Global Tennis Equipment Market - Key Trends & Drivers Summarized

What Are the Key Components Shaping the Tennis Equipment Market?

The tennis equipment market is an integral part of the broader sports industry, encompassing a range of products such as racquets, balls, shoes, apparel, and accessories. A key driver for this market is the increasing global participation in tennis, both as a recreational and competitive sport. Tennis is one of the most widely played sports worldwide, and with significant viewership in major events such as the Grand Slam tournaments, its appeal continues to grow. The rising number of tennis academies and training centers, especially in emerging economies, has further fueled demand for quality tennis equipment. Additionally, governing bodies like the International Tennis Federation (ITF) promote the sport across multiple demographics, contributing to the popularity and accessibility of tennis equipment. This expansion is not limited to traditional regions like North America and Europe but is also emerging in Asia-Pacific countries, reflecting a global trend.How Does Technology Influence the Evolution of Tennis Equipment?

Advancements in technology have radically transformed tennis equipment, with innovations playing a crucial role in enhancing both performance and user experience. For instance, modern racquets are being constructed with composite materials like carbon fiber and titanium, offering players better control, power, and durability. Ball manufacturing has also evolved, with the incorporation of high-quality rubber compounds and felt technology to ensure consistent performance across different court surfaces. In the footwear category, innovations such as lightweight yet supportive designs, advanced cushioning, and stability-enhancing features cater to both professionals and casual players. Moreover, the development of smart wearables and tracking devices has allowed players to monitor their training regimes, offering precise data on aspects such as swing speed and footwork, further fueling demand for connected equipment. These technological improvements are helping players at all levels refine their techniques, boosting the overall appeal of the sport and consequently, the market for tennis equipment.What Role Does Consumer Behavior Play in Shaping Demand?

Consumer behavior in the tennis equipment market is strongly influenced by factors such as product personalization, brand loyalty, and a growing interest in fitness. The increasing demand for customizable equipment is one notable trend, particularly among younger, tech-savvy consumers who seek personalized racquets, shoes, and apparel to enhance their playing experience. Additionally, professional athletes' endorsements and collaborations with major sports brands have a profound impact on consumer preferences, driving interest in high-end tennis products. Brand reputation plays a significant role, with consumers often gravitating toward companies that are associated with performance and quality, such as Wilson, Babolat, and Head. Furthermore, as fitness becomes a lifestyle choice, tennis is increasingly being adopted by a wider demographic as a means to maintain physical health, particularly in urban areas where tennis clubs and courts are more accessible. This shift towards a fitness-oriented lifestyle has expanded the consumer base beyond traditional tennis enthusiasts to include a broader group of recreational players.What Are the Major Growth Drivers in the Tennis Equipment Market?

The growth in the tennis equipment market is driven by several factors related to changing consumer preferences, technological innovations, and expanding end-use applications. One major driver is the increasing awareness and participation in tennis as a fitness activity, which has broadened the market's reach to include not only seasoned players but also fitness enthusiasts. The introduction of lightweight, high-performance equipment that caters to players of all skill levels has made the sport more accessible and appealing to a wider audience. Additionally, the rise of e-commerce has significantly boosted the market, with consumers now able to easily access a wide range of tennis equipment online, often benefiting from competitive pricing and customized options. The increasing number of women and youth participants, especially in developing countries, is another critical factor. Government initiatives to promote sports participation, coupled with corporate investments in tennis sponsorships and events, continue to expand the market. Finally, the growing interest in smart sports equipment, which integrates data-tracking capabilities, further fuels the demand for technologically advanced products in this sector.Report Scope

The report analyzes the Tennis Equipment market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Tennis Shoes, Tennis Apparel, Tennis Racquets, Tennis Balls, Tennis Bags, Other Products); Distribution Channel (Offline Distribution Channel, Online Distribution Channel).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tennis Shoes segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 2.3%. The Tennis Apparel segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $863.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Tennis Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Tennis Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Tennis Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABG-Prince, LLC, Adidas AG, Amer Sports Corporation, Babolat VS North America, Dunlop Sports and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Tennis Equipment market report include:

- ABG-Prince, LLC

- Adidas AG

- Amer Sports Corporation

- Babolat VS North America

- Dunlop Sports

- Gamma Sports

- Harrow Sports International

- HEAD

- Net World Sports

- Nike, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABG-Prince, LLC

- Adidas AG

- Amer Sports Corporation

- Babolat VS North America

- Dunlop Sports

- Gamma Sports

- Harrow Sports International

- HEAD

- Net World Sports

- Nike, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 295 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

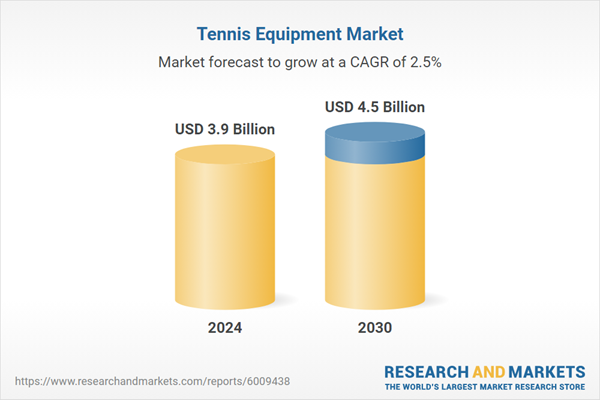

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 4.5 Billion |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | Global |