The China market dominated the Asia Pacific Application Performance Monitoring Software Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1.18 billion by 2031. The Japan market is registering a CAGR of 14.2% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 15.6% during (2024 - 2031).

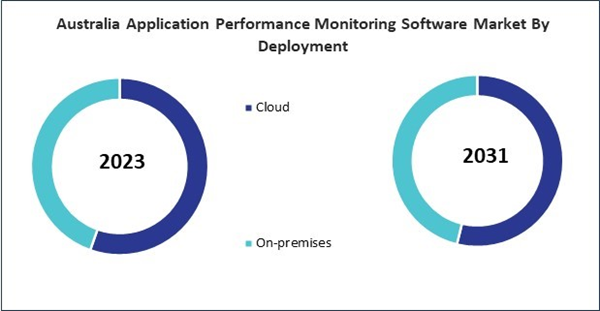

The shift toward multi-cloud and hybrid environments is another factor fueling the demand for APM software. As organizations move away from traditional, on-premises infrastructure in favor of cloud-based solutions, many are adopting multi-cloud strategies or hybrid environments that combine both on-premises and cloud resources. Managing application performance in such a diverse environment is challenging, as different cloud providers and on-premises systems operate under different conditions. APM software provides visibility across these environments, offering a centralized view of application performance regardless of where the components are hosted.

The growth of cloud-native and mobile applications contributes to expanding the application performance monitoring software market. The efficacy of cloud-native and mobile applications has become critically important to the success of businesses as they increasingly rely on digital channels to engage with customers. Customer churn and damage to brand reputation can be the consequences of a poor user experience, which can be caused by slow load times, failures, or errors in mobile applications. APM software helps organizations monitor the performance of these applications across different devices, operating systems, and network conditions, ensuring that they deliver a consistent and responsive experience to users.

Japan's healthcare sector is experiencing a growing reliance on digital applications for managing patient records, telemedicine, and other health-related services. Japan’s advanced healthcare system and aging population also drive the medical devices industry, valued at approximately $30 billion in 2021, according to the Japan External Trade Organization (JETRO). As hospitals and healthcare providers embrace electronic health records (EHRs) and telehealth solutions, APM software becomes crucial to ensure the uninterrupted performance of these critical applications. Australia’s booming e-commerce sector is a key driver of demand for APM software.

As an increasing number of consumers transition to online purchasing, e-commerce platforms must maintain high-performance levels to accommodate the increased traffic, guarantee transaction speeds, and reduce downtime. Australia's e-commerce sector has grown substantially, with online retail sales reaching AUD 45 billion in 2022, according to Australia Post's eCommerce Industry Report. APM tools enable businesses to monitor application health and optimize performance during peak demand, such as sales events. Thus, the need for seamless user experiences and high availability of digital services will continue to boost the market across the region.

Based on Enterprise Size, the market is segmented into Large Enterprise and Small & Medium Enterprise (SME). Based on Type, the market is segmented into Real User Monitoring (RUM), Synthetic Monitoring, Server-Side Monitoring, Database Monitoring, Network Performance Monitoring, and Other Type. Based on Access Type, the market is segmented into Web APM, Mobile APM, and Other Access Type. Based on Deployment, the market is segmented into Cloud and On-premises. Based on End Use, the market is segmented into IT & Telecommunications, BFSI, Retail, Healthcare, Media & Entertainment, E-Commerce, Manufacturing, Government & Academics, and Other End Use. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Cisco Systems, Inc.

- Broadcom, Inc.

- Datadog, Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Open Text Corporation

- Dynatrace, Inc.

Market Report Segmentation

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

By Type

- Real User Monitoring (RUM)Synthetic Monitoring

- Server-Side Monitoring

- Database Monitoring

- Network Performance Monitoring

- Other Type

By Access Type

- Web APM

- Mobile APM

- Other Access Type

By Deployment

- Cloud

- On-premises

By End Use

- IT & Telecommunications

- BFSI

- Retail

- Healthcare

- Media & Entertainment

- E-Commerce

- Manufacturing

- Government & Academics

- Other End Use

By Country

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Cisco Systems, Inc.

- Broadcom, Inc.

- Datadog, Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Open Text Corporation

- Dynatrace, Inc.