Global Welding Safety Market - Key Trends & Drivers Summarized

Why Is Welding Safety Increasingly Critical Across Industries?

Welding safety has become an increasingly critical concern across industries due to the inherent risks associated with welding processes. Welding is essential in sectors such as construction, automotive, aerospace, shipbuilding, and manufacturing, where metal joining and fabrication are core activities. However, the intense heat, UV radiation, sparks, toxic fumes, and electrical hazards associated with welding create significant health and safety risks for workers. Welding-related injuries can range from burns and eye damage to respiratory issues, with long-term exposure to hazardous fumes potentially leading to serious conditions such as lung disease. As industries worldwide become more focused on worker safety and regulatory compliance, the demand for welding safety equipment such as helmets, gloves, protective clothing, and fume extraction systems has grown significantly. Regulatory bodies like OSHA (Occupational Safety and Health Administration) and ANSI (American National Standards Institute) have established stringent guidelines for welding safety, making it mandatory for employers to invest in comprehensive protective gear and equipment.Furthermore, as the global workforce becomes more aware of occupational health risks, the importance of workplace safety culture is rising. Companies are now prioritizing not just compliance with safety standards but also creating environments where worker well-being is central. The growing awareness of the dangers associated with welding has led to an increase in demand for advanced personal protective equipment (PPE) that offers better protection, durability, and comfort. Welding helmets with auto-darkening filters, heat-resistant gloves, flame-retardant clothing, and respiratory protection are now considered essential tools for welders. As industries push toward automation and higher production rates, ensuring worker safety through high-quality PPE and advanced safety systems becomes crucial to prevent accidents and reduce downtime due to workplace injuries.

How Is Technology Enhancing Welding Safety Solutions?

Technological advancements are playing a pivotal role in enhancing welding safety, making equipment smarter, more efficient, and better suited to the needs of modern industries. One of the most significant innovations is the development of auto-darkening welding helmets. Unlike traditional passive helmets that require welders to manually lift and lower their visors, auto-darkening helmets automatically adjust their lens shade based on the intensity of the arc light. This allows welders to maintain focus on their work without interruption, improving both safety and productivity. These helmets also feature lightweight designs and ergonomic improvements, making them more comfortable for extended use, which reduces the risk of fatigue-related accidents. Additionally, innovations in protective clothing materials, such as heat-resistant fabrics with enhanced breathability and flexibility, are providing better protection against burns and heat stress, while also improving worker comfort.Another area where technology is transforming welding safety is in fume extraction systems. Welding fumes can contain hazardous substances like manganese, chromium, and lead, which pose serious health risks when inhaled over time. Advanced fume extraction systems are now integrated with welding setups, capturing harmful particles at the source and preventing them from entering the workspace. These systems are increasingly becoming mobile and adaptable, allowing them to be easily deployed in different work environments, from large-scale industrial facilities to smaller workshops. Moreover, the incorporation of Internet of Things (IoT) technologies into welding safety solutions is enabling real-time monitoring of environmental conditions and equipment usage. IoT-connected sensors can track factors such as air quality, equipment temperature, and welders' exposure levels, providing data that can be used to prevent accidents and ensure compliance with safety regulations. As industries continue to embrace automation and smart technologies, the integration of safety-focused innovations will be key to enhancing worker protection and reducing the risks associated with welding processes.

How Does Changing Workforce Dynamics Impact The Welding Safety Market?

The evolving dynamics of the global workforce are having a significant impact on the welding safety market. One notable trend is the increasing demand for more inclusive and ergonomically designed personal protective equipment (PPE) that caters to a diverse workforce. As more women and younger workers enter industries traditionally dominated by men, such as manufacturing and construction, there is a growing need for PPE that offers a better fit for different body types and sizes. In response, manufacturers are developing welding helmets, gloves, and clothing in a wider range of sizes, ensuring that all workers, regardless of gender or physical stature, are adequately protected. Additionally, ergonomic designs that reduce strain and improve comfort are becoming a priority, as companies recognize that uncomfortable or poorly fitting PPE can lead to fatigue, reduced productivity, and an increased risk of accidents. This shift towards more inclusive and worker-friendly safety gear is driving innovation in the welding safety market.Another key factor influencing workforce dynamics is the increasing use of automation and robotics in welding processes. While the adoption of automated welding systems has reduced the need for human welders in some sectors, it has also introduced new safety challenges, particularly in environments where human workers still operate alongside machines. In these hybrid settings, ensuring the safety of workers remains a top priority, leading to a demand for advanced safety protocols and protective gear that account for both traditional and automated welding hazards. Furthermore, the skills gap in the welding industry, driven by an aging workforce and a shortage of trained welders, has prompted companies to focus more on safety training and awareness programs. This includes equipping workers with the latest safety tools and technologies that simplify complex welding tasks, reducing the likelihood of accidents caused by human error. As industries grapple with these workforce changes, the focus on welding safety will only grow, with companies seeking comprehensive solutions to protect their employees in increasingly dynamic work environments.

What Is Driving The Growth Of The Welding Safety Market?

The growth in the welding safety market is driven by several key factors, including stringent safety regulations, technological advancements, and the rising focus on worker health and safety. One of the primary growth drivers is the enforcement of stricter safety regulations across industries that rely on welding, particularly in regions like North America and Europe. Regulatory bodies such as OSHA and the European Agency for Safety and Health at Work (EU-OSHA) have established comprehensive guidelines for welding safety, making it mandatory for employers to provide adequate personal protective equipment (PPE) and implement safety measures to protect workers from welding hazards. These regulations are not only pushing companies to invest in advanced PPE such as auto-darkening helmets, flame-resistant clothing, and respiratory protection but also in monitoring and fume extraction systems to maintain safe working environments. As governments and regulatory agencies increase their focus on occupational safety, particularly in high-risk industries, the demand for high-quality welding safety solutions is expected to rise.Another major driver is the growing adoption of advanced technologies in welding safety equipment. Innovations such as smart helmets with augmented reality (AR) features, real-time air quality monitoring systems, and IoT-enabled safety gear are transforming the way welding safety is approached. These technologies not only enhance the level of protection offered to workers but also provide data-driven insights that help companies proactively address potential safety risks. Moreover, the increasing emphasis on worker well-being and safety culture in organizations is driving demand for welding safety solutions that go beyond regulatory compliance. Companies are recognizing the long-term benefits of investing in safety, such as reducing downtime, preventing accidents, and improving worker morale and productivity. Additionally, the rising demand for sustainable and environmentally friendly PPE, such as gear made from recyclable materials or those with longer lifespans, is contributing to the growth of the market. With industries like construction, manufacturing, and automotive continuing to expand globally, the demand for effective welding safety solutions will remain strong, driven by the need to protect workers and comply with evolving safety standards.

Report Scope

The report analyzes the Welding Safety market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Automotive End-Use, Construction End-Use, Aerospace & Defense End-Use, Shipbuilding End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive End-Use segment, which is expected to reach US$6.7 Billion by 2030 with a CAGR of a 6.5%. The Construction End-Use segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.3 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $4.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Welding Safety Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Welding Safety Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Welding Safety Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Air Liquide Canada, Ansell Ltd., Changzhou Shine Science & Technology Co., Ltd., Delta Plus Group S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Welding Safety market report include:

- 3M Company

- Air Liquide Canada

- Ansell Ltd.

- Changzhou Shine Science & Technology Co., Ltd.

- Delta Plus Group S.A.

- Donaldson Company, Inc.

- ESAB

- Honeywell International, Inc.

- Illinois Tool Works, Inc.

- Kemppi Oy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Air Liquide Canada

- Ansell Ltd.

- Changzhou Shine Science & Technology Co., Ltd.

- Delta Plus Group S.A.

- Donaldson Company, Inc.

- ESAB

- Honeywell International, Inc.

- Illinois Tool Works, Inc.

- Kemppi Oy

Table Information

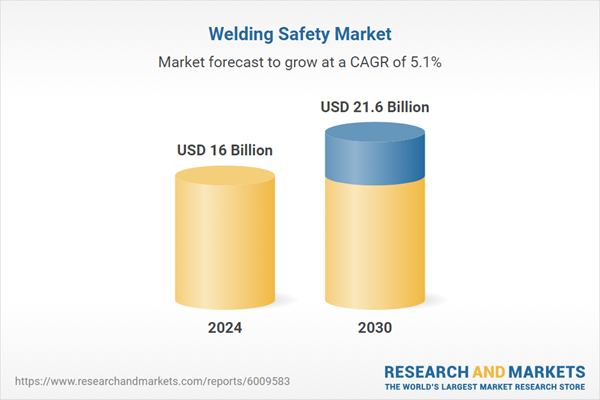

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16 Billion |

| Forecasted Market Value ( USD | $ 21.6 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |