Global Retail Colocation Market - Key Trends and Drivers Summarized

What Is Retail Colocation and How Does It Support Retail Operations?

Retail colocation refers to the practice of leasing data center space and infrastructure from third-party providers to support retail operations. In a retail colocation arrangement, businesses rent space within a data center to house their servers, storage systems, and networking equipment, while the data center provider is responsible for maintaining the physical infrastructure, including power, cooling, and security. Retail colocation is an attractive option for retailers looking to expand their IT capabilities without the capital expense and operational complexities of building and managing their own data centers. By leveraging retail colocation services, retailers can ensure high availability, scalability, and security for their digital operations, including e-commerce platforms, point-of-sale systems, and customer data management.How Are Technological Advancements Enhancing Retail Colocation Services?

Technological advancements have significantly enhanced retail colocation services, making them more scalable, secure, and efficient. The development of advanced cooling and power management technologies has improved the energy efficiency of data centers, reducing operational costs for retailers and minimizing their environmental impact. The integration of software-defined networking (SDN) and network function virtualization (NFV) has enabled more flexible and agile network configurations, allowing retailers to quickly adapt to changing business needs and optimize their IT resources. Advances in data center security, including biometric access controls and advanced encryption technologies, have strengthened the protection of sensitive customer and transaction data, ensuring compliance with industry regulations. Additionally, the rise of cloud connectivity within colocation facilities has provided retailers with seamless access to public and private cloud services, enabling hybrid IT architectures that combine the benefits of on-premises and cloud-based solutions. These technological advancements are driving the adoption of retail colocation services, helping retailers enhance their IT infrastructure and support their digital transformation initiatives.What Are the Key Applications and Benefits of Retail Colocation?

Retail colocation is used by a wide range of retailers to support their digital operations, offering numerous benefits that enhance IT infrastructure, security, and scalability. E-commerce retailers rely on colocation services to ensure the availability and performance of their online platforms, even during peak shopping periods, by providing the necessary computing power and network connectivity. Brick-and-mortar retailers use colocation to manage their point-of-sale systems and customer data securely, ensuring seamless transactions and protecting sensitive information. The retail industry also uses colocation to support data analytics and customer relationship management (CRM) systems, enabling more personalized marketing and improved customer experiences. The primary benefits of retail colocation include increased IT flexibility, improved security and compliance, reduced capital expenditures, and the ability to scale IT resources in response to business growth. By leveraging colocation services, retailers can focus on their core business operations while ensuring that their IT infrastructure is robust, reliable, and capable of supporting their digital initiatives.What Factors Are Driving the Growth in the Retail Colocation Market?

The growth in the retail colocation market is driven by several factors. The increasing demand for digital and e-commerce platforms is a significant driver, as retailers require scalable and reliable IT infrastructure to support their online operations. Technological advancements in data center infrastructure and connectivity are also propelling market growth, as these innovations enhance the efficiency and capabilities of colocation services. The rising focus on data security and compliance, particularly in the wake of increasing cyber threats and stringent data protection regulations, is further boosting demand for secure colocation solutions. Additionally, the expansion of global retail markets and the growing complexity of retail IT environments are contributing to market growth, as retailers seek flexible and cost-effective solutions to manage their IT infrastructure. The increasing adoption of hybrid IT architectures and the need for seamless integration between on-premises and cloud-based systems are also supporting the growth of the retail colocation market. These factors, combined with continuous innovation in data center technology and services, are driving the sustained growth of the retail colocation market.Report Scope

The report analyzes the Retail Colocation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Organization Size (SMEs, Large Enterprises); End-Use (IT & Telecom End-Use, Retail & eCommerce End-Use, Healthcare End-Use, Energy & Utilities End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the SMEs segment, which is expected to reach US$51.2 Billion by 2030 with a CAGR of a 13.2%. The Large Enterprises segment is also set to grow at 11.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.2 Billion in 2024, and China, forecasted to grow at an impressive 17.2% CAGR to reach $17.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Retail Colocation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Retail Colocation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Retail Colocation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as aPriori Technologies, Autodesk Inc., c5mi, Dassault Systemes SE, Hexagon AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Retail Colocation market report include:

- AT&T Inc.

- CoreSite Realty Corp.

- China Telecom Global Limited

- China Unicom Global Limited

- CyrusOne LLC

- Cogent Communications

- Digital Realty Trust Inc.

- Equinix Inc.

- Global Switch Ltd.

- NTT Communications Corporation

- PhoenixNAP

- Rackspace Technology, Inc.

- TERAGO Networks Inc.

- Yotta Data Services Private Limited

- Rahi Systems Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AT&T Inc.

- CoreSite Realty Corp.

- China Telecom Global Limited

- China Unicom Global Limited

- CyrusOne LLC

- Cogent Communications

- Digital Realty Trust Inc.

- Equinix Inc.

- Global Switch Ltd.

- NTT Communications Corporation

- PhoenixNAP

- Rackspace Technology, Inc.

- TERAGO Networks Inc.

- Yotta Data Services Private Limited

- Rahi Systems Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

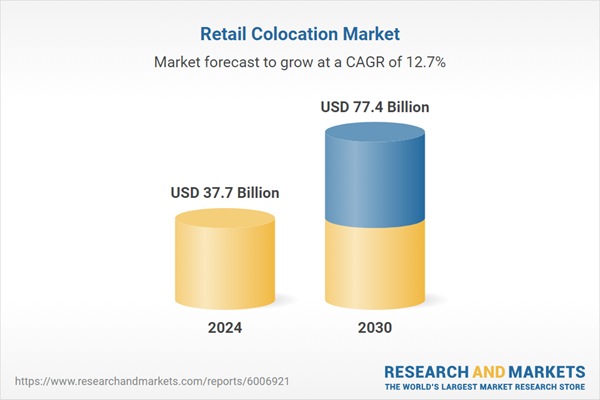

| Estimated Market Value ( USD | $ 37.7 Billion |

| Forecasted Market Value ( USD | $ 77.4 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |