This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The market is characterized by a shift towards more energy-efficient and environmentally friendly technologies, with a growing emphasis on reducing carbon emissions and operational costs. The increased focus on energy efficiency, which are both cost-effective and ecologically benign, is fueling market demand. Demand for residential boilers will rise in response to the increasing need for high-efficiency house boilers. The boiler heats interior rooms by utilizing trapped heat created by the condensation of water vapors while using substantially less fuel. Due to their great efficiency and cost-effectiveness, household boiler demand is thus anticipated to soar.

With the introduction of smart home concepts, it is projected that modern boilers with smart management choices will become more commonplace. Due to youth preference for smart home products, sales of smart boilers are expected to rise. Furthermore, the increasing adoption of tactics by major players has improved and will continue to boost the market of residential boiler market.

The International Energy Agency's stringent energy-saving regulations have increased demand for such windows even more. Additionally, with increasing carbon levels in the atmosphere, government regulations and spending on hydrogen as a fuel source are increasing. Over the projection period, it is anticipated that demand in the market will increase due to growing awareness of the advantages of residential boilers driven by hydrogen.

According to the research report, “Global Residential Boiler Market Outlook, 2029” the market is anticipated to cross USD 100 Billion by 2029, increasing from USD 54.26 Billion in 2023. The market is expected to grow with 12.23% CAGR by 2024-29. Modern condensing boilers are gaining traction due to their high efficiency. They utilize heat from exhaust gases that would otherwise be wasted, resulting in lower fuel consumption and reduced emissions. The integration of smart technology is enhancing the functionality of residential boilers. Smart boilers can be controlled remotely via smartphone apps, offering convenience and the ability to optimize heating schedules based on user preferences.

The demand for eco-friendly heating solutions is on the rise. Energy-efficient boilers not only help in reducing household energy bills but also contribute to a reduction in the overall carbon footprint. Stringent regulations and standards related to energy efficiency are influencing the market. Governments and regulatory bodies are setting higher efficiency standards to encourage the adoption of advanced heating systems. Biomass boilers, which use organic materials like wood pellets or chips, are becoming increasingly popular. They offer a renewable alternative to traditional fossil fuels and align with the growing trend towards sustainable energy solutions.

Hybrid systems that combine traditional boilers with renewable technologies, such as heat pumps, are gaining traction. These systems provide flexibility and enhance overall energy efficiency. The growth of the residential boiler market varies by region. In developed markets like North America and Europe, the emphasis is on upgrading existing systems to meet higher efficiency standards. In emerging markets, there is a growing demand for new installations driven by increasing urbanization and rising standards of living. The shift towards energy-efficient and eco-friendly solutions is influencing consumer preferences. Homeowners are increasingly seeking boilers that offer long-term savings and minimal environmental impact.

Market Drivers

- Increasing Focus on Energy Efficiency: The growing emphasis on energy efficiency is a primary driver in the residential boiler market. Homeowners are increasingly seeking solutions that offer reduced fuel consumption and lower utility bills, driven by both economic and environmental concerns. Energy-efficient boilers, such as condensing models, utilize advanced technology to capture and reuse heat that would otherwise be lost, leading to significant improvements in fuel efficiency and reductions in greenhouse gas emissions. This shift towards more efficient heating solutions aligns with global efforts to combat climate change and is bolstered by government regulations that encourage or mandate higher efficiency standards, further fueling the market’s expansion.

- Government Regulations and Incentives: Government regulations and incentives play a crucial role in shaping the residential boiler market. Many countries are implementing stringent energy efficiency standards and emission reduction requirements for residential heating systems. In response, various financial incentives, such as rebates, tax credits, and subsidies, are offered to homeowners who invest in advanced, energy-efficient boilers. These policies not only help reduce the financial burden of upgrading to new technologies but also drive widespread adoption by making it more economically viable. As a result, the residential boiler market benefits from increased consumer participation and accelerated growth driven by supportive regulatory frameworks.

Market Challenges

- High Initial Costs: One of the significant challenges facing the residential boiler market is the high initial cost associated with advanced and energy-efficient systems. While these modern boilers offer long-term savings through improved efficiency and reduced operational costs, the upfront investment required for purchase and installation can be substantial. This high cost may deter some homeowners from upgrading, particularly in regions where financial incentives are limited or unavailable. The challenge of high initial costs impacts market adoption rates and underscore the need for continued efforts to make advanced heating solutions more affordable and accessible to a broader consumer base.

- Complex Installation and Maintenance: The complexity of installing and maintaining modern residential boilers poses a notable challenge. Advanced systems, particularly those incorporating smart technology and hybrid solutions, often require specialized knowledge and expertise for proper installation and upkeep. The need for skilled technicians can increase service costs and complicate the maintenance process. Additionally, compatibility issues with existing home heating infrastructure may arise, potentially leading to additional expenses or operational challenges.

Market Trends

- Growth of Smart and Connected Boilers: The growth of smart and connected boilers is a prominent trend in the residential heating market. Advances in technology have enabled the development of boilers that offer enhanced functionality and user control through integration with smart home systems. These smart boilers can be monitored and managed remotely via smartphone apps, allowing homeowners to optimize heating schedules and adjust settings with ease. This trend towards increased connectivity and automation not only improves convenience but also supports energy management efforts by providing real-time insights into system performance. As smart home technology becomes more prevalent, the demand for connected heating solutions is expected to rise, driving innovation and market growth.

- Shift towards Renewable and Hybrid Systems: The shift towards renewable and hybrid heating systems reflects a growing consumer preference for sustainable and eco-friendly solutions. Renewable technologies, such as biomass boilers that use organic materials, and hybrid systems that combine traditional boilers with renewable sources like heat pumps, are gaining traction. This trend is driven by increasing environmental awareness and the desire to reduce carbon footprints. Hybrid systems, in particular, offer flexibility by integrating multiple heating technologies to optimize efficiency and performance. As sustainability becomes a more significant factor in consumer decision-making, the market for renewable and hybrid heating solutions is set to expand, aligning with broader global efforts to promote cleaner and more efficient energy use.

Fire tube boilers are leading in the residential boiler market primarily due to their superior thermal efficiency, cost-effectiveness, and proven reliability, which collectively make them a highly attractive option for residential heating.

Fire tube boilers have established themselves as a leading choice in the residential boiler market due to a combination of their thermal efficiency, affordability, and dependability. The design of fire tube boilers is centered on the principle of hot gases passing through a series of tubes that are surrounded by water. This setup allows for effective heat transfer from the hot gases to the water, resulting in high thermal efficiency. The efficiency of fire tube boilers ensures that they make optimal use of the fuel burned, which translates into lower fuel consumption and reduced energy costs for homeowners. Additionally, fire tube boilers are known for their cost-effectiveness.The straightforward design of these boilers, with fewer moving parts and a simpler construction compared to other types such as water tube boilers, leads to lower manufacturing and maintenance costs. This affordability makes them an attractive option for residential applications where budget considerations are significant. The simplicity of the fire tube boiler also means that installation is generally easier and quicker, contributing to reduced labor costs. Reliability is another key factor driving the popularity of fire tube boilers. Their robust construction and proven track record of performance make them a dependable choice for home heating.

Fire tube boilers are designed to handle fluctuations in demand effectively, providing consistent heat output over extended periods. This reliability is particularly valuable in residential settings where a constant and reliable heating source is essential for comfort and safety. Furthermore, fire tube boilers are relatively easy to operate and maintain. The straightforward design not only simplifies the installation process but also ensures that regular maintenance tasks, such as cleaning and inspection, are less complex and less frequent compared to more intricate boiler designs. This ease of maintenance further enhances their appeal to homeowners who seek a hassle-free heating solution.

Condensing boilers are leading in the residential boiler market primarily due to their high energy efficiency, which significantly reduces fuel consumption and lowers heating costs, aligning with the growing demand for environmentally friendly and cost-effective heating solutions.

Condensing boilers have gained prominence in the residential boiler market largely because of their exceptional energy efficiency and the associated benefits of reduced fuel consumption and lower heating costs. The key to their efficiency lies in their ability to recover and utilize heat from the exhaust gases that would otherwise be lost in traditional boilers. This process involves condensing the water vapor in the exhaust gases into liquid form, thereby extracting additional heat energy from the flue gases. This recovered heat is then transferred to the heating system, enhancing the overall efficiency of the boiler.By maximizing the use of heat generated from burning fuel, condensing boilers achieve efficiency levels often exceeding 90%, compared to conventional boilers which typically operate at around 70-80% efficiency. This substantial increase in efficiency means that homeowners can achieve the same level of heating with less fuel, translating into significant savings on energy bills. Over time, these cost savings can offset the higher initial investment required for condensing boilers, making them a financially viable option in the long run. In addition to their cost benefits, condensing boilers align with increasing environmental regulations and consumer preferences for greener, more sustainable heating solutions.

The high efficiency of condensing boilers results in lower carbon emissions and a reduced environmental footprint, which is becoming increasingly important as governments and individuals alike strive to reduce greenhouse gas emissions and combat climate change. Furthermore, the advanced technology used in condensing boilers often includes features such as modulating burners, which adjust the heat output based on demand, further enhancing efficiency and comfort. The ability to modulate heating output ensures that the boiler operates more effectively, adapting to varying heating needs without excessive energy consumption.

Gas-fired boilers are leading in the residential boiler market primarily due to their high efficiency, lower operational costs, and the widespread availability of natural gas, which collectively make them a convenient and economical heating solution for homeowners.

Gas-fired boilers have emerged as a leading choice in the residential boiler market due to their exceptional efficiency, cost-effectiveness, and the widespread availability of natural gas, which simplifies their adoption. One of the primary advantages of gas-fired boilers is their high efficiency in converting fuel into heat. Modern gas-fired boilers often feature advanced combustion technology and condensing capabilities, which allow them to achieve high efficiency ratings. This efficiency ensures that homeowners receive more heat from each unit of fuel, which translates into lower fuel consumption and reduced heating costs. The lower operational costs associated with gas-fired boilers further enhance their appeal.Natural gas is generally less expensive than other fossil fuels such as oil or propane, making gas-fired boilers a more economical choice for heating. Additionally, the infrastructure for natural gas is well-established in many regions, which not only makes the fuel more accessible but also helps keep operational costs low. The cost savings on fuel, combined with the relatively low maintenance requirements of gas-fired boilers, contribute to their overall affordability and attractiveness. Another significant factor contributing to the dominance of gas-fired boilers is the widespread availability and infrastructure of natural gas.

In many urban and suburban areas, natural gas is readily available and delivered through an extensive network of pipelines, making it a convenient and reliable fuel source for residential heating. The established infrastructure reduces the logistical challenges and costs associated with fuel delivery and storage, further supporting the popularity of gas-fired boilers. Moreover, gas-fired boilers offer a high level of convenience and ease of use.

They provide consistent and controllable heating with the ability to quickly respond to changes in heating demand. Many modern gas-fired systems also come equipped with advanced features such as programmable thermostats and remote controls, enhancing user convenience and allowing homeowners to optimize their heating systems for comfort and efficiency.

Asia-Pacific is leading in the residential boiler market primarily due to rapid urbanization, growing middle-class populations, and increasing demand for modern, energy-efficient heating solutions in the region's expanding residential sector.

Asia-Pacific's leadership in the residential boiler market can be attributed to several interconnected factors, with rapid urbanization, a burgeoning middle class, and heightened demand for energy-efficient solutions being central to this trend. The region is experiencing unprecedented urban growth, with millions of people moving into cities and new residential developments rising to meet the needs of expanding urban populations. This urban expansion creates a substantial demand for modern heating systems to ensure comfort in newly constructed homes and apartments. As urban areas become more developed, the need for efficient and reliable heating solutions becomes increasingly critical.Simultaneously, the Asia-Pacific region is witnessing a significant rise in the middle-class population. As incomes increase and living standards improve, there is a growing appetite for high-quality, energy-efficient home appliances, including boilers. The rising affluence among consumers drives their willingness to invest in advanced heating technologies that offer better performance, energy savings, and comfort. This shift is pushing the market towards more sophisticated and efficient residential heating solutions. Additionally, the growing emphasis on energy efficiency and environmental sustainability is influencing the residential boiler market in Asia-Pacific.

Governments and consumers alike are increasingly recognizing the benefits of energy-efficient technologies in reducing energy consumption and minimizing environmental impact. As a result, there is a strong push for the adoption of modern boilers that align with global sustainability goals and offer enhanced efficiency compared to older systems. This trend is supported by government policies and incentives that encourage the installation of energy-efficient heating solutions, further driving market growth.

- In May 2024, Innovator of high-efficiency water heaters and boilers, Lochinvar, launched the LECTRUSTM Light Commercial Electric Boiler. Along with helping the sector transition to electrification and decarbonization, this ground-breaking technology offers clients flexibility. The in-house designed and manufactured LECTRUS is Lochinvar's first electric boiler. This product is appropriate for both home and commercial use, with kW capabilities varying from 15 kW to 150 kW.

- In January 2024, the NEX R1 and NEX R2 water heaters, which are solely powered by home PV systems, were introduced by German heating system supplier Nexol Photovolthermic AG. The boilers include one or two 1,500 W heating elements and are outfitted with in-house designed Nexol Energy Controllers.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Residential Boiler market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type

- Fire Tube

- Electric

- Water Tube

By Technology

- Condensing

- Non Condensing

By Fuel Type

- Gas Fired

- Oil Fired

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Residential Boiler industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Robert Bosch GmbH

- Ariston Holding NV

- BDR Thermea Group B.V.

- The Viessmann Group

- NORITZ Corporation

- Daikin Industries, Ltd

- Lennox International Inc.

- Ferroli S.p.A.

- SPX Corporation

- Burnham Holdings, Inc.

- Bradford White Corporation

- Rinnai Corporation

- Carrier Global Corporation

- The Groupe Atlantic

- Immergas S.p.A.

- Simons Boiler Co

- Kiturami Boiler Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | September 2024 |

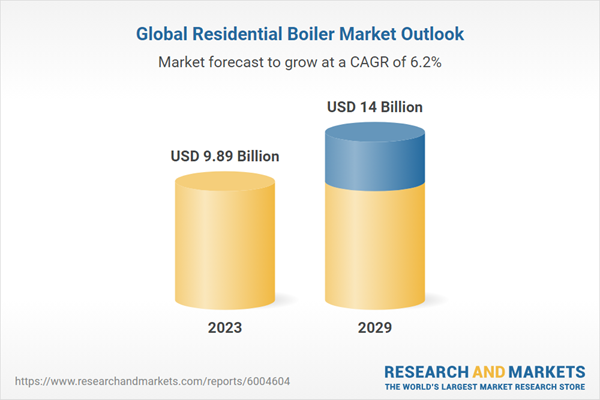

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 9.89 Billion |

| Forecasted Market Value ( USD | $ 14 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |