Global Workspace Aggregators Market - Key Trends & Drivers Summarized

What Are Workspace Aggregators and How Do They Revolutionize Work Environments?

Workspace aggregators are software solutions that integrate various digital workplace tools into a single platform to streamline access and management. These platforms typically bundle functionalities like email, instant messaging, file sharing, project management, and more, enabling users to access multiple services without switching between different applications. By simplifying the user experience and reducing the cognitive load of managing multiple interfaces, workspace aggregators enhance productivity and collaboration across teams, especially in environments where remote work and digital communication are prevalent.How Do Workspace Aggregators Enhance Productivity and Collaboration?

The primary benefit of workspace aggregators lies in their ability to centralize essential tools, which dramatically reduces the time and effort spent navigating between applications. This centralization not only speeds up workflow but also fosters better communication and collaboration within teams. For instance, by integrating communication tools with project management software, team members can discuss tasks and update statuses in real time, directly within the aggregator platform. Additionally, these systems often come with AI-driven features like automated task prioritization, meeting scheduling, and personalized alerts, further enhancing operational efficiency.What Technological Trends Influence the Development of Workspace Aggregators?

Technological advancements play a crucial role in shaping workspace aggregators. The rise of cloud computing has allowed for the scalable deployment of these platforms, ensuring that businesses of all sizes can leverage advanced digital tools. AI and machine learning have been instrumental in adding intelligent functionalities, such as predictive analytics for task management and natural language processing for easier navigation and data retrieval. Furthermore, the integration of cybersecurity measures within these platforms addresses growing concerns about data protection and compliance, making them suitable for even the most security-sensitive environments.What Drives the Growth of the Workspace Aggregators Market?

The growth in the workspace aggregators market is driven by several factors. The widespread adoption of remote and hybrid work models in response to the global shift in work dynamics necessitates tools that can support decentralized teams effectively. As businesses continue to embrace digital transformation, the demand for integrated solutions that can consolidate disparate workplace tools into a cohesive platform is on the rise. Additionally, the ongoing drive towards improving employee engagement and operational efficiency encourages organizations to invest in technologies that can simplify workflows and enhance communication. Economic factors such as the need to optimize IT expenditures also propel businesses towards aggregators that offer cost-effective solutions by reducing the need for multiple standalone products. These market drivers are expected to sustain the demand for workspace aggregators, making them integral components of modern work ecosystems.Report Scope

The report analyzes the Workspace Aggregators market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Deployment (Cloud Deployment, On-Premise Deployment); End-Use (Retail End-Use, IT & Telecom End-Use, Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cloud Deployment segment, which is expected to reach US$3.8 Billion by 2030 with a CAGR of a 10%. The On-Premise Deployment segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $906.1 Million in 2024, and China, forecasted to grow at an impressive 12.9% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Workspace Aggregators Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Workspace Aggregators Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Workspace Aggregators Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

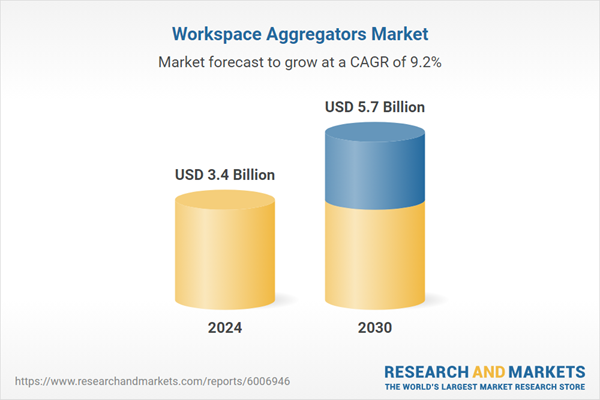

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABLIC Inc., Analog Devices, Inc., Applied Materials, Inc., Eurotronix, Futurrex, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Workspace Aggregators market report include:

- Amazon.com, Inc.

- AO Kaspersky Lab

- BlackBerry Ltd.

- Citrix Systems, Inc.

- FATbit Technologies

- International Business Machines Corp.

- Ivanti

- Microsoft Corp.

- Oracle Corp.

- ServiceNow, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon.com, Inc.

- AO Kaspersky Lab

- BlackBerry Ltd.

- Citrix Systems, Inc.

- FATbit Technologies

- International Business Machines Corp.

- Ivanti

- Microsoft Corp.

- Oracle Corp.

- ServiceNow, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |