Global Automotive eCommerce Market - Key Trends and Drivers Summarized

Why Is Automotive eCommerce Transforming the Way Vehicles and Parts Are Bought and Sold?

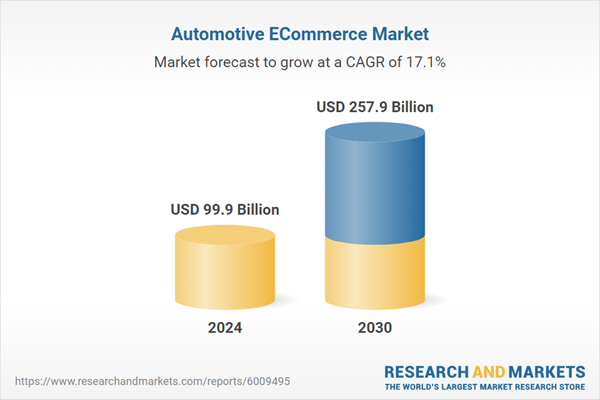

The automotive eCommerce market has seen explosive growth in recent years, revolutionizing the way vehicles, auto parts, and accessories are bought and sold. Traditionally, purchasing a vehicle or spare parts required multiple visits to dealerships or local stores, often involving lengthy negotiations and limited transparency. However, the rise of digital platforms has transformed the automotive shopping experience, making it more accessible, efficient, and consumer-centric. Automotive eCommerce encompasses a wide range of offerings, from new and used vehicle sales to aftermarket parts and accessories, all available through user-friendly online interfaces. With eCommerce platforms providing detailed product information, customer reviews, and transparent pricing, consumers now have more control over their purchasing decisions. The shift towards digital transactions has been accelerated by changing consumer behavior, as buyers increasingly prefer the convenience and flexibility of online shopping. Innovations such as virtual showrooms, augmented reality (AR) vehicle configurators, and AI-driven recommendation engines are further enhancing the online buying experience, allowing consumers to explore vehicles and parts in a personalized and immersive manner. These digital tools have not only streamlined the purchasing process but have also empowered customers to make well-informed decisions, setting the stage for a significant transformation in how the automotive industry engages with its customer base.Which Market Segments Are Driving the Growth of Automotive eCommerce?

The growth of automotive eCommerce is being fueled by various segments, including vehicle sales, aftermarket parts, and specialty accessories, with distinct consumer needs shaping each segment. In the vehicle sales segment, eCommerce is gaining traction across both new and used car markets. While online sales of new vehicles are still in their nascent stages, the pre-owned car segment has seen rapid adoption, driven by platforms such as Carvana, Vroom, and TrueCar, which offer a seamless online experience with detailed vehicle histories, virtual test drives, and home delivery options. The convenience of browsing an extensive inventory, comparing prices, and completing transactions online has made eCommerce a preferred option for millennials and tech-savvy consumers looking for a hassle-free car-buying experience. The aftermarket parts and accessories segment, on the other hand, is one of the most mature and rapidly growing areas within automotive eCommerce. Websites like Amazon, eBay Motors, and specialized platforms such as RockAuto and AutoZone have transformed the way consumers purchase replacement parts, tools, and performance upgrades. These platforms cater to both DIY enthusiasts and professional mechanics, offering a wide range of products, compatibility tools, and detailed specifications that simplify the buying process.How Are Technological Innovations and Business Models Shaping the Automotive eCommerce Market?

Technological innovations and evolving business models are significantly reshaping the automotive eCommerce landscape, enhancing the customer experience and streamlining operations for sellers. One of the most impactful technological advancements is the integration of augmented reality (AR) and virtual reality (VR) in the car-buying process. These tools allow customers to visualize vehicles in 3D, explore features, and even take virtual test drives, making the digital shopping experience more immersive and engaging. Additionally, AI and machine learning are being utilized to power chatbots, personalized recommendations, and dynamic pricing models, enabling eCommerce platforms to provide tailored solutions based on individual customer preferences and purchase history. The use of big data analytics is also playing a crucial role in optimizing inventory management and supply chain logistics, ensuring that the right products are available at the right time, reducing delivery times, and minimizing costs. Business models are evolving to keep pace with these technological advancements. Subscription-based services, for example, are gaining popularity as consumers seek more flexible ownership options. Companies like Fair and Care by Volvo are offering car subscription services that include maintenance, insurance, and roadside assistance, providing a more comprehensive solution than traditional leasing. Another key trend is the adoption of direct-to-consumer (DTC) sales models by automotive manufacturers. Additionally, the growing use of online-to-offline (O2O) models, which blend digital and physical experiences, is enabling consumers to complete initial research and transactions online before visiting showrooms for a final test drive or vehicle pickup. This approach is particularly effective in providing a seamless, omnichannel experience that caters to diverse consumer preferences.What's Driving the Growth of the Automotive eCommerce Market?

The growth in the automotive eCommerce market is driven by several factors, primarily centered around evolving consumer preferences, technological advancements, and the need for a more efficient sales process. One of the primary drivers is the increasing comfort and familiarity of consumers with online shopping across various product categories, which is now extending to high-value purchases like vehicles and auto parts. The convenience of researching, comparing, and purchasing products from the comfort of one's home is appealing to a broad demographic, especially younger, tech-savvy consumers. Another major driver is the growing demand for transparency in the car-buying process, as customers seek detailed information on pricing, specifications, and customer reviews before making a purchase decision. Automotive eCommerce platforms are meeting this demand by providing comprehensive product data, virtual showrooms, and digital financing options, making the buying process more transparent and user-friendly. The rise of the digital-first strategy among both established automakers and new entrants is also boosting the growth of automotive eCommerce. OEMs are increasingly investing in their own eCommerce platforms or partnering with third-party marketplaces to offer a direct purchasing experience. Additionally, the expanding availability of financing options, such as digital auto loans and leasing plans, is lowering the barriers to entry for online vehicle purchases. For the parts and accessories segment, the increasing prevalence of DIY culture and the growth of car customization trends are driving demand for online platforms that offer a wide range of aftermarket products, tools, and tutorials. Furthermore, the COVID-19 pandemic has acted as a catalyst, accelerating the adoption of eCommerce as consumers and businesses alike sought safer, contactless alternatives to traditional sales channels. This shift is likely to have a lasting impact on the market, as more customers become accustomed to the convenience and efficiency of online transactions. Finally, the growing integration of advanced technologies such as AI, VR, and blockchain is enabling automotive eCommerce platforms to deliver a highly personalized, secure, and interactive experience, making them a compelling choice for a new generation of digitally savvy car buyers.Report Scope

The report analyzes the Automotive eCommerce market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Vehicle Type (Passenger Cars, Two Wheelers, Commercial Vehicles); End-Use (Aftermarket End-Use, OEM End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $26.8 Billion in 2024, and China, forecasted to grow at an impressive 24.8% CAGR to reach $66.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive eCommerce Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive eCommerce Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive eCommerce Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advance Auto Parts, Inc., AutoZone, Inc., CARiD.com, CarParts Technologies, Delticom AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Automotive eCommerce market report include:

- Advance Auto Parts, Inc.

- AutoZone, Inc.

- CARiD.com

- CarParts Technologies

- Delticom AG

- Ebay, Inc.

- Flipkart Internet Pvt Ltd

- Genuine Parts Company

- Icahn Automotive Group LLC

- JC Whitney

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advance Auto Parts, Inc.

- AutoZone, Inc.

- CARiD.com

- CarParts Technologies

- Delticom AG

- Ebay, Inc.

- Flipkart Internet Pvt Ltd

- Genuine Parts Company

- Icahn Automotive Group LLC

- JC Whitney

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 99.9 Billion |

| Forecasted Market Value ( USD | $ 257.9 Billion |

| Compound Annual Growth Rate | 17.1% |

| Regions Covered | Global |