Global Passenger Vehicle Tires Market - Key Trends and Drivers Summarized

Why Are Passenger Vehicle Tires a Key Component in the Automotive Market?

Passenger vehicle tires play a critical role in vehicle safety, performance, and fuel efficiency, making them an essential component of the automotive market. They are designed to meet a range of requirements, from providing grip and traction under various weather conditions to ensuring a smooth and comfortable ride. With increasing consumer awareness about the importance of tire quality and safety, the demand for premium and high-performance tires has surged, driving manufacturers to develop tires that offer superior handling, reduced rolling resistance, and enhanced durability. Passenger vehicle tires are not a one-size-fits-all solution; they vary significantly based on vehicle type, driving conditions, and consumer preferences. As a result, the market is segmented into all-season, summer, winter, and specialty tires, each catering to specific needs and performance criteria. Additionally, advancements in tire technology, such as run-flat tires, low rolling resistance tires, and smart tires equipped with sensors for real-time monitoring, are transforming the landscape, offering consumers a range of options tailored to different driving environments and performance expectations. This increased specialization and innovation are making passenger vehicle tires a critical focus area for both automakers and tire manufacturers, as they strive to meet evolving safety standards and consumer demands.Which Segments Are Driving Demand for Passenger Vehicle Tires?

The demand for passenger vehicle tires is being driven by multiple segments, including original equipment (OE) and replacement markets, with distinct factors influencing each segment. The OE tire segment is directly linked to new vehicle production and sales, making it sensitive to fluctuations in the automotive industry. This segment is characterized by close collaborations between tire manufacturers and automakers to develop tires that are specifically designed to match the performance and safety requirements of new car models. As global automotive production continues to recover post-pandemic and as electric vehicle (EV) adoption accelerates, the OE tire segment is poised for robust growth. Electric vehicles, in particular, are creating a new demand for specialized tires that can handle the heavier weight, higher torque, and unique driving dynamics of EVs, prompting tire manufacturers to innovate with new materials and designs. The replacement tire segment, on the other hand, is much larger and driven by the need for regular tire maintenance and replacement due to wear and tear. With millions of vehicles on the road worldwide, the replacement market is a steady source of revenue for tire manufacturers, and its growth is influenced by factors such as road conditions, driving habits, and vehicle age.How Are Technological Advancements Transforming the Passenger Vehicle Tire Market?

Technological advancements are significantly reshaping the passenger vehicle tire market, leading to the development of smarter, safer, and more sustainable tires. One of the most prominent trends is the rise of smart tires, which are equipped with sensors that provide real-time data on tire pressure, temperature, and tread wear. This information is transmitted to the driver or fleet manager, enabling proactive maintenance and enhancing safety by reducing the risk of blowouts or under-inflation. Smart tires are gaining traction not only among performance enthusiasts but also in the growing electric vehicle (EV) market, where maximizing range and safety is critical. Another key innovation is the development of low rolling resistance tires, which reduce energy loss as the tire rolls, thereby improving fuel efficiency and lowering carbon emissions. These tires are becoming increasingly important as automakers strive to meet stringent fuel economy and emissions regulations, making them a preferred choice for both traditional internal combustion engine (ICE) vehicles and EVs. Additionally, advancements in tire materials and manufacturing processes are enabling the creation of more durable and environmentally friendly products. The use of advanced rubber compounds, silica-based materials, and nanotechnology is enhancing the strength, elasticity, and heat resistance of tires, resulting in longer lifespans and improved performance under extreme conditions. Sustainable tire technology is also gaining momentum, with manufacturers exploring alternatives such as dandelion rubber and bio-based polymers to reduce their reliance on synthetic rubber and petroleum-based materials. Innovations in tread design, such as self-healing compounds and adaptive tread patterns, are further enhancing tire performance and safety. For instance, some high-end tires now feature tread patterns that adjust to changing road conditions, providing optimal traction on wet, dry, or icy surfaces. Run-flat tire technology, which allows drivers to continue driving safely for a limited distance after a puncture, is another area of growth, catering to safety-conscious consumers.What Factors Are Driving the Growth of the Passenger Vehicle Tire Market?

The growth in the passenger vehicle tire market is driven by several factors, primarily centered around the increasing global vehicle fleet, rising consumer demand for high-performance and specialty tires, and evolving regulatory standards. One of the main drivers is the expanding vehicle ownership in emerging economies, particularly in Asia-Pacific, where rising disposable incomes and rapid urbanization are boosting car sales and, consequently, the demand for both OE and replacement tires. The replacement tire segment is also benefiting from the aging vehicle fleet in many developed markets, where longer vehicle lifespans lead to multiple tire replacements over the life of a vehicle. Additionally, the shift towards electric vehicles (EVs) is creating new growth opportunities for tire manufacturers. EVs require specialized tires that can handle higher torque and heavier loads, while also contributing to noise reduction and optimizing energy efficiency. As EV adoption accelerates worldwide, tire manufacturers are investing heavily in developing EV-specific tires, creating a new high-growth segment within the market. The growing consumer preference for high-performance and specialty tires is another major driver. Consumers are increasingly looking for tires that offer enhanced safety, comfort, and fuel efficiency, driving demand for premium products such as all-season tires, run-flat tires, and low rolling resistance tires. In regions with extreme weather conditions, such as Europe and North America, the seasonal demand for winter and summer tires is strong, supported by regulations mandating the use of appropriate tires for different weather conditions. Regulatory standards related to fuel efficiency, rolling resistance, and wet grip are also playing a crucial role in shaping the tire market. In response, manufacturers are focusing on producing eco-friendly and energy-efficient tires that meet these stringent requirements. Lastly, the increasing adoption of fleet management solutions, particularly in commercial and ride-sharing sectors, is driving demand for smart tires and advanced tire management systems, as fleet operators seek to optimize performance and reduce operational costs. These factors are expected to sustain robust growth in the passenger vehicle tire market, making it one of the most dynamic and competitive segments within the broader automotive industry.Report Scope

The report analyzes the Passenger Vehicle Tires market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (All Season Tires, Summer Season Tires, Winter Season Tires); End-Use (Aftermarket End-Use, OEM End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Passenger Vehicle Tires Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Passenger Vehicle Tires Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Passenger Vehicle Tires Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

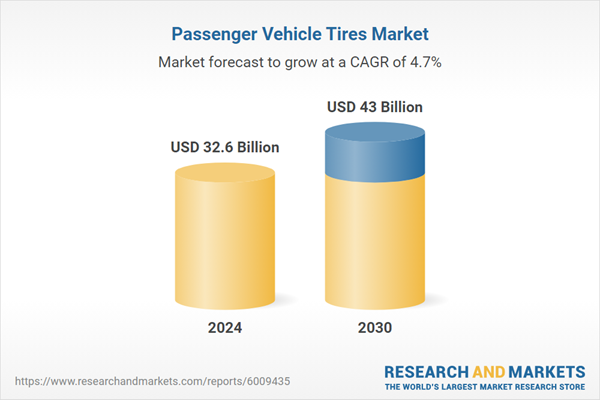

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apollo Tyres Ltd., Bridgestone Corporation, Continental AG, Giti Tire Pte., Ltd., Hankook Tire & Technology Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Passenger Vehicle Tires market report include:

- Apollo Tyres Ltd.

- Bridgestone Corporation

- Continental AG

- Giti Tire Pte., Ltd.

- Hankook Tire & Technology Co., Ltd.

- Huayi Tire Canada Inc.

- Maxxis International

- Michelin

- NEXEN TIRE Co. Ltd.

- Nokian Tyres PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apollo Tyres Ltd.

- Bridgestone Corporation

- Continental AG

- Giti Tire Pte., Ltd.

- Hankook Tire & Technology Co., Ltd.

- Huayi Tire Canada Inc.

- Maxxis International

- Michelin

- NEXEN TIRE Co. Ltd.

- Nokian Tyres PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 32.6 Billion |

| Forecasted Market Value ( USD | $ 43 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |