Global Welding Transformers Market - Key Trends & Drivers Summarized

Why Are Welding Transformers Remaining a Fundamental Component in Modern Welding Applications?

Welding transformers have remained a fundamental component in modern welding applications due to their ability to convert high-voltage, low-current electrical power into low-voltage, high-current output, which is essential for creating the controlled electric arc required in welding processes. These transformers serve as the backbone of traditional welding equipment, including manual arc welding and submerged arc welding setups, making them critical in industries such as construction, automotive, shipbuilding, and heavy machinery manufacturing. The demand for welding transformers is driven by the need for consistent and stable power supply during welding operations, which ensures high-quality welds and minimizes the risk of defects or inconsistencies. As industries continue to expand and modernize, the requirement for reliable welding transformers that can handle various welding techniques, including shielded metal arc welding (SMAW) and tungsten inert gas (TIG) welding, is increasing.The growth of the welding transformers market is also supported by the ongoing development of infrastructure projects and the rise of manufacturing activities, particularly in emerging markets like Asia-Pacific and Latin America. These regions are witnessing a surge in construction projects, urbanization, and industrialization, all of which require extensive welding activities for building frameworks, pipelines, and other critical infrastructure. In developed regions like North America and Europe, the demand for welding transformers is being driven by the automotive and aerospace sectors, where high-quality welding is essential for ensuring the safety and performance of vehicles and aircraft. Furthermore, welding transformers are widely used in repair and maintenance operations, making them indispensable in industries that rely on the longevity and structural integrity of their equipment and assets. As the global focus on manufacturing and infrastructure development intensifies, welding transformers continue to play a crucial role in supporting these activities by providing reliable and efficient power conversion solutions for a wide range of welding applications.

What Technological Innovations Are Enhancing the Efficiency and Versatility of Welding Transformers?

Technological advancements are significantly enhancing the efficiency, performance, and versatility of welding transformers, making them more adaptable to modern welding requirements and diverse industrial applications. One of the major innovations is the development of energy-efficient welding transformers that utilize advanced core materials and winding configurations to reduce energy losses and improve overall performance. By minimizing core saturation and hysteresis losses, these transformers can achieve higher efficiency levels, resulting in lower power consumption and reduced operating costs. This is particularly beneficial for industries with large-scale welding operations, where energy efficiency translates into significant cost savings and a reduced environmental footprint. Additionally, manufacturers are introducing transformers with higher power ratings and improved load-handling capabilities, enabling them to support a broader range of welding techniques and materials, from thin metal sheets to thick steel plates.Another key technological advancement is the integration of digital controls and monitoring systems into welding transformers. Digital controls allow for precise adjustment of voltage and current settings, providing greater flexibility and control over the welding process. This is especially important in applications where varying welding parameters are required to achieve optimal results, such as in welding dissimilar metals or working with complex geometries. Advanced monitoring systems can track critical parameters such as temperature, voltage stability, and arc characteristics in real time, allowing operators to make on-the-fly adjustments and prevent potential issues like overheating or excessive spatter. The use of programmable logic controllers (PLCs) and microprocessors is also enabling automation of repetitive welding tasks, improving productivity and reducing the need for manual intervention. Moreover, some modern welding transformers are being equipped with remote control capabilities and IoT connectivity, enabling operators to monitor and adjust welding parameters from a distance using digital devices. These technological innovations are not only improving the efficiency and versatility of welding transformers but are also making them more user-friendly and compatible with the evolving needs of modern industrial applications.

How Are Market Dynamics and Industry Trends Shaping the Welding Transformers Market?

The welding transformers market is being shaped by a complex set of market dynamics and industry trends that are influencing product demand, development, and application. One of the primary market drivers is the increasing investment in infrastructure development and construction activities, particularly in emerging economies such as India, China, and Brazil. The expansion of infrastructure, including roads, bridges, railways, and urban buildings, requires extensive welding operations for steel frameworks and other structural components. This trend is driving the demand for high-performance welding equipment, including transformers that can support diverse welding processes and deliver consistent power output. The automotive industry is another significant contributor to the growth of the welding transformers market, as welding is a critical process in vehicle manufacturing and assembly. The push towards electric vehicles (EVs) and lightweight automotive designs is creating new opportunities for specialized welding applications, further boosting the demand for advanced welding transformers.Industry trends such as the adoption of automated and robotic welding systems are also influencing the welding transformers market. As manufacturers strive to improve efficiency, precision, and safety in welding operations, there is a growing shift towards automated solutions that can perform complex welding tasks with minimal human intervention. Welding transformers are an integral part of these automated systems, providing the necessary power control and stability required for precision welding. The increasing use of robotic welding in industries such as aerospace, automotive, and heavy machinery is driving the need for transformers that can seamlessly integrate with automated setups and provide reliable performance under varying load conditions. Furthermore, the emphasis on sustainability and energy efficiency is prompting industries to adopt transformers with low energy consumption and reduced environmental impact. This is leading to the development of eco-friendly welding transformers that comply with environmental regulations and support industries in achieving their sustainability goals. As these market dynamics and industry trends continue to evolve, the welding transformers market is expected to witness sustained growth, driven by advancements in technology, increasing automation, and expanding industrial activities.

What Are the Key Growth Drivers Fueling the Expansion of the Welding Transformers Market?

The growth in the global welding transformers market is driven by several key factors, including rising infrastructure development, increasing demand for high-quality welding equipment, and technological advancements that enhance performance and efficiency. One of the primary growth drivers is the surge in infrastructure development projects around the world. Governments and private sector players are investing heavily in infrastructure to support economic growth and urbanization. Large-scale projects such as highways, bridges, commercial buildings, and energy facilities require extensive welding work for construction and maintenance, creating substantial demand for welding transformers that can provide stable power and high-quality welds. This trend is particularly strong in emerging economies like India, China, and Southeast Asian countries, where rapid industrialization and urban expansion are driving the need for robust and reliable welding equipment.Another significant growth driver is the increasing demand for high-quality welding equipment in manufacturing and heavy industries. The automotive industry, for instance, relies on welding transformers for various assembly and fabrication processes, including body construction and component welding. With the growing emphasis on lightweight vehicle designs and the shift towards electric vehicles (EVs), there is a need for more advanced welding techniques that require precise control and stability - capabilities that modern welding transformers are designed to deliver. Similarly, the aerospace and shipbuilding industries are adopting high-performance welding transformers to meet the stringent quality and safety standards required for complex welding applications. The expansion of these industries, coupled with the need for reliable welding equipment, is driving the demand for welding transformers across multiple regions.

Technological advancements are also playing a crucial role in driving the growth of the welding transformers market. The development of digital and automated welding solutions, including robotic welding systems, is creating new opportunities for transformer manufacturers to provide products that support these advanced applications. Automated welding systems require transformers that can deliver consistent power and integrate seamlessly with digital controls and sensors. The use of energy-efficient transformers with advanced cooling systems and optimized core materials is helping industries reduce energy consumption and operational costs, making them a preferred choice for large-scale and energy-intensive welding operations. Additionally, the growing focus on sustainability and environmental compliance is encouraging the adoption of eco-friendly welding transformers that use low-energy technologies and recyclable materials. As industries continue to modernize and adopt advanced welding techniques, the demand for innovative and high-performance welding transformers is expected to grow, supporting the sustained expansion of the global welding transformers market in the coming years.

Report Scope

The report analyzes the Welding Transformers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Automotive End-Use, Construction End-Use, Aerospace & Defense End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive End-Use segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of a 3.5%. The Construction End-Use segment is also set to grow at 2.8% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Welding Transformers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Welding Transformers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Welding Transformers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Automation International, Inc., Bosch Rexroth AG, DENGENSHA TOA CO., LTD., Electromech Corporation, EXPERT Transformatorenbau GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Welding Transformers market report include:

- Automation International, Inc.

- Bosch Rexroth AG

- DENGENSHA TOA CO., LTD.

- Electromech Corporation

- EXPERT Transformatorenbau GmbH

- Hong Ky Corporation

- Hyosung Heavy Industries

- Matuschek

- Naugra

- RoMan Manufacturing Inc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Automation International, Inc.

- Bosch Rexroth AG

- DENGENSHA TOA CO., LTD.

- Electromech Corporation

- EXPERT Transformatorenbau GmbH

- Hong Ky Corporation

- Hyosung Heavy Industries

- Matuschek

- Naugra

- RoMan Manufacturing Inc

Table Information

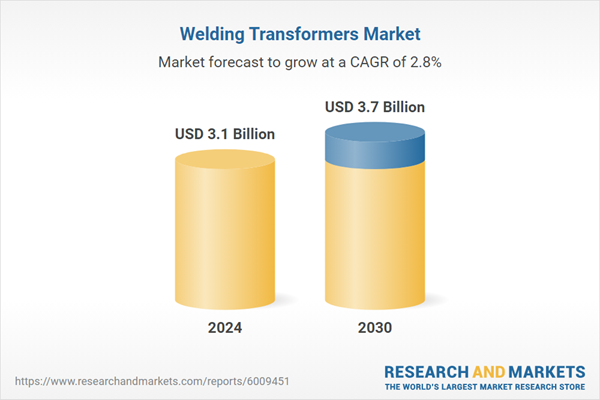

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |