Global Hydrogen Compressors Market - Key Trends and Drivers Summarized

What Are Hydrogen Compressors, and Why Are They Essential?

Hydrogen compressors are critical components in the hydrogen value chain, responsible for compressing hydrogen gas to high pressures for storage, transportation, and utilization across various applications. These devices are integral to ensuring that hydrogen, which is a light and low-density gas, can be efficiently stored in high-pressure tanks, transported through pipelines, and used in refueling stations for hydrogen-powered vehicles. Hydrogen compressors operate by mechanically increasing the pressure of hydrogen gas, enabling it to be stored in compact spaces and transported over long distances. This compression is essential for hydrogen to serve as an effective energy carrier, whether for industrial purposes, fueling hydrogen vehicles, or for use in power generation. Various types of compressors are used depending on the specific application, including diaphragm, piston, reciprocating, and centrifugal compressors, each with its own advantages in terms of efficiency, safety, and maintenance. For example, diaphragm compressors are often used when high purity is required, as they prevent contamination of the gas, while piston and reciprocating compressors are preferred for high-pressure applications. As the world transitions to cleaner energy systems, the role of hydrogen compressors is becoming even more prominent, supporting the growth of hydrogen as a versatile and sustainable energy source.Who is Using Hydrogen Compressors, and What Are Their Primary Applications?

Hydrogen compressors are utilized across a broad spectrum of industries, ranging from traditional sectors like petrochemicals and ammonia production to newer applications in renewable energy and transportation. In the petrochemical industry, hydrogen is used extensively in refining processes such as hydrocracking and desulfurization, where it helps reduce sulfur content in fuels and improves fuel quality. Compressors in this context are used to maintain high hydrogen pressure in reactors, ensuring optimal chemical reactions. Similarly, in the ammonia and fertilizer industry, hydrogen is compressed and combined with nitrogen to produce ammonia, which is a key ingredient in fertilizers. Beyond these traditional uses, hydrogen compressors are finding increasing demand in the rapidly expanding hydrogen mobility sector. As more countries invest in hydrogen refueling infrastructure for fuel cell electric vehicles (FCEVs), compressors are required to pressurize hydrogen gas up to 700 bar (about 10,000 psi) at refueling stations, enabling efficient and rapid refueling of vehicles. Another growing application is in the field of renewable energy, where hydrogen is produced through electrolysis using surplus wind or solar power. In this process, hydrogen compressors are needed to store the produced hydrogen in high-pressure tanks or to inject it into natural gas pipelines, a practice known as hydrogen blending. Additionally, hydrogen compressors play a critical role in energy storage systems that convert excess renewable electricity into hydrogen and then compress it for long-term storage, addressing the intermittency challenges associated with renewable power sources.What Challenges and Opportunities Shape the Hydrogen Compressor Market?

The hydrogen compressor market is poised for growth, but it also faces several technical and economic challenges that could hinder its expansion. One of the primary challenges is the demanding operational requirements of hydrogen compression. Hydrogen is the smallest and lightest molecule, making it prone to leakage and requiring extremely tight seals and specialized materials that can withstand high pressures and minimize wear and tear. Conventional compressor designs often struggle with hydrogen's unique properties, leading to increased maintenance needs and shorter equipment lifespans. Furthermore, hydrogen embrittlement - a phenomenon where hydrogen atoms penetrate the metallic structure of compressor components, causing them to become brittle and crack - poses a significant threat to the durability and safety of these systems. This issue necessitates the use of advanced materials like stainless steel alloys, special coatings, or non-metallic components, which can significantly increase costs. Another challenge is energy efficiency; compressing hydrogen to the high pressures needed for storage and transportation is energy-intensive, potentially offsetting some of the environmental benefits of using hydrogen as a clean fuel. However, these challenges have spurred innovation and new opportunities. For instance, recent advancements in compressor technology, such as the development of oil-free piston compressors and new diaphragm designs, are enhancing efficiency, reducing maintenance, and improving safety. Emerging technologies like electrochemical compression, which uses an electrochemical cell to compress hydrogen, are also showing promise in reducing energy consumption and operational complexity.What's Fueling the Expansion of the Hydrogen Compressor Market?

The growth in the hydrogen compressor market is driven by several factors, including the global shift towards decarbonization, increased investment in hydrogen infrastructure, and advancements in hydrogen technology. One of the most significant drivers is the growing adoption of hydrogen as a clean energy vector across multiple sectors. With countries around the world setting ambitious targets for reducing carbon emissions and achieving net-zero goals, hydrogen is being promoted as a versatile solution for decarbonizing hard-to-abate sectors such as heavy industry, transportation, and power generation. This has led to a surge in demand for hydrogen infrastructure, including production, storage, and distribution facilities, all of which rely heavily on hydrogen compressors. The expansion of hydrogen refueling networks, in particular, is a major growth driver. As the number of fuel cell electric vehicles (FCEVs) increases, so does the need for high-pressure compressors to supply hydrogen at refueling stations, ensuring fast and efficient refueling experiences. Another factor is the growing focus on green hydrogen - hydrogen produced using renewable energy sources - which is driving investments in electrolyzer capacity and integrated hydrogen systems. These projects require specialized compression solutions to store and transport hydrogen at high pressures, creating a burgeoning market for advanced compressor technologies. Additionally, government support in the form of subsidies, tax incentives, and hydrogen roadmaps is playing a pivotal role in accelerating the deployment of hydrogen infrastructure, which in turn fuels demand for compressors. The development of large-scale hydrogen hubs and cross-border hydrogen corridors is also contributing to market growth, as these initiatives require robust compression capabilities to manage the large volumes of hydrogen being produced, stored, and transported. Finally, the rise of innovative applications such as hydrogen blending with natural gas, seasonal energy storage, and hydrogen-powered turbines for grid balancing is expanding the scope of the hydrogen compressor market, making it a key enabler of the global hydrogen economy.Report Scope

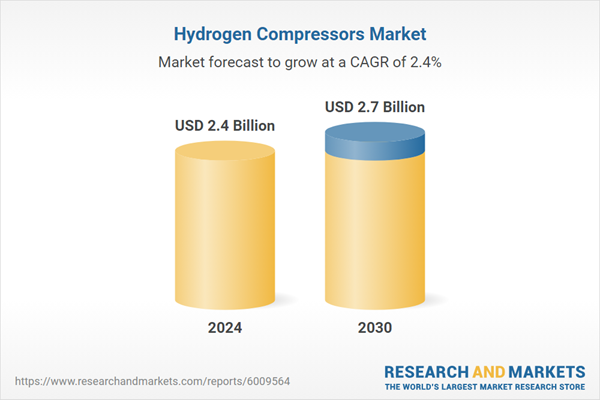

The report analyzes the Hydrogen Compressors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Mechanical Compressors, Non-Mechanical Compressors); Lubrication Type (Oil-Free Lubrication, Oil-Filled Lubrication); End-Use (Oil & Gas End-Use, Chemicals End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mechanical Compressors segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of a 2.6%. The Non-Mechanical Compressors segment is also set to grow at 1.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $645.9 Million in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $546.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydrogen Compressors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydrogen Compressors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydrogen Compressors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ariel Corporation, Baker Hughes Company, CYRUS S.A., Fluitron, Inc., HAUG Kompressoren AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 45 companies featured in this Hydrogen Compressors market report include:

- Ariel Corporation

- Baker Hughes Company

- CYRUS S.A.

- Fluitron, Inc.

- HAUG Kompressoren AG

- Hiperbaric, S.A.

- Hydro-Pac, Inc.

- Indian Compressors Ltd.

- Lenhardt & Wagner GmbH

- Mehrer Compression GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ariel Corporation

- Baker Hughes Company

- CYRUS S.A.

- Fluitron, Inc.

- HAUG Kompressoren AG

- Hiperbaric, S.A.

- Hydro-Pac, Inc.

- Indian Compressors Ltd.

- Lenhardt & Wagner GmbH

- Mehrer Compression GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |