Global Calcium Oxide Market - Key Trends & Drivers Summarized

Why Is Calcium Oxide Becoming a Critical Material Across Multiple Industrial Applications?

Calcium oxide, commonly known as quicklime, is a versatile and essential chemical compound used across a wide range of industrial applications due to its unique properties, including its strong basicity, high reactivity, and ability to neutralize acidity. Derived from the thermal decomposition of calcium carbonate (limestone) in a lime kiln, calcium oxide plays a crucial role in sectors such as construction, metallurgy, environmental protection, chemical manufacturing, and agriculture. In the construction industry, it is a key ingredient in the production of cement and mortar, where it acts as a binding agent that contributes to the strength and durability of structures. Additionally, calcium oxide is used in the production of steel, where it serves as a flux to remove impurities such as silica, phosphorus, and sulfur from molten metal, ensuring the production of high-quality steel. The ongoing growth in global construction activities and the expansion of the steel industry are major drivers of the calcium oxide market, as these sectors rely heavily on this chemical for efficient operations.The environmental applications of calcium oxide are also fueling its demand, particularly in water treatment and flue gas desulfurization (FGD) systems. As a strong alkaline compound, calcium oxide is effective at neutralizing acidic pollutants and heavy metals, making it an ideal choice for treating industrial wastewater and reducing sulfur dioxide (SO2) emissions from power plants and industrial furnaces. With increasing regulatory pressure to minimize environmental pollution and enhance sustainability, industries are turning to calcium oxide-based solutions for effective pollution control and waste management. Furthermore, calcium oxide is used in the agricultural sector to adjust soil pH, enhance crop yield, and provide a source of essential calcium nutrients. As the global focus on sustainable agriculture and environmental stewardship continues to grow, the demand for calcium oxide as a multifunctional chemical in these applications is expected to rise steadily.

What Technological Advancements Are Enhancing the Production and Application of Calcium Oxide?

Technological advancements in the production and application of calcium oxide are significantly improving its quality, efficiency, and environmental impact. One of the key innovations is the development of energy-efficient lime kilns and advanced calcination technologies that reduce energy consumption and greenhouse gas emissions during the production of calcium oxide. Traditional lime kilns, which require high temperatures to decompose calcium carbonate into calcium oxide and carbon dioxide, are being replaced or upgraded with modern kilns that utilize advanced heat recovery systems, optimized fuel usage, and improved insulation materials. These improvements not only reduce operational costs but also minimize carbon emissions, making calcium oxide production more sustainable and aligned with environmental regulations. Additionally, the use of alternative fuels, such as biomass and waste-derived fuels, is being explored to further decrease the carbon footprint of lime production.In terms of application, advancements in particle size reduction and surface modification technologies are expanding the use of calcium oxide in various industries. The production of ultra-fine calcium oxide powders with controlled particle size distribution is enhancing its performance in chemical processes, enabling faster reaction rates and more efficient neutralization in applications such as wastewater treatment and flue gas scrubbing. Surface modification techniques, such as coating calcium oxide particles with hydrophobic or hydrophilic materials, are being developed to tailor its properties for specific applications. For example, hydrophobic calcium oxide can be used as a moisture scavenger in packaging and sealing applications, while hydrophilic calcium oxide is more suitable for water treatment and soil conditioning. These technological innovations are enhancing the versatility and functionality of calcium oxide, making it a preferred choice for a wider range of industrial and environmental applications.

Another significant advancement is the integration of calcium oxide in composite materials and advanced formulations. For instance, calcium oxide is being incorporated into composite materials used in building construction, where it improves thermal insulation, fire resistance, and mechanical strength. In the chemical industry, calcium oxide is being used as a catalyst and reagent in the production of various chemicals, including calcium-based sorbents for carbon capture and storage (CCS) applications. Moreover, research is being conducted on the use of calcium oxide in new and emerging applications, such as energy storage and waste-to-energy processes, where its chemical reactivity and thermal stability offer unique benefits. These technological advancements are not only optimizing the production and application of calcium oxide but are also opening up new opportunities for its use in innovative and high-value applications.

How Are Market Dynamics and Regulatory Standards Influencing the Calcium Oxide Market?

The calcium oxide market is influenced by a complex interplay of market dynamics and regulatory standards that are shaping its demand, production practices, and application across various regions. One of the primary market drivers is the increasing demand for calcium oxide in construction and infrastructure development. With rapid urbanization and industrialization in emerging economies such as China, India, and Southeast Asia, there is a growing need for construction materials such as cement, concrete, and mortar, which rely heavily on calcium oxide as a key ingredient. Government initiatives aimed at boosting infrastructure development and housing projects are further supporting this demand, creating a favorable market environment for calcium oxide producers. In developed regions like North America and Europe, the renovation of aging infrastructure and the adoption of green building practices are contributing to the steady demand for calcium oxide in construction-related applications.Regulatory standards and environmental considerations are also playing a critical role in shaping the calcium oxide market. Stringent environmental regulations aimed at reducing greenhouse gas emissions and controlling air and water pollution are driving industries to adopt more sustainable practices and technologies. For example, power plants and industrial facilities are required to implement flue gas desulfurization (FGD) systems to control sulfur dioxide emissions, creating significant demand for calcium oxide-based sorbents and neutralizers. In water treatment, regulations governing the discharge of industrial effluents are prompting industries to use calcium oxide as a cost-effective solution for pH adjustment and heavy metal removal. Compliance with these regulations is crucial for companies operating in regulated sectors such as power generation, chemicals, and wastewater treatment, making calcium oxide an indispensable chemical in ensuring regulatory compliance and environmental stewardship.

Market dynamics such as raw material availability, production costs, and global trade policies are also affecting the calcium oxide market. The production of calcium oxide is heavily reliant on the availability of high-quality limestone, which serves as the primary raw material. Any fluctuations in limestone supply or quality can impact production costs and product availability. Additionally, the energy-intensive nature of lime production means that energy costs play a significant role in determining profitability. In regions where energy costs are high or where there are limitations on carbon emissions, the production of calcium oxide may face challenges. Global trade policies, including tariffs and import/export regulations, can also influence the flow of calcium oxide and related products across international markets. For example, trade restrictions or tariffs on raw materials and finished products can affect the competitiveness of calcium oxide producers in different regions. These market dynamics and regulatory standards are shaping the growth trajectory of the calcium oxide market, influencing production strategies, product development, and market positioning.

What Are the Key Growth Drivers Fueling the Expansion of the Calcium Oxide Market?

The growth in the global calcium oxide market is driven by several key factors, including the expansion of the construction and steel industries, increasing demand for environmental applications, and the adoption of advanced production technologies. One of the primary growth drivers is the robust demand for calcium oxide in the construction sector, where it is used as a crucial component in cement, plaster, and mortar. The rapid urbanization and industrial development in emerging economies are leading to increased construction activities, thereby driving the demand for calcium oxide as a building material. Additionally, the emphasis on infrastructure development in countries like China, India, and Brazil is creating significant opportunities for calcium oxide manufacturers to supply the construction industry with high-quality lime products. The trend towards sustainable construction and the use of eco-friendly materials is also boosting the adoption of calcium oxide-based products, as it contributes to the durability and thermal efficiency of green buildings.Another significant growth driver is the increasing use of calcium oxide in environmental applications, particularly in flue gas desulfurization (FGD) and wastewater treatment. As industries strive to comply with stringent environmental regulations, the demand for calcium oxide-based solutions for pollution control is rising. In power plants, calcium oxide is used to neutralize sulfur dioxide emissions, a major contributor to acid rain. Similarly, in industrial wastewater treatment, calcium oxide is used to adjust pH levels and precipitate heavy metals, ensuring that effluents meet environmental discharge standards. The growing focus on environmental sustainability and the need to reduce industrial pollution are creating a strong demand for calcium oxide in these applications.

Furthermore, advancements in production technology and the development of high-performance calcium oxide grades are supporting the growth of the market. The introduction of energy-efficient lime kilns and process optimization techniques is enabling manufacturers to produce high-purity calcium oxide with lower environmental impact. These high-purity grades are increasingly being used in specialized applications, such as in the production of specialty chemicals, pharmaceuticals, and ceramics. The adoption of digital technologies and automation in lime production is also enhancing process control and product consistency, making calcium oxide a more reliable and versatile chemical for various industries. As the demand from key sectors such as construction, steel, and environmental protection continues to rise, and as manufacturers innovate to improve production efficiency and sustainability, the global calcium oxide market is expected to witness sustained growth, driven by its broad applicability, functional properties, and expanding range of industrial and environmental applications.

Report Scope

The report analyzes the Calcium Oxide market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Construction End-Use, Agriculture End-Use, Food End-Use, Chemicals End-Use, Mining End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Construction End-Use segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of a 4.4%. The Agriculture End-Use segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Calcium Oxide Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Calcium Oxide Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Calcium Oxide Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Elements, Astrra Chemicals, Calcinor, CAO Industries Sdn. Bhd., Carmeuse Group SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Calcium Oxide market report include:

- American Elements

- Astrra Chemicals

- Calcinor

- CAO Industries Sdn. Bhd.

- Carmeuse Group SA

- Graymont Ltd.

- Grupo Calidra

- Kraft Chemical Co., Inc.

- Lhoist Group

- Linwood Mining & Minerals Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Elements

- Astrra Chemicals

- Calcinor

- CAO Industries Sdn. Bhd.

- Carmeuse Group SA

- Graymont Ltd.

- Grupo Calidra

- Kraft Chemical Co., Inc.

- Lhoist Group

- Linwood Mining & Minerals Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | February 2026 |

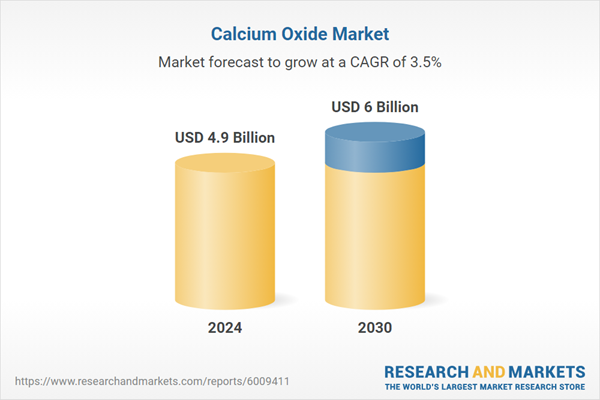

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.9 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |