Global Artificial Hearts Market - Key Trends and Drivers Summarized

Why Are Artificial Hearts Revolutionizing the Field of Cardiology?

Artificial hearts have emerged as a groundbreaking innovation in the field of cardiology, providing life-saving solutions for patients suffering from end-stage heart failure or severe cardiac conditions where conventional treatments are insufficient. But what exactly are artificial hearts, and why are they so critical to modern medicine? Unlike traditional mechanical heart pumps or ventricular assist devices (VADs), which are used to support a failing heart, total artificial hearts (TAHs) are designed to entirely replace the heart's natural function, taking over the job of both ventricles to circulate blood throughout the body. This is particularly important for patients who are ineligible for heart transplants due to age, lack of suitable donors, or complications that preclude traditional surgeries. By replicating the full functionality of a human heart, artificial hearts provide a bridge-to-transplant solution or serve as a permanent replacement, offering hope to those who would otherwise face limited options. The design and application of artificial hearts have evolved dramatically since their inception, incorporating biocompatible materials and advanced sensors to reduce clotting risks and improve hemodynamic stability. Today, artificial hearts are no longer considered experimental but are viewed as viable options in the toolkit of cardiac surgeons, significantly enhancing patient survival rates and quality of life.What Are the Major Technological Innovations Driving Artificial Heart Development?

The development of artificial hearts is being propelled by a confluence of cutting-edge technologies and bioengineering advancements that are transforming these devices from rudimentary mechanical pumps into sophisticated, life-sustaining systems. One of the most significant innovations is the use of biomimetic designs, where artificial hearts are modeled to replicate the natural pulsatile flow of a human heart, reducing the risk of complications like thrombosis and hemolysis. These designs are achieved through the use of advanced computational models and 3D printing technologies, allowing engineers to fine-tune the shape and function of artificial hearts to match individual patient anatomies. Another pivotal advancement is the integration of smart sensors and real-time monitoring systems, which enable artificial hearts to automatically adjust blood flow based on the body's changing needs, such as during physical activity or rest. This adaptability is critical for ensuring that the device can respond to physiological demands in a manner similar to a healthy heart. Additionally, progress in battery technology is extending the lifespan and portability of artificial hearts, reducing the need for frequent replacements and enhancing patient mobility. Innovations in biocompatible materials, such as polymers and titanium alloys, are also minimizing immune responses and improving the long-term durability of these devices. Furthermore, researchers are exploring the use of wireless energy transfer and fully implantable artificial hearts that eliminate the need for external components, thereby reducing infection risks.How Are Artificial Hearts Enhancing Patient Outcomes and Quality of Life?

The advent of artificial hearts is dramatically enhancing patient outcomes, providing a new lease on life for individuals who would otherwise face high mortality rates due to severe cardiac conditions. For patients awaiting heart transplants, artificial hearts offer a crucial bridge-to-transplant option, allowing them to stabilize and strengthen their health while waiting for a suitable donor organ. In cases where a heart transplant is not feasible, artificial hearts can serve as a permanent solution, enabling patients to lead relatively normal lives. The introduction of total artificial hearts (TAHs) has been particularly impactful, as these devices can completely take over cardiac function, supporting blood circulation and oxygenation throughout the body. Compared to earlier iterations, modern artificial hearts are significantly more compact, energy-efficient, and user-friendly, allowing patients greater freedom and mobility. Clinical data has shown that the use of artificial hearts can significantly improve survival rates in high-risk patients and reduce hospital readmissions, contributing to better long-term health outcomes. Additionally, artificial hearts are engineered to minimize complications such as blood clot formation and device failure, which were common issues in earlier models. This is achieved through meticulous design improvements, including smoother surfaces to reduce blood cell damage and advanced anticoagulation management systems. Psychological benefits are also notable, as patients and their families experience reduced anxiety and an improved sense of security knowing that the device is capable of autonomously adapting to the body's needs. As these devices continue to evolve, they are not only extending life expectancy for heart failure patients but also restoring a higher quality of life.What Factors Are Driving the Growth of the Artificial Hearts Market?

The growth in the artificial hearts market is driven by several factors, primarily influenced by advancements in medical technology, a growing prevalence of heart disease, and evolving healthcare policies. One of the main drivers is the rising incidence of end-stage heart failure and other severe cardiac conditions, which are creating an urgent demand for alternative treatment options as the global population ages. This trend is exacerbated by the chronic shortage of donor hearts, with waiting lists often spanning years and many patients succumbing before a suitable organ becomes available. As a result, artificial hearts are being increasingly adopted as either a bridge-to-transplant solution or as a destination therapy for patients who are not candidates for heart transplantation. Another critical driver is the rapid pace of innovation in bioengineering and material science, which is leading to the development of more durable, biocompatible, and efficient artificial heart models. These technological advancements are making artificial hearts safer and more accessible, thereby expanding their use beyond academic research centers to a broader range of healthcare facilities worldwide. Moreover, growing investments in research and development by both public and private sectors are accelerating the commercialization and clinical adoption of artificial hearts. Additionally, increased healthcare expenditure and rising awareness about advanced cardiac care options are encouraging hospitals to adopt these cutting-edge devices, further boosting market demand. The expansion of telemedicine and remote monitoring technologies is another factor enhancing the appeal of artificial hearts, as these solutions enable real-time tracking of device performance and patient health, reducing complications and improving overall patient management. Collectively, these drivers are propelling the growth of the artificial hearts market, positioning it as a critical component of the future of cardiovascular care and a beacon of hope for patients with severe cardiac ailments.Report Scope

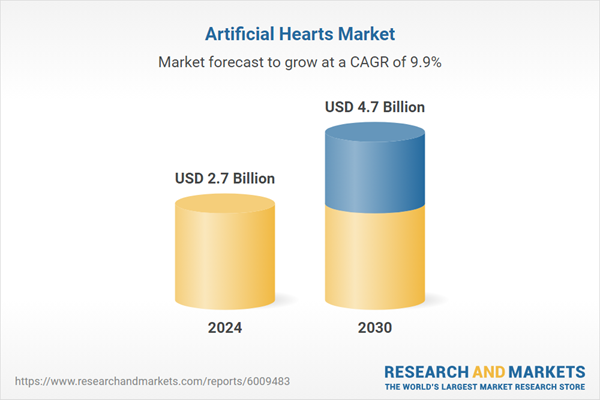

The report analyzes the Artificial Hearts market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Equipment Type (Left Ventricular Assist Devices, Total Artificial Heart, Heart-Lung Machines).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Left Ventricular Assist Devices segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of a 9.7%. The Total Artificial Heart segment is also set to grow at 12.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $724.3 Million in 2024, and China, forecasted to grow at an impressive 13.6% CAGR to reach $999.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Artificial Hearts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Artificial Hearts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Artificial Hearts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Inc., Abiomed, Inc., Artivion, Inc, Berlin Heart GmbH, BiVACOR, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Artificial Hearts market report include:

- Abbott Laboratories, Inc.

- Abiomed, Inc.

- Artivion, Inc

- Berlin Heart GmbH

- BiVACOR, Inc.

- Boston Scientific Corporation

- Calon Cardio-Technology Ltd.

- CARMAT

- Edwards Lifesciences Corporation

- Jarvik Heart, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories, Inc.

- Abiomed, Inc.

- Artivion, Inc

- Berlin Heart GmbH

- BiVACOR, Inc.

- Boston Scientific Corporation

- Calon Cardio-Technology Ltd.

- CARMAT

- Edwards Lifesciences Corporation

- Jarvik Heart, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 4.7 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |