Global LNG Infrastructure Market - Key Trends & Drivers Summarized

How Is LNG Infrastructure Transforming the Global Energy Sector?

Liquefied Natural Gas (LNG) infrastructure encompasses the facilities and technologies required for the production, transportation, storage, and regasification of natural gas in its liquefied form. By cooling natural gas to approximately - 162 degrees Celsius, it becomes a liquid, reducing its volume by about 600 times, making it economically feasible to transport over long distances where pipelines are impractical. LNG infrastructure includes liquefaction plants, LNG carriers, storage tanks, and regasification terminals. This infrastructure is pivotal in connecting gas-rich regions with high-demand markets, thereby playing a critical role in the global energy supply chain by enhancing energy security, diversifying supply sources, and enabling access to cleaner-burning fuel alternatives.The expansion of LNG infrastructure is significantly transforming the global energy landscape by facilitating a shift towards natural gas as a primary energy source. As countries seek to reduce greenhouse gas emissions and transition to cleaner energy, LNG offers a more environmentally friendly alternative to coal and oil. The flexibility provided by LNG infrastructure allows importing nations to diversify their energy mix and reduce dependence on pipeline gas, which can be subject to geopolitical tensions. Additionally, LNG infrastructure supports the development of spot markets and more flexible trading arrangements, promoting competitive pricing and energy security. The strategic deployment of LNG facilities is reshaping global energy dynamics, fostering greater connectivity between producers and consumers across continents.

What Technological Innovations Are Advancing LNG Infrastructure?

Technological advancements are significantly enhancing the efficiency, safety, and environmental performance of LNG infrastructure. The development of Floating LNG (FLNG) facilities allows for offshore gas fields to be exploited without the need for extensive onshore infrastructure, reducing environmental footprints and project costs. FLNG units combine production, liquefaction, storage, and offloading capabilities on a single vessel, enabling access to remote gas reserves that were previously considered economically unviable. Innovations in LNG carrier designs, such as the adoption of membrane containment systems and more efficient propulsion technologies, have improved cargo capacity and fuel efficiency, lowering transportation costs and emissions.Advancements in small-scale LNG technologies are enabling the distribution of LNG to remote areas and for use in transportation sectors like shipping and heavy-duty vehicles. Improvements in regasification technologies, including Floating Storage and Regasification Units (FSRUs), provide flexible and rapid deployment options for importing nations, enhancing their ability to respond to fluctuating energy demands. Additionally, the integration of digital technologies, such as automation and real-time monitoring systems, is improving operational efficiency and safety across LNG facilities. The use of advanced materials and engineering techniques is also enhancing the durability and reliability of LNG infrastructure, reducing maintenance requirements and extending operational lifespans.

How Are Market Dynamics and Consumer Demand Influencing LNG Infrastructure Development?

Global market dynamics and shifting consumer demands are profoundly impacting LNG infrastructure development. The increasing emphasis on reducing carbon emissions is driving a transition from coal and oil to cleaner energy sources like natural gas. Emerging economies in Asia, particularly China and India, are experiencing surging energy needs and are turning to LNG to meet demand while mitigating environmental impacts. Consumer demand for reliable and cleaner energy is prompting utilities and industries to invest in natural gas-fired power generation, boosting the need for expanded LNG infrastructure. Furthermore, the liberalization of gas markets and the move towards more flexible trading arrangements are encouraging investments in infrastructure that can adapt to spot market trading and shorter-term contracts, necessitating more agile and technologically advanced LNG facilities.The rise of renewable energy sources is also influencing LNG infrastructure, as natural gas is increasingly seen as a complementary energy source that can provide stability to grids with high penetration of intermittent renewables like wind and solar. This role as a bridging fuel is accelerating the development of LNG infrastructure to ensure energy security during the transition to fully renewable systems. Additionally, geopolitical factors and efforts to enhance energy independence are prompting countries to diversify their energy imports through LNG, reducing reliance on pipeline gas from single suppliers. The growth of LNG bunkering infrastructure is also notable, driven by stricter environmental regulations in maritime shipping and a shift towards LNG as a cleaner marine fuel.

The Growth in the LNG Infrastructure Market Is Driven by Several Factors

The growth in the LNG infrastructure market is driven by several factors. Technological innovations, such as FLNG facilities, advanced LNG carriers, and small-scale LNG solutions, are reducing operational costs and opening new avenues for LNG production and transportation. The global push towards cleaner energy sources is accelerating demand for natural gas, leading to increased investments in LNG liquefaction and regasification facilities. End-use sectors like power generation, industrial manufacturing, and transportation are expanding their use of LNG due to its lower environmental impact compared to other fossil fuels. Consumer behavior trends emphasizing sustainability and environmental responsibility are encouraging the adoption of natural gas, thereby stimulating the need for robust LNG infrastructure.Furthermore, regulatory pressures and international agreements aimed at reducing greenhouse gas emissions are incentivizing the shift towards LNG. The flexibility of LNG infrastructure in meeting fluctuating energy demands and its ability to support energy security by diversifying supply sources are also significant growth drivers. Additionally, the development of LNG bunkering facilities to support the maritime industry's transition to cleaner fuels is expanding the scope of LNG infrastructure. The combination of technological advancements, market dynamics, and consumer demand for cleaner energy solutions is propelling the global LNG infrastructure market forward, making it a critical component of the evolving energy landscape.

Report Scope

The report analyzes the LNG Infrastructure market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Liquefaction Terminal, Regasification Terminal).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $4.3 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LNG Infrastructure Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LNG Infrastructure Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LNG Infrastructure Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AF POYRY AB, Bechtel Corporation, Cheniere Energy Inc, Chevron Corporation, Chiyoda Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this LNG Infrastructure market report include:

- AF POYRY AB

- Bechtel Corporation

- Cheniere Energy Inc

- Chevron Corporation

- Chiyoda Corporation

- Dominion Energy, Inc.

- Golar LNG Ltd.

- JGC Holdings Corporation

- MAN Energy Solutions SE

- McDermott International, Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AF POYRY AB

- Bechtel Corporation

- Cheniere Energy Inc

- Chevron Corporation

- Chiyoda Corporation

- Dominion Energy, Inc.

- Golar LNG Ltd.

- JGC Holdings Corporation

- MAN Energy Solutions SE

- McDermott International, Ltd.

Table Information

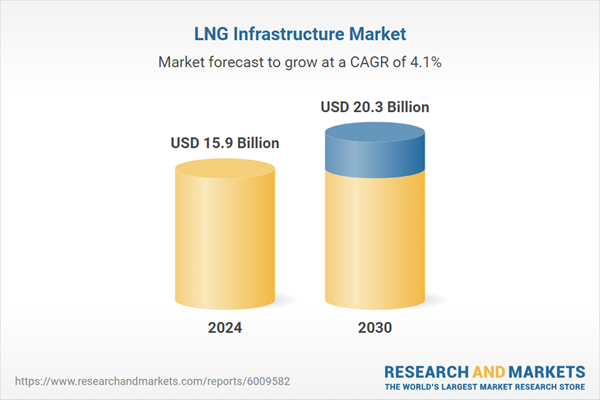

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.9 Billion |

| Forecasted Market Value ( USD | $ 20.3 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |