Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this favorable outlook, the market encounters significant hurdles related to increasing health awareness and scrutiny of nutritional profiles. Consumers are becoming more cautious about the high sodium content and artificial preservatives typically present in canned soups, resulting in a migration toward fresh or frozen alternatives viewed as healthier. This growing demand for clean-label products and low-sodium formulations is forcing manufacturers to reformulate existing product lines, a trend that may hinder volume growth in the traditional canned segment as shoppers increasingly opt for minimally processed food options.

Market Drivers

The rising popularity of shelf-stable foods amid economic uncertainty serves as a primary market force, as inflation and cost-of-living pressures compel consumers to prioritize affordability and non-perishable staples. This economic climate has revitalized the appeal of canned and ambient soups as essential pantry items that offer both long-term value and convenient storage. Manufacturers are capitalizing on this trend by ensuring product availability and emphasizing the cost-effectiveness of these meal solutions compared to fresh or foodservice alternatives. The financial impact of this demand is evident in the performance of major regional players focusing on ambient categories; according to Premier Foods' "Annual Report 2023/24" from May 2024, headline revenue in the Grocery category increased by 16.7%, underscoring robust consumer reliance on savory staples and cooking sauces during periods of economic tightness.Additionally, the acceleration of product innovation featuring premium and ethnic flavor profiles acts as a critical counter-strategy to volume stagnation in the traditional condensed segment. To attract younger demographics and health-conscious shoppers, companies are aggressively acquiring or developing clean-label, high-quality brands that feature distinct ethnic ingredients and superior taste profiles.

This strategic pivot toward premiumization allows firms to drive top-line growth even when organic unit volumes face pressure. For instance, according to the Campbell Soup Company's "Fourth Quarter and Full Year Fiscal 2024 Results" released in August 2024, net sales increased by 3%, largely due to a 5-point benefit from the acquisition of Sovos Brands, which includes premium sauce and soup portfolios. Such value-added innovation is essential in a challenging retail landscape where, according to General Mills in 2024, annual net sales decreased by 1 percent, signaling broader headwinds for legacy processed food portfolios.

Market Challenges

Rising health consciousness and the intense scrutiny of nutritional labels present a formidable barrier to the Global Canned Soup Market. As consumers become more educated regarding the long-term effects of dietary intake, there is a quantifiable shift away from products perceived as heavily manufactured. Traditional canned soups are frequently associated with excessive sodium content and industrial preservation methods, which contradicts the growing preference for clean-label items. This negative perception encourages shoppers to bypass the canned food aisle in favor of fresh or frozen alternatives that offer transparent ingredient profiles, directly stalling volume growth for legacy brands.This avoidance behavior is substantiated by recent industry data which confirms the economic risk to this category. According to the International Food Information Council, in 2024, 63% of consumers reported actively avoiding processed foods at least some of the time. This statistic highlights a significant portion of the consumer base that is systematically filtering out shelf-stable meal solutions. Consequently, the market faces a structural headwind as the core attribute of canned soup - its preservation method - is increasingly viewed by the modern shopper as a health liability rather than a convenience asset.

Market Trends

The adoption of sustainable and BPA-free packaging solutions is rapidly transforming the manufacturing landscape as companies respond to environmental regulatory pressures and consumer demand for circular economy practices. Major soup producers are systematically transitioning away from traditional single-use materials toward fully recyclable or biodegradable formats to reduce their carbon footprint and minimize landfill waste. This operational shift extends beyond simple material substitution, involving the redesign of steel cans and flexible pouches to ensure they meet rigorous environmental standards without compromising shelf stability. The scale of this transition is evident in the sustainability milestones of leading industry players; according to General Mills' "2024 Global Responsibility Report" published in April 2024, 93% of the company's packaging portfolio by weight was recyclable or reusable, reflecting a comprehensive push across its brands, including Progresso, to eliminate non-compliant packaging materials.Simultaneously, the expansion of plant-based and vegan product portfolios is reshaping the category as manufacturers reformulate recipes to cater to the growing demographic of flexitarian and ethically motivated consumers. To mitigate the volume decline in traditional meat-based segments, brands are launching vegetable-forward lines that utilize legumes, pulses, and dairy alternatives to deliver high-protein, cruelty-free meal solutions. This strategic diversification allows canned soup brands to align with broader dietary shifts while capitalizing on the premium positioning often associated with plant-based certifications. The economic viability of this segment is supported by robust regional performance data; according to The Good Food Institute Europe's December 2024 analysis of retail sales data, sales of plant-based foods in six key European markets grew by 5.5% to €5.4 billion in 2023, signaling a sustained consumer pivot that is compelling global soup manufacturers to diversify their protein sources.

Key Players Profiled in the Canned Soup Market

- Campbell Soup Company

- General Mills Inc.

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- Unilever PLC

- Amy's Kitchen Inc.

- Baxters Food Group Limited

- Bar Harbor Foods

- BCI Foods Inc.

- Sprague Foods, Ltd.

Report Scope

In this report, the Global Canned Soup Market has been segmented into the following categories:Canned Soup Market, by Type:

- Condensed

- Ready-to-Eat

- Others

Canned Soup Market, by Sales Channel:

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online

- Others

Canned Soup Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Canned Soup Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Canned Soup market report include:- Campbell Soup Company

- General Mills Inc.

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- Unilever PLC

- Amy's Kitchen Inc.

- Baxters Food Group Limited

- Bar Harbor Foods

- BCI Foods Inc.

- Sprague Foods, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

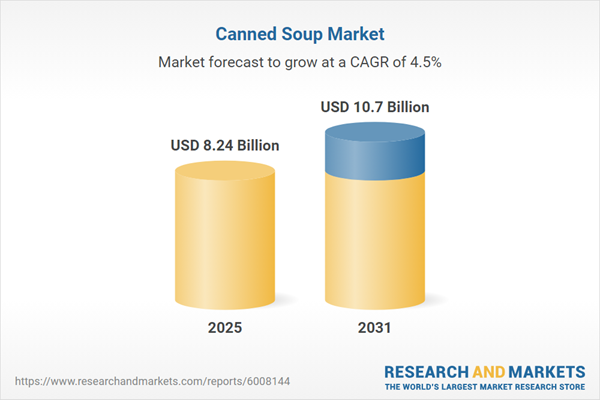

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 8.24 Billion |

| Forecasted Market Value ( USD | $ 10.7 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |