The rising demand for these services in the region is a result of the European Union's emphasis on data privacy and security, as well as its strong emphasis on digital transformation, as evidenced by government initiatives like the European Digital Strategy. Consequently, the European region would acquire nearly 30% of the total market share by 2031.

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, in May, 2024, IBM Corporation announced the acquisition of SKYARCH NETWORKS, a Japanese firm specializing in Amazon Web Services (AWS). This move will enhance IBM Consulting’s capacity to support clients in cloud transformation and underscores IBM’s dedication to strategic partners like AWS, crucial for leveraging data and scaling generative AI. Moreover, in July, 2024, ServiceNow, Inc. announced the acquisition of Raytion, an internationally operating IT business consultancy to boost GenAI-powered search and knowledge management on the Now Platform. Raytion’s advanced information retrieval technology will provide unified, real-time access to critical business data from various sources, enhancing AI search capabilities for a more efficient and personalized experience on a single platform.

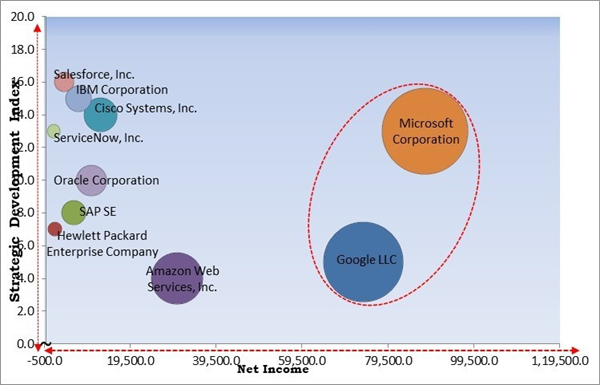

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Market. In January, 2023, Microsoft Corporation announced the acquisition of Fungible Inc., a company specializing in composable infrastructure for enhancing datacenter networking and storage with efficient, low-power data processing units (DPUs). Fungible's technology supports high-performance, scalable datacenter infrastructure. The Fungible team will integrate with Microsoft's datacenter engineering division to drive DPU solutions and network innovations. Companies such as Cisco Systems, Inc., IBM Corporation, and Oracle Corporation are some of the key innovators in Market.Market Growth Factors

The adoption of DevOps and Continuous Integration/Continuous Deployment (CI/CD) practices has transformed software development. These services are critical in effectively implementing DevOps and CI/CD practices. They provide the necessary infrastructure to automate testing, integration, and deployment, enhancing the speed and quality of software delivery. Hence, as more organizations aim to accelerate their software development pipelines, the demand for these services continues to grow.Unlike traditional monolithic architectures, where all components of an application are tightly integrated, microservices architecture breaks down complex applications into smaller, independent services. As more businesses adopt microservices, particularly in sectors such as e-commerce, financial services, and cloud-based applications, the demand for these services continues to grow. Thus, as the microservices trend expands, the role of platform engineering in facilitating smooth, reliable, and scalable service-based applications will become increasingly vital, further driving the market for these services.

Market Restraining Factors

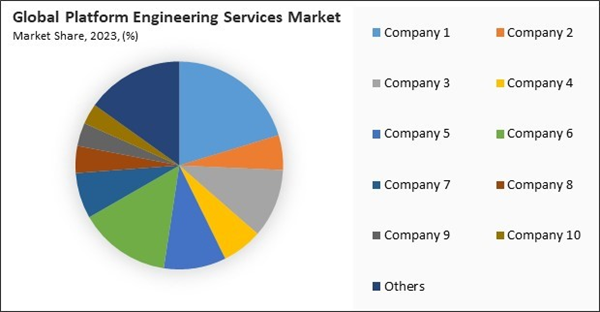

Platform engineering is a highly specialized field that requires in-depth knowledge across various domains, such as cloud architecture, software development, automation, DevOps practices, and cybersecurity. This talent shortage directly impacts organizations' ability to implement platform engineering solutions effectively. Hence, the shortage of skilled workforce may hamper the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

Driving and Restraining Factors

Drivers

- Adoption of DevOps and Continuous Integration/Continuous Deployment (CI/CD) Practices

- Growing adoption of microservices architecture

- Rising demand for cloud-native solutions

Restraints

- Substantial shortage of skilled workforce

- High initial investment costs

Opportunities

- Increased focus on digital transformation

- Emphasis on security and compliance

Challenges

- Integration complexity associated with platform engineering services

- Rising wariness of organizations on a single vendor

Organization Size Outlook

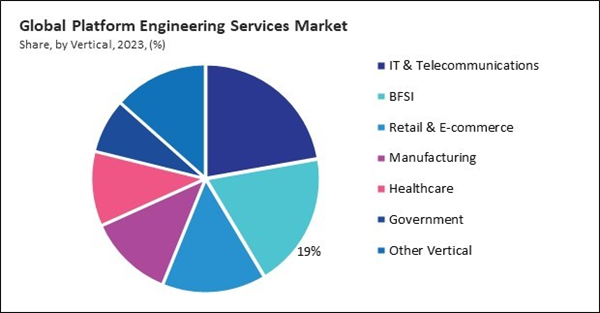

On the basis of organization size, the market is classified into large enterprises and SMEs. The SMEs segment recorded 38% revenue share in the market in 2023. As SMEs increasingly prioritize digitalization to improve operational efficiency and compete in a fast-evolving business landscape, their adoption of these services has grown.Vertical Outlook

Based on product, the market is classified into DAW systems, mixers, interfaces, power amplifiers, PA systems, network switches, processors, speakers, headphones, microphones, and others. The PA systems segment procured 15% revenue share in the market in 2023. Public Address (PA) systems are extensively employed in large venues, including concert halls, theaters, and corporate events, where the delivery of speeches, music, and performances is contingent upon the clear and powerful amplification of sound.Type Outlook

Based on type, the market is segmented into design & architecture, development & implementation, support & maintenance, optimization & performance tunings, integration & migration, and others. The support & maintenance segment recorded 19% revenue share in the market in 2023. As organizations rely on these services for critical operations, ongoing support, troubleshooting, and system maintenance have become essential.Deployment Outlook

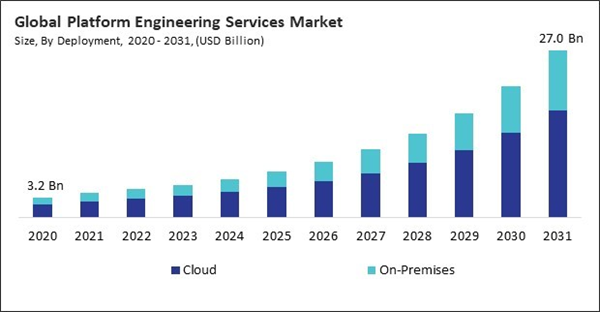

Based on deployment, the market is bifurcated into cloud and on-premises. The on-premises segment procured 34% revenue share in the market in 2023. On-premises solutions are the preferred choice for numerous organizations, particularly those with more regulations such as finance and healthcare, as they offer better control over infrastructure, data security, and compliance.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 38% revenue share in the market in 2023. In addition to the early adoption of emerging technologies, the rise can be ascribed to the presence of major technological companies such as Amazon Web Services (AWS), Microsoft, Google, and IBM.Market Competition and Attributes

The Market is highly competitive, with a diverse range of players offering customized solutions for enterprise needs. Companies focus on innovation, scalability, and integration capabilities, making differentiation crucial. Key competitors include established IT service providers, specialized engineering firms, and emerging startups.

Recent Strategies Deployed in the Market

- Aug-2024: Hewlett Packard Enterprise Company announced the acquisition of Morpheus Data, a leader in hybrid cloud management software. This move underscores HPE's dedication to reducing IT complexity by enhancing hybrid operations through its HPE GreenLake cloud platform, addressing the challenges of managing diverse and complex IT environments.

- Jun-2024: Hewlett Packard Enterprise Company unveiled its hybrid cloud solutions with HPE Private Cloud's virtualization capability. This combines open-source KVM with HPE’s cluster orchestration software to meet high-performance needs. Managed via a cloud-based control plane, it optimizes resource use and remains available even offline.

- Apr-2024: Microsoft Corporation teamed up with Cloud Software Group Inc., a company provides enterprise software to enhance collaboration on Citrix's virtual application and desktop platform and developing new cloud and AI solutions. Cloud Software Group will invest $1.65 billion in Microsoft’s cloud and AI, with Citrix becoming the preferred Azure partner for Enterprise Desktop as a Service.

- Mar-2024: Oracle Corporation announced the partnership with NVIDIA, an American multinational corporation and technology company are deepening their partnership to offer sovereign AI solutions globally. Their combined strengths in distributed cloud, AI infrastructure, and generative AI services allow governments and enterprises to deploy AI factories locally or on-premises, enhancing economic growth and meeting sovereignty objectives with robust operational controls.

- Feb-2024: Salesforce, Inc. announced the acquisition of Spiff, a company offering advanced incentive compensation management (ICM) software with a user-friendly interface, spreadsheet familiarity, and robust processing capabilities. This acquisition will help Chief Revenue Officers better coordinate with financial and sales teams, streamline compensation plans, and boost revenue performance.

List of Key Companies Profiled

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Cisco Systems, Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Company

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

Market Report Segmentation

By Deployment

- Cloud

- On-Premises

By Organization Size

- Large Enterprises

- SMEs

By Vertical

- IT & Telecommunications

- BFSI

- Retail & E-commerce

- Manufacturing

- Healthcare

- Government

- Other Vertical

By Type

- Design & Architecture

- Development & Implementation

- Support & Maintenance

- Optimization & Performance Tunings

- Integration & Migration

- Other Type

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Cisco Systems, Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Company

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.