Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One significant obstacle that could hinder market progress involves the intricate nature of thermal management within high-density designs, which adds complexity to both integration and manufacturing procedures. Data from the World Semiconductor Trade Statistics (WSTS) indicates that in 2025, the Analog semiconductor sector, which includes power management devices, experienced a 4 percent growth rate during the first half of the year. This figure suggests a consistent demand pattern, remaining resilient despite broader supply chain oscillations that periodically impact the pricing and availability of components.

Market Drivers

The widespread adoption of hybrid and electric vehicles acts as a major catalyst for the Power Management IC sector, fundamentally reshaping semiconductor requirements within the automotive industry. Modern electric vehicle architectures necessitate sophisticated battery management systems and highly efficient power conversion modules to optimize driving range and safety, leading to a substantial increase in the volume of power chips per unit. This transition demands high-performance components capable of managing high voltages and thermal dissipation within electric powertrains. As noted by the International Energy Agency in its 'Global EV Outlook 2024' from April 2024, electric car sales reached nearly 14 million in 2023, a 35 percent rise from the previous year, directly driving the procurement of specialized voltage regulators and battery monitoring ICs needed for transportation electrification.Market expansion is further supported by the extensive deployment of 5G telecommunications networks and the ongoing demand for connected consumer devices. As mobile devices incorporate faster connectivity and artificial intelligence capabilities, power density requirements escalate, necessitating efficient integrated circuits to handle heat and extend battery life in compact forms. According to the 'Ericsson Mobility Report' from June 2024, 5G subscriptions grew by 160 million in the first quarter of 2024, reaching a global total of roughly 1.7 billion. Additionally, the Semiconductor Industry Association reported that global semiconductor sales reached $53.1 billion in August 2024, a 20.6 percent increase compared to the same month the prior year, underscoring the strong demand for chip components, including power management units, to support signal integrity and energy efficiency.

Market Challenges

Managing thermal dynamics in high-density designs represents a major barrier to the rapid scalability of the Global Power Management IC Market. As manufacturers strive to integrate increased functionality into diminishing footprints for electric vehicles and compact IoT devices, dissipating the resulting heat density without sacrificing reliability or performance becomes increasingly difficult. This physical constraint forces the adoption of complex, often costly cooling architectures and advanced packaging materials, which disrupts standard manufacturing workflows. Consequently, fabrication costs increase while production yields may suffer, creating bottlenecks that delay product time-to-market and limit the volume of next-generation power chips available to satisfy rising demand.The impact of these technical friction points is measurable in the market's comparatively moderate expansion rates. Despite strong demand for electrification, the difficulty in easily scaling high-density power solutions dampens the sector's overall growth trajectory relative to other semiconductor categories. According to the World Semiconductor Trade Statistics (WSTS), the global Analog semiconductor category is expected to achieve a full-year growth rate of 7 percent in 2025. This figure, while positive, trails significantly behind the double-digit surges observed in digital logic sectors, emphasizing how thermal integration and design complexities effectively constrain the production capacity and market potential of power management devices.

Market Trends

The industry is increasingly shifting toward Wide Bandgap (WBG) materials such as Silicon Carbide (SiC) and Gallium Nitride (GaN), moving beyond the physical restrictions of traditional silicon. These materials allow power management ICs to operate at significantly higher voltages and temperatures with minimal energy loss, a capability essential for optimizing electric vehicle powertrains and industrial charging infrastructure. Manufacturers are aggressively expanding production capacities to support this technical transition, often investing in vertically integrated supply chains to ensure wafer availability. For instance, STMicroelectronics announced in a May 2024 press release, 'STMicroelectronics to build the world's first fully integrated silicon carbide facility in Italy,' a multi-year commitment of €5 billion to construct a new high-volume SiC campus, highlighting the significant capital allocation driving this material revolution.Concurrently, the integration of Artificial Intelligence for dynamic power optimization is transforming data center power architectures. Because AI training clusters require exceptional levels of current with extremely fast transient responses, standard voltage regulators are being replaced by intelligent, multiphase power management solutions. These advanced ICs employ real-time telemetry and adaptive control algorithms to safeguard sensitive processors and maximize efficiency during peak computational loads, establishing a distinct hyper-growth segment. As reported by Monolithic Power Systems in their 'Q2 2024 Earnings Release' from August 2024, the company saw a 290 percent year-over-year increase in Enterprise Data revenue, a surge explicitly linked to the escalating need for power solutions supporting artificial intelligence applications.

Key Players Profiled in the Power Management IC Market

- Texas Instruments Incorporated

- Infineon Technologies AG

- Maxim Integrated Products, Inc.

- STMicroelectronics N.V.

- Semiconductor Components Industries, LLC

- Analog Devices, Inc.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- Richtek Technology Corporation

- Microchip Technology Inc.

Report Scope

In this report, the Global Power Management IC Market has been segmented into the following categories:Power Management IC Market, by Application:

- Linear Regulators

- Reset ICs

- LED Controllers

- DC-DC Converters

- Switch ICs

- Others

Power Management IC Market, by End Use:

- Consumer Electronics

- Automotive

- IT & Telecommunication

- Healthcare

Power Management IC Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Power Management IC Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Power Management IC market report include:- Texas Instruments Incorporated

- Infineon Technologies AG

- Maxim Integrated Products, Inc.

- STMicroelectronics N.V.

- Semiconductor Components Industries, LLC

- Analog Devices, Inc.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- Richtek Technology Corporation

- Microchip Technology Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

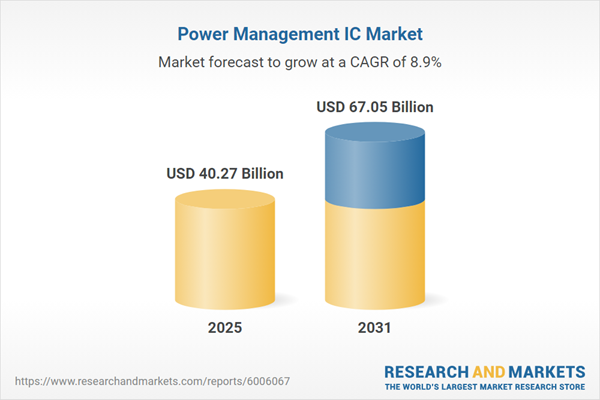

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 40.27 Billion |

| Forecasted Market Value ( USD | $ 67.05 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |