Global Industrial Burners Market - Key Trends & Drivers Summarized

How Are Industrial Burners Transforming Efficiency in Manufacturing?

Industrial burners are critical components in various manufacturing and processing industries, where they are used to provide controlled combustion of fuels to generate heat. From the steel and cement industries to chemical processing and power generation, industrial burners are essential for ensuring energy efficiency and meeting stringent production demands. Over the years, manufacturers have been incorporating advanced technologies into burners to improve fuel efficiency, reduce emissions, and lower operational costs. For instance, modern industrial burners often come equipped with sensors and control systems that allow for real-time monitoring and adjustments to optimize combustion, minimizing fuel wastage and environmental impact. These technological improvements are vital, as industries worldwide face increasing pressure to comply with environmental regulations while maintaining profitability. The adoption of energy-efficient burners is also being driven by the need to cut down on operating expenses, with companies seeking solutions that can offer both cost savings and better performance.What Role Does Technology Play in the Advancement of Industrial Burners?

The industrial burner market is undergoing a technological evolution, with advancements that are focused on improving combustion performance and emissions control. One significant development is the rise of low-NOx (nitrogen oxides) and ultra-low-NOx burners, designed to reduce harmful emissions that contribute to air pollution. These burners employ advanced mixing techniques and staged combustion to minimize the formation of NOx, making them ideal for industries facing stringent environmental regulations. Additionally, digital control systems are becoming a standard feature in modern industrial burners, allowing for more precise regulation of air-fuel mixtures and combustion temperatures. Automation and IoT (Internet of Things) connectivity are further enhancing the functionality of industrial burners, enabling remote monitoring and diagnostics, which reduces downtime and allows for predictive maintenance. As industries continue to prioritize sustainability and operational efficiency, technological innovations like these are driving the market toward more sophisticated, high-performance burner systems.How Is Changing Consumer Behavior Impacting Demand for Industrial Burners?

The demand for industrial burners is heavily influenced by shifting consumer behaviors and growing awareness of environmental concerns. Consumers and businesses alike are increasingly demanding products and services that align with sustainability goals, which, in turn, is prompting manufacturers to adopt more eco-friendly production processes. This trend has accelerated the adoption of burners that minimize carbon footprints through improved fuel efficiency and reduced emissions. Moreover, the industrial sectors are also reacting to the demand for flexible energy solutions. As more companies transition to cleaner energy sources, such as natural gas, hydrogen, and biogas, industrial burner manufacturers are innovating to develop systems capable of operating with these alternative fuels. The ability to adapt to different fuel types without sacrificing performance is becoming a key factor for companies looking to future-proof their operations. This shift towards greener production methods and energy diversity is a direct reflection of changing consumer expectations and has a profound impact on the development and adoption of modern industrial burners.What Factors Are Driving Growth in the Industrial Burners Market?

The growth in the industrial burners market is driven by several factors, including advancements in burner technology, regulatory pressures, and the growing use of alternative fuels. One key driver is the increasing demand for energy-efficient and low-emission burners, especially in industries where environmental regulations are becoming stricter. Manufacturers are investing in research and development to create burners that can meet these demands while maintaining optimal performance. Additionally, the shift toward natural gas and renewable fuels is driving the need for burners that can handle a variety of fuel sources with high efficiency. The growing trend of automation and IoT integration in industrial settings is also influencing market growth, as companies seek burners with smart control systems that allow for better monitoring and management of combustion processes. The rise of retrofitting solutions for existing industrial equipment is another significant factor, as many businesses are upgrading their older systems with modern, more efficient burner technology. Together, these factors are contributing to the robust expansion of the industrial burners market across a wide range of applications.Report Scope

The report analyzes the Industrial Burners market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Chemicals End-Use, Power Generation End-Use, Metals & Mining End-Use, Petrochemicals End-Use, Food & Beverages End-Use, Automotive End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Chemicals End-Use segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of a 4.5%. The Power Generation End-Use segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Burners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Burners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Burners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval AB, Alzeta Corporation, Andritz AG, Ariston Holding N.V., Astec Industries, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Industrial Burners market report include:

- Alfa Laval AB

- Alzeta Corporation

- Andritz AG

- Ariston Holding N.V.

- Astec Industries, Inc.

- Babcock Wanson

- Baltur S.P.A.

- Bloom Engineering Company, Inc.

- Fives Group

- Forbes Marshall Pvt., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Laval AB

- Alzeta Corporation

- Andritz AG

- Ariston Holding N.V.

- Astec Industries, Inc.

- Babcock Wanson

- Baltur S.P.A.

- Bloom Engineering Company, Inc.

- Fives Group

- Forbes Marshall Pvt., Ltd.

Table Information

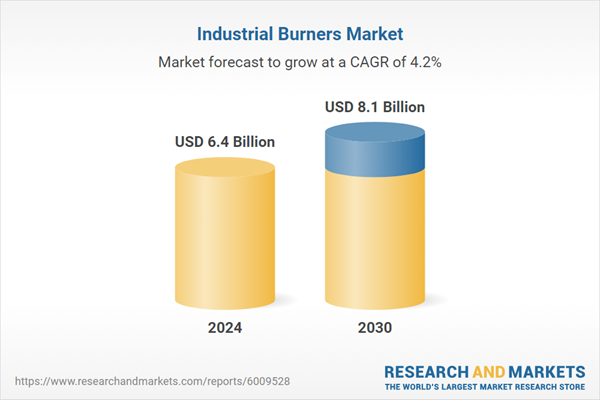

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.4 Billion |

| Forecasted Market Value ( USD | $ 8.1 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |