Global Industrial Wireline Networking Market - Key Trends and Drivers Summarized

Industrial Wireline Networking: Powering Reliable Industrial Communication

Industrial wireline networking refers to the use of wired communication technologies to connect various industrial devices and systems, ensuring reliable and secure data transmission across manufacturing floors, power plants, and other industrial environments. Unlike wireless networks, wireline networking provides higher data integrity and is less susceptible to interference, making it ideal for critical industrial applications where data accuracy and real-time communication are paramount. This technology is essential in enabling the automation and control of industrial processes, supporting the seamless integration of various machines, sensors, and controllers to improve operational efficiency, safety, and productivity.How Is the Industrial Wireline Networking Market Evolving with Technology?

The industrial wireline networking market is evolving with advancements in technology that enhance the speed, reliability, and security of data transmission. One of the key trends is the adoption of Ethernet-based networking protocols, which offer higher data rates and more robust communication capabilities compared to traditional serial communication systems. The development of Power over Ethernet (PoE) technology is also influencing the market, as it allows for the transmission of both power and data over a single cable, simplifying network infrastructure and reducing costs. Additionally, the increasing use of fiber optics in industrial networking is providing higher bandwidth and longer transmission distances, which are critical for large-scale industrial operations. The integration of industrial Ethernet with cloud computing and IoT platforms is further driving the evolution of the market, enabling real-time monitoring and control of industrial processes from remote locations.What Challenges Does the Industrial Wireline Networking Market Face?

Despite the benefits of industrial wireline networking, the market faces several challenges that could impact its growth. One of the primary challenges is the high cost and complexity of installing and maintaining wired networks, particularly in large or complex industrial environments. The need for specialized cabling and infrastructure can be a significant investment, especially for companies looking to upgrade from older, legacy systems. Additionally, the rapid pace of technological change in industrial automation and IoT requires constant updates and integration of new networking standards, which can be both time-consuming and costly. The risk of physical damage to cables in harsh industrial environments is another challenge, as it can lead to network downtime and costly repairs.What Is Driving Growth in the Industrial Wireline Networking Market?

The growth in the industrial wireline networking market is driven by several factors. The increasing adoption of automation and Industry 4.0 practices is a major driver, as these technologies rely on reliable and secure communication networks to function effectively. The demand for high-speed and high-bandwidth communication in industrial environments is also fueling the adoption of Ethernet and fiber optic-based networking solutions. Additionally, the need for enhanced security and data integrity in critical industrial applications is driving the market, as wireline networks are generally more secure and less vulnerable to interference than wireless networks. The ongoing expansion of industrial IoT and the integration of cloud-based systems are further contributing to the demand for robust and reliable wireline networking solutions in various industries.Report Scope

The report analyzes the Industrial Wireline Networking market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Deployment (On-Premise Deployment, Cloud Deployment); Application (Industrial Ethernet Application, Fieldbus Application).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the On-Premise Deployment segment, which is expected to reach US$4.2 Billion by 2030 with a CAGR of a 3.8%. The Cloud Deployment segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Wireline Networking Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Wireline Networking Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Wireline Networking Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abracon LLC, Antenova Ltd., AT&T, Inc., Cisco Systems, Inc., Comba Telecom Systems Holdings Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Industrial Wireline Networking market report include:

- ABB Limited

- Amphenol Network Solutions

- BCE Inc.

- Broadcom

- Cisco Systems, Inc.

- Emerson Electric Co.

- Huawei Technologies Co., Ltd.

- Industrial Networking Solutions (INS)

- Infosys BPM

- Intel Corporation

- L&T Technology Services Limited

- Moxa Inc.

- NXP Semiconductors

- Techwave

- VIAVI Solutions Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Limited

- Amphenol Network Solutions

- BCE Inc.

- Broadcom

- Cisco Systems, Inc.

- Emerson Electric Co.

- Huawei Technologies Co., Ltd.

- Industrial Networking Solutions (INS)

- Infosys BPM

- Intel Corporation

- L&T Technology Services Limited

- Moxa Inc.

- NXP Semiconductors

- Techwave

- VIAVI Solutions Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 267 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

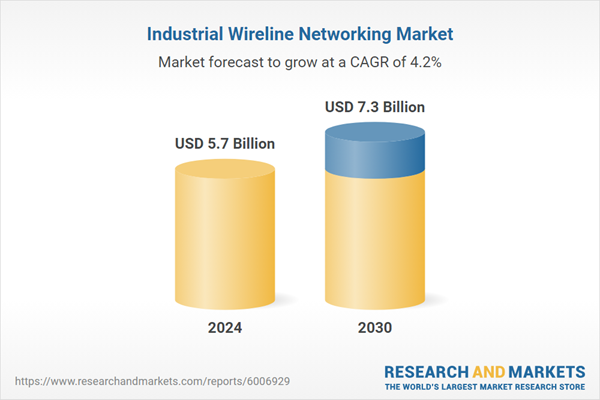

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 7.3 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |