The United States, in particular, has been a key player in driving innovation in sectors such as information technology, telecommunications, and defense, which heavily rely on eNVM technologies. The growth of smart manufacturing, increasing investments in IoT, and the expanding automotive and aerospace sectors have further propelled the demand for eNVM in North America. Consequently, the North American region would acquire nearly 24% of the total market share by 2031.

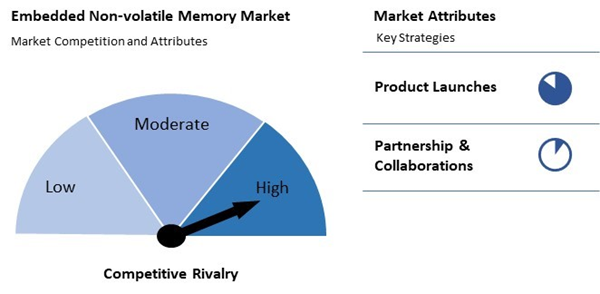

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in March, 2024, STMicroelectronics N.V. unveiled an 18nm FD-SOI process with embedded phase change memory (PCM), co-developed with Samsung Foundry. This technology boosts performance and power efficiency for embedded processing, supports larger memory sizes, and integrates more analog and digital peripherals. Moreover, in October, 2023, Micron Technology, Inc. unveiled a 32Gbit dual-layer 3D stacked non-volatile ferroelectric memory. Titled "NVDRAM," it claims to deliver near-DRAM performance with enhanced energy efficiency for AI workloads, supporting faster data movement and larger neural network models.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunner in the Market. In January, 2022, Samsung Electronics Co., Ltd. unveiled the world's first in-memory computing using MRAM (Magnetoresistive Random Access Memory). The innovation, detailed in the paper "A crossbar array of magnetoresistive memory devices for in-memory computing," highlights Samsung's advancements in in-memory technology and AI chips. Companies such as NXP Semiconductors N.V., STMicroelectronics N.V., and Infineon Technologies AG are some of the key innovators in Market.Market Growth Factors

Information and communication technologies are integrated into a variety of city infrastructure components in order to enhance the quality of life for residents and optimize the efficacy of urban services in smart cities. In smart grid applications, eNVM plays a crucial role in managing the vast data generated by energy meters, sensors, and control systems. Hence, as more cities worldwide embrace the smart city model, the demand for this memory is expected to rise.As digital interconnectivity expands, concerns about data breaches, cyberattacks, and unauthorized access have intensified, particularly in finance, healthcare, and government services. The necessity of secure eNVM is further emphasized by the proliferation of Internet of Things (IoT) devices. Thus, the demand for secure eNVM solutions will grow as digital threats evolve.

Market Restraining Factors

The manufacturing process for eNVM, especially when using sophisticated technologies like FinFET and FD-SOI, requires specialized equipment and high-quality materials, which significantly drive up production costs. The expensive materials required for eNVM production also contribute to manufacturing costs. Hence, the high manufacturing costs associated with eNVM production present a barrier to its widespread adoption.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Rapid proliferation of smart cities

- Increased focus on data security

- Emergence of AI and machine learning applications

Restraints

- Substantially high manufacturing costs

- Competition from other memory technologies

Opportunities

- Growth of automotive electronics

- Adoption of advanced manufacturing processes

Challenges

- Limited endurance and write cycles

- Complex integration processes for eNVMs

Wafer Size Outlook

On the basis of wafer size, the market is bifurcated into < 100mm and >100mm. The < 100mm segment recorded 41% revenue share in the market in 2023. The segment's growth reflects the growing significance of applications that require higher performance, reduced power consumption, and greater data density. Wafers below 100mm are instrumental in cutting-edge technology sectors such as advanced consumer electronics, telecommunications, and IoT devices.Product Outlook

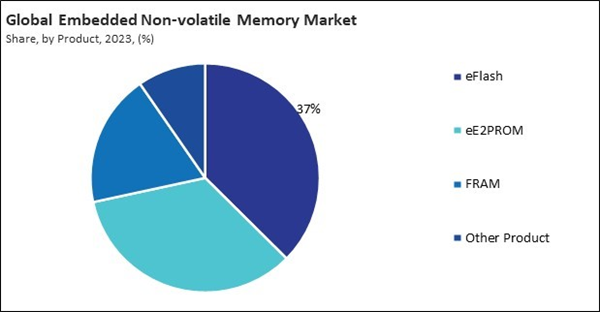

Based on product, the market is divided into eFlash, eE2PROM, FRAM, and others. The eE2PROM segment procured 34% revenue share in the market in 2023. eE2PROM (Electrically Erasable Programmable Read-Only Memory) is widely utilized in applications where frequent data writing and reprogramming are essential.Application Outlook

By application, the market is segmented into BFSI, consumer electronics, government, telecommunications, information technology, and others. The information technology segment garnered 20% revenue share in the market in 2023. The IT sector’s increasing reliance on eNVM stems from the rising demand for advanced data storage solutions that offer enhanced performance, data security, and reliability.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired 46% revenue share in the market in 2023. This strong performance is driven by the region's thriving consumer electronics industry, rapid industrialization, and increasing demand for advanced semiconductor technologies.Market Competition and Attributes

The competition in the market is intense, driven by technological advancements and increasing demand for compact, low-power memory solutions. Major players focus on innovation, product differentiation, and integration capabilities, while startups explore niche applications. Strategic partnerships and acquisitions further intensify market rivalry.

Recent Strategies Deployed in the Market

- Jan-2024: Intel Corporation signed an agreement with United Microelectronics Corporation to develop a 12-nanometer semiconductor process platform for mobile, communication infrastructure, and networking markets. This long-term agreement combines Intel's U.S. manufacturing with UMC's foundry expertise, enhancing global customer choices and supply chain resilience.

- Aug-2023: Fujitsu Limited unveiled the 512Kbit FeRAM "MB85RC512LY," their highest-density automotive-grade FeRAM with an I2C interface. It offers low operating current, 10 trillion read/write cycles at 125°C, and is ideal for industrial robots and automotive applications like ADAS. Evaluation samples are now available.

- May-2023: NXP Semiconductors N.V. has partnered with TSMC and unveiled the first automotive-embedded MRAM in 16 nm FinFET technology. This advancement supports software-defined vehicles' need for multiple software upgrades on one hardware platform, combining NXP's S32 processors with advanced, reliable non-volatile memory.

- Apr-2023: Infineon Technologies AG unveiled the SEMPER X1 LPDDR Flash memory, the first for automotive E/E architectures. It offers 8 times the performance and 20 times faster random read speeds than NOR Flash, enhancing real-time code execution, safety, and flexibility in software-defined vehicles.

- Nov-2022: Infineon Technologies AG and TSMC are set to unveil TSMC's Resistive RAM (RRAM) Non-Volatile Memory technology into Infineon’s next-gen AURIX microcontrollers. RRAM, advancing beyond embedded Flash memory, will enhance automotive ECUs, supporting innovations in electrification, new E/E architectures, and automated driving at 28nm and beyond.

List of Key Companies Profiled

- Samsung Electronics Co., Ltd. (Samsung Group)

- Micron Technology, Inc.

- ROHM Co., Ltd.

- Toshiba International Corporation

- Honeywell International Inc.

- Fujitsu Limited

- Infineon Technologies AG

- Intel Corporation

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

Market Report Segmentation

By Wafer Size

- >100 mm

- < 100 mm

By Product

- eFlash

- eE2PROM

- FRAM

- Other Product

By Application

- BFSI

- Information Technology

- Consumer Electronics

- Telecommunications

- Government

- Others Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Samsung Electronics Co., Ltd. (Samsung Group)

- Micron Technology, Inc.

- ROHM Co., Ltd.

- Toshiba International Corporation

- Honeywell International Inc.

- Fujitsu Limited

- Infineon Technologies AG

- Intel Corporation

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

Table Information

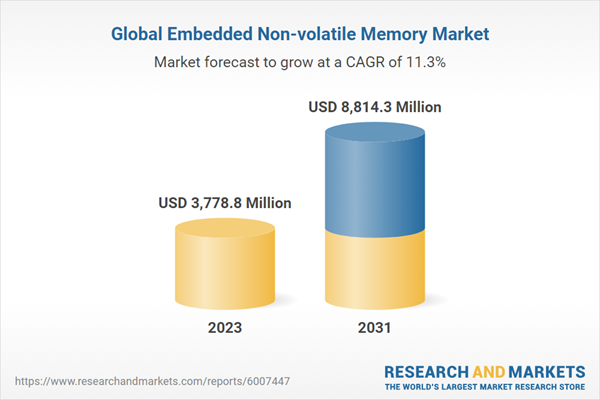

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | September 2024 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 3778.8 Million |

| Forecasted Market Value ( USD | $ 8814.3 Million |

| Compound Annual Growth Rate | 11.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |