Global Chromite Market - Key Trends and Drivers Summarized

Why Is Chromite Essential for the Global Metallurgical Industry?

Chromite, a crucial industrial mineral, is primarily used as a raw material for the production of ferrochrome, an alloy essential in the manufacture of stainless steel. Its significance in the metallurgical industry stems from its unique properties, including high heat stability, corrosion resistance, and hardness, which make it indispensable in producing high-strength steel products. Over 90% of chromite produced globally is utilized in the steel industry, where it serves as a key ingredient in making different grades of stainless steel, which are in turn used across sectors such as automotive, construction, aerospace, and heavy machinery. The remaining portion finds applications in the refractory and chemical industries, making chromite a versatile mineral. The availability of high-grade chromite ores in key mining regions, such as South Africa, Kazakhstan, and India, has solidified these countries' roles as major suppliers in the global market. However, fluctuations in chromite supply due to geopolitical tensions, export regulations, and mining restrictions in these regions have a significant impact on the global stainless steel production chain, making the supply-demand dynamics for chromite a critical focal point for the industry.What Factors Are Shaping Chromite's Role Beyond Metallurgy?

While the metallurgical sector remains the dominant consumer of chromite, the mineral is gaining traction in various non-metallurgical applications, creating new opportunities for market diversification. Chromite is increasingly being used in the refractory industry, where its high melting point and thermal conductivity make it an excellent material for lining high-temperature furnaces, kilns, and reactors. The growth in the global manufacturing sector, particularly in developing regions, is boosting demand for refractory-grade chromite, as countries continue to invest in infrastructure development and heavy industrial facilities. In addition, the chemical industry utilizes chromite in the production of sodium dichromate, which is a precursor for a range of chromium-based chemicals used in pigments, tanning, and corrosion inhibitors. Another emerging application is the use of chromite in foundry sands, where it acts as a heat-resistant molding material in metal casting. This trend is gaining momentum as the automotive and aerospace industries seek more efficient and higher-quality casting materials for complex component production. The expansion of these non-metallurgical applications is broadening chromite's market footprint and mitigating the risks associated with its reliance on the cyclical steel industry.How Are Technological Innovations Impacting Chromite Mining and Processing?

Technological advancements in mining and beneficiation processes are transforming the chromite market by improving ore quality, reducing waste, and increasing operational efficiency. Innovations in gravity separation, magnetic separation, and flotation techniques have enabled the effective extraction and concentration of chromite from low-grade ores, making previously uneconomical deposits viable for commercial mining. Additionally, advancements in sustainable mining practices are addressing environmental concerns related to chromite mining, particularly in regions with strict environmental regulations. Technologies such as dry processing, water reclamation, and waste minimization are helping reduce the environmental footprint of mining operations. Another significant trend is the integration of automation and digital technologies, which is enhancing productivity and safety in chromite mines. Real-time data analytics, drone-based monitoring, and automated drilling are optimizing resource management, improving yield, and reducing labor costs. Furthermore, innovations in smelting technologies are lowering energy consumption in ferrochrome production, making the process more cost-effective and environmentally friendly. These technological shifts are not only strengthening the supply chain but also positioning chromite producers to meet the evolving demands of a global market focused on sustainability and efficiency.What Are the Key Factors Driving the Growth of the Chromite Market?

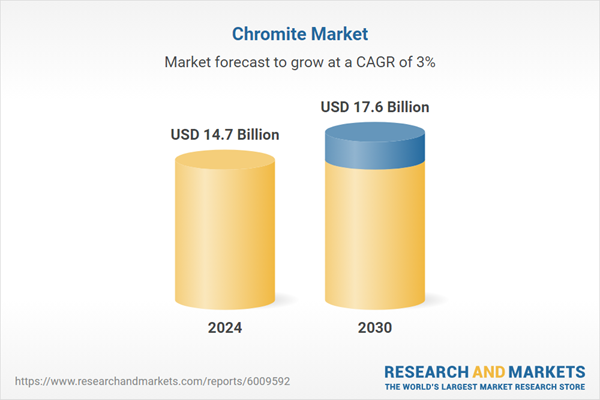

The growth in the chromite market is driven by several factors, primarily centered around its diverse end-use applications and increasing demand from the steel industry. The primary driver is the rising production of stainless steel, which continues to be the largest consumer of chromite. As the global economy recovers and infrastructure projects resume post-pandemic, the demand for stainless steel in construction, automotive, and industrial manufacturing is fueling chromite consumption. Another major driver is the expansion of the refractory industry, where chromite is crucial for producing high-temperature resistant materials used in steel, cement, and glass manufacturing. The chemical industry is also contributing to market growth, as chromite's use in producing chromium chemicals for pigments, leather tanning, and corrosion inhibitors remains strong. Moreover, the increasing adoption of chromite in foundry applications is driven by the growing need for high-quality casting materials in the automotive and heavy machinery sectors. On the supply side, technological advancements in ore beneficiation and sustainable mining practices are improving the quality and availability of chromite, enabling producers to tap into lower-grade reserves and enhance overall productivity. Lastly, government support for mining activities and investments in infrastructure development in emerging economies are expected to boost chromite production and drive market expansion in the coming years. These factors combined are setting the stage for steady growth in the global chromite market, with expanding applications and innovations reshaping its future outlook.Report Scope

The report analyzes the Chromite market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Metallurgical End-Use, Refractories End-Use, Chemical & Foundry End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Metallurgical End-Use segment, which is expected to reach US$13.3 Billion by 2030 with a CAGR of a 2.9%. The Refractories End-Use segment is also set to grow at 1.4% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chromite Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chromite Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chromite Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AlbChrome, Clover Alloys SA (Pty) Ltd, Dhairya International, Glencore International AG, LKAB Minerals AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 45 companies featured in this Chromite market report include:

- AlbChrome

- Clover Alloys SA (Pty) Ltd

- Dhairya International

- Glencore International AG

- LKAB Minerals AB

- Oman Chromite Company

- Otto Chemie Pvt., Ltd.

- Outokumpu Oyj

- Samancor Chrome Limited

- SCR-Sibelco NV

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AlbChrome

- Clover Alloys SA (Pty) Ltd

- Dhairya International

- Glencore International AG

- LKAB Minerals AB

- Oman Chromite Company

- Otto Chemie Pvt., Ltd.

- Outokumpu Oyj

- Samancor Chrome Limited

- SCR-Sibelco NV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.7 Billion |

| Forecasted Market Value ( USD | $ 17.6 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |