This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

With the continuous rise of smart vehicles, there is a growing requirement for advanced driver assistance systems equipped with high-resolution cameras to enhance safety and functionality. Moreover, heightened attention to road safety standards is fueling the adoption of automotive cameras, aimed at reducing accidents and improving overall driving experience. The vehicle consists of various cameras and signaling components integrated into the ADAS system and helps improve vehicle safety. Onboard cameras are important in identifying obstacles, especially in blind spot areas. Camera and signaling components are mounted on the vehicle's rear, sides, and front.

According to the World Health Organization, about 20 million to 50 million are injured and about 1.25 million people die each year in road accidents. The main cause of traffic accidents is the driver's carelessness and mistakes caused by fatigue. Governments in developing countries are imposing strict safety regulations on manufacturers equipping entry-level vehicles with onboard cameras. Strict safety regulations have also proven to be an advantage for occupants in the event of an accident to make a case against insurance companies.

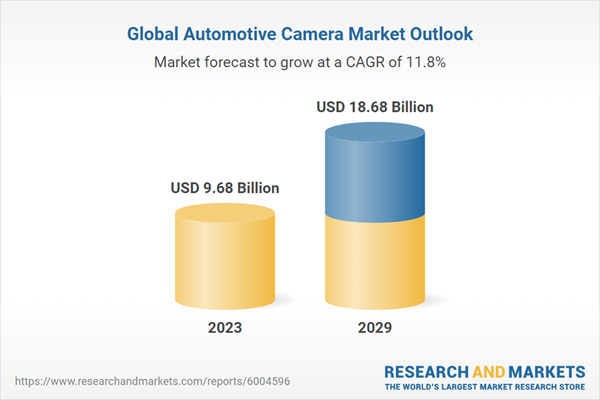

According to the research report "Global Automotive Camera Market Outlook, 2029" the Global Automotive Camera market was valued at more than USD 9.68 Billion in 2023, and expected to reach a market size of more than USD 18.68 Billion by 2029 with the CAGR of 11.83%. Factors such as increasing penetration of safety systems in vehicles and a high degree of competition among vendors for providing value-added services and products that cater to customer needs are likely to contribute to enhanced development in the market. However, high installation costs and malfunctioning camera components like sensors, modules, etc., are projected to act as potential challenges over the forecast period.

In March 2020, BMW launched plug-in hybrid 330e and 330e drive. Its ADAS includes active cruise control with stop and go, which can accelerate and slow automatically to maintain the desired speed set by the driver. It also has standard features such as active guard, frontal collision warning, city collision mitigation, and lane departure warning. Autonomous vehicles will heavily rely on automotive cameras as a crucial component of their sensor suite, providing high-resolution images and video feeds that enable the vehicle's AI system to detect and respond to its surroundings.

Automotive cameras will play a vital role in enhancing the safety and efficiency of autonomous vehicles by providing a 360-degree view of the vehicle's surroundings, detecting obstacles, and enabling features like lane departure warning, blind spot detection, and automatic emergency braking. The integration of cameras with AI algorithms will enable autonomous vehicles to interpret visual data, make informed decisions, and react accordingly, ensuring a safe and smooth driving experience.

In April 2024, Hyundai (South Korea) announced plans to conduct a major self-driving test in South Korea, featuring a L4 autonomous vehicle based on the Hyundai Ioniq 5. The test will cover 37.3 miles in Incheon, generating valuable data for commercialization and mass production. The Ioniq 5 is equipped with a mirror camera and a monocular camera, among other cameras, from Hyundai Mobis (South Korea).

Market Drivers

- Increasing Demand for Advanced Driver Assistance Systems: The primary driver of the automotive camera market is the escalating demand for ADAS, which includes features such as lane departure warning, collision avoidance, and blind spot detection. These systems rely heavily on camera technology to enhance vehicle safety and improve the driving experience. Governments worldwide are implementing stringent safety regulations that mandate the inclusion of ADAS features in new vehicles, leading to a surge in the adoption of automotive cameras. For instance, regulations requiring rear-view cameras have become common, further boosting market growth. As consumers become more safety-conscious, the demand for vehicles equipped with these advanced systems is expected to continue rising, thereby driving the automotive camera market.

- Rise of Autonomous Vehicles: The second major driver is the rapid development and testing of autonomous vehicles, which rely on sophisticated camera systems for perception and object detection. Autonomous vehicles require high-resolution cameras to navigate complex environments and make real-time decisions. As the automotive industry progresses towards fully autonomous driving, the demand for advanced camera technologies will witness substantial growth. This shift towards automation is prompting manufacturers to invest heavily in camera systems that can provide the necessary data for safe and efficient vehicle operation.

Market Challenges

- Regulatory Compliance: While regulatory mandates are a significant driver of growth, they also present challenges for manufacturers. Compliance with various safety standards can be complex and costly, particularly for companies operating in multiple regions with differing regulations. Ensuring that automotive cameras meet these stringent requirements while maintaining affordability is a critical challenge for OEMs and suppliers in the industry.

- Technological Integration: The integration of advanced camera systems with existing vehicle architectures poses another challenge. As vehicles become more technologically sophisticated, ensuring seamless communication between cameras and other vehicle systems (such as ADAS and infotainment) is essential. This requires significant investment in research and development, as well as collaboration among various stakeholders, including camera manufacturers, automotive OEMs, and software developers.

Market Trends.

Advancements in Camera Technology: Technological advancements are transforming the automotive camera market. Innovations such as higher resolution cameras, enhanced low-light performance, and advanced image processing capabilities are becoming standard. These improvements enable better object detection, recognition, and tracking, thereby enhancing the overall safety and performance of vehicles. The development of AI-based cameras is also gaining traction, as they can analyze real-time data to improve the functionality of ADAS and support autonomous driving capabilities.Growing Importance of Safety Features: There is a notable trend towards prioritizing safety features in vehicles, driven by consumer demand and regulatory pressures. As consumers become more aware of the benefits of advanced safety technologies, they are more likely to choose vehicles equipped with these features. This trend is particularly evident in the increasing adoption of ADAS technologies, which rely on automotive cameras for effective operation. Consequently, manufacturers are focusing on integrating more safety features into their vehicles to meet consumer expectations and comply with regulatory requirements.

Based on the report, the view type is segmented into Rear View, Front View, Side View and Surround View. Rear View leads the market due to regulatory mandates aimed at enhancing vehicle safety.

The rise of rear-view cameras in the automotive industry can be largely attributed to significant regulatory changes implemented globally to improve vehicle safety. Governments have recognized the alarming statistics surrounding back-over incidents, which often result in serious injuries or fatalities, particularly involving children and the elderly. In response, many countries, including the United States, have enacted laws requiring all new vehicles to be equipped with rear-view cameras. For example, the National Highway Traffic Safety Administration (NHTSA) in the U.S. mandated that all passenger vehicles must include rear-view cameras by 2018.This regulation has not only standardized safety features across the automotive landscape but has also created a robust market for rear-view camera systems. The result is a surge in demand as manufacturers are compelled to integrate these systems into their vehicles to comply with safety standards. The growing trend toward electric and autonomous vehicles (EVs and AVs) is another factor driving the rear-view camera market.

As these vehicles often come equipped with sophisticated ADAS, rear-view cameras play a crucial role in enhancing safety and supporting automated functions like self-parking and obstacle detection. The integration of rear-view cameras with other safety features, such as parking sensors and automated parking systems, has made them an essential component of modern vehicles. This convergence of technologies not only improves vehicle safety but also enhances the overall functionality of the vehicle, making it more appealing to consumers.

Based on the report, the vehicle type is segmented into Passenger Car, Light Commercial Vehicle, Electric Vehicles (EVs), Heavy Commercial Vehicle. Passenger Car leads due to the increasing adoption of advanced driver assistance systems and the growing consumer demand.

The integration of ADAS technologies in passenger vehicles has become increasingly prevalent in recent years. These systems, which rely heavily on camera inputs, provide a wide range of safety and convenience features, such as lane departure warning, blind spot detection, forward collision warning, and parking assistance. As consumers become more safety-conscious, the demand for vehicles equipped with ADAS has surged, driving the adoption of automotive cameras in the passenger car segment. Moreover, the growing trend towards electric and autonomous vehicles (EVs and AVs) has further boosted the demand for automotive cameras in passenger cars.EVs and AVs often come equipped with sophisticated ADAS, which require multiple cameras strategically positioned around the vehicle to provide comprehensive situational awareness. As the adoption of EVs and AVs continues to rise, the need for advanced camera systems in passenger vehicles will only increase. The increasing affordability of advanced safety features has made them more accessible to a broader range of consumers. As automotive manufacturers continue to integrate ADAS into their mid-range and entry-level passenger car models, the market for automotive cameras has expanded significantly.

This trend has been particularly evident in emerging markets, where the growing middle-class population and rising disposable incomes have fueled the demand for vehicles with advanced safety features. Many countries have enacted laws requiring the installation of rear-view cameras in all new vehicles to enhance safety and reduce the risk of back-over incidents. These regulations have standardized the inclusion of automotive cameras across the passenger car segment, contributing to its market dominance.

Based on the report, the technology type is segmented into Digital, Infrared and Thermal. Digital leads the market due to its ability to provide high-resolution imaging, advanced processing capabilities, and essential integration with advanced driver assistance systems.

The automotive camera market is rapidly evolving, with digital technology at its forefront, primarily driven by the increasing demand for safety and driver assistance features in vehicles. Digital cameras offer significant advantages over traditional analog systems, including superior image quality, faster processing speeds, and enhanced functionality.These features are crucial for the effective operation of ADAS, which rely on real-time data from cameras to assist drivers in various situations, such as parking, lane keeping, and collision avoidance. As consumers become more safety-conscious, the demand for vehicles equipped with these advanced systems has surged, propelling the growth of digital automotive cameras.

For instance, in the United States, the NHTSA has mandated that all new passenger vehicles must include rear-view cameras to reduce the risk of back-over accidents. This regulatory push has created a robust market for digital cameras, as they are the preferred choice for meeting these safety standards. Recent innovations have led to the development of high-resolution cameras capable of capturing detailed images in various lighting conditions, including low-light environments. These advancements enhance the effectiveness of ADAS, enabling features such as night vision and improved object detection.

For example, the introduction of new CMOS image sensors with higher megapixel counts allows for better clarity and precision in monitoring the vehicle's surroundings. As manufacturers continue to invest in research and development, the capabilities of digital cameras are expected to expand further, solidifying their position in the automotive camera market.

Based on the report, the application type is segmented into ADAS (Lane Assistance, Collision Avoidance, and Blind Spot Detection), Park Assist System and Others (Driver Monitoring Systems).

ADAS leads due to the increasing emphasis on vehicle safety, regulatory mandates, and consumer demand for enhanced driving experiences.

The automotive landscape is undergoing a transformative shift, with ADAS technologies becoming a cornerstone of modern vehicle design and functionality. This shift is largely driven by the urgent need to improve road safety, as statistics indicate that a significant percentage of traffic accidents are attributable to human error. ADAS aims to mitigate these risks by utilizing camera systems to provide real-time data and feedback to drivers, enhancing their situational awareness and enabling proactive safety measures. For instance, lane assistance systems utilize cameras to monitor lane markings and provide alerts or corrective steering inputs if the vehicle begins to drift out of its lane.Similarly, collision avoidance systems rely on cameras to detect potential hazards, triggering automatic braking or evasive maneuvers to prevent accidents. This proactive approach to safety is resonating with consumers, who are increasingly prioritizing safety features when purchasing vehicles. Modern automotive cameras are equipped with high-resolution imaging capabilities, advanced processing algorithms, and enhanced connectivity features that allow them to operate effectively in various environmental conditions.

These innovations enable cameras to perform complex tasks such as recognizing traffic signs, detecting pedestrians, and assessing distances to other vehicles with remarkable accuracy. The rising trend of electrification and automation in the automotive sector is driving the demand for ADAS technologies. As manufacturers develop electric and autonomous vehicles, the need for sophisticated camera systems that can facilitate safe and efficient driving becomes paramount.

Based on the report, the distribution channel is segmented into OEM and Aftermarket. OEM leads the market due to their ability to integrate advanced camera systems seamlessly into vehicle designs, ensuring optimal performance and safety.

OEMs play a crucial role in driving the growth of the automotive camera market by leveraging their expertise in vehicle engineering and design. They work closely with camera manufacturers and technology providers to develop customized solutions that cater to the specific needs of their vehicle platforms. This collaboration allows OEMs to incorporate advanced camera systems into their vehicles in a way that enhances overall functionality, safety, and user experience. For instance, OEMs can strategically position cameras around the vehicle to provide comprehensive situational awareness, enabling features like blind spot detection, lane departure warning, and 360-degree surround view parking assistance.By optimizing the placement and integration of these cameras, OEMs ensure that they operate effectively and provide reliable data to the vehicle's ADAS and autonomous driving systems. This level of integration is essential for achieving the desired performance and safety standards set by OEMs and regulatory bodies. OEMs also contribute to the growth of the automotive camera market by investing in research and development to stay ahead of the curve. They work closely with camera manufacturers and technology providers to develop next-generation camera systems that offer enhanced performance, reliability, and functionality.

For example, OEMs are exploring the integration of artificial intelligence (AI) and machine learning algorithms into camera systems to enable advanced object recognition, pedestrian detection, and traffic sign interpretation. These advancements not only improve the effectiveness of ADAS but also pave the way for more sophisticated autonomous driving capabilities. By continuously innovating and pushing the boundaries of what automotive cameras can achieve, OEMs are shaping the future of the industry and driving the adoption of these technologies.

Asia Pacific is leading the automotive camera industry primarily due to its robust vehicle production capabilities, increasing adoption of advanced safety systems, and significant government support for automotive innovation.

The Asia Pacific region, particularly countries like China, Japan, and South Korea, is at the forefront of the automotive camera market, projected to be the largest by 2030. This dominance can be attributed to several interrelated factors that create a conducive environment for growth in this sector. First and foremost, the sheer volume of vehicle production in Asia Pacific is unparalleled.China, as the largest automotive market globally, has seen a consistent rise in vehicle sales, with millions of passenger cars sold annually. This high production rate naturally leads to an increased demand for automotive cameras, which are integral components in modern vehicles equipped with advanced driver-assistance systems (ADAS) and safety features.

As consumers become more safety-conscious, the demand for vehicles equipped with advanced safety technologies, such as lane departure warnings, collision avoidance systems, and parking assist features, has surged. This shift in consumer preference has prompted automotive manufacturers to integrate more sophisticated camera systems into their vehicles. For instance, the implementation of active safety systems, which utilize cameras for functions like blind spot detection and adaptive cruise control, has become a standard offering in many new models.

The Asia Pacific automotive camera market is particularly influenced by the increasing installation of these safety systems in mid-range vehicles, making advanced safety technology accessible to a broader audience.For example, China has upgraded its New Car Assessment Program (NCAP) to enhance safety standards, which has directly influenced the demand for automotive cameras. The regulatory environment encourages manufacturers to innovate and adopt advanced technologies, thereby fostering a competitive landscape that benefits the automotive camera industry.

- In March 2024, ZF Friedrichshafen AG (Germany) acquired a 6% stake in the South Korean software company StradVision, an artificial intelligence-based vision processing technology for autonomous vehicles and ADAS. The acquisition extends ZF’s autonomous driving perception and sensor fusion capabilities.

- In January 2024, Valeo (France) collaborated with Teledyne FLIR LLC (US), part of Teledyne Technologies Incorporated, to bring thermal imaging technology to the automotive industry to enhance the safety of road users.

- In January 2024, Continental AG (Germany) unveiled Face Authentication Display, a two-stage access control system based on biometric user recognition, which uses special camera systems mounted externally on the vehicle’s B-pillar and behind the driver display console. With biometric face authentication, the vehicle unlocks and starts upon detecting a registered user while enabling driver monitoring for enhanced safety.

- In December 2023, Valeo (France) launched the first remanufactured windshield-mounted video camera at Valeo's Circular Electronics Lab.

- In October 2023, Denso Corporation (Japan) collaborated with Koito Manufacturing Co., Ltd. (Japan) to develop a system to improve the object recognition rate of vehicle image sensors at night.

- In September 2023, Robert Bosch GmbH (Germany) launched standalone camera heads at the IAA Mobility 2023. It enables ADAS functionality from SAE levels 0 to 4 and includes 3 and 8 MP versions that are scalable up to 12 MP. The standalone camera heads include a tele camera, front and rear cameras, a camera wing-back, a camera wing front, and a new range camera.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Automotive Camera market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By View Type

- Rear View

- Front View

- Side View

- Surround View

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Electric Vehicles (EVs)

- Heavy Commercial Vehicle

By Technology

- Digital

- Infrared

- Thermal

By Application Type

- ADAS (Lane Assistance, Collision Avoidance, Blind Spot Detection)

- Park Assist System

- Others (Driver Monitoring Systems)

By Sales Channel

- OEMs

- Aftermarket

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Automotive Camera industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Valeo S.A.

- Continental AG

- Magna International Inc.

- Panasonic Corporation

- DENSO Corporation

- STONKAM CO.,LTD.

- Gentex Corporation

- Pioneer Corporation

- OmniVision Technologies Inc.

- Blaupunkt GmbH

- Veoneer

- KYOCERA Corporation

- Teledyne Technologies Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 212 |

| Published | September 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 9.68 Billion |

| Forecasted Market Value ( USD | $ 18.68 Billion |

| Compound Annual Growth Rate | 11.8% |

| Regions Covered | Global |