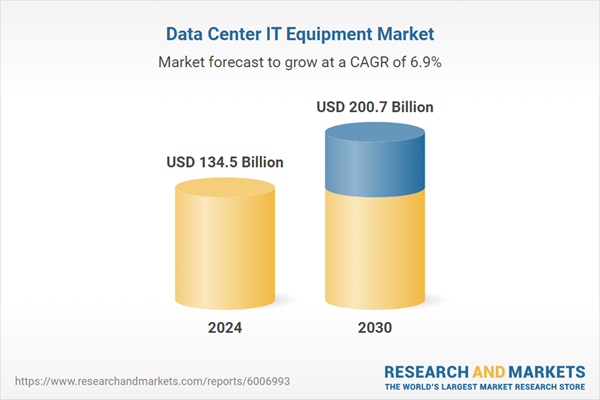

Global Data Center IT Equipment Market - Key Trends and Drivers Summarized

Data Center IT Equipment: The Backbone of Modern Digital Infrastructure

Data Center IT Equipment refers to the hardware and technology infrastructure used within data centers to store, process, and manage vast amounts of data. This equipment includes servers, storage systems, networking devices, power distribution units (PDUs), and cooling systems, all of which work together to ensure the smooth operation of data centers. Data centers are the backbone of modern digital operations, supporting everything from cloud computing and big data analytics to e-commerce and social media platforms. As businesses and organizations increasingly rely on digital services, the demand for robust and efficient Data Center IT Equipment is growing, making it a critical component of the global IT infrastructure.How Are Technological Advancements Enhancing Data Center IT Equipment?

Technological advancements are driving significant improvements in Data Center IT Equipment, making it more powerful, efficient, and scalable. The development of next-generation processors and high-performance computing (HPC) systems has enhanced the processing capabilities of data center servers, enabling them to handle more complex workloads and larger datasets. Innovations in storage technology, such as solid-state drives (SSDs) and non-volatile memory express (NVMe) devices, have increased data storage speed and capacity, improving overall data center performance. Advances in networking technology, including the adoption of 5G and software-defined networking (SDN), have optimized data center connectivity, ensuring faster and more reliable data transmission. Additionally, the integration of AI and machine learning into data center management systems has enabled more efficient resource allocation, predictive maintenance, and energy optimization. These technological advancements are transforming data centers into more efficient, flexible, and cost-effective facilities, capable of supporting the growing demands of the digital economy.What Are the Key Applications and Benefits of Data Center IT Equipment?

Data Center IT Equipment is used across a wide range of industries and applications, providing the essential infrastructure needed to support modern digital services and operations. In the cloud computing industry, data center servers and storage systems power the virtual machines and storage solutions that form the backbone of cloud services. In financial services, data centers support high-frequency trading platforms, risk management systems, and data analytics, ensuring that financial institutions can operate efficiently and securely. The healthcare industry relies on data centers to store and process large volumes of patient data, support telemedicine services, and manage electronic health records (EHRs). The primary benefits of Data Center IT Equipment include increased processing power, enhanced data storage and retrieval, improved connectivity, and greater operational efficiency. By investing in advanced Data Center IT Equipment, organizations can ensure that their digital infrastructure is capable of meeting the demands of the modern digital landscape.What Factors Are Driving the Growth in the Data Center IT Equipment Market?

The growth in the Data Center IT Equipment market is driven by several factors. The increasing demand for cloud computing, big data analytics, and AI-driven applications is a significant driver, as these technologies require robust data center infrastructure to operate effectively. Technological advancements in processors, storage devices, and networking equipment are also propelling market growth, as these innovations enhance the performance and efficiency of data centers. The rising need for data security and regulatory compliance is further boosting demand for Data Center IT Equipment, as organizations seek to protect sensitive data and meet industry standards. Additionally, the expansion of global digital services and the growing adoption of digital transformation initiatives are contributing to market growth, as businesses and organizations require scalable and reliable data center infrastructure to support their operations. The increasing focus on energy efficiency and sustainability in data center operations is also supporting the growth of the market. These factors, combined with continuous innovation in data center technology, are driving the sustained growth of the Data Center IT Equipment market.Report Scope

The report analyzes the Data Center IT Equipment market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Equipment Type (Server Equipment, Storage Equipment, Network Equipment, Other Equipment Types); End-Use (IT & Telecom End-Use, BFSI End-Use, Government & Public Sector End-Use, Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Server Equipment segment, which is expected to reach US$95.6 Billion by 2030 with a CAGR of a 7.6%. The Storage Equipment segment is also set to grow at 6.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $36.2 Billion in 2024, and China, forecasted to grow at an impressive 11.1% CAGR to reach $44.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Data Center IT Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Data Center IT Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Data Center IT Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Dockmaster, Inc., Envision Enterprise Solutions Pvt. Ltd., Harba ApS, Harbor Compliance, Harbor Lab S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Data Center IT Equipment market report include:

- Alcatel-Lucent S.A.

- Arista Networks Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- CoreSite Realty Corp.

- CyrusOne LLC

- Extreme Networks, Inc.

- F5, Inc.

- Fortinet Inc.

- Fratelli Indelicato S.r.l.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Development LP

- IEI Integration Corp.

- Juniper Networks Inc.

- NEC Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alcatel–Lucent S.A.

- Arista Networks Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- CoreSite Realty Corp.

- CyrusOne LLC

- Extreme Networks, Inc.

- F5, Inc.

- Fortinet Inc.

- Fratelli Indelicato S.r.l.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Development LP

- IEI Integration Corp.

- Juniper Networks Inc.

- NEC Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 134.5 Billion |

| Forecasted Market Value ( USD | $ 200.7 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |