North America has stringent health and hygiene standards, particularly in food handling and processing industries. These are a critical component of pest control strategies to ensure compliance with these standards and prevent contamination. The increase in commercial construction projects, such as office buildings, shopping centers, and industrial facilities, creates additional demand for fly traps. These commercial spaces require pest control solutions to address fly issues related to waste management, food handling, and high foot traffic. Canadian construction sites generate significant amounts of organic waste, including food scraps from workers and materials like wood and soil that can attract flies. Thus, the North America region witnessed 48% revenue share in the fly traps market in 2023. In terms of volume, the North America region is expected to utilize 9.66 million units of fly traps by 2031.

This heightened scrutiny has driven the demand for reliable and effective fly traps to ensure compliance and avoid penalties. Public health campaigns and educational programs have raised awareness about maintaining cleanliness and the risks associated with pest infestations. Additionally, as the demand for processed foods grows, food processing facilities are expanding. These facilities, which often handle large quantities of food and ingredients, are prone to fly infestations. The need for fly traps in these environments to manage and prevent infestations is a significant driver for the market. Hence, growth in the food service and hospitality industries drives the market's growth.

However, agricultural and livestock operations generate substantial amounts of organic waste, including manure, feed, and crop residues. These waste products create ideal breeding sites for flies. The higher the volume of waste, the greater the potential for fly infestations. Consequently, there is an increased need for fly traps to manage and mitigate these infestations. In conclusion, rising agricultural activities and livestock farming are driving the market's growth.

Driving and Restraining Factors

Drivers

- Increasing awareness of hygiene and sanitation

- Urbanization and increasing residential developments

- Growth in the food service and hospitality industries

Restraints

- Evolving resistance among fly populations

- Negative impact on non-target beneficial insects and ecological balance

Opportunities

- Rising agricultural activities and livestock farming

- Climate change and environmental factors

Challenges

- Increasing competition from alternative solutions

- Short lifespan of disposable traps

Application Outlook

Based on application, the market can be categorized into residential and commercial. In 2023, the residential segment acquired 21% revenue share in the market. In terms of volume 5.60 million units are expected to be utilized in residential applications by 2031. Flies are known carriers of various diseases and pathogens. Increased awareness about the health risks posed by flies, such as food poisoning, dysentery, and other infections, has led homeowners to seek effective solutions to control fly populations.Commercial Outlook

The commercial segment is further subdivided into HoReCa, factories, building management, and others. The building management segment held 21% revenue share in the market in 2023. In terms of volume, 3.72 million units of fly traps are expected to be utilized in building management applications by 2031. Building management systems integrate various building functions, such as HVAC and security, into a single platform.Distribution Channel Outlook

By distribution channel, the market is divided into supermarkets & hypermarkets, independent retail stores, e-commerce, and others. In 2023, the e-commerce segment registered 38% revenue share in the market. In terms of volume, 9.75 million units of fly traps are expected to be sold by e-commerce by 2031. E-commerce platforms provide the convenience of shopping for fly traps anytime, allowing customers to place orders outside traditional business hours.Price Range Outlook

On the basis of price range, the market is segmented into low, medium, and high. In 2023, the high segment attained 18% revenue share in the market. In terms of volume, 4.05 million units of high-priced fly traps are expected to be utilized by 2031. High-priced fly traps often incorporate cutting-edge technology, such as advanced UV light systems, energy-efficient LEDs, and sophisticated attractants.Container Outlook

The container segment is further subdivided into fly light traps, fly baits, delta traps, and others. The delta trap segment attained 15% revenue share in the market in 2023. In terms of volume, 22.27 million units of delta traps are expected to be utilized by 2031. Delta traps are designed to attract flies using a combination of visual and olfactory cues.Type Outlook

Based on type, the market is divided into container, sticky, and electric. The electric segment garnered 44% revenue share in the market in 2023. In terms of volume, 4.05 million units of electric fly traps are expected to be utilized by 2031. Electric fly traps attract and capture flies, particularly those using ultraviolet (UV) light.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 20% revenue share in the market. The Asia-Pacific region is experiencing rapid urbanization, leading to increased population density and the growth of commercial and residential areas. In terms of volume the Asia pacific region is expected to utilize 9.50 million units of fly traps by 2031.List of Key Companies Profiled

- AGRI PHERO SOLUTIONZ

- ARBICO ORGANICS

- com

- ECOTRAP GUARD

- ECOMAN BIOTECH

- Combined Distributors, Inc. (Flies be gone)

- GODWILL ENERGY PRODUCTS PVT LTD

- McQwin's

- Pestronics Services Pvt Ltd.

- Reza Hygene

Market Report Segmentation

By Application (Volume, Thousand Units, USD Million, 2020-2031)

- Commercial

- HoReCa

- Factories

- Building Management

- Other Commercial Types

- Residential

By Type (Volume, Thousand Units, USD Million, 2020-2031)

- Electric

- Container

- Fly Light Traps

- Fly Baits

- Delta Traps

- Other Container Types

- Sticky

By Price Range (Volume, Thousand Units, USD Million, 2020-2031)

- Medium

- Low

- High

By Distribution Channel (Volume, Thousand Units, USD Million, 2020-2031)

- E-commerce

- Supermarkets & Hypermarkets

- Independent Retail Stores

- Other Distribution Channel

By Geography (Volume, Thousand Units, USD Million, 2020-2031)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- AGRI PHERO SOLUTIONZ

- ARBICO ORGANICS

- cleanrth.com

- ECOTRAP GUARD

- ECOMAN BIOTECH

- Combined Distributors, Inc. (Flies be gone)

- GODWILL ENERGY PRODUCTS PVT LTD

- McQwin's

- Pestronics Services Pvt Ltd.

- Reza Hygene

Table Information

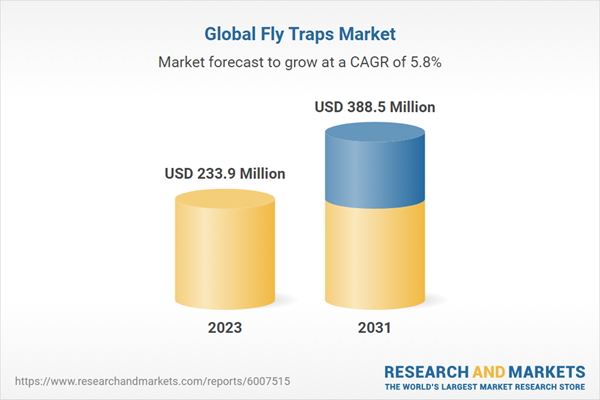

| Report Attribute | Details |

|---|---|

| No. of Pages | 559 |

| Published | September 2024 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 233.9 Million |

| Forecasted Market Value ( USD | $ 388.5 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |