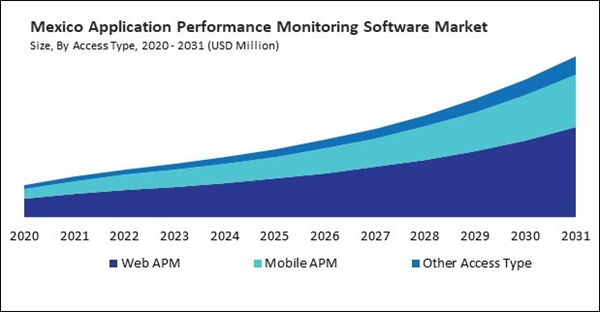

The US market dominated the North America Application Performance Monitoring Software Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $455.8 million by 2031. The Canada market is experiencing a CAGR of 9.7% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 9.1% during (2024 - 2031).

Application Performance Monitoring (APM) software refers to a suite of tools and processes designed to track, analyze, and manage the performance of software applications in real-time. The primary goal of APM software is to ensure that applications are running efficiently, without issues such as slow response times, crashes, or downtime, which can negatively affect user experience and business operations. In general, APM tools provide visibility into how applications behave, helping IT teams and developers identify performance bottlenecks, troubleshoot errors, and optimize resource utilization.

The market is witnessing rapid growth as organizations across industries increasingly rely on software applications to deliver services, maintain operations, and engage with customers. APM software plays a pivotal role in ensuring that these applications perform optimally, providing real-time visibility into the health, functionality, and performance of applications. In an era where software underpins critical operations in finance, healthcare, and e-commerce sectors, maintaining optimal performance is not just important - it’s essential. This demand for seamless, high-performance software is driving the expansion of the market.

In Canada, the media and entertainment industry is a key factor fueling the demand for APM software. According to Statistics Canada, the film, television, and video production sector brought in $11.3 billion in operating revenue in 2021, up 20.2% from the previous year. Most of the business comprised television productions, which brought in 59.2% of all production income in 2021 (up from 59.1% in 2019). Feature films slightly increased in 2021, with a share of 22.6% of total production revenue. As streaming platforms, digital media, and online gaming experience a surge in user engagement, particularly post-pandemic, businesses in this sector require advanced APM software tools to maintain optimal performance across various digital platforms. Similarly, the e-commerce sector in Mexico is experiencing rapid growth, and this expansion is significantly driving demand for APM software. According to ITA, the domestic e-commerce industry was valued at USD 26.2 billion in 2022, representing a 23% growth over 2021. Therefore, the increasing reliance on digital platforms and the need for seamless application experiences are expected to continue propelling North America's market in the coming years.

Based on Enterprise Size, the market is segmented into Large Enterprise and Small & Medium Enterprise (SME). Based on Type, the market is segmented into Real User Monitoring (RUM), Synthetic Monitoring, Server-Side Monitoring, Database Monitoring, Network Performance Monitoring, and Other Type. Based on Access Type, the market is segmented into Web APM, Mobile APM, and Other Access Type. Based on Deployment, the market is segmented into Cloud and On-premises. Based on End Use, the market is segmented into IT & Telecommunications, BFSI, Retail, Healthcare, Media & Entertainment, E-Commerce, Manufacturing, Government & Academics, and Other End Use. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Cisco Systems, Inc.

- Broadcom, Inc.

- Datadog, Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Open Text Corporation

- Dynatrace, Inc.

Market Report Segmentation

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

By Type

- Real User Monitoring (RUM)Synthetic Monitoring

- Server-Side Monitoring

- Database Monitoring

- Network Performance Monitoring

- Other Type

By Access Type

- Web APM

- Mobile APM

- Other Access Type

By Deployment

- Cloud

- On-premises

By End Use

- IT & Telecommunications

- BFSI

- Retail

- Healthcare

- Media & Entertainment

- E-Commerce

- Manufacturing

- Government & Academics

- Other End Use

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Cisco Systems, Inc.

- Broadcom, Inc.

- Datadog, Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Open Text Corporation

- Dynatrace, Inc.