Global Micromobility Market - Key Trends & Drivers Summarized

Why Is Micromobility Gaining Popularity in Urban Transportation Systems?

Micromobility is rapidly gaining popularity in urban transportation systems as cities around the world seek efficient, affordable, and eco-friendly solutions to address traffic congestion, pollution, and last-mile connectivity challenges. Micromobility refers to the use of lightweight, small vehicles - such as electric scooters, bicycles, and e-bikes - typically for short-distance travel, often under 10 kilometers. As urban areas become more densely populated and traditional public transportation systems reach capacity, micromobility offers a flexible, efficient alternative for urban commuters. These vehicles are particularly appealing for last-mile travel, allowing users to easily connect to public transportation hubs, such as subway stations or bus stops, and complete their journeys quickly and conveniently.One of the major factors driving the rise of micromobility is the growing emphasis on sustainability and reducing carbon emissions. As cities work to meet climate goals and reduce reliance on fossil fuels, micromobility solutions provide an attractive option for reducing the carbon footprint of urban transportation. E-scooters and e-bikes, in particular, offer a clean, energy-efficient alternative to cars and buses, which contribute significantly to air pollution in urban areas. In addition to environmental benefits, micromobility is cost-effective for both users and municipalities, as it reduces the need for expensive infrastructure projects like roads and bridges while offering affordable transportation options for residents. As cities continue to grapple with traffic congestion and environmental concerns, micromobility is becoming an essential component of urban transportation networks.

How Are Technological Advancements Enhancing the Micromobility Experience?

Technological advancements are playing a critical role in enhancing the micromobility experience, making it safer, more efficient, and more accessible to users across the globe. One of the most impactful innovations is the rise of smart vehicle technology and connected platforms. Micromobility vehicles, such as e-scooters and e-bikes, are increasingly equipped with GPS, Bluetooth, and IoT (Internet of Things) capabilities, allowing users to locate and unlock vehicles via smartphone apps. This connectivity also allows fleet operators to monitor vehicle status in real time, track usage patterns, and deploy vehicles where demand is highest, optimizing fleet management and improving service availability. The integration of GPS and data analytics ensures that vehicles are evenly distributed across cities, reducing instances of overcrowding at popular locations while ensuring that vehicles are available in underserved areas.Battery technology has also seen significant improvements, which has extended the range and durability of micromobility vehicles. Modern lithium-ion batteries are lighter, more efficient, and capable of longer ranges on a single charge, making e-scooters and e-bikes more practical for daily commuters. These advancements in battery life also reduce the need for frequent recharging, lowering operational costs for micromobility companies and improving service reliability for users. Additionally, innovations in charging infrastructure, such as wireless charging stations and battery-swapping technologies, are making it easier to maintain large fleets and keep vehicles on the road longer, enhancing the overall user experience.

Safety features are another area where technological advancements are making a significant impact. As micromobility continues to grow in popularity, concerns about rider safety have prompted companies to develop new safety technologies. For instance, e-scooters and e-bikes are now being equipped with features like anti-lock braking systems (ABS), speed limiters, and improved suspension systems to enhance rider stability and control. Furthermore, some companies are experimenting with advanced rider assistance systems (ARAS) that use sensors and AI to detect obstacles and provide collision warnings, improving safety for both riders and pedestrians. These technological advancements are helping to address some of the key challenges associated with micromobility, making it safer, more efficient, and more convenient for urban travelers.

How Are Changing Consumer Preferences and Urban Policies Shaping the Micromobility Market?

Changing consumer preferences and evolving urban policies are shaping the micromobility market, driving its growth and adoption across cities worldwide. One of the key trends influencing consumer behavior is the growing demand for flexible, on-demand transportation options that offer convenience and affordability. As urban commuters seek alternatives to traditional transportation methods, such as cars and public transit, micromobility solutions provide a viable option for short-distance travel. The rise of shared mobility services, where users can rent e-scooters or e-bikes via apps on a pay-as-you-go basis, has made micromobility more accessible, particularly for people who do not want to own or maintain their own vehicles. These shared services align with the broader trend toward “mobility as a service” (MaaS), where transportation is seen as a flexible, subscription-based service rather than a product to own.Urban policies are also playing a crucial role in shaping the micromobility landscape, as city governments look for innovative ways to reduce traffic congestion, improve air quality, and enhance urban livability. Many cities have introduced policies to promote micromobility, such as building dedicated bike lanes, implementing vehicle-sharing programs, and offering subsidies or incentives for users to adopt e-scooters and e-bikes. Some cities have even designated micromobility-friendly zones, where cars are restricted, and pedestrians and cyclists are given priority. These policies are aimed at encouraging a shift away from car dependency and promoting greener, more sustainable transportation options. At the same time, cities are implementing regulations to ensure the safe and orderly use of micromobility vehicles, including speed limits, designated parking areas, and helmet requirements, all of which help integrate micromobility into existing transportation networks.

The COVID-19 pandemic has further accelerated changes in consumer preferences and urban policies. During the pandemic, micromobility solutions like e-scooters and bikes offered a socially distanced alternative to crowded public transportation, leading to a surge in usage in many cities. As cities rethink their transportation strategies post-pandemic, micromobility is increasingly being seen as a critical component of resilient, flexible, and sustainable urban mobility systems. With growing interest in healthier, eco-friendly modes of transport, micromobility is well-positioned to play a major role in the future of urban transportation, aligning with consumer demand for safe, efficient, and environmentally conscious travel options.

What Is Driving the Growth of the Global Micromobility Market?

The growth of the global micromobility market is being driven by several key factors, including urbanization, technological advancements, sustainability goals, and shifting consumer preferences. One of the primary drivers is the rapid urbanization taking place around the world. As more people move into cities, the demand for efficient, flexible, and cost-effective transportation options is rising. Traditional modes of urban transportation, such as cars and public transit, often struggle to keep up with the growing population density, leading to traffic congestion, pollution, and longer commute times. Micromobility solutions, such as e-scooters, e-bikes, and shared bicycles, offer a practical alternative for short-distance trips, helping to alleviate traffic and provide a more accessible transportation option for urban dwellers.Another significant driver of market growth is the increasing focus on sustainability and reducing greenhouse gas emissions. Governments and municipalities are implementing stringent environmental regulations and promoting clean transportation options as part of their efforts to combat climate change. Micromobility, which includes electric-powered vehicles that produce zero emissions, fits perfectly into these sustainability goals. E-scooters and e-bikes provide a greener alternative to gas-powered vehicles, helping cities reduce their carbon footprints and improve air quality. Many cities are offering incentives, such as subsidies or grants, to encourage the adoption of micromobility solutions as part of broader climate action plans, further driving demand for these vehicles.

Technological advancements are also playing a major role in the expansion of the micromobility market. The development of more durable, efficient, and connected vehicles has made micromobility more attractive to both consumers and operators. Improvements in battery technology, charging infrastructure, and vehicle durability have extended the range and lifespan of e-scooters and e-bikes, making them more reliable for daily commuting. At the same time, digital platforms and apps have made it easier for users to access micromobility services, track their rides, and make payments, enhancing the overall user experience. The integration of IoT and GPS technology allows operators to optimize fleet management, track vehicle usage, and prevent theft, contributing to more efficient and scalable micromobility operations.

The growing popularity of shared mobility services is another important factor driving the market. Shared e-scooter and e-bike services offer a flexible and affordable transportation option that can be accessed on-demand, without the need for ownership. As more cities embrace shared mobility models, micromobility is becoming a mainstream mode of transport, particularly among younger, tech-savvy urban residents. The ability to rent a vehicle via smartphone apps has made micromobility more convenient and accessible, while also reducing the need for personal car ownership. This trend toward shared, on-demand transportation is expected to continue fueling the growth of the micromobility market in the coming years.

In addition to these factors, the increasing integration of micromobility into broader urban transportation ecosystems is contributing to market growth. Many cities are incorporating micromobility options into their public transportation networks, offering seamless connectivity between micromobility vehicles and buses, trains, and subways. This integration allows for a more cohesive and efficient urban transportation system, where micromobility solutions fill the gaps in last-mile connectivity. As cities continue to develop smarter, more connected transportation infrastructure, the role of micromobility in providing flexible, sustainable, and efficient urban transportation is expected to grow.

The combination of urbanization, technological advancements, sustainability goals, and the rise of shared mobility is driving the rapid expansion of the global micromobility market. As cities continue to prioritize sustainable transportation and reduce reliance on cars, micromobility solutions are poised to play a key role in shaping the future of urban mobility, offering a more efficient, eco-friendly, and accessible alternative for short-distance travel.

Report Scope

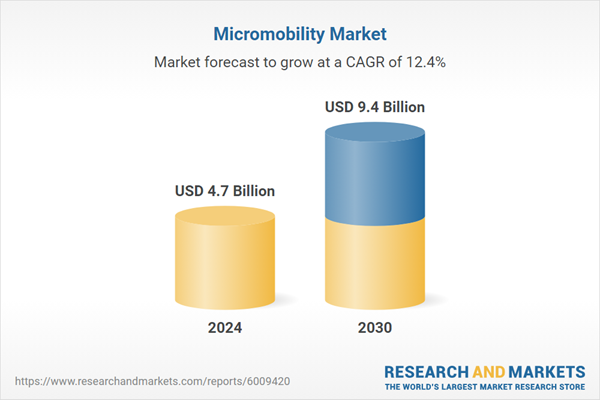

The report analyzes the Micromobility market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Vehicle Type (E-Bicycles, E-Bikes, E-Kick Scooters, Other Vehicle Types); Sharing Type (Docked Sharing, Dockless Sharing).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the E-Bicycles segment, which is expected to reach US$6.7 Billion by 2030 with a CAGR of a 12.2%. The E-Bikes segment is also set to grow at 12.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Micromobility Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Micromobility Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Micromobility Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aeris Communications, Inc., Bird Rides, Inc., Bolt Technology OU, CycleHop, LLC., Helbiz, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Micromobility market report include:

- Aeris Communications, Inc.

- Bird Rides, Inc.

- Bolt Technology OU

- CycleHop, LLC.

- Helbiz, Inc.

- Hellotracks

- INVERS GmbH

- Lyft, Inc.

- Micro Mobility Systems AG

- Motivate LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aeris Communications, Inc.

- Bird Rides, Inc.

- Bolt Technology OU

- CycleHop, LLC.

- Helbiz, Inc.

- Hellotracks

- INVERS GmbH

- Lyft, Inc.

- Micro Mobility Systems AG

- Motivate LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 9.4 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |