Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Germany Curing Adhesives Market represents a dynamic landscape shaped by a combination of factors driving its growth and evolution. With Germany renowned for its precision engineering and advanced manufacturing practices, the market for curing adhesives thrives on innovation and technological excellence. The country's robust industrial base, spanning automotive, aerospace, electronics, and construction sectors, provides a fertile ground for the adoption of curing adhesives across diverse applications. In recent years, the market has witnessed a surge in demand fueled by several key factors.

Firstly, the automotive industry, a cornerstone of the German economy, relies heavily on curing adhesives for structural bonding, lightweighting, and assembly processes. As automotive manufacturers seek to improve fuel efficiency, reduce emissions, and enhance vehicle performance, the demand for high-performance curing adhesives continues to rise. The construction sector, driven by urbanization and infrastructure development, presents significant opportunities for curing adhesives. These adhesives play a crucial role in bonding various building materials, including glass, metal, and composite panels, contributing to the efficiency and durability of construction projects.

The electronics industry, characterized by rapid technological advancements and miniaturization trends, relies on curing adhesives for component assembly, encapsulation, and protection against environmental factors. As electronic devices become more complex and compact, the demand for specialized curing adhesives tailored to the industry's unique requirements grows accordingly. The Germany Curing Adhesives Market thrives on a combination of industrial prowess, technological innovation, and diverse application opportunities, positioning it as a key player in the global adhesives industry.

Key Market Drivers

Industrial Advancements

Industrial advancements play a pivotal role in shaping the Germany Curing Adhesives Market, driving innovation, efficiency, and competitiveness across various sectors. Germany's reputation for precision engineering and advanced manufacturing practices positions it as a global leader in industrial advancements, creating a fertile ground for the adoption of curing adhesives. In sectors such as automotive manufacturing, industrial advancements drive the demand for high-performance curing adhesives.The automotive industry relies on these adhesives for structural bonding, light weighting, and assembly processes, enabling manufacturers to achieve stringent performance requirements while reducing weight and improving fuel efficiency. Advanced curing adhesives offer superior bonding strength, durability, and resistance to environmental factors, meeting the demanding needs of modern automotive applications. Similarly, in the aerospace sector, industrial advancements drive the adoption of curing adhesives for aircraft assembly, repair, and maintenance. These adhesives provide lightweight, yet robust bonding solutions for aerospace components, contributing to fuel efficiency, aircraft performance, and safety.

With continuous advancements in materials science and adhesive technologies, aerospace manufacturers can achieve greater design flexibility and performance optimization in aircraft construction. The industrial advancements in electronics manufacturing drive the demand for specialized curing adhesives tailored to the unique requirements of electronic devices. As electronic components become smaller, more complex, and integrated into diverse applications, the need for reliable bonding solutions to ensure component assembly, encapsulation, and protection against environmental factors becomes increasingly critical.

Advanced curing adhesives offer precise control over bond strength, conductivity, thermal management, and other properties essential for electronic applications, supporting the development of innovative electronic devices. The industrial advancements drive the Germany Curing Adhesives Market by fostering innovation, efficiency, and performance across key sectors such as automotive, aerospace, and electronics. As manufacturers continue to push the boundaries of technological excellence, the demand for advanced curing adhesives is expected to grow, reinforcing Germany's position as a global leader in adhesive solutions.

Automotive Sector

The automotive sector is a driving force in the Germany Curing Adhesives Market, fueling demand for advanced adhesive solutions that enhance vehicle performance, safety, and durability. As a cornerstone of the German economy, the automotive industry relies heavily on curing adhesives for various applications throughout vehicle manufacturing and assembly processes. The primary uses of curing adhesives in the automotive sector are structural bonding. These adhesives play a crucial role in bonding lightweight materials such as aluminum, carbon fiber, and composite panels, contributing to the overall strength and rigidity of vehicle structures.By replacing traditional mechanical fastening methods with adhesives, manufacturers can achieve significant weight savings, improve fuel efficiency, and enhance crashworthiness. Curing adhesives are also integral to automotive assembly processes, facilitating the bonding of components such as body panels, chassis components, interior trim, and glass. These adhesives offer fast curing times, allowing for efficient production line operations and enabling manufacturers to meet demanding production schedules.

In the German market, a decline of 1% to a further 2.8 million units in 2024 is anticipated. This would represent a decrease of around a quarter compared to the pre-crisis year of 2019. Lower sales of electric cars are expected, with a projected decrease of 9% to 635,000 units. Conversely, sales of plug-in hybrids (PHEV) are forecasted to rise by 5% to 185,000 units. However, a decline of 14% to 451,000 units is expected for purely battery-electric vehicles (BEV).

Across Europe (U27, EFTA & UK) and the USA, slightly faster growth rates of 4% and 2%, respectively, are anticipated compared to the projected 1% growth in the Chinese market for 2024. This uptick in growth is attributed to the weak performance in the previous year. Globally, the passenger car market is expected to experience a moderate increase of 2%, nearing the levels observed in 2019. Additionally, curing adhesives provide excellent adhesion to a wide range of substrates, ensuring reliable and long-lasting bonds in the harsh operating environments encountered in automotive applications. The curing adhesives contribute to noise, vibration, and harshness (NVH) reduction in vehicles by dampening vibrations and improving acoustics.

By effectively bonding components and sealing gaps, these adhesives help minimize noise transmission and enhance ride comfort for vehicle occupants. Innovations in adhesive formulations, such as high-strength structural adhesives, low-VOC formulations, and heat-resistant adhesives, cater to the evolving needs of the automotive industry. Manufacturers in Germany are at the forefront of developing cutting-edge adhesive solutions that meet stringent performance requirements while addressing environmental concerns and regulatory standards. The automotive sector's reliance on curing adhesives underscores their importance in vehicle manufacturing, driving market growth and innovation in the Germany Curing Adhesives Market. As automotive technologies continue to evolve, the demand for advanced adhesive solutions is expected to grow, reinforcing Germany's position as a global leader in adhesive technology.

Growth of Construction Sector in Forecasted Period

The growth of construction sector in Germany has a significant impact on the Curing Adhesives Market, driving demand for adhesive solutions that meet the diverse needs of modern construction projects. With rapid urbanization, infrastructure development, and renovation projects taking place across the country, curing adhesives play a crucial role in various construction applications.Germany holds the distinction of being Europe’s largest construction market, boasting the continent’s most extensive building stock. In 2020, the industry experienced a notable revenue uptick, surging by 5.9 percent to €143 billion. However, a recent study conducted by the DIW Institute suggests a forthcoming downturn, with construction volume projected to contract by 3.5% to (€546 billion) USD 597.38 billion in 2024. Despite this anticipated decline, the industry is expected to witness a marginal recovery, with a modest 0.5% increase forecasted for 2025.

The key areas where curing adhesives are extensively used in construction is in the bonding of building materials. These adhesives provide strong and durable bonds between materials such as glass, metal, concrete, and composite panels, enhancing the structural integrity and longevity of buildings and infrastructure. Whether it's bonding facade elements, installing flooring, or assembling prefabricated components, curing adhesives offer efficient and reliable solutions for construction projects of all scales. The curing adhesives are essential for sealing and waterproofing applications in construction.

These adhesives are used to seal joints, gaps, and seams in buildings, preventing water infiltration and enhancing the overall weatherproofing of structures. From sealing windows and doors to waterproofing roofs and balconies, curing adhesives provide durable and flexible seals that withstand the rigors of the environment. The construction boom in Germany drives demand for specialized curing adhesives tailored to specific construction materials and applications. Whether it's high-strength adhesives for bonding heavy structural elements, low-VOC formulations for indoor applications, or fire-resistant adhesives for fire-rated assemblies, manufacturers are developing adhesive solutions to meet the evolving needs of the construction industry.

The adoption of sustainable building practices and green construction standards further fuels the demand for eco-friendly curing adhesives. Manufacturers in Germany are developing adhesive formulations that minimize environmental impact while delivering superior performance, aligning with the sustainability goals of construction projects. The construction boom in Germany presents significant opportunities for growth and innovation in the Curing Adhesives Market. As construction activities continue to expand, the demand for advanced adhesive solutions that offer strength, durability, and sustainability will remain high, driving market growth and development in the years to come.

Key Market Challenges

Regulatory Compliance

Regulatory compliance is a critical aspect of the Germany Curing Adhesives Market, shaping product development, manufacturing processes, and market dynamics. Germany has stringent regulations and standards governing the production, sale, and use of adhesives, aimed at protecting human health, safety, and the environment. The primary regulatory considerations for curing adhesives is the control of volatile organic compounds (VOCs). VOC emissions from adhesives can contribute to air pollution and have adverse effects on indoor air quality and human health.As such, adhesive manufacturers must comply with regulations such as the European Union's VOC Directive and Germany's Federal Immission Control Act (BImSchG), which set limits on VOC content in adhesive formulations. The regulations such as the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) and the Classification, Labeling, and Packaging (CLP) Regulation govern the use of hazardous substances in adhesives. Adhesive manufacturers are required to register substances with the European Chemicals Agency (ECHA), assess their risks, and ensure safe handling and labeling to protect workers and consumers. The environmental regulations such as the Waste Framework Directive and the Circular Economy Action Plan promote sustainable practices and encourage the use of eco-friendly materials in adhesive formulations.

Manufacturers are increasingly focusing on developing adhesives with reduced environmental impact, improved recyclability, and bio-based or renewable ingredients to meet these regulatory requirements. Compliance with regulatory standards requires significant investment in research, development, testing, and certification processes. Manufacturers must stay abreast of evolving regulations, adapt their formulations and processes accordingly, and ensure ongoing compliance throughout the product lifecycle. The regulatory compliance is a complex and challenging aspect of the Germany Curing Adhesives Market, but it also presents opportunities for innovation, differentiation, and market leadership for manufacturers who can successfully navigate the regulatory landscape while delivering high-quality, sustainable adhesive solutions.

Raw Material Costs

Raw material costs play a significant role in shaping the dynamics of the Germany Curing Adhesives Market, influencing product pricing, profitability, and competitiveness. The curing adhesives industry relies on a wide range of raw materials, including resins, solvents, additives, and fillers, sourced from petrochemical and natural sources. Fluctuations in raw material costs, particularly those derived from petrochemical sources, can impact the overall production costs of curing adhesives. Factors such as changes in crude oil prices, supply-demand dynamics, geopolitical tensions, and currency fluctuations can lead to volatility in raw material prices, affecting the profitability of adhesive manufacturers. The availability and accessibility of raw materials can also impact production costs and supply chain stability. Disruptions in the supply chain, such as shortages, transportation delays, or trade restrictions, can lead to increased procurement costs and production delays, affecting market competitiveness and product availability.To mitigate the impact of raw material costs on their bottom line, adhesive manufacturers in Germany often engage in strategic sourcing practices, including long-term supplier partnerships, diversification of supply sources, and inventory management strategies. Also, manufacturers may explore alternative raw materials, such as bio-based or renewable ingredients, to reduce dependency on petrochemical-derived materials and mitigate price volatility.

The adhesive manufacturers may pass on the increased raw material costs to customers through price adjustments. However, balancing competitive pricing with profitability is crucial to maintaining market share and customer loyalty. Raw material costs are a key consideration for adhesive manufacturers in the Germany Curing Adhesives Market, influencing pricing strategies, supply chain management, and product development decisions. Navigating the challenges posed by raw material cost fluctuations requires proactive management and strategic planning to ensure competitiveness and sustainability in the market.

Key Market Trends

Sustainable Formulations

The Germany Curing Adhesives Market is witnessing a significant shift towards sustainable formulations as environmental awareness and regulatory pressures continue to mount. Manufacturers are responding to these trends by developing eco-friendly adhesive solutions that minimize environmental impact while maintaining high performance standards. One of the key focuses of sustainable formulations is reducing volatile organic compound (VOC) emissions, which can contribute to air pollution and indoor air quality concerns. Adhesive manufacturers are investing in research and development to create low-VOC or VOC-free formulations that comply with stringent regulations and meet green building standards.There is a growing emphasis on utilizing bio-based or renewable ingredients in adhesive formulations. By incorporating renewable resources such as plant-based resins or bio-derived solvents, manufacturers can reduce reliance on fossil fuels and minimize carbon footprint. These bio-based adhesives offer comparable performance to traditional petroleum-based counterparts while providing environmental benefits. The recyclability and biodegradability are key considerations in sustainable adhesive formulations.

Manufacturers are exploring materials and processes that enable adhesive products to be easily recycled or decomposed at the end of their lifecycle, reducing waste and environmental pollution. By embracing circular economy principles, adhesive manufacturers are contributing to the development of a more sustainable and resource-efficient industry. The sustainable formulations are becoming increasingly important in the Germany Curing Adhesives Market as stakeholders prioritize environmental stewardship and sustainable practices. Manufacturers that can innovate and offer eco-friendly adhesive solutions will not only meet regulatory requirements but also gain a competitive edge in the market, catering to the growing demand for sustainable construction and manufacturing solutions.

Digitalization and Industry 4.0

Digitalization and Industry 4.0 are transforming the Germany Curing Adhesives Market, revolutionizing manufacturing processes, improving efficiency, and driving innovation. As the industry embraces digital technologies and automation, adhesive manufacturers are experiencing significant advancements in production, quality control, and supply chain management. The key benefits of digitalization and Industry 4.0 in the curing adhesives market is increased automation and connectivity throughout the production process. Manufacturers are implementing smart manufacturing systems that integrate machinery, sensors, and data analytics to optimize production workflows, reduce downtime, and improve overall efficiency.

Automated adhesive dispensing systems, for example, enable precise and consistent application of adhesives, enhancing product quality and reliability. Digitalization enables real-time monitoring and control of manufacturing processes, allowing manufacturers to identify and address issues proactively. IoT sensors and data analytics platforms provide valuable insights into production performance, material usage, and quality metrics, enabling continuous improvement and optimization of adhesive formulations and processes.

Industry 4.0 technologies facilitate seamless integration and collaboration across the adhesive supply chain. Digital platforms and communication tools enable efficient coordination between adhesive manufacturers, raw material suppliers, distributors, and end-users, improving communication, visibility, and responsiveness. Digitalization and Industry 4.0 are driving innovation and competitiveness in the Germany Curing Adhesives Market. By embracing digital technologies, manufacturers can enhance productivity, quality, and sustainability, positioning themselves for success in an increasingly digital and interconnected marketplace.

Segmental Insights

Resins Insights

Based on resin, polyurethane adhesives dominated the Germany Curing Adhesives Market. This is ascribed due to their versatile properties and wide range of applications. One key reason for their dominance is their exceptional bonding strength, which allows them to bond various substrates, including metals, plastics, wood, and composites, with excellent adhesion. This versatility makes polyurethane adhesives suitable for diverse industries such as automotive, construction, electronics, and aerospace. The polyurethane adhesives offer excellent resistance to environmental factors such as moisture, heat, and chemicals, ensuring durable and long-lasting bonds even in harsh conditions.They also provide flexibility and elasticity, allowing for movement and expansion of bonded materials without compromising bond integrity. Polyurethane adhesives exhibit fast curing times, enabling efficient production processes and quick assembly of components. Their ability to cure at room temperature or with minimal heat application enhances manufacturing efficiency and reduces energy consumption. The combination of strong bonding strength, versatility, durability, and fast curing times makes polyurethane adhesives a preferred choice in the Germany Curing Adhesives Market, driving their dominance across various industries and applications.

Polyurethane resins offer a unique blend of flexibility, toughness, and adhesion. These resins are well-suited for applications where resilience to dynamic stresses, such as in automotive and construction, is crucial. Polyurethane-based curing adhesives provide a balance between strength and flexibility, making them ideal for bonding materials with different coefficients of thermal expansion.

Product Insights

In 2023, UV Cure adhesives dominated the Germany Curing Adhesives Market. This is ascribed due to their rapid curing capabilities and versatility. UV Cure adhesives polymerize upon exposure to ultraviolet (UV) light, offering swift and efficient bonding solutions. Industries such as automotive and electronics reap substantial benefits from these adhesives, as they streamline assembly processes, thereby reducing production times. The precise control over the curing process facilitates meticulous application, enhancing performance across various applications.Moisture Cure adhesives, alternatively recognized as ambient cure adhesives, initiate the curing process through atmospheric moisture. Particularly advantageous in environments where maintaining controlled curing conditions proves challenging, these adhesives find favor within the construction industry for bonding applications amidst diverse weather conditions. Their ability to cure at room temperature renders them versatile for bonding materials across varied settings.

Thermal Cure adhesives harness heat to trigger the curing process, furnishing a controlled and dependable bonding solution. The Germany Curing Adhesives Market observes notable demand for thermal cure adhesives, notably in sectors where elevated temperatures pose no hindrances. Industries such as aerospace and high-temperature industrial applications derive benefits from the robust bonds fostered by thermal cure adhesives. The regulated curing process ensures optimal adhesion and performance even in demanding environments.

Regional Insights

North Rhine-Westphalia dominated the Germany Curing Adhesives Market due to its vibrant industrial landscape and strategic positioning within the country's manufacturing sector. The region serves as a hub for various industries, including automotive, aerospace, electronics, and construction, all of which are significant consumers of curing adhesives.Furthermore, North Rhine-Westphalia boasts a dense network of research institutions, universities, and technology centers, fostering innovation and technological advancements in adhesive formulations and applications. Moreover, the region's well-developed infrastructure and access to transportation networks facilitate efficient distribution and supply chain operations, further enhancing its attractiveness to adhesive manufacturers and end-users alike. Thus, North Rhine-Westphalia's industrial prowess, innovation ecosystem, and logistical advantages position it as a dominant player in the Germany Curing Adhesives Market.

Recent Developments

- In April 2022, DELO Industries introduced an advanced process technology, seamlessly integrating adhesive dosing and pre-activation into a single step. This innovation offers enhanced flexibility for users in product and process design while simultaneously reducing costs and significantly lowering CO2 emissions. This groundbreaking approach marks a significant advancement in adhesive application methods, promising efficiency gains and environmental benefits for industries utilizing adhesive bonding technologies.

Key Market Players

- H B Fuller Company

- Henkel AG & Company, KGaA

- DELO Industrial Adhesives

- 3M Company

- Sika AG

- Tosoh Corporation

Report Scope:

In this report, the Germany Curing Adhesives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Germany Curing Adhesives Market, By Resin:

- Epoxy

- Polyurethane

- Acrylate

- Silicone

- Others

Germany Curing Adhesives Market, By Product:

- UV Cure

- Moisture Cure

- Thermal Cure

Germany Curing Adhesives Market, By End Use:

- Automotive

- Construction

- Electronics and Electrical

- Medical

- Woodworking

- Others

Germany Curing Adhesives Market, By Region:

- North Rhine-Westphalia

- Bavaria

- Baden-Wurttemberg

- Saxony

- Hesse

- Rest of Germany

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Germany Curing Adhesives Market.Available Customizations:

Germany Curing Adhesives market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- H B Fuller Company

- Henkel AG & Company, KGaA

- DELO Industrial Adhesives

- 3M Company

- Sika AG

- Tosoh Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | October 2024 |

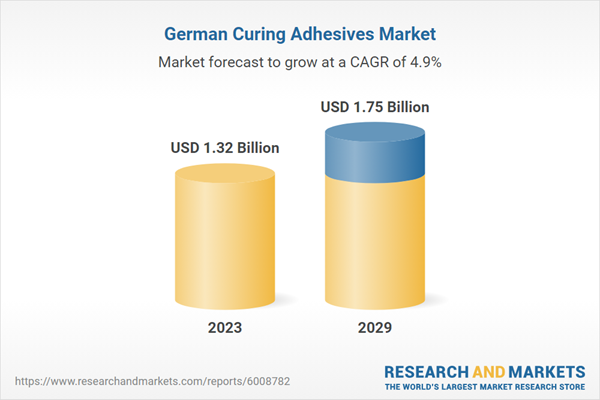

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.32 Billion |

| Forecasted Market Value ( USD | $ 1.75 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Germany |

| No. of Companies Mentioned | 6 |