Global Green Hydrogen Market - Key Trends and Drivers Summarized

Is Green Hydrogen the Future of Clean Energy?

Green hydrogen refers to hydrogen produced through the electrolysis of water using renewable energy sources such as wind, solar, or hydropower. This production process is carbon-free, unlike traditional methods such as steam methane reforming, which rely on fossil fuels and emit significant amounts of CO2. The fundamental appeal of green hydrogen lies in its potential to serve as a clean energy carrier that can be utilized across a wide range of applications, from power generation and industrial manufacturing to transportation and residential heating. What makes green hydrogen particularly compelling is its versatility - it can be stored, transported, and converted back into electricity or used directly as a fuel source without emitting harmful pollutants. The production of green hydrogen involves splitting water into hydrogen and oxygen using an electrolyzer powered by renewable energy. The result is a fuel that, when combusted, releases only water vapor, making it an ideal solution for industries and applications where electrification is not feasible. With the global push towards decarbonization and the need to meet ambitious climate goals, green hydrogen is increasingly seen as a crucial pillar of the future energy system, capable of reducing carbon footprints in sectors that are difficult to decarbonize, such as steel manufacturing, chemical production, and heavy-duty transport.Who is Investing in Green Hydrogen, and What Are the Main Areas of Application?

The momentum behind green hydrogen is being propelled by a coalition of governments, major energy companies, technology innovators, and financial institutions. Many countries, particularly in Europe and Asia, have outlined comprehensive hydrogen strategies as part of their broader climate action plans. For instance, the European Union's Hydrogen Strategy aims to install at least 40 GW of electrolyzer capacity by 2030, while countries like Germany, Japan, and South Korea are investing billions of dollars in research, pilot projects, and infrastructure development. In parallel, energy giants such as Shell, BP, and TotalEnergies are entering the green hydrogen market, either through direct investments in production facilities or by forming partnerships with technology firms specializing in electrolyzer manufacturing. These investments are not limited to large-scale projects; smaller firms and startups are also playing a key role, focusing on niche applications and technological innovations that enhance the efficiency and scalability of hydrogen production. The primary areas of application for green hydrogen are diverse and rapidly expanding. In the industrial sector, it is being used as a feedstock in refining and ammonia production, replacing conventional hydrogen derived from natural gas. In the transportation sector, green hydrogen is gaining traction as a fuel for fuel cell electric vehicles (FCEVs), particularly in heavy-duty trucking, shipping, and aviation, where battery technology faces limitations. Additionally, green hydrogen is emerging as a solution for seasonal energy storage, where it can be stored for long durations and converted back into electricity to balance intermittent renewable energy sources like wind and solar.What Challenges and Opportunities Lie Ahead for the Green Hydrogen Market?

Despite its promise, the green hydrogen market faces several challenges that could impede its large-scale adoption. One of the primary hurdles is the high cost of production. Currently, green hydrogen is significantly more expensive than “grey” hydrogen produced from natural gas, primarily due to the cost of electrolyzers and the reliance on renewable electricity, which can be variable and location-dependent. This price gap makes green hydrogen economically unviable without supportive policies, subsidies, or carbon pricing mechanisms. Another challenge is the lack of a dedicated infrastructure for storage and distribution. Hydrogen, being a low-density gas, requires either high-pressure compression or liquefaction, both of which involve substantial costs and technical complexities. Transporting hydrogen through pipelines designed for natural gas or via trucks is also fraught with safety and efficiency concerns. However, these challenges are stimulating significant innovation and investment. Advances in electrolyzer technology, such as the development of solid oxide electrolyzers and improvements in proton exchange membrane (PEM) systems, are gradually lowering production costs and enhancing efficiency. Moreover, the expansion of renewable energy capacity and the creation of green hydrogen hubs - integrated clusters where hydrogen is produced, stored, and utilized in close proximity - are helping to mitigate infrastructure challenges. Countries are also investing in dedicated hydrogen pipelines and refueling stations, which will be critical for scaling up the use of green hydrogen in transportation. Opportunities abound for green hydrogen to serve as a cornerstone of a new, cleaner industrial economy, particularly if cost reductions can be achieved through economies of scale and technological advancements. Additionally, the growing emphasis on hydrogen as a geopolitical asset, with countries positioning themselves as future “hydrogen superpowers,” is likely to accelerate investment and cross-border cooperation.What Are the Key Growth Drivers in the Green Hydrogen Market?

The growth in the green hydrogen market is driven by several factors related to policy support, technological advancements, and changing industrial dynamics. One of the most significant drivers is the global push toward decarbonization and the urgency to meet stringent climate targets set under the Paris Agreement. Governments around the world are implementing supportive policies, subsidies, and regulatory frameworks to make green hydrogen competitive. These include direct funding for research and development, tax incentives for green hydrogen projects, and the establishment of carbon pricing mechanisms that penalize CO2 emissions, making green alternatives more attractive. Another major growth driver is the falling cost of renewable energy, which is critical since electricity accounts for a large portion of green hydrogen's production cost. As the cost of solar and wind energy continues to plummet, producing hydrogen through electrolysis is becoming more economically viable. Technological advancements are also playing a crucial role in accelerating growth. Innovations in electrolyzer technology are improving the efficiency and durability of these systems, while economies of scale are helping to reduce capital costs. Additionally, the rise of integrated hydrogen ecosystems, where hydrogen production, storage, and utilization are co-located, is creating synergies that enhance overall feasibility. Moreover, the growing demand for green hydrogen from industries that cannot be easily electrified - such as heavy manufacturing, long-haul transportation, and chemical production - is driving investment and accelerating commercialization. Lastly, the role of international collaboration and strategic partnerships cannot be overlooked. Several cross-border hydrogen initiatives are underway, such as those between the European Union and North African countries, aiming to establish global supply chains and turn hydrogen into a tradable commodity. This international cooperation is laying the groundwork for a global green hydrogen economy, poised to transform the energy landscape over the coming decades.Report Scope

The report analyzes the Green Hydrogen market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Alkaline Electrolyzer Technology, Polymer Electrolyte Membrane (PEM) Electrolyzer Technology); Distribution Channel (Pipeline Distribution Channel, Cargo Distribution Channel); Application (Transport Application, Power Generation Application, Other Applications).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Green Hydrogen Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Green Hydrogen Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Green Hydrogen Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

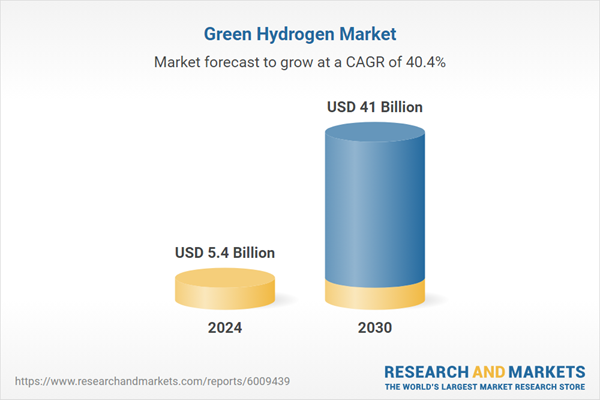

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, Air Products, Aker Solutions ASA, Bloom Energy Corporation, BP Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Green Hydrogen market report include:

- Air Liquide SA

- Air Products

- Aker Solutions ASA

- Bloom Energy Corporation

- BP Plc

- Clariant International Ltd.

- Cummins, Inc.

- Dastur Energy

- Equinor ASA

- Linde plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- Air Products

- Aker Solutions ASA

- Bloom Energy Corporation

- BP Plc

- Clariant International Ltd.

- Cummins, Inc.

- Dastur Energy

- Equinor ASA

- Linde plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 41 Billion |

| Compound Annual Growth Rate | 40.4% |

| Regions Covered | Global |