Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Diacetone Alcohol (DAA) market in India is evolving at a rapid pace, reflecting the country's rising prominence in the global chemical landscape. DAA, a vital solvent and precursor in various industries, finds applications in paints, coatings, adhesives, and more. The Indian Diacetone Alcohol market has undergone substantial growth in recent years. Historically, the market primarily catered to domestic demand, supporting sectors like paints and coatings. However, globalization and increased industrialization have redefined the market's landscape. Today, India both consumers and produces DAA on a notable scale, cementing its position in the global chemical industry. The Indian DAA market can be segmented into industrial and commercial categories, reflecting the diverse applications of this versatile chemical.

Diacetone Alcohol's multifaceted utility is a pivotal driver of its demand in India. It serves as a vital component in the production of paints, coatings, adhesives, and varnishes. Additionally, it finds application in the cosmetics and pharmaceutical sectors. Its broad spectrum of applications spans industries such as construction, automotive, packaging, and textiles, making it a key chemical in these sectors. Several factors contribute to the growing demand for Diacetone Alcohol in India. The construction and automotive sectors play a substantial role in fueling the need for paints and coatings where DAA is an essential ingredient. The pharmaceutical and cosmetic industries are witnessing substantial growth, further driving demand for this versatile chemical.

The DAA market in India encounters its set of challenges. Fluctuations in raw material prices, regulatory concerns, and the need for sustainability are key challenges. The volatility of acetone prices, a primary raw material for DAA, can impact production costs. Compliance with stringent environmental regulations and a growing emphasis on eco-friendly practices is pushing the industry to adopt cleaner production methods. As environmental consciousness grows, regulations related to chemical emissions, waste disposal, and worker safety have become more stringent. The DAA industry in India is responding to these changes by adopting eco-friendly production processes and emphasizing worker safety and well-being. Such measures not only meet regulatory requirements but also align with global sustainability goals.

The Indian DAA market is witnessing several noteworthy trends. The rising demand for high-performance coatings and environmentally friendly paints is driving innovation in DAA formulations. Manufacturers are exploring bio-based DAA production methods, reducing the carbon footprint of this chemical. The future outlook for the Diacetone Alcohol market in India is promising. With the continued growth of industries that rely on DAA, including construction, automotive, pharmaceuticals, and cosmetics, the demand for this chemical is expected to remain robust. The industry's adaptation to changing market dynamics, regulatory requirements, and environmental consciousness will be key in shaping its growth trajectory.

The Diacetone Alcohol market in India presents a captivating narrative of growth, adaptation, and transformation. Its diverse applications across various sectors make it a crucial chemical in the country's industrial landscape. As the market faces challenges and embraces sustainability, it is poised to meet not only domestic demand but also contribute to the global chemical industry. India's journey in the DAA market is a testament to its resilience, innovation, and commitment to sustainable practices.

Key Market Drivers

Growing Demand from Paints and Coatings Industry for Formulation of Paints, Varnishes, and Coatings Propels Indian Diacetone Alcohol Market Growth

The Indian Diacetone Alcohol market is experiencing a substantial surge in demand, driven by the growing needs of the paints and coatings industry. Diacetone Alcohol, a versatile chemical compound, plays a pivotal role as a solvent and chemical intermediate in the formulation of paints, varnishes, and coatings. This expanding application of Diacetone Alcohol in the paints and coatings sector is expected to propel market growth, contributing to India's economic development. The paints and coatings industry in India is currently on an upward trajectory, with significant growth driven by factors such as increasing urbanization, infrastructure development, and a surge in construction activities.Diacetone Alcohol is a crucial component in this industry, serving as a solvent in the formulation of various types of paints, including water-based and solvent-based paints. Its unique properties make it an excellent choice for dissolving resins, binders, and pigments, enabling the development of high-quality and long-lasting paint formulations. As the demand for top-notch paints and coatings continues to grow, the need for Diacetone Alcohol in the paints and coatings industry is anticipated to experience robust expansion. Diacetone Alcohol is an essential ingredient in the production of varnishes. Varnishes are used to protect and enhance the aesthetics of wood, metal, and other surfaces. Diacetone Alcohol is favored for its ability to dissolve resins and create a smooth, glossy finish in varnish formulations. With increasing construction and renovation projects, the demand for varnishes in India is rising, driving the need for Diacetone Alcohol in this specific application.

The industrial coatings segment also relies on Diacetone Alcohol as a solvent. These coatings are essential for protecting machinery, equipment, and industrial structures from corrosion and wear and tear. Diacetone Alcohol's role in dissolving resins and binders makes it a valuable component in the formulation of industrial coatings, contributing to the longevity and performance of coated surfaces.

As industries expand and upgrade their facilities in India, the demand for industrial coatings containing Diacetone Alcohol is set to grow. Diacetone Alcohol serves as a chemical intermediate in the production of a variety of chemicals and derivatives. Its versatility enables the synthesis of products used in diverse industries, including pharmaceuticals, textiles, and personal care. This further underscores its importance and wide-ranging applications in the chemical sector.

As the paints and coatings industry in India continues to thrive, the Diacetone Alcohol market is positioned for substantial growth. Its multifaceted role as a solvent, varnish ingredient, and chemical intermediate makes it a critical component for various applications across industries. The increasing focus on quality and aesthetics in construction and infrastructure development, coupled with the need for protective coatings in industrial settings, contributes to the growing demand for Diacetone Alcohol. This growth not only benefits the chemical industry but also plays a crucial role in supporting the broader economy by catering to the needs of an expanding paints and coatings sector, pivotal for India's progress and modernization.

Rising Diacetone Alcohol Usage as Solvent Propels India's Diacetone Alcohol Market Growth

The Indian Diacetone Alcohol market is experiencing robust growth, primarily driven by the increasing usage of Diacetone Alcohol as a solvent across various industries. Diacetone Alcohol, a versatile and highly effective solvent, has become an essential component in multiple applications, propelling the market's expansion and contributing to India's economic development. One of the key sectors driving the demand for Diacetone Alcohol as a solvent is the paints and coatings industry. Diacetone Alcohol serves as a critical solvent in the formulation of various paints, including water-based and solvent-based paints.Its unique chemical properties make it an excellent solvent for resins, binders, and pigments, allowing for the creation of high-quality paints and coatings with exceptional durability and finish. As the construction and infrastructure development sectors continue to thrive in India, the need for top-notch paints and coatings remains high, leading to increased demand for Diacetone Alcohol as a solvent in this industry. Diacetone Alcohol is an essential ingredient in the production of varnishes. Varnishes are used for protecting and enhancing the aesthetics of wood, metal, and other surfaces. Diacetone Alcohol's ability to dissolve resins and create a smooth, glossy finish in varnish formulations makes it a preferred solvent in this application. As construction and renovation projects continue to proliferate in India, the demand for varnishes has surged, further driving the usage of Diacetone Alcohol as a solvent.

Another sector benefiting from Diacetone Alcohol's role as a solvent is the adhesives industry. Diacetone Alcohol serves as an effective solvent in the production of adhesives, enabling the binding of various materials in sectors like manufacturing, construction, and automotive. As these industries expand, the need for adhesives has grown, subsequently increasing the demand for Diacetone Alcohol as a solvent in adhesive formulations. Diacetone Alcohol is a crucial component in the manufacture of cleaning and degreasing solutions. Its strong solvency power makes it an ideal choice for removing grease, grime, and contaminants from surfaces and equipment in various industrial settings. With an increasing emphasis on cleanliness and hygiene in both households and industrial environments, the demand for cleaning and degreasing products containing Diacetone Alcohol is on the rise.

In addition, the pharmaceutical industry in India is recognizing the value of Diacetone Alcohol as a solvent in the production of pharmaceutical formulations and active pharmaceutical ingredients (APIs). The versatility and efficiency of Diacetone Alcohol as a solvent has positioned it as a vital component in drug manufacturing, contributing to the growth of the pharmaceutical sector. As the usage of Diacetone Alcohol as a solvent continues to gain momentum across various industries, the Indian Diacetone Alcohol market is poised for substantial growth.

Its versatility and effectiveness as a solvent, as seen in paints and coatings, varnishes, adhesives, cleaning solutions, and pharmaceutical applications, highlights its significance and wide-ranging applications in the chemical sector. The ever-growing construction, infrastructure development, and manufacturing sectors in India, coupled with the rising focus on quality and cleanliness, are expected to drive the demand for Diacetone Alcohol. This growth not only benefits the chemical industry but also contributes to India's economic development by supporting multiple sectors that are pivotal for the nation's progress and industrial diversification.

Growing Demand from Pharmaceutical and Cosmetic Industries is Propelling the India Diacetone Alcohol Market Growth

The India Diacetone Alcohol market is currently experiencing significant growth, primarily fueled by the surging demand from the pharmaceutical and cosmetic industries. Diacetone Alcohol, a versatile chemical compound, has emerged as a vital ingredient in the production of various products in these sectors, propelling the market's expansion and contributing to India's economic development. The pharmaceutical industry in India is witnessing remarkable growth, driven by a combination of factors such as increasing healthcare needs, growing population, and the country's position as a global pharmaceutical hub.Diacetone Alcohol plays a pivotal role in this sector, as it serves as a key solvent and chemical intermediate in the production of various pharmaceutical formulations and active pharmaceutical ingredients (APIs). Its versatility and efficiency in dissolving a wide range of pharmaceutical compounds make it an indispensable component in drug manufacturing, contributing to the development of high-quality medications. As the pharmaceutical sector continues to evolve, the demand for Diacetone Alcohol is expected to grow in tandem with the increasing need for pharmaceutical products and API synthesis.

The cosmetic industry in India is also experiencing substantial expansion, driven by shifting consumer preferences, increased disposable incomes, and a growing demand for personal care and grooming products. Diacetone Alcohol finds extensive use in the formulation of cosmetics, including lotions, creams, nail care products, and perfumes. Its inclusion in cosmetic formulations enhances the texture and consistency of these products, contributing to a better user experience. As the demand for high-quality cosmetics continues to rise, the need for Diacetone Alcohol in the cosmetic industry is projected to experience robust growth. Diacetone Alcohol is employed as a solvent in the production of fragrances and perfumes.

The fragrance industry relies on this chemical compound for its ability to dissolve and blend fragrance components effectively, ensuring a harmonious and long-lasting scent in perfumes. With the growing interest in perfumes and fragrances among Indian consumers, the demand for Diacetone Alcohol as a solvent in the fragrance sector is on the rise. The versatility of Diacetone Alcohol extends to the production of industrial and specialty chemicals, contributing to processes and products in diverse industries such as agriculture, textiles, and personal care. Its role as a chemical intermediate offers a broad spectrum of applications that cater to the needs of various sectors.

As the pharmaceutical and cosmetic industries in India continue to thrive, the Diacetone Alcohol market is poised for substantial growth. Its multifaceted role as a solvent, pharmaceutical intermediate, and cosmetic ingredient makes it a critical component for various applications across these sectors. The increasing focus on healthcare, personal grooming, and product quality, coupled with the changing consumer preferences in India, are expected to drive the demand for Diacetone Alcohol in the coming years. This growth not only benefits the chemical industry but also contributes to India's economic development by supporting two pivotal sectors that are crucial for the nation's progress and the well-being of its citizens.

Key Market Challenges

Volatility of Acetone Prices

The volatility of acetone prices has become a substantial obstacle to the growth of India's Diacetone Alcohol market. Diacetone Alcohol, a key chemical solvent and intermediate used in various industries, relies heavily on acetone as its primary raw material. The erratic fluctuations in acetone prices can significantly affect the production costs and pricing strategies of Diacetone Alcohol manufacturers. The unpredictable nature of acetone prices in the global market can lead to sudden cost spikes, forcing producers to grapple with increased expenses. This price volatility impacts their ability to maintain stable and competitive prices for Diacetone Alcohol, hindering market growth and posing challenges for long-term planning and investment.To mitigate the adverse effects of acetone price fluctuations, companies in the Diacetone Alcohol sector must consider risk management strategies, diversify their supply sources, and explore cost-effective alternatives for acetone production. This adaptability will not only help them navigate market challenges but also foster resilience and sustainable growth in the face of volatile raw material prices.

Competition from Imports

Competition from imports has emerged as a significant hindrance to the growth of the Diacetone Alcohol market in India. Diacetone Alcohol is a versatile solvent and chemical intermediate, and the market faces fierce competition from cheaper imports, often from countries with lower production costs. These imported products are typically priced more competitively, putting domestic manufacturers at a disadvantage. The influx of cheaper imported Diacetone Alcohol can erode the market share of local producers, affecting their profitability and market growth potential. Indian manufacturers often struggle to match the pricing offered by foreign competitors, especially when dealing with economies of scale and cost-efficiency. This not only hampers the market's expansion but also poses challenges for domestic manufacturers to invest in research and development and enhance their product quality.To foster the growth of the Diacetone Alcohol market in India, it is crucial for local manufacturers to focus on quality, innovation, and efficiency to compete effectively with imported products. Additionally, government policies that promote domestic production and address trade imbalances can also play a vital role in supporting the growth of the domestic Diacetone Alcohol industry.

Key Market Trends

Rising Demand for High-Performance Coatings and Environmentally Friendly Paints

The India Diacetone Alcohol market is experiencing a significant growth trend, driven by the rising demand for high-performance coatings and environmentally friendly paints. This shift in consumer preferences and industry practices is reshaping the landscape of the chemical market, particularly for diacetone alcohol, which serves as a critical component in the formulation of advanced coatings and eco-friendly paints.The surge in demand for high-performance coatings can be attributed to India's growing industrial and infrastructure sectors. These coatings offer enhanced durability, resistance to harsh environmental conditions, and improved aesthetics, making them essential for various applications, including automotive, aerospace, and industrial equipment. Diacetone alcohol, with its exceptional solvent and coalescing properties, plays a pivotal role in ensuring the effectiveness of these high-performance coatings.

Simultaneously, the push for environmentally friendly paints and coatings, which adhere to strict regulatory and sustainability standards, has gained substantial momentum in India. Consumers and businesses alike are increasingly choosing paints that contain lower volatile organic compounds (VOCs) and are eco-conscious. Diacetone alcohol, as a low-VOC solvent, is instrumental in the formulation of such paints. Its use helps reduce environmental impacts and air pollution while ensuring that the end products maintain high-quality performance and aesthetics.

As India continues to focus on environmental sustainability and stringent regulations, the demand for diacetone alcohol is expected to grow, given its indispensable role in crafting both high-performance coatings and eco-friendly paints. This dual demand trend not only reflects the evolving consumer preferences but also showcases the Indian market's commitment to balancing innovation and environmental responsibility, positioning diacetone alcohol as a vital component in the nation's transition toward more sustainable and technologically advanced coatings and paints.

Exploring Bio-Based DAA Production Method

In the ever-evolving landscape of the India Diacetone Alcohol (DAA) market, a noteworthy and transformative trend is the exploration of bio-based DAA production methods. This emerging trend is catalyzing significant growth within the industry, driven by a growing emphasis on sustainability and environmental responsibility. The pursuit of bio-based DAA production is seen as a critical step towards reducing the carbon footprint associated with traditional petrochemical manufacturing processes.Bio-based DAA production harnesses renewable feedstocks and sustainable production techniques to create a more environmentally friendly alternative to conventional methods. As global concerns about climate change intensify and the need for sustainable chemical solutions becomes increasingly apparent, India is taking proactive steps in embracing this innovative approach.

Research and development activities are vigorously focused on optimizing biobased DAA production, with a key aim of improving efficiency and cost-effectiveness. Researchers and industry players are exploring various biomass sources and biotechnological methods to develop sustainable and economically viable production techniques. This aligns perfectly with India's commitment to not only foster growth within its chemical industry but to do so while minimizing its ecological impact.

The exploration of biobased DAA production stands as a pivotal factor in the growth of the India DAA market. As the nation continues to invest in research and development, it positions itself to meet the rising domestic demand for this versatile chemical while contributing to global sustainability goals. This trend reflects India's aspiration to balance economic progress with environmental responsibility, showcasing a strong commitment to driving a more sustainable and ecologically conscious chemical industry.

Segmental Insights

End User Industry Insights

Based on the end user Industry, the paint & coatings segment is projected to experience rapid growth during the forecast period. This growth is attributed to the vital role that Diacetone Alcohol plays as a key ingredient in the formulation of high-quality paints, coatings, varnishes, and related products. Diacetone Alcohol is renowned for its effectiveness as a solvent and coalescing agent in the paints and coatings industry.It aids in the dispersion of pigments, resins, and additives, while also contributing to film formation and the overall quality of the coatings. This results in coatings with excellent adhesion, durability, and resistance to environmental factors. The Indian market has witnessed substantial growth in the construction, automotive, and industrial sectors, which has driven the demand for superior paints and coatings. Diacetone Alcohol's versatility and performance-enhancing properties make it an indispensable component in the formulation of coatings, ensuring vibrant colors, durability, and protection for a variety of surfaces.

The dominance of the paints and coatings segment is further reinforced by the increasing emphasis on aesthetic appeal, corrosion resistance, and environmental sustainability in the coatings industry. Diacetone Alcohol is well-suited to meet these demands and is integral to the production of high-quality coatings. As India's construction and industrial activities continue to expand, the paints and coatings segment is expected to maintain its pivotal role in the Diacetone Alcohol market, providing innovative and high-performance coating solutions for a growing market.

Regional Insights

Based on the region, the South region has indeed emerged as the dominant player, marking its significance in the production and distribution of this essential chemical compound. This regional dominance can be attributed to a combination of factors, including well-established industrial clusters, strategic geographical advantages, and access to key resources. The South region, particularly the state of Tamil Nadu, hosts a significant portion of the country's chemical and petrochemical manufacturing facilities. The region boasts well-developed industrial infrastructure, industrial parks, and chemical clusters that have been pivotal in the production of Diacetone Alcohol. These facilities support the region's dominance in the Diacetone Alcohol market.The South region benefits from its strategic location with access to major ports along the eastern coastline, which facilitates the import of crucial raw materials like acetone and isopropanol, key feedstocks for Diacetone Alcohol production. This logistical advantage ensures a steady supply chain for manufacturers in the region. The presence of a skilled workforce and a business-friendly environment in the South region has encouraged investments in the chemical and petrochemical sector, further reinforcing its dominance in the Diacetone Alcohol market. As India's industrial and manufacturing sectors continue to grow, the South region's robust capabilities and strategic advantages make it a key contributor to the country's chemical and petrochemical development and the Diacetone Alcohol market.

Key Market Players

- Alpha Chemika

- Prasol Chemicals Pvt. Ltd.

- Chemex Chemicals LLC

- Galaxy Chemicals LLC

- Arihant Solvents and Chemicals

- Report Scope:

India Diacetone Alcohol Market, By Functions:

- Solvents

- Chemical Intermediates

- Additives

India Diacetone Alcohol Market, By End User Industry:

- Paints coating

- Chemicals

- Construction

- Polymer Plastics

- Textile

- Leather

- Agrochemicals

- Automotive

- Others

India Diacetone Alcohol Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the India Diacetone Alcohol Market.Available Customizations:

India Diacetone Alcohol Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Alpha Chemika

- Prasol Chemicals Pvt. Ltd.

- Chemex Chemicals LLC

- Galaxy Chemicals, LLC.

- Arihant Solvents and Chemicals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | October 2024 |

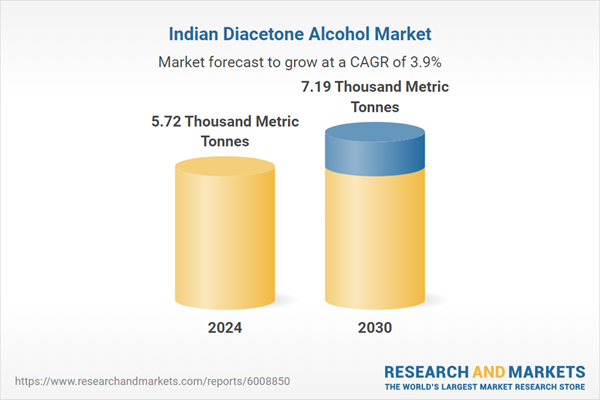

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 5.72 Thousand Metric Tonnes |

| Forecasted Market Value by 2030 | 7.19 Thousand Metric Tonnes |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | India |

| No. of Companies Mentioned | 5 |