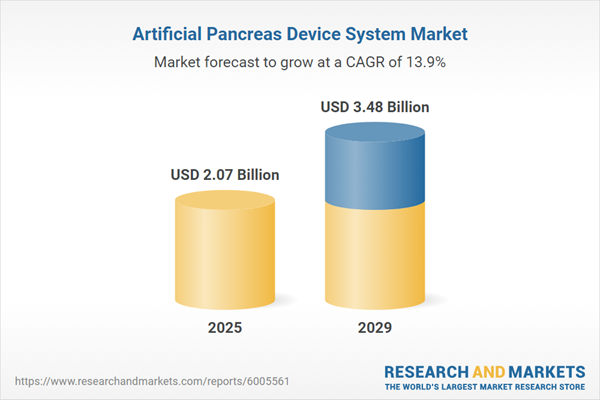

The artificial pancreas device system market size has grown rapidly in recent years. It will grow from $1.81 billion in 2024 to $2.07 billion in 2025 at a compound annual growth rate (CAGR) of 14.1%. The growth in the historic period can be attributed to rising inflow of investment, growing government initiative in clinical research, growing demand for automated systems in glycemic control, intensive R&D efforts by industry players, and increasing geriatric population.

The artificial pancreas device system market size is expected to see rapid growth in the next few years. It will grow to $3.48 billion in 2029 at a compound annual growth rate (CAGR) of 13.9%. The growth in the forecast period can be attributed to growing prevalence of diabetes, increasing prevalence of pancreatic cancer, growing occurrence of diabetes and obesity, rising demand minimally invasive (MI) drug delivery systems, and driving innovation in diabetes management technology. Major trends in the forecast period include technological innovations, increasing research and development activities, increasing product approvals, partnerships and collaborations, and increasing activities in tele consultancy for follow-up.

The growing incidence of pancreatic cancer is projected to drive the expansion of the artificial pancreas device system (APDS) market. Pancreatic cancer is a malignant tumor originating in the pancreas, which is located behind the stomach. The development of pancreatic cancer is influenced by a mix of lifestyle, genetic, medical, and environmental factors, including genetic mutations that can cause hereditary pancreatitis and result in chronic pancreatic inflammation. An artificial pancreas device system is primarily designed to assist individuals with diabetes in managing their blood sugar levels by automatically monitoring glucose and delivering the appropriate amount of insulin. For example, in March 2024, according to theCancer Australia, an Australia-based government agency, estimated that 4,506 new cases of pancreatic cancer were diagnosed in 2023, up from 3,751 cases over the previous five years. Thus, the rising prevalence of pancreatic cancer is contributing to the growth of the artificial pancreas device system market.

Key players in the artificial pancreas device system market are developing automated insulin delivery systems to improve diabetes management by automatically monitoring blood glucose levels and administering the correct amount of insulin. These systems aim to mimic the function of a healthy pancreas, alleviating the need for constant blood sugar monitoring and manual insulin injections. For instance, in May 2023, Beta Bionics, a US-based medical equipment manufacturer, received FDA 510(k) clearance for its iLet Insulin-Only Bionic Pancreas System, an automated insulin delivery device. This artificial pancreas system autonomously determines and delivers insulin doses to regulate blood glucose levels. The closed-loop system adjusts insulin delivery based on glucose levels measured by a connected continuous glucose monitor (CGM), requiring only the user’s body weight and a meal size estimate for automatic adjustments.

In September 2023, Abbott Laboratories, a US-based pharmaceutical company, acquired Bigfoot Biomedical for an undisclosed amount. This acquisition strengthens Abbott's position in diabetes care by integrating its leading Freestyle Libre continuous glucose monitoring technology with Bigfoot Biomedical’s expertise in automated insulin delivery systems. Bigfoot Biomedical, a US-based company, specializes in developing prototypes of automated insulin delivery systems, also known as artificial pancreas systems.

Major companies operating in the artificial pancreas device system market are Johnson & Johnson, Abbott Laboratories, Medtronic plc, DexCom Inc., Insulet Corporation, Tandem Diabetes Care Inc., Juvenile Diabetes Research Foundation (JDRF), Beta Bionics Inc., Glooko Inc., Bigfoot Biomedical Inc., CeQur SA, Medtrum Technologies Inc., Diabeloop SA, Beta-O2 Technologies Ltd, Pancreum Inc., TypeZero Technologies LLC, Inreda Diabetic B.V., Defymed SAS, Admetsys Corporation, DreaMed Diabetes Ltd.

North America was the largest region in the artificial pancreas device system market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the artificial pancreas device system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the artificial pancreas device system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An Artificial Pancreas Device System (APDS) is a medical technology designed to automate blood glucose management for people with diabetes. This system combines continuous glucose monitoring (CGM) with an insulin pump and employs a sophisticated algorithm to adjust insulin delivery automatically based on real-time glucose readings. The goal of the device is to replicate the glucose-regulating function of a healthy pancreas, thus minimizing the need for manual blood glucose monitoring and insulin injections, and assisting in keeping blood glucose levels within a target range.

The artificial pancreas device system market features three main types of devices threshold suspend device systems, control-to-range systems, and control-to-target systems. Threshold suspend device systems are insulin pump technologies that automatically halt insulin delivery when blood glucose levels fall below a set threshold. The different treatment types include bi-hormonal, insulin-only, and hybrid systems, with end-users such as hospitals, medical centers, and other healthcare settings.

The artificial pancreas device system market research report is one of a series of new reports that provides artificial pancreas device system market statistics, including the artificial pancreas device system industry global market size, regional shares, competitors with artificial pancreas device system market share, detailed artificial pancreas device system market segments, market trends, and opportunities, and any further data you may need to thrive in the artificial pancreas device system industry. These artificial pancreas device system market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The artificial pancreas device system market includes revenues earned by entities by providing services such as patient monitoring, device maintenance, data management, software updates, healthcare provider consultations, and training and support for patients and healthcare professionals. The market value includes the value of related goods sold by the service provider or included within the service offering. The artificial pancreas device system market also includes sales of insulin pumps, continuous glucose monitors, control algorithms and software applications. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Artificial Pancreas Device System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on artificial pancreas device system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for artificial pancreas device system ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The artificial pancreas device system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Device Type: Threshold Suspend Device Systems; Control-To-Range Systems; Control-To-Target Systems2) By Treatment Type: Bi-Hormonal; Insulin Only; Hybrid

3) By End-User: Hospitals; Medical Centers; Other End-Users

Subsegments:

1) By Threshold Suspend Device Systems: Insulin Pump with Threshold Suspend; Continuous Glucose Monitoring (CGM) Integrated Systems2) By Control-To-Range Systems: Hybrid Closed-Loop Systems; Insulin Delivery Systems with Range Control; Real-Time Glucose Adjustment Systems

3) By Control-To-Target Systems: Fully Closed-Loop Artificial Pancreas Systems; Insulin Pumps with Targeted Glucose Control; Automated Glucose Regulation Systems

Key Companies Mentioned: Johnson & Johnson; Abbott Laboratories; Medtronic plc; DexCom Inc.; Insulet Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Artificial Pancreas Device System market report include:- Johnson & Johnson

- Abbott Laboratories

- Medtronic plc

- DexCom Inc.

- Insulet Corporation

- Tandem Diabetes Care Inc.

- Juvenile Diabetes Research Foundation (JDRF)

- Beta Bionics Inc.

- Glooko Inc.

- Bigfoot Biomedical Inc.

- CeQur SA

- Medtrum Technologies Inc.

- Diabeloop SA

- Beta-O2 Technologies Ltd

- Pancreum Inc.

- TypeZero Technologies LLC

- Inreda Diabetic B.V.

- Defymed SAS

- Admetsys Corporation

- DreaMed Diabetes Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.07 Billion |

| Forecasted Market Value ( USD | $ 3.48 Billion |

| Compound Annual Growth Rate | 13.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |