This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The use of gaskets is very important in many cases, but the seal sales are more significant. It is generally because the seals are diversified in many applications. Gaskets and seals are used in oil refineries, heavy industrial machinery and fuel injectors in engines as they resist extreme temperatures and pressures. Technological advancements are happening along with rapid industrialization, leading to advancements in electronic appliances. The requirement for lightweight and efficient gaskets and seals is providing new opportunities. Gaskets are used in many sectors like pulp & paper, oil & gas, electric production, and transport. One of the common applications for the seals is to avoid leakage.

There is an increase in cases of leakage in the industrial units, which leads to substantial loss in health risks and property damage, which can be controlled using seals and gaskets. In sectors like the automotive, marine, and aerospace sectors, where thorough detailing is necessary for the efficiency and performance of machines, the requirement for spares and engine parts is crucial.

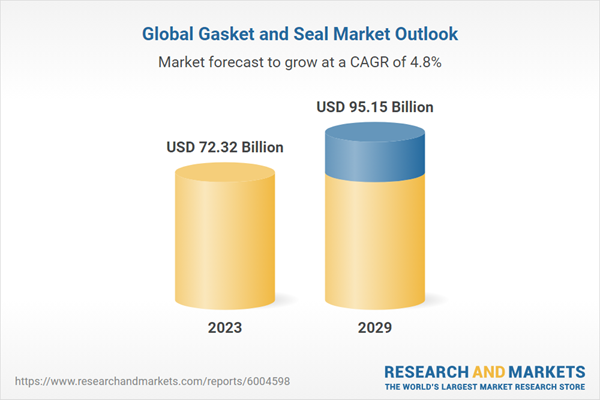

According to the research report "Global Gasket and Seals Market Outlook, 2029" the Global Gasket and Seals market was valued at more than USD 72.32 Billion in 2023, and expected to reach a market size of more than USD 95.15 Billion by 2029 with the CAGR of 4.78%. The rising demand for gaskets and seals in electric vehicles (EVs) is driven by several factors contributing to their critical role in EVs' performance, efficiency, and longevity. Gaskets and seals in EV batteries protect against dust, moisture, and heat. They maintain the integrity of the battery pack by preventing external contaminants from entering and internal fluids from leaking out.

Gaskets and seals help maintain the battery's integrity by preventing electrolytes and other fluids from leaking outside the battery pack in case of a rupture. This containment is critical for both safety and environmental protection. Effective thermal management is vital for the optimal performance of EV batteries, electric motors, and power electronics. Gaskets and seals are used to manage and dissipate heat effectively. Seals help maintain proper thermal insulation and protection from temperature extremes.

In addition, the utilization of advanced materials in the production of gaskets and seals for key applications, including chemical processing, medical equipment, and aircraft manufacturing, is expected to drive product growth over the forecast period. Furthermore, the market for gaskets and seals is likely to benefit from the increasing growth of the products for reducing vibrations in electrical & electronic components.

Additionally, the automotive industry, particularly with the rise of electric vehicles, is increasing the need for these components to maintain battery integrity and prevent fluid leaks. The chemical and petrochemical industries also contribute significantly to market growth, as gaskets and seals are vital for operational efficiency and contamination prevention. The expansion of the manufacturing sector enhances the demand for these components across various applications.

Market Drivers

- Increasing Demand in the Industrial Sector: The expansion of industries such as automotive, aerospace, oil and gas, and chemical processing is a major driver for the gaskets and seals market. These components are essential for preventing leaks and ensuring seamless operations, which in turn boosts demand for reliable sealing solutions as these sectors grow.

- Technological Advancements: Innovations in materials and manufacturing processes are enhancing the performance of gaskets and seals. New technologies allow for the production of high-performance solutions that can withstand extreme conditions, thereby improving reliability and efficiency across various industrial applications. This trend is crucial for meeting the diverse requirements of modern industries.

Market Challenges

- Changes in Automotive Engine Designs: The shift towards new automotive engine technologies, such as BS4 engines in developing countries, complicates inventory management for manufacturers. This transition necessitates the production of different seals and gaskets, leading to difficulties in selling older inventory, which can result in significant financial losses.

- Long Sales Cycles: The gaskets and seals market is characterized by long sales cycles, which can delay revenue generation for manufacturers. This aspect can hinder the ability of companies to respond quickly to market changes and customer demands, impacting overall growth.

Market Trends

- Growing Infrastructure Projects: The global expansion of infrastructure projects, including construction and transportation, is driving demand for gaskets and seals. These components are critical in applications such as building construction and HVAC systems, which underscores their importance in maintaining structural integrity and longevity.

- Rising Use of Advanced Materials: The market is witnessing a shift towards the use of advanced materials in gasket and seal production. These materials not only enhance performance but also cater to specific industry needs, such as chemical resistance and durability. The increasing integration of technologies like 3D printing is also expected to revolutionize production processes, offering customization and efficiency.

- Regulatory Compliance: Stringent regulations regarding emissions and safety are propelling the demand for efficient sealing solutions. Industries are increasingly seeking gaskets and seals that ensure compliance with environmental standards, highlighting the growing importance of sealing technology in operational safety.

Based on the report, the product is segmented into Seals and Gasket. Seals lead due to their diverse applications across multiple sectors, particularly in automotive and industrial machinery.

The dominance of seals over gaskets in the gasket and seals industry can be attributed to their versatility and essential functionality in a wide range of applications. Seals are designed to create a barrier that prevents the escape of fluids and gases, which is crucial in many industrial and automotive settings. For instance, in the automotive sector, seals are used extensively in engines, transmissions, and fuel systems to prevent leaks that could lead to performance issues, safety hazards, and environmental concerns. As vehicles evolve, particularly with the rise of electric vehicles (EVs), the demand for advanced sealing solutions has surged.Seals in EVs are vital for protecting battery packs from moisture and contaminants, ensuring thermal management, and maintaining the integrity of the battery, which is crucial for safety and efficiency. This growing trend in the automotive sector is a significant driver for the seals market. The industrial sector's expansion, driven by increasing manufacturing activities and infrastructure development, further propels the demand for seals. As industries seek to enhance productivity and sustainability, the need for reliable sealing solutions becomes paramount, making seals indispensable. Technological advancements have also played a crucial role in the growth of the seals market.

Innovations in materials and manufacturing processes have led to the development of high-performance seals that can withstand extreme temperatures, pressures, and harsh chemicals. For example, seals made from advanced polymers or composite materials can offer superior resistance to wear and tear, thereby extending the lifespan of machinery and reducing maintenance costs.

Based on the report, the application is segmented into Automotive, Industrial Machinery, Aerospace, Oil and Gas, Electrical and Electronics, Food and Beverage, Others. Automotive leads due to the critical role these components play in ensuring the safety, efficiency, and reliability of vehicles.

The automotive industry's dominance in the gaskets and seals market can be attributed to several factors. First and foremost, gaskets and seals are essential components in vehicles, used extensively in various systems such as engines, transmissions, fuel systems, and cooling systems. These components create a tight seal between mating surfaces, preventing fluid and gas leaks that can lead to costly damage, safety hazards, and environmental concerns. As vehicles age, there is an increased demand for replacement gaskets and seals to maintain optimal performance and reliability. The rapid growth of the automotive industry, particularly in emerging markets like China, India, and Southeast Asia, is driving the demand for gaskets and seals.As vehicle production increases to meet the growing consumer demand, the need for these critical components rises proportionally. Additionally, the shift towards electric and hybrid vehicles has created new opportunities for gasket and seal manufacturers. Electric vehicles require specialized sealing solutions to manage temperature systems, battery packs, and electric drivetrains, further boosting the market. The growing emphasis on vehicle safety and reliability by both consumers and regulatory organizations has driven the demand for high-quality gaskets and seals.

These components are vital for preventing leaks, maintaining fluid integrity, and ensuring the proper operation of critical vehicle systems. As automakers strive to meet demanding safety standards and improve vehicle reliability, the need for dependable sealing solutions continues to rise, further solidifying the automotive industry's position as the leading market for gaskets and seals.

Based on the report, the material type is segmented into metallic and Non-metallic. Non-metallic leads due to their superior flexibility, chemical resistance, and lightweight properties.

The prominence of non-metallic gaskets and seals in the industry can be attributed to several key advantages that these materials offer over their metallic counterparts. Non-metallic gaskets are typically made from materials such as elastomers, advanced fibers, and plastics, each providing distinct benefits that enhance performance and application versatility. For instance, elastomeric gaskets, which are made from rubber-like materials such as silicone and neoprene, are known for their excellent flexibility and resilience. This allows them to create effective seals even in dynamic applications where movement and vibration are present.Many non-metallic materials are engineered to withstand exposure to harsh chemicals, oils, and other aggressive substances, making them suitable for use in industries such as oil and gas, chemical processing, and pharmaceuticals. For example, plastic-based gaskets, including those made from Polytetrafluoroethylene (PTFE), are particularly valued in environments where chemical compatibility is essential. Their non-reactive nature ensures that they do not degrade or compromise the integrity of the sealing surface, thereby enhancing safety and operational efficiency. The lightweight nature of non-metallic gaskets and seals is another factor contributing to their market leadership.

In sectors like aerospace and automotive, where weight reduction is crucial for improving fuel efficiency and performance, non-metallic components provide a significant advantage. For instance, the use of lightweight sealing solutions in aircraft can lead to lower fuel consumption and increased payload capacity, which are critical considerations in aviation design and operation.

Based on the report, the application is segmented into OEMs and Aftermarket. OMEs lead due to their critical role in supplying essential components for various applications across multiple sectors.

The dominance of OEMs in the gasket and seals market stems from their integral position in the manufacturing supply chain. OEMs produce parts and products that are essential for the assembly of larger systems, making gaskets and seals indispensable components in their operations. These components are crucial for ensuring the integrity and functionality of machinery and vehicles. For instance, in the automotive sector, gaskets and seals are vital for preventing leaks of fluids such as oil, coolant, and fuel, which can lead to severe operational issues and costly repairs. The automotive industry relies heavily on OEMs to provide high-quality sealing solutions that ensure vehicles operate efficiently and safely.As vehicle designs evolve, particularly with the rise of electric and hybrid models, the demand for innovative gasket and seal solutions has surged, further solidifying the OEMs' position in the market. In addition to automotive applications, OEMs serve a wide array of industries, including aerospace, industrial machinery, and electrical appliances. Each of these sectors has unique sealing requirements that OEMs must meet to ensure optimal performance.

For example, in aerospace, seals must withstand extreme temperatures and pressures while maintaining reliability over long operational periods. This necessitates the use of advanced materials and manufacturing techniques, driving innovation within the gasket and seals market. As OEMs invest in research and development to create tailored sealing solutions, they enhance their competitive edge and contribute to the overall growth of the market.

Asia Pacific is leading in the gasket and seals industry primarily due to its rapid industrialization, significant automotive production, and increasing demand for sealing solutions across various sectors.

The Asia Pacific region's dominance in the gasket and seals market is a multifaceted phenomenon driven by several interrelated factors. First and foremost, the region has experienced unprecedented industrial growth over the past few decades. Countries such as China and India have emerged as global manufacturing hubs, significantly contributing to the demand for gaskets and seals. This industrial expansion is fueled by the increasing production of machinery, vehicles, and consumer goods, all of which require reliable sealing solutions to ensure operational efficiency and safety. For instance, in China, the automotive sector is booming, with the country being the largest producer of vehicles globally.This surge in automotive manufacturing directly correlates with heightened demand for gaskets and seals, which are essential for preventing leaks in engines, transmissions, and fuel systems. The Asia Pacific region is witnessing a substantial increase in infrastructure development, which further drives the demand for gaskets and seals. Governments in countries like India are investing heavily in infrastructure projects, including transportation, energy, and utilities. These projects require various sealing solutions for pipelines, HVAC systems, and construction applications, thereby propelling market growth.

The region's growing urbanization and rising living standards also contribute to the increased demand for durable and efficient sealing products in residential and commercial construction. The Asia Pacific region benefits from a robust supply chain and the availability of raw materials. Countries like Thailand are leading producers of natural rubber, which is a key material for manufacturing rubber gaskets and seals. This local availability of materials reduces production costs and ensures a steady supply of components to meet the growing demand.

- In December 2023: Trelleborg, through its business unit Trelleborg Sealing Solutions, acquired MNE Group, which consists of organizations like Materials Nano Engineering and Materials Nano Solution. MNE group was focused on manufacturing high-performance speciality seals used in semiconductor production equipment. Through MNE Group, the organization is gaining many customer contacts with some of the largest semiconductor manufacturers. It will eventually help the organization expand its gaskets and seals market share.

- In June 2023, Pipeotech launched its new seal product, 304L stainless steel DeltaV-Seal, for nitric acid service. The product will help reduce the frequency of changing gaskets in fertilizer plants. This, in turn, will reduce maintenance costs and increase the function time of the plants.

- October 2022: The Erith Group, a provider of high-end designed sealing systems, began manufacturing industrial seals and gaskets for customers all over the world from its manufacturing hub in Ras Al Khaimah.

- In August 2022, Trelleborg Sealing Solutions launched its new HMF FlatSeal product range. It is a flat gasket suitable for static sealing in high and low-temperature applications. In addition, the range includes several materials used in industries including automotive, aerospace, food & beverage, oil & gas, pharmaceutical, and chemical processing.

- September 2019, Freudenberg Sealing Technologies has developed a new conductive seals to ensure a lasting electrical connection between housings and shafts while also preventing bearing damage.

- June 2019, Freudenberg Sealing Technologies introduced new material and sealing innovations that are designed for aerospace industry to increase safety and performance requirements in the industry.

- May 2018, Federal-Mogul Powertrain developed a piston ring eLine™ for commercial vehicle diesel engines that will enhance gas sealing capability, also enhancing engine efficiency, increased robustness and lower emissions.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Gasket and Seals market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product

- Seals

- Gaskets

By Application

- Automotive

- Industrial Machinery

- Aerospace

- Oil and Gas

- Electrical and Electronics

- Food and Beverage

- Others

By Material Type

- Metallic

- Non-Metallic

By End User

- OEMs

- Aftermarket

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Gasket and Seals industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Dana Incorporated

- AB SKF

- Cooper Standard Holdings Inc

- Trelleborg AB

- Daetwyler Holding AG

- Flowserve Corporation

- ElringKlinger AG

- Tenneco, Inc.

- BRUSS Sealing Systems GmbH

- Freudenberg SE

- Amg Sealing Limited

- Smiths Group plc

- Boyd Corporation

- Hexpol AB

- Parker-Hannifin Corporation

- Garlock

- NOK Corp

- Aesseal Plc

- Flexitallic

- Technetics Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | September 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 72.32 Billion |

| Forecasted Market Value ( USD | $ 95.15 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |