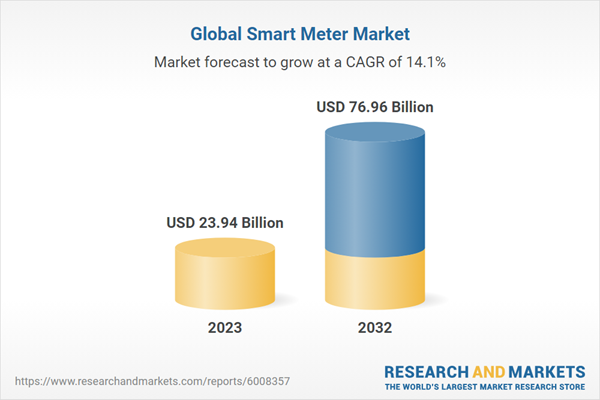

The global smart meter market has experienced significant growth in recent years, driven by the increasing demand for energy efficiency, government initiatives promoting smart grid technologies, and the integration of renewable energy sources. Smart meters, which enable two-way communication between utilities and consumers, are instrumental in optimizing energy usage, reducing operational costs, and enhancing grid reliability. The rising focus on sustainable energy management and the need to modernize outdated infrastructure has further accelerated the adoption of smart meters across residential, commercial, and industrial sectors.Global Smart Meter Market Forecast till 2032: Set to Reach US$ 76.96 Billion by 2032 with a CAGR of 14.08%

Key regions like North America, Europe, and Asia-Pacific are leading the market, with major utilities deploying large-scale smart meter programs. Additionally, advancements in Internet of Things (IoT) technologies, data analytics, and cloud-based systems are fueling innovations in smart metering solutions. However, challenges such as data privacy concerns and high installation costs may hinder market growth in certain areas.

Growth Influencers:

Government financial support for grid digitalization is vital for advancing the smart meter market, especially amid rapid urbanization and industrialization in Asia and the Middle East. Countries like South Korea aim for 20% of power generation from renewables by 2030, fostering smart grid initiatives. India's National Smart Grid Mission has accelerated modernization with substantial investments, including a $38 billion scheme launched in 2022. Japan aligns with global standards through its Smart Energy Grid Architecture Model and announced a $155 billion funding program to enhance smart grid investments. In the Middle East, nations like Saudi Arabia and Kuwait focus on diverse energy mixes and significant renewable contributions by 2030. Smart meters play a crucial role in these initiatives, enabling real-time energy monitoring and efficient management. As concerns over energy conservation and sustainability grow, smart meter adoption is rising. Japan plans to deploy 80 million smart meters by 2024, while partnerships in Abu Dhabi, Vietnam, and Kenya highlight their importance in promoting sustainable practices. Overall, the smart meter market is set for continued growth as energy efficiency and climate change become increasingly pressing issues.Segment Overview:

The Global Smart Meter market is categorized based on Components, Technology, End User and Sales Channel.

By Components

- Hardware

- Power Relays

- Sensors

- Capacitors

- Resistors

- Switches

- Others

- Software

- Services

- Installation and Maintenance

- Consultation

By Technology

- Radio Frequency (RF)

- Wi-SUN

- LoRA

- Bluetooth

- Wi-Fi

- 4G-LTE/5G

- GNSS

- Others

By End User

- Residential

- Commercial

- Industrial

By Sales Channel

- Online Sale

- Offline Sales

- Direct Sales

- Distributor Based

- Others

The global and Japanese smart meter markets have grown rapidly, driven by energy efficiency, grid modernization, and real-time monitoring. Radio Frequency (RF) technology leads the market, enabling real-time control of energy consumption, resulting in energy savings. RF-enabled meters support demand response programs, load balancing, and grid optimization through valuable data. Standardized RF protocols ensure interoperability across systems, while technologies like Wi-SUN, LoRa, and Bluetooth provide diverse connectivity options based on range and power needs. As demand for smart meters grows, RF technology is expected to remain central, influencing the future direction of energy management and smart meter advancements.

The smart meter market is segmented into residential, commercial, and industrial sectors, each with unique drivers. The residential segment dominates due to the number of households and energy consumption, with smart meters helping homeowners track usage and reduce their carbon footprint. Many governments offer incentives to encourage residential adoption. In contrast, the industrial segment has the smallest share due to its complex energy needs, but smart meters help industrial facilities optimize energy use, leading to cost savings. As IoT integration progresses, smart meters will further enhance energy efficiency across all sectors, contributing to a more sustainable energy landscape.

The global and Japanese smart meter markets have been historically dominated by offline sales, as physical stores, distributors, and utilities manage installation and maintenance. Consumers often prefer trusted local vendors for meter purchases and services. However, online sales are rapidly increasing, fueled by the growth of e-commerce and online marketplaces. Manufacturers can now sell directly to consumers, lowering costs and improving relationships. Online platforms offer competitive pricing and convenience, attracting tech-savvy consumers. While offline channels still hold significant market share, the rise of online sales is poised to grow, transforming the way smart meters are distributed.

Regional Overview:

Based on Region, the market is divided into North America, Europe, Asia Pacific, Middle East, Africa and South America.- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Saudi Arabia

- Kuwait

- UAE

- Qatar

- Oman

- Bahrain

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Nigeria

- Kenya

- Rest of Africa

- South America

- Argentina

- Brazil

- Rest of South America

Competitive Landscape:

The Global Smart Meter market is characterized by a vigorous competitive landscape, with prominent entities like Landis+Gyr, Itron Inc., Siemens, Hubbell Incorporated, Honeywell International Inc. and Schneider Electric among others at the forefront, collectively accounting for approximately/ more than 40% of the overall market share. This competitive milieu is fueled by their intensive efforts in research and development as well as strategic partnerships and collaborations, underscoring their commitment to solidifying market presence and diversifying their offerings. The primary competitive factors include pricing, product caliber, and technological innovation. As the Global Smart Meter industry continues to expand, the competitive fervor among these key players is anticipated to intensify. The impetus for ongoing innovation and alignment with evolving customer preferences and stringent regulations is high. The industry's fluidity anticipates an uptick in novel innovations and strategic growth tactics from these leading corporations, which in turn propels the sector's comprehensive growth and transformation.Report Insights:

- The global Smart Meter market is projected to grow from US$ 23.94 billion in 2023 to US$ 76.96 billion by 2032, at a CAGR of 14.08%.

- Increasing demand for energy efficiency and government initiatives are driving market growth.

- Radio Frequency (RF) technology leads the market, enabling real-time monitoring of energy consumption.

- Rapid urbanization in Asia and the Middle East is accelerating smart grid initiatives.

Questions to be Answered:

- What is the estimated growth rate of the Global Smart Meter market?

- What are the key drivers and potential restraints?

- Which market segments are expected to witness significant growth?

- Who are the leading players in the market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- General Electric Company

- Holley Technology Ltd.

- Honeywell International Inc.

- Hubbell Incorporated

- Itron Inc.

- Jiangsu Linyang Energy Co., Ltd.

- Kamstrup

- L&T Electrical & Automation

- Landis+Gyr

- Mitsubishi Electric

- NEC Corp.

- Neptune Technology Group Inc.

- Osaki Group

- Panasonic Corp.

- Shneider Electric

- Siemens AG

- Tata Power Company Limited

- Wasion Group Co. Ltd.

- Xylem Inc.

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 557 |

| Published | September 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 23.94 Billion |

| Forecasted Market Value ( USD | $ 76.96 Billion |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | Global |