This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The creation and use of sleep technology solutions have been considerably aided by ongoing technological developments, such as the miniaturization of sensors, improvements in data analytics, and the widespread use of smartphones and wearables. These developments have improved the usability and accessibility of sleep tracking and analysis. Smartwatches and fitness trackers are two examples of wearable technology that have significantly increased in popularity among customers. These gadgets frequently come packed with sleep tracking capabilities. The expanding use of wearable technology has increased consumer acceptance of sleep technology and created new industry prospects.

The government has started public education, training for clinicians, and surveillance and monitoring campaigns to raise awareness of sleep disorders and improve diagnosis and treatment. A few countries have likewise started different partnership projects to support the medical care experts working on sleep medication. These kinds of programs aim to make healthcare professionals more aware of sleep disorders.

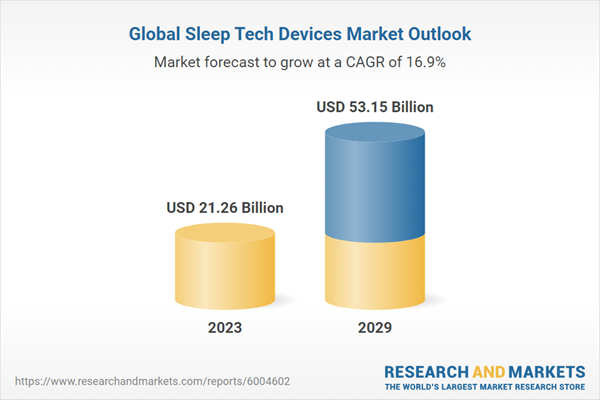

According to the research report "Global Sleep Tech Market Outlook, 2029" the Global Sleep Tech market was valued at more than USD 21.26 Billion in 2023, and expected to reach a market size of more than USD 53.15 Billion by 2029 with the CAGR of 16.85%. The demand for sleep tech devices is primarily being boosted by the increasing patient population suffering from various sleep disorders such as insomnia, obstructive sleep apnea, and others, the surge in cases of depression, increasing number of risk factors such as obesity and smoking among others associated with causing poor sleep, rise in the number of sleep awareness campaigns and programs highlighting the importance of sleep, and innovation in product development among others.

One of the key factors influencing the growth of the sleep tech devices market is the increasing prevalence of sleep disorders such as insomnia, sleep apnea, and others coupled with a rise in risk factors such as depression, obesity, and COPD among others is affecting sleep quality. As per DelveInsight analysis, in 2023, the total diagnosed prevalent cases of insomnia were estimated to be approximately 85,968,021 cases in the 7MM region which includes the US, France, Germany, Italy, Spain, UK, and Japan. According to World Health Organization 2021, worldwide around 280 million people were suffering from depression in 2019.

For instance, in September 2022, National Campaign titled “Sleep is Good Medicine” was launched by the American Academy of Sleep Medicine to increase public education about the importance of sleep and its connection to health. Similarly, the Safe to sleep campaign by the US Department of Health and Human Services intends to educate millions of caregivers including parents, grandparents, babysitters, childcare providers, healthcare providers, and others about ways to reduce the risk of Sudden Infant Death Syndrome (SIDS) and other sleep-related causes of infant death.

The rising geriatric population base will fuel market growth in sleep tech. Geriatric populations are vulnerable to rising chronic diseases such as cardiovascular disease and high blood pressure. Such diseases are known to cause metabolism to act inappropriately, which can lead to changes in rhythm and breathing patterns. Such changes include disruptive sleeping habits as a major consequence.

Market Drivers

- Increasing awareness of sleep health: There is a growing awareness of the importance of quality sleep for overall health and well-being. Sleep tech devices provide individuals with insights into their sleep patterns and help them understand the impact of sleep on their health. This increased awareness drives the demand for sleep tech devices as people seek to improve their sleep habits.

- Growing investment in healthcare facilities: Surging focus on improving the condition of healthcare facilities and improving the overall healthcare infrastructure is another important factor fostering the growth of the market. The rising number of partnerships and strategic collaborations between the public and private players about funding and application of new and improved technology further creates lucrative market opportunities.

Market Challenges

- Accuracy and reliability: Sleep tech devices use sensors and algorithms to track and analyze sleep data. However, ensuring the accuracy and reliability of these devices can be a challenge. Variations in individual sleep patterns, device placement, and environmental factors can affect the accuracy of sleep measurements. Manufacturers need to continually improve the precision and reliability of their sleep tech devices to gain user trust and confidence.

- User compliance and engagement: Sleep tech devices require users to wear or place the device consistently during sleep. However, user compliance can be challenging as some individuals may find wearing or using sleep tech devices uncomfortable or inconvenient. Additionally, maintaining user engagement over time can be difficult, as individuals may lose interest or forget to use the device regularly. Manufacturers must focus on designing user-friendly, comfortable, and engaging sleep tech devices to overcome these challenges.

Market Trends

- Rise of Non-Wearable Sleep Tech Solutions: There is a notable trend towards the development of non-wearable sleep tech solutions, such as smart beds and sleep monitoring systems integrated into home environments. These devices offer a more unobtrusive way to track sleep patterns compared to traditional wearables. The growing consumer preference for seamless integration of sleep technology into daily life is likely to drive the demand for these innovative solutions.

- Integration with Smart Home Technology: The convergence of sleep tech with smart home systems is another emerging trend. As consumers increasingly adopt smart home devices, sleep tech products that can communicate and interact with these systems are gaining traction. For example, sleep tech devices that adjust lighting, temperature, or sound based on sleep patterns can enhance the overall sleep environment. This trend not only improves user convenience but also positions sleep tech as an integral part of holistic health and wellness solutions.

Based on the report, the product type is segmented into wearable and non-wearable. Wearable sleep tech devices, lead the sleep tech market due to their convenience, widespread adoption, and ability.

Wearable sleep tech devices have become increasingly popular due to their convenience and ability to provide insights into sleep patterns without the need for specialized equipment. These devices, which include smartwatches, fitness trackers, and other wearable technologies, are designed to be worn during sleep and track various parameters such as sleep duration, sleep stages, heart rate, breathing patterns, and movement. As wearable technologies have become more affordable and accessible, they have gained significant popularity among consumers.Many people already own smartwatches or fitness trackers for their general health and fitness benefits, and the inclusion of sleep tracking features in these devices has made it easier for users to monitor their sleep without the need for additional equipment. Moreover, wearable sleep tech devices offer a convenient and unobtrusive way to track sleep patterns. Unlike traditional sleep monitoring methods, which often require users to sleep in a laboratory setting or use bulky equipment, wearable devices are designed to be comfortable and easy to use.

Users simply need to wear the device during sleep, and it will automatically collect and analyze the relevant data. In addition to their convenience and widespread adoption, wearable sleep tech devices have also benefited from the rapid advancements in technology. As wearable devices have become more sophisticated, they have been able to incorporate more advanced sensors and algorithms to provide more accurate and detailed sleep data.

Based on the report, the application is segmented into Insomnia, Obstructive sleep apnea, Narcolepsy, Others. Insomnia applications are leading the sleep tech industry primarily due to their ability to provide personalized, accessible, and evidence-based solutions.

The rise of insomnia applications can be attributed to several interrelated factors that cater to the growing need for effective sleep management tools. The prevalence of insomnia has surged, with studies indicating that up to 30% of adults experience symptoms of insomnia at some point in their lives. This growing recognition has created a substantial demand for effective solutions, propelling insomnia applications to the forefront of the sleep tech market. These applications leverage advanced technology to offer users personalized insights into their sleep patterns, helping them identify triggers and develop better sleep hygiene practices.Unlike traditional sleep therapies that may require in-person consultations or specialized equipment, these apps can be downloaded directly onto smartphones or tablets, allowing users to access sleep management tools anytime and anywhere. This convenience is particularly appealing to individuals who may be hesitant to seek help for their sleep issues due to stigma or the inconvenience of scheduling appointments. Many insomnia applications also incorporate features such as guided meditations, cognitive behavioral therapy (CBT) techniques, and sleep tracking, which empower users to take control of their sleep health without the need for external intervention.

For instance, cognitive behavioral therapy for insomnia (CBT-I) has been shown to be highly effective in treating insomnia, and many apps incorporate CBT-I principles to help users address the underlying causes of their sleep difficulties. This evidence-based approach not only improves user outcomes but also fosters trust in the application, encouraging more individuals to utilize these tools.

Based on the report, the distribution channel is segmented into Sleep Centers & Fitness Centers, Hypermarkets & Supermarkets, E-Commerce, Pharmacy & Retail Stores and Others. Sleep centers and fitness centers leads due to their role in providing specialized, professional services that integrate advanced sleep monitoring technologies.

The prominence of sleep centers and fitness centers in the sleep tech market can be attributed to several key factors that align with the increasing recognition of sleep health as a vital component of overall well-being. Sleep centers are equipped with sophisticated diagnostic tools and technologies, such as polysomnography (PSG), which allow for comprehensive assessments of sleep disorders.

These facilities not only diagnose conditions like sleep apnea and insomnia but also provide tailored treatment plans that may include the use of advanced sleep tech devices. By offering a blend of clinical expertise and cutting-edge technology, sleep centers can deliver a level of care that is often unattainable through consumer-grade devices alone.

In addition to sleep centers, fitness centers are increasingly incorporating sleep health into their wellness offerings. Many fitness facilities recognize that sleep quality is closely linked to physical performance and recovery. By offering sleep tracking devices, educational workshops, and personalized sleep coaching, fitness centers are tapping into a growing market of health-conscious consumers who are eager to improve their sleep quality.

For instance, patients diagnosed with sleep apnea at a sleep center can be referred to a fitness center that offers tailored fitness programs and sleep improvement strategies, thereby enhancing their overall health outcomes. This integrated approach is particularly appealing to consumers who are looking for a one-stop solution for their health and wellness needs.

North America is leading the sleep tech industry primarily due to its high prevalence of sleep disorders, significant consumer awareness regarding sleep health, and the presence of major market players that drive innovation and product development.

The dominance of North America in the sleep tech market can be attributed to a confluence of factors that create a robust environment for the growth of sleep technology solutions. First and foremost, the region has one of the highest rates of sleep disorders, with approximately 50 to 70 million adults in the United States alone suffering from conditions such as insomnia, sleep apnea, and restless leg syndrome. As per the National Center for Health Statistics under the Centers for Disease Control and Prevention 2022, about 14.5% of adults faced trouble falling asleep and around 17.8% of adults had trouble staying asleep in the US in 2020.The presence of key market players, such as Eight Sleep, Casper, and Philips, fosters a competitive landscape that encourages continuous innovation and the introduction of new products tailored to meet consumer needs. The source also stated that in 2020 about 17.1% of women and 11.7% of men in the US faced trouble falling asleep. American Sleep Apnea Association 2023 stated that nearly 84 million people which means one in three American adults do not get the required uninterrupted sleep regularly. Coupled with the surge in cases of sleeping disorders, the rising focus of companies on launching new products in the region will accelerate the demand for sleep tech devices.

For example, in September 2019, Dreem, a sleep tech company, launched the second version of its AI-enabled sleep-tracking headband and companion app, Dreem 2 in the United States. Thus, due to the increase in demand for sleep tech devices in the region, there will subsequent rise in the growth of the sleep tech devices regional market during the forecast period.

- In April 2023, LG Electronics and Asleep, a South Korean sleep-tech AI firm that specializes in sleep diagnostics, teamed together to develop next-generation smart home appliances that are tailored and optimized for the unique sleep circumstances of individual customers.

- In July 2022, the introduction of the Boult Drift and Boult Cosmic Smartwatches in India signifies Boult Audio's foray into the wearable market.

- In May 2022, According to Sleep Disorders Facts and Statistics, 50-70 million individuals in the US suffer from sleep disorders, and the incidence of these conditions follows a similar trend. Such factors are observed to promote the growth of the sleep tech devices market.

- In February 2022, Xiaomi launched Redmi Smart Band Pro which is the latest fitness band by the brand in India. It brings health features like Heart rate monitoring. SPO2 tracking, sleep monitoring, women's health tracking, and stress tracking.

- In August 2021, ResMed, a global leader in digital health and sleep apnea treatment, launched AirSense 11, the company’s next-generation PAP (positive airway pressure) device designed to help hundreds of millions of people worldwide with sleep apnea.

- In June 2021, Huawei launched the HUAWEI Watch 3 Pro which measures daily and weekly records of step count, periods of activity, calories burned, sleep quality, stress levels, and other activities.

- In 2020, Philips launched the SmartSleep Deep Sleep Headband, a wearable device that uses audio tones to enhance deep sleep. It is designed to help individuals improve the quality of their sleep and wake up feeling refreshed.

- In August 2020, Nihon Koden, announced launching of "Polysmith 12 Polysomnography Software". The new product's version 12 of the Polysmith software involves more than 40 market-driven features for sleep specialists to improve workflow analysis and outcomes.

- In September 2019, Koninklijke Philips N.V. announced launching of "Philips NightBalance", a new prescription-based sleep position therapy device designed for patients suffering from OSA. The new product is clinically-validated positional therapy utilizing gentle vibrations to encourage users to alter their sleep positions and prevent different apneas.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Sleep Tech Device market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product Type

- Wearable

- Non-Wearable

By Application

- Insomnia

- Obstructive sleep apnea

- Narcolepsy

- Others (restless leg syndrome, parasomnias, or general sleep health)

By Distribution Channel

- Sleep Centers & Fitness Centers

- Hypermarkets & Supermarkets

- E-Commerce

- Pharmacy & Retail Stores

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Sleep Tech Device industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Koninklijke Philips N.V.

- Apple Inc.

- Compumedics Limited

- ResMed Inc.

- Huawei Technologies Co., Ltd

- Garmin Ltd.

- Withings

- Xiaomi Corporation

- Fossil Group, Inc.

- Oura Health Oy

- Casper Sleep Inc.

- Masimo Corporation

- Fisher & Paykel Healthcare Corporation Limited

- Inspire Medical Systems, Inc.

- Nihon Kohden Corporation

- SomnoMed

- Tempur Sealy International, Inc.

- Mediflow Inc.

- Emfit Ltd

- Eight Sleep

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | September 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 21.26 Billion |

| Forecasted Market Value ( USD | $ 53.15 Billion |

| Compound Annual Growth Rate | 16.8% |

| Regions Covered | Global |