Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a major obstacle hindering broader market growth is the technical conflict between battery autonomy and device portability. Industrial settings often demand printers that operate continuously throughout long shifts without needing a recharge, yet increasing battery capacity typically results in heavier, bulkier units that negatively impact user ergonomics. This compromise between ensuring adequate power longevity and maintaining a lightweight design constitutes a significant barrier for enterprises that require uninterrupted, high-volume operations without imposing additional physical stress on their mobile workforce.

Market Drivers

The swift growth of e-commerce and logistics networks demands efficient, high-volume labeling solutions to handle the increase in parcel traffic. As reliance on home delivery grows, logistics providers are adopting mobile printers to produce shipping labels and tracking codes immediately at the handling point, drastically cutting transit times and labeling mistakes. According to the 'Parcel Shipping Index' by Pitney Bowes in June 2025, U.S. parcel volume rose by 3.4% in 2024, totaling 22.4 billion shipments.This rising volume emphasizes the urgent need for portable printing infrastructure capable of dynamic operation within warehouses and during last-mile delivery. Supporting this immense operational load, the wider logistics sector continues to grow financially; the Council of Supply Chain Management Professionals reported in their June 2025 'State of Logistics Report' that U.S. business logistics costs reached $2.58 trillion, underscoring the massive scale of the supply chain ecosystem dependent on these technologies.

Furthermore, the widespread implementation of mobile point-of-sale (mPOS) systems in the retail sector is fueling market growth by evolving the traditional checkout into a flexible, customer-focused experience. Retailers are utilizing mobile printers alongside handheld terminals to enable queue-busting and inventory management directly on the sales floor, boosting associate productivity and service speed.

This transition empowers staff to print receipts, shelf labels, and markdown tags without needing to return to a fixed station or back office. According to Zebra Technologies' '18th Annual Global Shopper Study' from November 2025, 87% of retail leaders stressed the vital importance of automation and intelligent workflow tools in modernizing store operations. This high priority indicates a strategic shift toward arming mobile workers with ruggedized devices that guarantee real-time accuracy and agility in a competitive retail landscape.

Market Challenges

The technical limitation concerning battery life versus device portability poses a significant barrier to the Global Mobile Printer Market's expansion. With retail and logistics environments increasingly running on continuous, high-speed schedules, the inability of lightweight mobile printers to maintain power through long shifts creates a serious operational weakness. When devices run out of power during workflows, field staff are forced to pause tasks to recharge or swap batteries, resulting in unscheduled downtime that cancels out the efficiency benefits of mobile deployment. This trade-off compels enterprises to decide between heavy units that risk worker fatigue or lighter ones that sacrifice uptime, causing hesitation in adopting these solutions for mission-critical operations.This hardware constraint is especially detrimental in the current industrial environment, where maximizing employee productivity is crucial. Confirming the severity of this issue, the MHI 2025 Annual Industry Report notes that 83% of supply chain professionals view the ongoing talent shortage as a major operational challenge. In a market with scarce labor resources, organizations cannot sustain the productivity losses linked to frequent power interruptions or the ergonomic risks of bulkier equipment. Consequently, the failure to balance power duration with user comfort acts as a direct impediment to market penetration, causing potential buyers to postpone investments to avoid adding friction to an already strained workforce.

Market Trends

The widespread adoption of linerless labeling technology is fundamentally altering the Global Mobile Printer Market by meeting the dual needs of environmental sustainability and operational efficiency. By eliminating the traditional backing liner, this technology allows for more labels per roll and significantly lowers the frequency of media replacements that interrupt field workforce productivity. As retail and logistics companies face growing pressure to cut industrial waste, integrating linerless-compatible mobile units has become a strategic priority for lessening the ecological impact of high-volume documentation. Validating the environmental benefits of this transition, an article in Label and Narrow Web from March 2024 titled 'Avery Dennison scoops 2024 MHI sustainability award' states that moving from standard linered media to direct thermal linerless solutions leads to a 49% decrease in carbon emissions.At the same time, the rise of RFID-enabled mobile printing capabilities is converting inventory management from a static, barcode-dependent system into a dynamic, real-time operation. To support the detailed visibility modern supply chains demand, organizations are increasingly utilizing mobile printers fitted with UHF encoders, allowing staff to generate and encode smart tags on demand at the point of application. This distributed encoding ability is vital for managing the exponential rise in trackable assets entering the global market, ensuring accurate digitization of items from the moment they are received. Highlighting the magnitude of this technological adoption, the Retail Technology Review reported in March 2024, in an article titled 'RAIN Alliance reports 32% Increase in global RAIN RFID chip shipments', that global RAIN RFID tag chip volume hit 44.8 billion units in 2023, requiring a strong expansion of mobile infrastructure to handle this massive encoding workload.

Key Players Profiled in the Mobile Printer Market

- Zebra Technologies Corporation

- Canon Inc.

- Brother Industries, Ltd.

- Seiko Epson Corporation

- Hewlett-Packard Inc.

- Honeywell International Inc.

- Toshiba Tec Corporation

- Star Micronics Co., Ltd.

- Printek, Inc.

- Polaroid Corporation

Report Scope

In this report, the Global Mobile Printer Market has been segmented into the following categories:Mobile Printer Market, by Output:

- Barcode Labels

- Receipts

- Others

Mobile Printer Market, by Technology:

- Infrared Data Association

- Others

Mobile Printer Market, by End-User:

- Residential

- Corporate Office

- Healthcare

- Others

Mobile Printer Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Mobile Printer Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Mobile Printer market report include:- Zebra Technologies Corporation

- Canon Inc.

- Brother Industries, Ltd.

- Seiko Epson Corporation

- Hewlett-Packard Inc.

- Honeywell International Inc.

- Toshiba Tec Corporation

- Star Micronics Co., Ltd.

- Printek, Inc.

- Polaroid Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

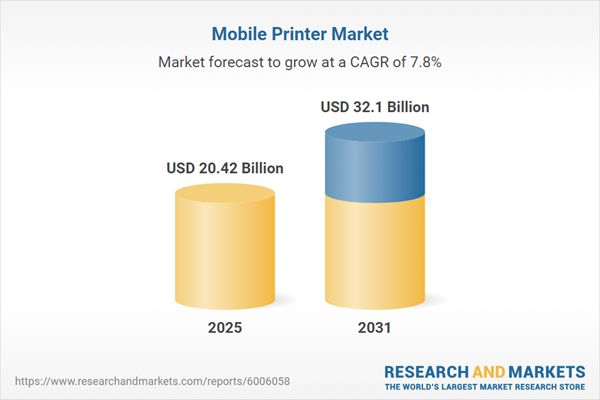

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 20.42 Billion |

| Forecasted Market Value ( USD | $ 32.1 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |