Global HVAC Safety Devices Market - Key Trends and Drivers Summarized

How Are HVAC Safety Devices Crucial for System Integrity and Occupant Safety?

HVAC safety devices are integral components that ensure the safe and efficient operation of heating, ventilation, and air conditioning systems. These devices protect against potential hazards such as electrical failures, gas leaks, and fires, which can arise from system malfunctions. Common HVAC safety devices include smoke detectors, carbon monoxide detectors, pressure switches, and flame rollout switches. These components monitor the system continuously, providing early warnings or shutting down the system automatically to prevent dangerous conditions from escalating. By safeguarding against mechanical and electrical issues, HVAC safety devices not only protect the physical integrity of the HVAC equipment but also significantly enhance the safety and well-being of building occupants, making them essential for residential, commercial, and industrial environments.What Innovations Are Enhancing the Functionality of HVAC Safety Devices?

Innovations in HVAC safety devices focus on enhancing their reliability, sensitivity, and integration capabilities. Technological advancements have led to the development of smarter, more connected safety devices that can communicate with each other and with central control systems. This connectivity allows for comprehensive monitoring and coordinated responses to potential threats, improving overall system safety and efficiency. For example, modern smoke and carbon monoxide detectors are equipped with internet connectivity, enabling them to send alerts to smartphones or central monitoring services in real time. Additionally, advancements in sensor technology have improved the accuracy and response time of HVAC safety devices, reducing false alarms and ensuring prompt detection of real hazards. There is also a growing emphasis on integrating HVAC safety systems with broader building management systems (BMS), allowing for centralized control and more efficient maintenance scheduling.How Do HVAC Safety Devices Impact Maintenance Practices and Costs?

HVAC safety devices significantly impact maintenance practices and operational costs by preventing major system failures and ensuring efficient system operation. By detecting issues early, these devices allow for timely maintenance interventions, which can prevent the escalation of minor problems into more serious, costly repairs. For instance, pressure sensors can detect when an HVAC system is operating under strain, which might indicate a clogged filter or a failing motor. Early detection and maintenance can extend the lifespan of the system, reduce downtime, and lower energy consumption by ensuring the system operates at optimal efficiency. Additionally, the use of advanced safety devices in HVAC systems can lower insurance premiums for property owners by reducing the risk of costly accidents and liability claims.What Trends Are Driving Growth in the HVAC Safety Devices Market?

The growth of the HVAC safety devices market is driven by several trends, including increased regulations regarding building safety, growing awareness of indoor air quality, and the rising adoption of smart home technologies. Stricter safety and environmental regulations are compelling building owners and operators to upgrade their HVAC systems with advanced safety features to comply with codes and avoid penalties. There is also a heightened awareness among consumers and businesses about the importance of maintaining excellent indoor air quality, which has increased demand for systems equipped with reliable safety devices. Furthermore, the integration of HVAC systems with smart home technology is becoming more prevalent, boosting demand for safety devices that can connect to and communicate with other smart devices, enhancing the overall safety and convenience of managing indoor environments. These trends underscore the increasing importance of HVAC safety devices in modern building management and maintenance strategies.Report Scope

The report analyzes the HVAC Safety Devices market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Electrical Safety Devices, Flow & Pressure Safety Devices); End-Use (Non-Residential End-Use, Residential End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electrical Safety Devices segment, which is expected to reach US$3.4 Billion by 2030 with a CAGR of a 4.2%. The Flow & Pressure Safety Devices segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global HVAC Safety Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global HVAC Safety Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global HVAC Safety Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bryant Heating & Cooling System, CAREL INDUSTRIES S.p.A., Carrier Global Corporation, CIAT Group, Eaton Corporation plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 49 companies featured in this HVAC Safety Devices market report include:

- Bryant Heating & Cooling System

- CAREL INDUSTRIES S.p.A.

- Carrier Global Corporation

- CIAT Group

- Eaton Corporation plc

- Emerson Electric Co.

- Heil (ICP)

- Intermatic Incorporated

- Johnson Controls International PLC

- Lennox International Inc.

- Siemens AG

- Tempstar

- Toshiba Corporation

- Trane Technologies Company, LLC

- York Now

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bryant Heating & Cooling System

- CAREL INDUSTRIES S.p.A.

- Carrier Global Corporation

- CIAT Group

- Eaton Corporation plc

- Emerson Electric Co.

- Heil (ICP)

- Intermatic Incorporated

- Johnson Controls International PLC

- Lennox International Inc.

- Siemens AG

- Tempstar

- Toshiba Corporation

- Trane Technologies Company, LLC

- York Now

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

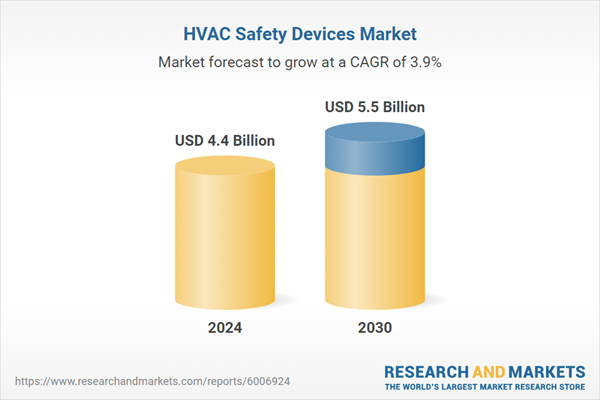

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |