Global Blue Hydrogen Market - Key Trends and Drivers Summarized

Why Is Blue Hydrogen Positioned as the Future of Clean Energy?

Blue hydrogen is a type of hydrogen fuel that is produced using natural gas through a process known as Steam Methane Reforming (SMR) or Auto-Thermal Reforming (ATR), coupled with Carbon Capture, Utilization, and Storage (CCUS) technology. This makes it distinct from other forms of hydrogen, such as grey hydrogen, which is produced without capturing carbon emissions, and green hydrogen, which is derived through the electrolysis of water using renewable energy sources. The key differentiator of blue hydrogen lies in its method of production: the CO2 generated during the reforming process is captured and either stored underground or utilized in industrial applications, thereby significantly reducing its environmental footprint compared to traditional methods. Although blue hydrogen is not entirely carbon-free, it represents a substantial improvement over conventional fossil fuel-based hydrogen production. Blue hydrogen serves as a transitional technology, bridging the gap between today's fossil-fuel-dependent energy systems and a future dominated by renewable energy sources. Its compatibility with existing natural gas infrastructure and its ability to support large-scale hydrogen production make it an attractive option for industries and governments aiming to reduce greenhouse gas emissions in the short to medium term.What Role Does Blue Hydrogen Play Across Various Industries?

Blue hydrogen is emerging as a pivotal player in the energy transition, with its applications extending far beyond just serving as a clean fuel. It is increasingly being utilized in various sectors such as power generation, transportation, industrial manufacturing, and even residential heating. In the power generation sector, blue hydrogen can be used to decarbonize natural gas power plants by replacing a portion of the natural gas feedstock, thereby reducing overall CO2 emissions. This is particularly relevant for regions with established gas infrastructure that are seeking to lower their carbon footprint without a complete overhaul of their energy systems. In the transportation industry, blue hydrogen is being adopted as a fuel for fuel-cell electric vehicles (FCEVs), particularly in heavy-duty applications such as buses, trucks, and trains, where battery technology faces limitations in terms of range and weight. Blue hydrogen's high energy density and rapid refueling capability make it a more practical choice for these sectors. The chemical and industrial manufacturing industries are also leveraging blue hydrogen for processes such as ammonia production, refining, and steelmaking, where the use of clean hydrogen can drastically cut CO2 emissions. Moreover, blue hydrogen is being explored as an option for residential and commercial heating, either by blending it with natural gas or using it in pure form in hydrogen-ready boilers, thereby enabling a gradual transition to cleaner heating solutions. As a versatile and scalable energy carrier, blue hydrogen holds significant promise in sectors where direct electrification is not feasible or cost-effective.What Environmental and Economic Challenges Does Blue Hydrogen Face?

Despite its potential, blue hydrogen is not without its challenges, both from an environmental and an economic standpoint. One of the primary criticisms against blue hydrogen is that while carbon capture can significantly reduce CO2 emissions, it does not entirely eliminate them. Typically, the capture rates range from 60% to 90%, leaving some residual emissions that still contribute to climate change. Furthermore, the upstream methane leakage associated with natural gas extraction and transportation can undermine the environmental benefits of blue hydrogen, as methane is a potent greenhouse gas with a global warming potential much higher than CO2. This has led to concerns that blue hydrogen might serve as a “greenwashed” solution that distracts from more sustainable alternatives like green hydrogen. From an economic perspective, the deployment of blue hydrogen technology requires substantial investments in carbon capture and storage (CCS) infrastructure, which can be prohibitively expensive. The cost of capturing, compressing, and storing CO2 adds significantly to the production costs, making blue hydrogen currently more expensive than grey hydrogen and, in some cases, even less competitive than renewable-based green hydrogen, depending on regional electricity prices and carbon tax regulations. Additionally, public opposition to CCS projects due to perceived risks of CO2 leakage and land use concerns can delay or derail project development. Thus, while blue hydrogen is a viable solution for decarbonizing industries in the short term, its long-term sustainability will depend on addressing these environmental and economic challenges, as well as on policy frameworks that incentivize its adoption.What Are the Key Growth Drivers of the Blue Hydrogen Market?

The growth in the blue hydrogen market is driven by several factors, with governmental policy support and industrial decarbonization targets being at the forefront. Many governments, particularly in Europe and North America, are rolling out policies and financial incentives to promote the adoption of low-carbon hydrogen as part of broader strategies to meet their climate commitments under the Paris Agreement. For instance, the European Union's Hydrogen Strategy explicitly supports blue hydrogen as a transitional technology until green hydrogen can be scaled up. In the United States, the Infrastructure Investment and Jobs Act and other federal programs are allocating significant funds for hydrogen projects, with a particular focus on blue hydrogen to leverage existing natural gas resources. Another critical driver is the industrial sector's push to decarbonize heavy-emission processes, such as steelmaking, refining, and chemical production, where blue hydrogen provides a feasible pathway to reduce CO2 emissions without a complete overhaul of existing operations. Furthermore, the transportation sector is increasingly looking at blue hydrogen as a viable alternative to diesel for heavy-duty transport, given its high energy density and suitability for long-range applications. Additionally, the integration of blue hydrogen into power grids through hydrogen-fired turbines and its use in gas blending for residential heating are expanding its market potential. The increased focus on energy security, particularly in regions reliant on natural gas imports, is also driving interest in blue hydrogen as a means of diversifying energy sources and enhancing energy resilience. Lastly, advancements in CCUS technology and the development of hydrogen clusters, where multiple industries share CO2 transport and storage infrastructure, are making blue hydrogen more economically attractive, spurring investment and scaling up production capacity. With these trends in place, the blue hydrogen market is set to grow rapidly in the coming years, positioning itself as a cornerstone of the global energy transition.Report Scope

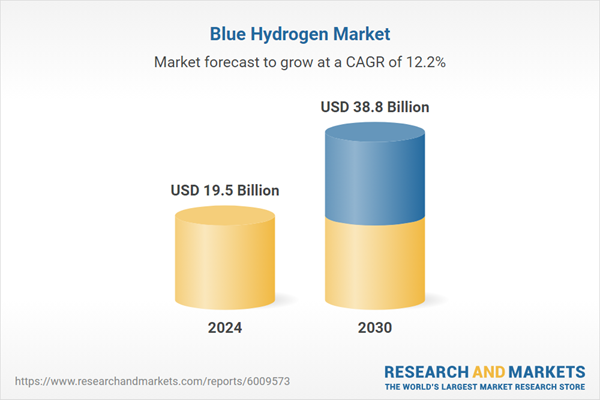

The report analyzes the Blue Hydrogen market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (Steam Methane Reforming Technology, Gas Partial Oxidation Technology, Auto Thermal Reforming Technology); End-Use (Power Generation End-Use, Chemicals End-Use, Petroleum Refinery End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Steam Methane Reforming Technology segment, which is expected to reach US$20.7 Billion by 2030 with a CAGR of a 12.8%. The Gas Partial Oxidation Technology segment is also set to grow at 11.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.3 Billion in 2024, and China, forecasted to grow at an impressive 16.6% CAGR to reach $8.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blue Hydrogen Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blue Hydrogen Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blue Hydrogen Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, Air Products, Aker Solutions ASA, ATCO Group, BP Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Blue Hydrogen market report include:

- Air Liquide SA

- Air Products

- Aker Solutions ASA

- ATCO Group

- BP Plc

- Clariant International Ltd.

- Dastur Energy

- Equinor ASA

- Linde plc

- McPhy Energy SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- Air Products

- Aker Solutions ASA

- ATCO Group

- BP Plc

- Clariant International Ltd.

- Dastur Energy

- Equinor ASA

- Linde plc

- McPhy Energy SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.5 Billion |

| Forecasted Market Value ( USD | $ 38.8 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |