Environmental laws in this region are very harsh, notably those that are implemented by the Industrial Emissions Directive (IED) of the European Union. This region is differentiated by these rules. Refineries, oil and gas companies, and petrochemical companies are among the businesses that are required to comply with this directive's tight restrictions on flare emissions. Consequently, the European region would acquire nearly 28% of the total market share by 2031.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2024, Ametek, Inc. introduced the LWIR-640 thermal imager for battery storage, advancing fire prevention with early detection of thermal runaway. Features include precise temperature measurement, continuous monitoring, alarm triggering, and data logging, ensuring proactive safety and seamless system integration. Moreover, in November, 2023, Emerson Electric Co. introduces the Fisher FIELDVUE DPC2K digital process controller, enhancing pneumatic controllers with improved closed-loop control, reliability, and safety. It features extensive remote connectivity, easy maintenance, and versatile applications for pressure, flow, level, and temperature control in hazardous environments.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Siemens AG, Honeywell International, Inc. and Thermo Fisher Scientific are the forerunners in the Market. In December, 2023, Siemens announced the launch of enhanced fire safety solutions for its Building X platform. The introduction of new applications and an API significantly boosts remote monitoring, real-time notifications, and predictive maintenance capabilities. These advancements enhance transparency, operational efficiency, and sustainability, optimizing data management and reducing CO2 emissions from site visits. Companies such as Emerson Electric Co. and ABB Group are some of the key innovators in Market.Market Growth Factors

Infrared (IR) and ultraviolet (UV) sensing technologies have greatly enhanced the precision and dependability of these systems, allowing industries to detect even the smallest emissions. The improvements in sensor technology have driven the widespread adoption of these systems, particularly in emission-heavy industries such as oil and gas, petrochemicals, and refineries. Hence, the continuous evolution of monitoring technologies, particularly in sensor capabilities, is a key factor propelling the growth of the market.With considerable expansion in a variety of regions, particularly in the Middle East, North America, and Asia, the oil and gas industry around the world is continuing to expand and see tremendous growth. Furthermore, the Russian Federation, the Islamic Republic of Iran, Iraq, the United States, República Bolivariana de Venezuela, Algeria, Libya, Nigeria, and Mexico remain the top nine flaring countries in 2023. Thus, as the global energy demand grows, the market will continue to expand.

Market Restraining Factors

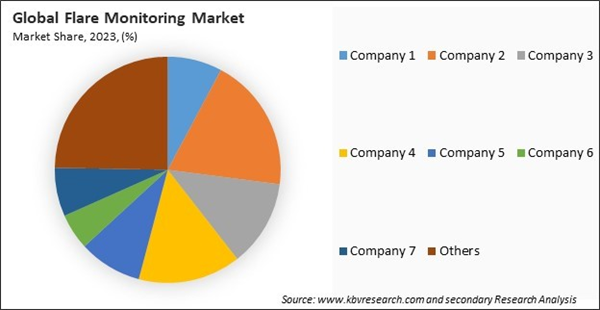

Cutting-edge systems like infrared sensors, mass spectrometry, and optical gas imaging require substantial capital to purchase, configure, and integrate into existing infrastructure. Small and medium-sized enterprises frequently operate with restricted financial resources and are more susceptible to capital-intensive investments. Hence, the high cost of these technologies has emerged as a key factor obstructing market growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Technological advancements in monitoring systems

- Growth in the oil & gas industry

- Rising demand for real-time monitoring and analytics

Restraints

- High initial investment costs

- Lack of stringent regulations in developing regions

Opportunities

- Safety concerns in industrial operations

- Adoption of Industry 4.0 technologies

Challenges

- Technological complexity of flare monitoring systems

- Competition from alternative emission reduction solutions

Industry Outlook

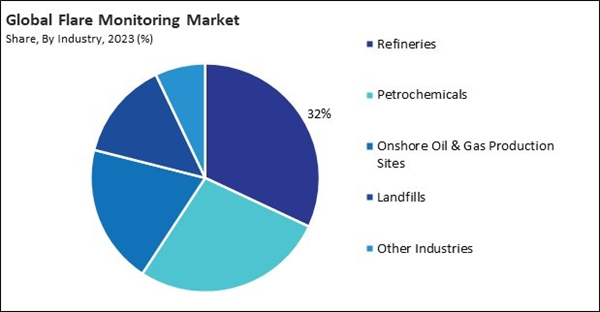

Based on industry, the market is segmented into refineries, petrochemicals, onshore oil & gas production sites, landfills, and others. The petrochemicals segment acquired 27% revenue share in the market in 2023. Petrochemical plants are responsible for the production of a wide variety of chemicals that are obtained from natural gas and petroleum.Mounting Method Outlook

Based on mounting method, the market is bifurcated into in-process and remote. The remote segment procured 44% revenue share in the market in 2023. Remote monitoring systems are gaining traction because they offer non-invasive methods of tracking flare emissions from a distance.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34% revenue share in the market in 2023. The oil and gas industry's substantial presence in the United States and Canada is the primary reason for this dominance, as it is responsible for a substantial portion of global flare emissions.Market Competition and Attributes

The competition in the Market is growing, with established players focusing on advanced technologies for accurate emissions tracking and compliance. Rising environmental regulations are driving innovation, while smaller companies explore cost-effective solutions. Strategic collaborations and regional expansions are key factors intensifying the competitive landscape.

Recent Strategies Deployed in the Market

- Jun-2024: Emerson Electric Co. and Equinor and entered into a strategic partnership for advanced well completion monitoring at the Rosebank field in the North Sea. Emerson's Roxar tools will play a pivotal role in boosting oil recovery, optimizing reservoir performance, and ensuring well integrity, thus supporting Equinor’s production goals and regulatory compliance.

- May-2024: Fluenta AS came into partnership with SEGITEC in North Africa. This collaboration will leverage Fluenta’s advanced ultrasonic flare gas measurement technology and SEGITEC’s regional expertise to enhance environmental compliance, support decarbonization initiatives, and advance sustainable practices within the oil and gas sector.

- Dec-2023: Emerson Electric Co. announced its acquisition of Flexim, a prominent provider of clamp-on ultrasonic flow measurement technology. This acquisition will strengthen Emerson’s automation portfolio and enhance its measurement capabilities. Following the transaction, Flexim’s Berlin headquarters will be designated as Emerson’s Ultrasonic Flow Measurement Center of Excellence.

- May-2023: Honeywell introduces its latest flare systems: Multi-Point Ground Flares, Totally Enclosed Ground Flares (TEGF), Hemisflare, Elevated Flares, and Flare Gas Recovery Systems. These advanced, cost-effective solutions enhance efficiency, safety, and environmental performance across diverse applications.

- Apr-2023: Emerson Electric Co. introduced a new data analytics system that predicts 79% of flare events using advanced techniques like principal component analysis and wavelet transform. The system forecasts flare events, improving safety and efficiency in refineries by providing early warnings and critical insights.

List of Key Companies Profiled

- Ametek, Inc.

- Emerson Electric Co.

- Siemens AG

- ABB Group

- Honeywell International, Inc.

- Thermo Fisher Scientific

- Yokogawa Electric Corporation

- Fluenta AS

- Zeeco, Inc.

- John Zink Company, LLC

Market Report Segmentation

By Mounting Method

- In-process

- Gas Chromatographs

- Mass Spectrometers

- Flowmeters

- Calorimeters

- Other In-process Type

- Remote

- Thermal (IR) Imagers

- Multi-Spectrum Infrared (MSIR) Imagers

- Other Remote Type

By Industry

- Refineries

- Petrochemicals

- Onshore Oil & Gas Production Sites

- Landfills

- Other Industries

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Netherlands

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Ametek, Inc.

- Emerson Electric Co.

- Siemens AG

- ABB Group

- Honeywell International, Inc.

- Thermo Fisher Scientific

- Yokogawa Electric Corporation

- Fluenta AS

- Zeeco, Inc.

- John Zink Company, LLC

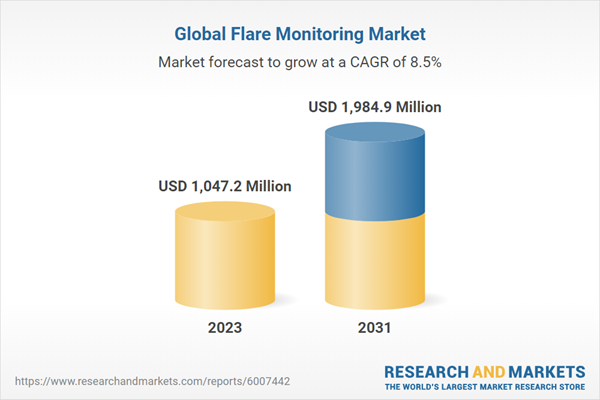

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | September 2024 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 1047.2 Million |

| Forecasted Market Value ( USD | $ 1984.9 Million |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |