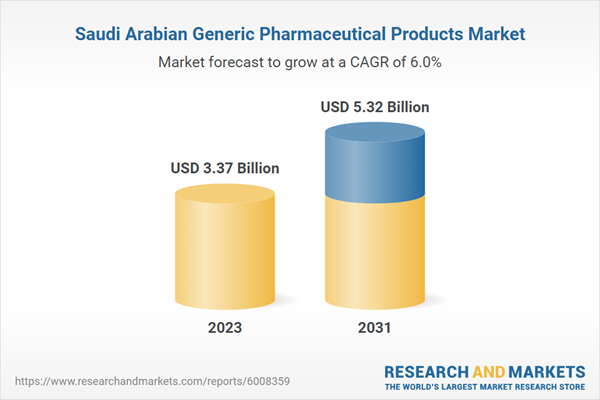

The Saudi Arabian generic pharmaceutical market is experiencing significant growth, driven by increasing healthcare needs and a push for cost-effective medication options. As the largest market in the Middle East, Saudi Arabia is focusing on expanding its healthcare infrastructure and improving access to affordable medicines. The government’s initiatives, such as the Vision 2030 program, aim to enhance the local pharmaceutical industry by promoting domestic production and reducing reliance on imports. The growing prevalence of chronic diseases, coupled with rising healthcare expenditures, is fueling demand for generic drugs. Additionally, favorable regulatory frameworks and incentives for generic drug manufacturers are fostering a competitive environment. With a strong emphasis on quality and cost-efficiency, the Saudi generic pharmaceutical market is poised for continued expansion, offering opportunities for both local and international players to contribute to the sector’s development and meet the evolving healthcare needs of the population.Saudi Arabia Generic Pharmaceutical Products Market Forecast till 2031: Set to Reach US$ 5.32 Billion by 2031 with a CAGR of 5.99%

Growth Influencers:

The expiration of branded drug patents significantly boosts Saudi Arabia’s generic pharmaceutical market, enhancing access to affordable medications for the population. Generic drugs are typically more cost-effective, alleviating the financial burden on the healthcare system and expanding treatment accessibility. This shift encourages innovation in the pharmaceutical sector, as companies invest in research and development of existing medications and alternative formulations, resulting in a wider range of treatment options. Currently, Saudi Arabia relies heavily on imports for its pharmaceutical needs, with only 30% of drugs manufactured locally. To address this, the government aims to increase local production to 40% as part of its Vision 2030 plan. With over 40 licensed drug manufacturers, including notable companies like SPIMACO and Tabuk Pharmaceuticals, the focus is shifting from repackaging imports to enhancing local production capabilities. Furthermore, the government promotes collaboration with international firms to transfer knowledge and technology, ensuring compliance with quality standards. These initiatives are designed to reduce healthcare costs, ensure a sustainable supply of essential medications, and create job opportunities within the sector, ultimately strengthening the kingdom's pharmaceutical landscape.Segment Overview:

The Saudi Arabia Generic Pharmaceutical Products market is categorized based on Type, Application, Route of Administration, End User and Distribution Channel.

By Type

- Antibacterial

- Antiviral

- Anti-hypertensive

- Anti-inflammatory

- Others

By Application

- Central Nervous System Disorders

- Respiratory Diseases

- Hormones & Related Diseases

- Gastrointestinal Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Cancer

- Diabetes

- Others

By Route of Administration

- Oral

- Injectable

- Inhalable

- Others

By End User

- Hospitals

- Homecare

- Specialty Clinics

- Others

By Distribution Channel

- Online Pharmacies

- Retail Pharmacies

- Hospital Pharmacies

In 2023, cardiovascular diseases dominated the generic pharmaceutical market in Saudi Arabia, fueled by a rising prevalence of related health issues. The Saudi Health Council projects that the number of individuals affected by cardiovascular diseases could increase by approximately 480,000 by the year 2035. This growing burden on public health systems is driving demand for effective generic medications to manage these conditions. While cardiovascular diseases currently hold a significant share of the market, cancer is expected to grow at the highest CAGR during the forecast period. According to the International Agency for Research on Cancer, 27,885 cases were registered in 2020 across all demographics. As healthcare providers adapt to this shifting landscape, the development and availability of generic drugs for both cardiovascular and cancer treatments will be essential in improving patient outcomes and reducing overall healthcare costs.

The oral route of administration led the Saudi generic pharmaceutical market in 2023 and is anticipated to continue its strong growth trajectory. Oral medications, available in both liquid and solid forms, are favored for their convenience and cost-effectiveness, enhancing patient compliance across various demographics. Factors influencing the success of oral drugs include their solubility, stability in the gastrointestinal environment, and mucosal permeability. This method of drug delivery is particularly beneficial for pediatric and geriatric populations, who may have difficulty with alternative routes. The ease of administration contributes significantly to the widespread preference for oral dosage forms, as they typically require no specialized training for consumption. As healthcare continues to evolve, innovations in oral drug formulations will likely further solidify this route's dominance in the market.

In 2023, the hospital segment accounted for over 40% of Saudi Arabia's generic pharmaceutical market and is projected to maintain the highest CAGR moving forward. Hospitals have unique advantages, such as bulk purchasing agreements with pharmaceutical suppliers, which enable them to secure favorable pricing on generic drugs. This accessibility not only enhances the affordability of medications but also provides healthcare professionals with a diverse array of therapeutic options to meet the varying needs of their patients. The flexibility afforded by having multiple generic alternatives allows for personalized treatment plans that can effectively address individual health conditions. As hospitals continue to integrate generic drugs into their formularies, they will play a pivotal role in improving healthcare outcomes while managing costs, ultimately contributing to a more sustainable healthcare system in Saudi Arabia.

In terms of distribution channels, hospital pharmacies dominate the Saudi generic pharmaceutical market due to their high patient volumes and diverse medical needs. They are crucial in ensuring that a wide range of generic drugs is readily available to healthcare professionals and patients alike. However, online pharmacies are projected to experience the fastest growth in the coming years, driven by the increasing digitalization and e-commerce adoption in Saudi Arabia. These platforms offer consumers the convenience of ordering medications from home, making them particularly beneficial for individuals with limited mobility or busy schedules. The shift toward online shopping in the pharmaceutical sector enhances access to essential medications and caters to changing consumer preferences. As both hospital and online pharmacies expand their reach, the overall availability and accessibility of generic drugs in Saudi Arabia are likely to improve significantly.

Competitive Landscape:

The Saudi Arabia Generic Pharmaceutical Products market is characterized by a vigorous competitive landscape, with prominent entities like Jamjoom Pharma, Pfizer, Hikma Pharmaceuticals PLC Fresenius SE & Co. KGaA and Novartis among others at the forefront, collectively accounting for more than 45% of the overall market share. This competitive milieu is fueled by their intensive efforts in research and development as well as strategic partnerships and collaborations, underscoring their commitment to solidifying market presence and diversifying their offerings. The primary competitive factors include pricing, product caliber, and technological innovation. As the Saudi Arabia Generic Pharmaceutical Products industry continues to expand, the competitive fervor among these key players is anticipated to intensify. The impetus for ongoing innovation and alignment with evolving customer preferences and stringent regulations is high. The industry's fluidity anticipates an uptick in novel innovations and strategic growth tactics from these leading corporations, which in turn propels the sector's comprehensive growth and transformation.Report Insights:

- The market is projected to grow from US$ 3.37 billion in 2023 to US$ 5.32 billion by 2031, with a CAGR of 5.99%.

- The antibacterial segment is expected to capture over 35% of the market in 2024, driven by common antibiotics' accessibility.

- The hospital segment accounted for over 40% of the market in 2023, benefiting from bulk purchasing agreements.

- Prominent players, including Jamjoom Pharma and Pfizer, hold over 45% of the market share, driving competition.

Questions to be Answered:

- What is the estimated growth rate of the Saudi Arabia Generic Pharmaceutical Products market?

- What are the key drivers and potential restraints?

- Which market segments are expected to witness significant growth?

- Who are the leading players in the market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Pharmaceutical Factory

- AstraZeneca

- Fresenius SE & Co. KGaA

- Hikma Pharmaceuticals PLC

- Jamjoom Pharma

- Novartis AG

- Pfizer Inc.

- SAJA Pharmaceuticals

- Tabuk Pharmaceuticals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | September 2024 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 3.37 Billion |

| Forecasted Market Value ( USD | $ 5.32 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Saudi Arabia |