Ammonium nitrate is a widely used component for formulating explosives and blasting agents. Utilizing high-energy explosives enhances the fragmentation of rocks and efficiently carries out mining operations. Further, roads and tunnel construction play an important role in the economic development of a country. Thus, the growing mining and construction activities in developing economies are a leading factor in driving the global industrial explosives market. Further, industrial explosives are essential for efficient and safe mining operations. They play a vital role in fragmenting rocks and accessing mineral deposits. Buyers in the mining industry depend on industrial explosives to achieve their production targets. Due to the criticality of the product, buyers might have limited flexibility in seeking alternative solutions or negotiating on price or terms. Due to safety concerns and regulatory compliance, switching manufacturers can be complex and expensive.

Based on application, the industrial explosives market is segmented into mining, construction, and others. The mining segment is expected to register the highest CAGR in the industrial explosives market from 2023 to 2031. The mining application majorly consists of coal mining and metal mining. Explosives used in coal mines need to be efficient in blasting rock and coal; simultaneously, these explosives must not ignite the flammable atmosphere. Coal mining is the largest consumer of industrial explosives. Gold, platinum, and silver are a few examples of precious metals of high economic value that have been mined extensively. Metal mining uses less explosives than coal mining as metallic minerals are generally low-grade ores found only in geologically favorable areas.

Based on application, the market is segmented into mining, construction, and others. The mining segment held the largest share of the industrial explosives market in 2023. Coal surface mines rely entirely on explosives to uncover mineral deposits. Blasting is essential for successfully extracting coal resources from the deposits. Further, metal mining is one of the integral parts of the mining sector and contributes significantly to the growth of other manufacturing industries such as automotive, construction, electronics, etc. Southeast Asia registered the largest mining production of base metals such as nickel and copper as of 2022. According to the Institute for Development of Economics and Finance, the mining sector in Indonesia provides lucrative business opportunities, thereby prompting the government to invest in the sector. The government also announced its plan to map rare earth element reserves and focus on eight known mine locations at the early exploration stage.

In the industrial explosives market, Asia Pacific is expected to register the highest CAGR during 2023-2031. According to a report released by the US Geological Survey in 2022, China held the leading position in mine production of critical minerals: antimony, barite, germanium, graphite, magnesium, rare-earth elements, titanium, and tellurium. The British Geological Survey released in 2023 shows China accounted for the highest aluminum production, accounting for over 50% of global aluminum mining in 2021. The coal mining production in the country reached 4.36 billion metric tons in 2021, an increase from 4.13 billion metric tons in 2020. Mining operations primarily involve blasting mines using chemicals to break mineral-containing rocks.

A few players operating in the global industrial explosives market include Orica Ltd; AECI Ltd; Austin Powder Company; Dyno Nobel Ltd; Enaex SA; MaxamCorp Holding, S.L., Solar Industries India Ltd; EPC Groupe; Keltech Energies Ltd; and Hanwha Corp. Players operating in the global industrial explosives market focus on providing high-quality products to fulfill customer demand. Also, they are focusing on launching new and high-quality products for their customers.

The overall global industrial explosives market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers - along with external consultants such as valuation experts, research analysts, and key opinion leaders - specializing in the industrial explosives market.

Reasons to Buy:

- Progressive industry trends in the industrial explosives market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the industrial explosives market from 2021 to 2031

- Estimation of the demand for industrial explosives across various industries

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict the market growth

- Recent developments to understand the competitive market scenario and the demand for industrial explosives across the globe

- Market trends and outlook coupled with factors driving and restraining the growth of the industrial explosives market.

- Decision-making process by understanding strategies that underpin commercial interest concerning the global industrial explosives market growth

- The global industrial explosives market size at various nodes of market

- Detailed overview and segmentation of the industrial explosives market as well as its dynamics in the industry

- The industrial explosives market size in different regions with promising growth opportunities

Table of Contents

Companies Mentioned

- Industrial Explosives Market

- Orica Ltd

- AECI Ltd

- Austin Powder Company

- Dyno Nobel Ltd

- Enaex SA

- MaxamCorp Holding SL

- Solar Industries India Ltd

- EPC Groupe

- Keltech Energies Ltd

- Hanwha Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | August 2024 |

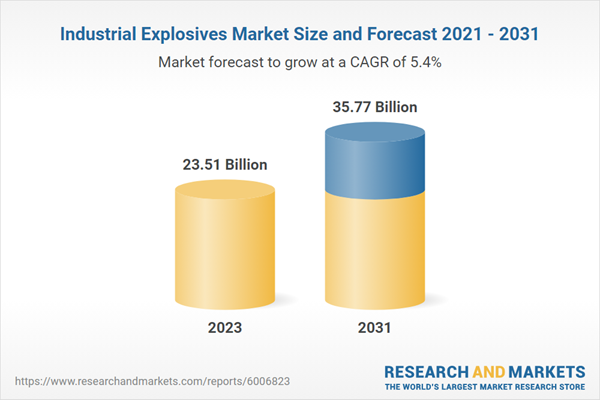

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 23.51 Billion |

| Forecasted Market Value by 2031 | 35.77 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |