Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion confronts a significant hurdle regarding the high capital expenditure necessary to retrofit legacy infrastructure and guarantee cross-border interoperability. The financial magnitude of this sector highlights the difficulty of investment; for instance, according to UNIFE, the train control systems segment alone accounted for an annual market volume of €22.3 billion in 2024. Consequently, the cost complexity associated with integrating modern digital solutions into aging rail assets remains a primary impediment to universal adoption.

Market Drivers

Robust government investments in high-speed rail and infrastructure modernization serve as a primary catalyst for the intelligent railway sector, as nations prioritize upgrading aging networks to meet safety and capacity requirements. These capital injections are crucial for deploying advanced signaling and control architectures that constitute the backbone of smart rail operations. For example, according to the Federal Railroad Administration in October 2024, the agency awarded over $2.4 billion in funding for 122 rail improvement projects to enhance safety and supply chain resilience across the United States. Such funding directly facilitates the integration of digital technologies necessary to modernize legacy systems, ensuring that physical infrastructure can support automated protection and real-time traffic management solutions.Simultaneously, the integration of IoT, big data analytics, and AI for predictive maintenance is fundamentally reshaping market dynamics by transitioning operations from reactive repairs to data-driven asset management. This digital transformation lowers lifecycle costs and improves fleet availability by utilizing real-time sensor data to predict component failures before they occur. A notable example of this trend is evident in the private sector; according to Alstom in July 2024, the company secured a contract valued at over €4 billion for the S-Bahn Cologne network, which explicitly includes predictive maintenance obligations over a 34-year term. The scale of these technological investments contributes to a broader industry resurgence; according to UNIFE in September 2024, the global rail supply market reached an average annual volume of €201.8 billion between 2021 and 2023, reflecting the critical momentum behind these intelligent systems.

Market Challenges

The high capital expenditure required to modernize legacy infrastructure acts as a substantial barrier to the growth of the intelligent railway transport system market. Integrating advanced signaling and sensor technologies with aging rail networks demands significant financial resources, which strains the budgets of operators and infrastructure managers. This cost complexity is particularly acute when projects involve retrofitting older physical assets to support digital interoperability, leading to delayed implementation timelines and hesitation in adopting comprehensive system upgrades.Financial constraints often force railway operators to prioritize essential maintenance over technological modernization, thereby slowing the market penetration of intelligent transport solutions. The magnitude of this financial burden is evident in recent industry spending reports regarding basic network upkeep. According to the Association of American Railroads, in 2024, major United States freight railroads projected spending approximately $23 billion on capital expenditures and maintenance to ensure network safety and efficiency. Such high baseline operational costs limit the available discretionary funds needed to deploy new digital systems, creating a restrictive environment for rapid market expansion.

Market Trends

The advancement toward high-level Autonomous Train Operations (ATO) is rapidly establishing itself as a dominant market trend, driven by the need for increased network capacity and reduced operational headways in dense urban environments. Unlike basic signaling upgrades, this shift involves deploying sophisticated Communication-Based Train Control (CBTC) systems that enable Grade of Automation 3 (GoA3) and GoA4, allowing trains to operate driverless or with minimal human intervention. This progression addresses critical labor shortages while maximizing the frequency of service on existing infrastructure. A significant indicator of this trajectory is evident in the United States; according to Railway-News in December 2024, the Metropolitan Atlanta Rapid Transit Authority (MARTA) awarded a contract worth $500 million to Stadler Rail to replace its existing signaling infrastructure with a new CBTC solution, marking a major step toward fully automated rail capabilities.Simultaneously, the deployment of 5G and the Future Railway Mobile Communication System (FRMCS) is transforming the connectivity landscape, replacing obsolete GSM-R protocols with high-bandwidth, low-latency networks. This transition is essential for supporting real-time video surveillance, critical operational data transmission, and the robust security frameworks required for modern digital railways. Operators are increasingly investing in these advanced telecommunication backbones to ensure secure and seamless interoperability across high-speed networks. For instance, according to Railway PRO in November 2024, Siemens Mobility secured multiple contracts for the UK's HS2 project with a combined value of approximately €670 million, which explicitly included the delivery of operational telecommunications and security systems to support the line’s digital infrastructure.

Key Players Profiled in the Intelligent Railway Transport System Market

- Siemens AG

- Hitachi Rail Ltd.

- Alstom SA

- Alstom

- CRRC Corporation Limited

- Thales Group

- Mitsubishi Electric Corporation

- ABB Ltd.

- Kapsch TrafficCom AG

- Wabtec Corporation

Report Scope

In this report, the Global Intelligent Railway Transport System Market has been segmented into the following categories:Intelligent Railway Transport System Market, by Devices & Components:

- Rail Sensors

- Smart Cards

- Video Surveillance Cameras

Intelligent Railway Transport System Market, by Solutions:

- Passenger Information System (PIS)

- Advanced Security Management System

Intelligent Railway Transport System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Intelligent Railway Transport System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Intelligent Railway Transport System market report include:- Siemens AG

- Hitachi Rail Ltd.

- Alstom SA

- Alstom

- CRRC Corporation Limited

- Thales Group

- Mitsubishi Electric Corporation

- ABB Ltd.

- Kapsch TrafficCom AG

- Wabtec Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

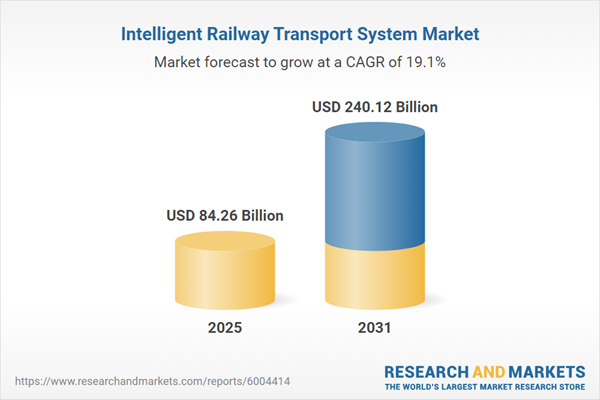

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 84.26 Billion |

| Forecasted Market Value ( USD | $ 240.12 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |