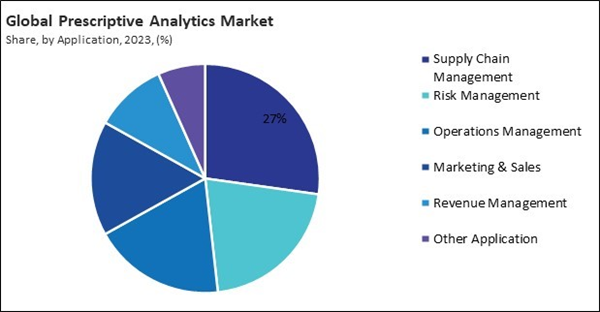

Prescriptive analytics enables organizations to analyze customer data, including purchase history, behavior, and preferences, to recommend highly targeted marketing strategies and personalized offers. Hence, the marketing and sales segment held 16% revenue share in the market in 2023. Effectively targeting and personalizing marketing efforts is crucial for maximizing campaign effectiveness and sales performance. This precision in targeting improves customer engagement and conversion rates, driving the demand for prescriptive analytics in marketing and sales.

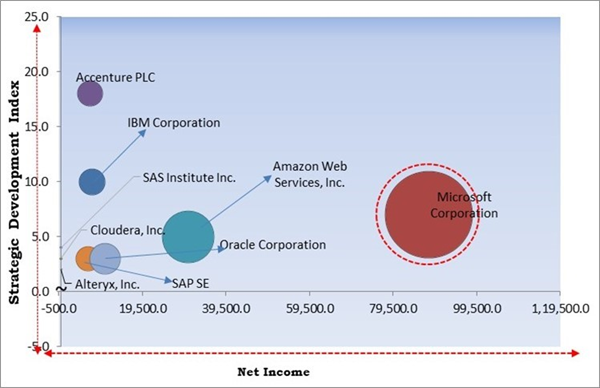

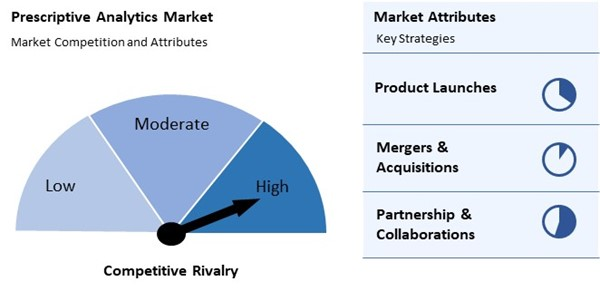

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December, 2023, Accenture PLC has partnered with Union Bank of India to develop a data lake platform utilizing advanced analytics, AI, and machine learning. This collaboration aims to improve business forecasting and customer personalization, integrating closely with prescriptive analytics for optimized decision-making. Additionally, In August, 2024, Alteryx, Inc. has partnered with Udacity to introduce a new course focused on data preparation using Alteryx Designer. This initiative is designed to advance data literacy and AI skills, equipping learners with critical analytics capabilities.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix, Microsoft Corporation is the forerunner in the Prescriptive Analytics Market. In June, 2024, Microsoft Corporation and Hitachi, Ltd. have announced a partnership to integrate Microsoft’s cloud, AI, and analytics tools into Hitachi’s Lumada solutions. Companies such as Accenture PLC and IBM Corporation are some of the key innovators in the Prescriptive Analytics Market.Market Growth Factors

The rapid growth in data generation is a key driver for the prescriptive analytics market. In today’s digital age, data is being produced at an unprecedented rate from various sources, including social media, IoT devices, transactional systems, and more. Every interaction, transaction, and sensor reading contributes to a vast data pool, creating a significant challenge for organizations to manage and make sense of this information. In conclusion, rapid data generation growth is driving the market’s growth.Responding quickly to changing conditions is critical in fast-paced business environments. Organizations face continuous shifts in market trends, customer behavior, and operational challenges. To maintain a competitive edge, businesses need the capability to analyze data and make decisions in real time. For example, in financial trading, real-time analytics can offer recommendations on trading strategies based on live market data. In healthcare, it can suggest treatment adjustments based on real-time patient monitoring data. This critical decision-making capability supports the effective management of high-stakes situations. Thus, the rising demand for real-time data analysis propels the market’s growth.

Market Restraining Factors

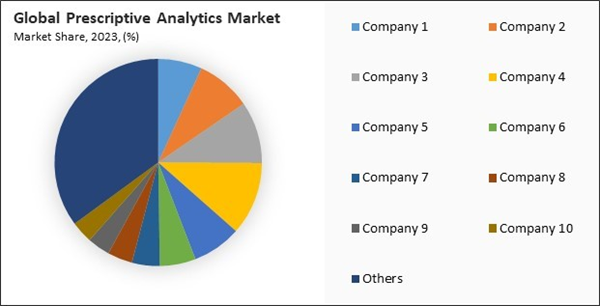

Implementing prescriptive analytics solutions often requires a substantial initial investment. This includes costs for purchasing sophisticated software, acquiring necessary hardware, and integrating these tools into existing systems. These upfront expenditures can be an immense impediment to adoption for numerous organizations, particularly those that are more diminutive. Prescriptive analytics solutions frequently need to be customized to fit an organization’s specific needs and workflows. This concern can deter potential adopters from making the financial commitment required. Therefore, the high implementation costs of prescriptive analysis hamper the market’s growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Rapid Growth in Data Generation

- Rising Demand for Real-Time Data Analysis

- Expansion of the Digital Transformation Worldwide

Restraints

- High Implementation Costs of Prescriptive Analysis

- Data Privacy and Security Concerns

Opportunities

- Demand for Improved Decision-Making

- Growing Complexity of Business Operations

Challenges

- Shortage of Skilled Personnel for Development and Interpretation

- Challenges Related to Data Quality and Accuracy

Component Outlook

Based on component, the market is divided into software and services. In 2023, the software segment garnered 63% revenue share in the prescriptive analytics market. The software segment offers advanced analytical capabilities crucial for extracting actionable insights from large and complex datasets. These capabilities include machine learning algorithms, optimization techniques, and simulation models, which enable organizations to make data-driven decisions. The ability to handle sophisticated analytical tasks makes prescriptive analytics software highly sought after across various industries.Application Outlook

On the basis of application, the market is segmented into supply chain management, risk management, operations management, revenue management, marketing & sales, and others. In 2023, the operations management segment attained 19% revenue share in the market. Organizations are constantly seeking ways to enhance operational efficiency and reduce costs. Prescriptive analytics helps identify inefficiencies, optimize processes, and recommend best practices for improving productivity.End Use Outlook

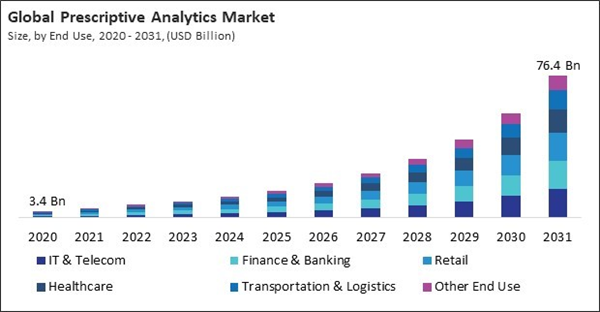

By end use, the market is divided into healthcare, finance and banking, retail, IT & telecom, transportation and logistics, and others. The healthcare segment held 16% revenue share in the market in 2023. Prescriptive analytics supports improved patient care by analyzing clinical data, patient histories, and treatment outcomes to recommend personalized care plans. By providing actionable insights into the most effective treatments and interventions, prescriptive analytics helps healthcare providers enhance patient outcomes and deliver tailored care, driving its demand in the healthcare sector.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 35% revenue share in the market in 2023. North America, particularly the United States and Canada, has a highly advanced technological infrastructure. This robust infrastructure supports deploying and integrating prescriptive analytics solutions across various sectors, including finance, healthcare, and retail. The availability of cutting-edge technology and infrastructure drives high demand for prescriptive analytics in the region.Market Competition and Attributes

The prescriptive analytics market is becoming increasingly competitive as demand for data-driven decision-making rises across industries. Major tech giants like IBM, Microsoft, and Google are expanding their capabilities in AI, machine learning, and big data analytics. Companies are integrating prescriptive analytics into their platforms, enhancing automation and decision-making. The growing need for real-time insights further intensifies competition.

Recent Strategies Deployed in the Market

- Jul-2024: Cloudera, Inc. introduces new premium observability solutions for on-premises and public cloud data centers, featuring real-time monitoring, automated actions, and advanced data observability to enhance platform performance and financial governance.

- Feb-2024: SAS Institute Inc. and Carahsoft have announced a strategic partnership to distribute SAS's advanced analytics, AI, and data management solutions to US government agencies. This collaboration aims to enhance access to SAS’s prescriptive analytics tools, thereby improving decision-making and boosting productivity in the public sector.

- Feb-2024: IBM Corporation came into partnership with Wipro Limited, launching the Wipro Enterprise AI-Ready Platform. This platform, powered by IBM’s watsonx technologies, aims to advance enterprise AI adoption by providing advanced tools for integration, automation, and governance.

- Feb-2024: Accenture PLC plans to acquire GemSeek, a prominent provider of customer experiences analytics and AI solutions. This acquisition will strengthen Accenture Song’s data and AI capabilities, supporting its strategy to drive growth through advanced customer insights and prescriptive analytics.

- Jan-2024: Microsoft Corporation has introduced new AI and data solutions for the retail sector, featuring generative AI tools designed for personalized shopping experiences, streamlined store operations, and advanced insights through Microsoft Fabric. These innovations aim to elevate decision-making and operational efficiency, supporting prescriptive analytics objectives.

List of Key Companies Profiled

- Accenture PLC

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Sisense, Inc.

- Cloudera, Inc.

- Alteryx, Inc.

Market Report Segmentation

By End Use

- IT & Telecom

- Finance & Banking

- Retail

- Healthcare

- Transportation & Logistics

- Other End Use

By Application

- Supply Chain Management

- Risk Management

- Operations Management

- Marketing & Sales

- Revenue Management

- Other Application

By Component

- Software

- Services

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Accenture PLC

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Sisense, Inc.

- Cloudera, Inc.

- Alteryx, Inc.