Global Agricultural Rollers Market - Key Trends & Drivers Summarized

Why Are Agricultural Rollers Becoming Essential in Modern Farming Practices?

Agricultural rollers are gaining increasing importance in modern farming due to their ability to improve soil health, enhance seedbed preparation, and optimize crop yields. These machines are primarily used to flatten land, break down soil clumps, and press seeds into the soil for better germination. They help create a smooth, firm seedbed that promotes consistent seed placement, leading to uniform crop growth. In addition to preparing fields for planting, agricultural rollers are essential in managing soil compaction, which is a critical issue for many farmers. By breaking up compacted soil layers, rollers improve water infiltration and root penetration, ensuring that crops have better access to nutrients and moisture.Furthermore, agricultural rollers contribute to post-harvest field management by aiding in residue management and weed control. They can be used to press down crop residues, facilitating easier decomposition and nutrient cycling in the soil. This improves the overall soil structure and health, setting up the field for the next planting cycle. The growing focus on sustainable farming practices has also spurred demand for agricultural rollers, as they help reduce the need for chemical inputs like herbicides and fertilizers by promoting better soil health naturally. As farmers seek to adopt more efficient and eco-friendly practices, agricultural rollers have become indispensable tools in both conventional and organic farming systems worldwide.

How Are Technological Advancements Enhancing the Efficiency of Agricultural Rollers?

Technological advancements are playing a significant role in improving the efficiency, performance, and versatility of agricultural rollers. One of the most notable innovations is the integration of precision farming technologies with agricultural rollers, allowing farmers to optimize their field operations. Modern rollers are now equipped with GPS-guided systems that ensure consistent and accurate coverage across large fields. By using GPS and automation technologies, farmers can ensure that rollers cover the field evenly, reducing overlaps and gaps in soil coverage. This results in more efficient field preparation, minimizing soil compaction issues and improving seed-to-soil contact, which is crucial for achieving optimal crop yields.Another significant advancement is the development of multi-purpose rollers that can perform several tasks simultaneously. For instance, some modern rollers are designed to incorporate features such as seeders or sprayers, allowing farmers to perform multiple operations in a single pass. These multi-functional rollers reduce the time and labor required for field preparation, making farming more efficient, especially in large-scale operations. Additionally, hydraulic-adjustable rollers enable farmers to adapt to varying field conditions by easily modifying the roller's pressure and weight. This flexibility allows for better soil management, even in uneven or challenging terrain, contributing to improved crop outcomes.

Moreover, advancements in materials and design are enhancing the durability and longevity of agricultural rollers. Rollers made from high-strength steel and other durable materials can withstand the wear and tear of long-term use in harsh agricultural environments. Additionally, the development of non-stick coatings for roller drums has reduced soil adhesion, making the equipment more efficient and easier to clean. These advancements not only improve the performance of the rollers but also reduce maintenance needs, lowering the overall cost of ownership for farmers. As technology continues to evolve, agricultural rollers are becoming more adaptable, efficient, and user-friendly, contributing to their growing adoption across diverse farming operations.

How Are Shifting Agricultural Practices and Sustainability Goals Shaping the Agricultural Rollers Market?

Shifting agricultural practices and the global push toward sustainability are having a profound impact on the agricultural rollers market, particularly as farmers prioritize soil health, resource efficiency, and environmentally friendly methods. One of the most significant trends shaping the market is the growing adoption of conservation tillage and no-till farming practices. These techniques aim to minimize soil disturbance, reduce erosion, and improve moisture retention in the soil. Agricultural rollers play a key role in no-till farming by pressing crop residues into the soil surface, creating a mulch layer that protects the soil and conserves water. By helping to maintain soil structure and prevent erosion, rollers are essential for farmers looking to implement more sustainable land management practices.Another important factor shaping the agricultural rollers market is the increasing demand for precision agriculture tools. As farmers seek to reduce inputs like water, fertilizers, and pesticides, they are turning to technology-driven solutions that enhance field efficiency. Rollers integrated with precision farming technologies, such as GPS guidance and data analytics, allow for more targeted and precise soil management. By using these technologies, farmers can minimize soil compaction, improve crop emergence, and reduce the need for chemical treatments, which aligns with sustainability goals. This shift toward more precise and efficient farming practices is driving the adoption of advanced agricultural rollers, particularly in regions with large-scale commercial farming.

The growing focus on organic farming and regenerative agriculture is also influencing the demand for agricultural rollers. In organic farming systems, where the use of synthetic chemicals is restricted, soil health is of paramount importance. Agricultural rollers help improve soil aeration and water retention without the need for chemical inputs, making them an ideal tool for organic farmers. Similarly, in regenerative agriculture, which focuses on rebuilding soil health and increasing biodiversity, rollers are used to manage cover crops and reduce soil disturbance. These practices are gaining popularity among farmers who are committed to enhancing the long-term sustainability of their land. As the global agricultural industry continues to shift toward more sustainable practices, agricultural rollers are becoming an essential tool for improving soil management and promoting eco-friendly farming.

What Is Driving the Growth of the Global Agricultural Rollers Market?

The growth of the global agricultural rollers market is being driven by several key factors, including the increasing need for efficient soil management, the expansion of precision farming technologies, and rising demand for sustainable farming solutions. One of the primary drivers is the growing importance of soil health in achieving high crop yields. As farmers face challenges such as soil compaction, erosion, and nutrient depletion, agricultural rollers provide an effective solution for improving soil structure and creating optimal conditions for plant growth. By enhancing seedbed preparation and promoting better seed-to-soil contact, rollers help farmers achieve more uniform crop emergence and higher yields, making them a valuable tool in modern agriculture.Another significant driver of market growth is the increasing adoption of precision farming technologies, which are transforming the way farmers manage their fields. Precision farming relies on data-driven techniques to optimize resource use, reduce waste, and improve efficiency. Agricultural rollers integrated with GPS-guided systems and automated controls are becoming popular among farmers who want to ensure consistent soil coverage and minimize overlaps or gaps in field operations. These high-tech rollers allow for more efficient use of time and resources, reducing the labor and fuel costs associated with field preparation. As precision farming continues to expand, the demand for technologically advanced agricultural rollers is expected to grow, particularly in regions with large commercial farming operations.

The global push for sustainable farming practices is also fueling the growth of the agricultural rollers market. As environmental concerns about soil erosion, water scarcity, and chemical use intensify, farmers are increasingly adopting practices that promote soil conservation and reduce the environmental impact of farming. Agricultural rollers, particularly those used in conservation tillage and no-till farming, help farmers achieve sustainability goals by minimizing soil disturbance and enhancing soil moisture retention. In addition, the use of rollers to manage cover crops and crop residues is gaining popularity as farmers look for natural ways to improve soil fertility and reduce reliance on chemical fertilizers. This trend toward more eco-friendly farming methods is expected to drive continued demand for agricultural rollers in the coming years.

Moreover, the rising global demand for food is placing pressure on farmers to increase productivity, further driving the adoption of efficient soil management tools like agricultural rollers. As the global population grows, particularly in regions like Asia-Pacific and Africa, farmers are seeking ways to maximize their yields without expanding their agricultural footprint. Agricultural rollers play a critical role in helping farmers optimize land use and improve crop outcomes, making them a key tool in meeting the world's growing food needs. The combination of technological advancements, sustainability initiatives, and rising food demand is driving the robust growth of the global agricultural rollers market, positioning it as a vital component of modern agricultural practices.

As farmers continue to embrace precision agriculture and sustainable farming methods, agricultural rollers are expected to see sustained demand, driven by their ability to enhance soil health, improve field efficiency, and contribute to higher crop yields. The future of farming will likely see further integration of smart technologies and environmentally friendly practices, ensuring that agricultural rollers remain an essential tool in the global agricultural landscape.

Report Scope

The report analyzes the Agricultural Rollers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Hydraulic Rollers, Non-Hydraulic Rollers).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hydraulic Rollers segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of a 2.7%. The Non-Hydraulic Rollers segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 4.5% CAGR to reach $887.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Agricultural Rollers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Agricultural Rollers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Agricultural Rollers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ag Shield Manufacturing Ltd., Bach-Run Farms Ltd., DALBO A S, Degelman Industries LP., Flaman and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Agricultural Rollers market report include:

- Ag Shield Manufacturing Ltd.

- Bach-Run Farms Ltd.

- DALBO A S

- Degelman Industries LP.

- Flaman

- Fleming Agri-Products Limited

- Grimme Landmaschinenfabrik GmbH & Co. KG

- HE-VA ApS

- Horsch Maschinen GmbH

- KUHN SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ag Shield Manufacturing Ltd.

- Bach-Run Farms Ltd.

- DALBO A S

- Degelman Industries LP.

- Flaman

- Fleming Agri-Products Limited

- Grimme Landmaschinenfabrik GmbH & Co. KG

- HE-VA ApS

- Horsch Maschinen GmbH

- KUHN SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

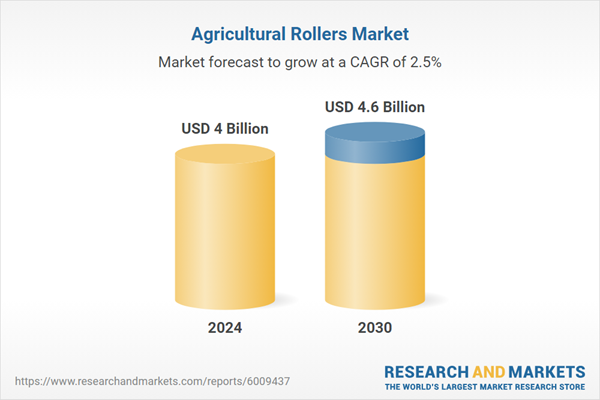

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 4.6 Billion |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | Global |