Global Third-Party Banking Software Market - Key Trends & Drivers Summarized

What Is Third-Party Banking Software, and Why Is It Transformative?

Third-party banking software refers to the systems and solutions provided by external vendors that enable banks and financial institutions to manage core operations such as accounts processing, customer relationship management (CRM), loan management, and fraud detection. These platforms are crucial for banks seeking to modernize their infrastructure without the hefty investment and time required to develop in-house systems. By adopting third-party software, banks can leverage cutting-edge technology to enhance operational efficiency, improve customer service, and adapt quickly to changing regulatory landscapes. This software often includes features that support digital banking experiences, automate back-office processes, and provide analytical tools to derive insights from vast amounts of data.How Is Third-Party Banking Software Innovating Financial Services?

The financial sector is witnessing rapid innovation, driven by evolving customer expectations and the disruptive entry of fintech companies. Third-party banking software stands at the forefront of this transformation, providing traditional banks with the tools needed to compete in today's digital age. These solutions offer advanced functionalities like real-time payments, blockchain-based security, and personalized customer service through AI-driven chatbots and machine learning algorithms. The ability to integrate with existing banking infrastructure and third-party services, including non-banking platforms, empowers banks to offer a seamless and comprehensive service ecosystem to their customers.What Impact Does Third-Party Software Have on Banks’ Strategic Agility?

Adopting third-party banking software significantly enhances a bank's strategic agility - the ability to respond swiftly to market changes and customer needs. This agility is crucial in a landscape where technological advancements and consumer behaviors evolve rapidly. With robust third-party solutions, banks can quickly roll out new services, comply with updated regulations, and tap into emerging markets without the need for extensive redevelopment of their core systems. Moreover, these software solutions facilitate better data management and risk assessment practices, enabling banks to make informed decisions and manage risks proactively in their operations.What Drives the Growth of the Third-Party Banking Software Market?

The growth in the third-party banking software market is driven by several factors. Firstly, the digital transformation within the banking industry necessitates scalable and flexible software solutions that can address the complex demands of modern banking, including the need for omnichannel customer experiences and robust cybersecurity measures. Additionally, as banks face increasing pressure to reduce operational costs while enhancing service offerings, third-party solutions offer a cost-effective way to achieve these objectives without the capital expenditure required for new infrastructure. The rise in regulatory compliance requirements worldwide also compels banks to adopt sophisticated solutions that ensure compliance while maintaining competitive service offerings. Lastly, the growing consumer expectation for personalized, on-demand financial services drives banks to continuously innovate, often relying on third-party software providers to quickly adapt and deliver these services effectively. As these trends persist, the market for third-party banking software is expected to expand, reflecting the critical role these solutions play in the ongoing evolution of the banking sector.Report Scope

The report analyzes the Third-Party Banking Software market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Core Banking Software, Wealth Management Software, Omnichannel Banking Software, Business Intelligence Software, Other Product Types); Deployment (On-Premise Deployment, Cloud Deployment).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Core Banking Software segment, which is expected to reach US$14.3 Billion by 2030 with a CAGR of a 6.1%. The Wealth Management Software segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.9 Billion in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $8.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Third-Party Banking Software Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Third-Party Banking Software Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Third-Party Banking Software Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 1010data, Inc., Advan Research Corporation, Convergence, Dataminr, Eagle Alpha and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 49 companies featured in this Third-Party Banking Software market report include:

- Accenture Plc

- Capgemini SE

- Fidelity National Information Services, Inc. (FIS)

- Fiserv, Inc.

- Infosys Limited

- International Business Machines Corporation (IBM Corp.)

- Microsoft Corp.

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos Headquarters SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture Plc

- Capgemini SE

- Fidelity National Information Services, Inc. (FIS)

- Fiserv, Inc.

- Infosys Limited

- International Business Machines Corporation (IBM Corp.)

- Microsoft Corp.

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos Headquarters SA

Table Information

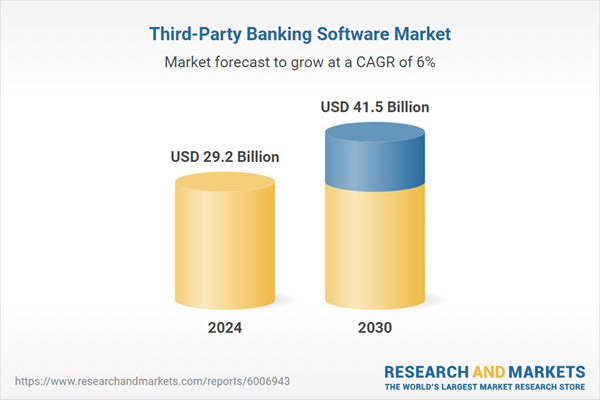

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.2 Billion |

| Forecasted Market Value ( USD | $ 41.5 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |