renewable energy technologies within infrastructure projects.Additionally, the industry is adopting practices such as recycling and waste reduction to minimize environmental impact. The development of sustainable infrastructure also includes efforts to rehabilitate and repurpose existing assets to extend their lifecycle and reduce the need for new construction. This focus on sustainability is not only aligned with regulatory requirements but also enhances the industry’s reputation and supports long-term viability. As sustainability becomes a core business imperative, the oil and gas infrastructure market is likely to see continued investments and advancements in environmentally friendly technologies and practices.

Expansion of Infrastructure Networks

The expansion of infrastructure networks is a key trend in the United States Oil and Gas Infrastructure Market. As domestic production of oil and natural gas continues to rise, there is a growing need to expand and enhance infrastructure networks to support increased production and distribution. This trend involves the development of new pipelines, storage facilities, and processing plants to accommodate the growing volumes of hydrocarbons. The expansion efforts are also driven by the need to improve connectivity between production sites and end-users, ensuring efficient transportation and distribution of energy resources.Additionally, the expansion of infrastructure networks includes the development of new infrastructure in previously underserved or emerging regions, which can open up new opportunities for production and economic growth. This trend is further supported by government initiatives and investments aimed at enhancing energy security and infrastructure resilience. As the industry continues to grow and evolve, the expansion of infrastructure networks will play a crucial role in meeting increasing energy demands and supporting the overall development of the oil and gas sector.

Segmental Insights

Upstream Infrastructure Insights

In 2023, the Exploration and Production Facilities segment dominated the United States Oil and Gas Infrastructure Market and is expected to maintain its dominance throughout the forecast period. This segment encompasses the comprehensive infrastructure required for the exploration, extraction, and initial processing of oil and natural gas resources. The significant focus on expanding domestic production capabilities, driven by advancements in extraction technologies and increased drilling activities, has led to a heightened demand for robust exploration and production facilities.These facilities are crucial for accommodating the growing volumes of hydrocarbons being extracted and processed, including the installation of state-of-the-art equipment and systems to enhance operational efficiency and safety. As production levels continue to rise, driven by technological advancements such as hydraulic fracturing and horizontal drilling, the need for extensive and sophisticated exploration and production infrastructure becomes increasingly critical.

While drilling rigs and wellheads are essential components of the upstream infrastructure, the comprehensive nature and broad scope of exploration and production facilities make them the focal point of investment and development. This segment's ability to integrate various components of upstream operations, from initial exploration to production, positions it as the key driver of growth in the oil and gas infrastructure market. Consequently, the exploration and production facilities segment is anticipated to sustain its leading position, reflecting ongoing investments and the strategic emphasis on expanding and upgrading infrastructure to support the burgeoning domestic energy production.

Regional Insights

In 2023, the South United States region dominated the United States Oil and Gas Infrastructure Market and is expected to retain its dominance throughout the forecast period. This region's preeminence is largely attributed to its significant concentration of oil and natural gas production activities, particularly in states like Texas and Louisiana, which are pivotal to the nation’s energy landscape. The South United States benefits from extensive reserves of hydrocarbons and a well-established infrastructure network that supports exploration, production, and transportation activities.Additionally, the region's favorable geological conditions and advanced extraction technologies have bolstered its position as a leading hub for oil and gas operations. The South United States also hosts a large number of refineries and processing facilities, further cementing its role as a central player in the oil and gas infrastructure market. As the demand for domestic energy resources continues to grow, ongoing investments in expanding and upgrading infrastructure within this region are anticipated to sustain its dominant position. This includes enhancements to pipelines, storage facilities, and production plants to accommodate increased production and distribution needs. While other regions such as the Midwest, North-East, and West United States also contribute to the market, the South United States' extensive resource base, established infrastructure, and strategic investments ensure its continued leadership in the oil and gas infrastructure sector.

Key Market Players

- ExxonMobil Corporation

- Chevron Corporation

- Kinder Morgan, Inc

- Enterprise Products Partners L.P

- Williams Companies, Inc

- Enbridge Inc

- ONEOK, Inc

- Dominion Energy, Inc

- BP p.l.c

- Crestwood Equity Partners LP

Report Scope:

In this report, the United States Oil & Gas Infrastructure Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Oil & Gas Infrastructure Market, By Upstream Infrastructure:

- Exploration & Production Facilities

- Drilling Rigs

- Wellheads

United States Oil & Gas Infrastructure Market, By Midstream Infrastructure:

- Pipelines

- Storage Facilities

- Transportation Systems

United States Oil & Gas Infrastructure Market, By Support Infrastructure:

- Maintenance & Repair Services

- Control Systems

- Safety & Compliance Equipment

United States Oil & Gas Infrastructure Market, By Region:

- South US

- Midwest US

- North-East US

- West US

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Oil & Gas Infrastructure Market.Available Customizations:

United States Oil & Gas Infrastructure Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ExxonMobil Corporation

- Chevron Corporation

- Kinder Morgan, Inc

- Enterprise Products Partners L.P

- Williams Companies, Inc

- Enbridge Inc

- ONEOK, Inc

- Dominion Energy, Inc

- BP p.l.c

- Crestwood Equity Partners LP

Table Information

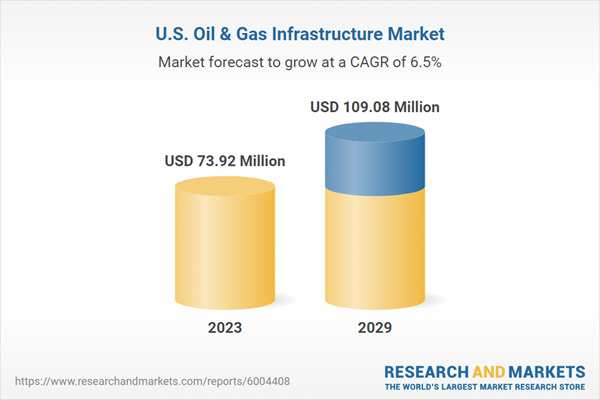

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 73.92 Million |

| Forecasted Market Value ( USD | $ 109.08 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |