Global Floor Safety Products Market - Key Trends and Drivers Summarized

How Do Floor Safety Products Help Prevent Slips, Trips, and Falls?

Floor safety products are crucial components in safeguarding environments where slip, trip, and fall hazards are prevalent. These hazards are a significant concern in workplaces, public spaces, and homes, accounting for a large portion of injuries and accidents worldwide. Floor safety products, ranging from anti-slip tapes and mats to safety signs and coatings, play a key role in minimizing risks by improving traction, alerting people to potential hazards, and providing safer walking surfaces. Anti-slip tapes, for example, are commonly applied to staircases, ramps, and other areas with a high risk of slipping. These tapes often have rough, grit-like surfaces that enhance friction, preventing foot slippage even in wet or greasy conditions.Another widely used product is anti-fatigue mats, which not only reduce the risk of slipping but also provide comfort for workers who stand for extended periods, such as in manufacturing, healthcare, or food service industries. These mats help prevent muscle fatigue and reduce stress on the feet, knees, and back, contributing to overall workplace safety and ergonomics. Additionally, brightly colored safety signs and floor markers serve as visual cues, reminding employees and visitors to stay alert in potentially dangerous areas like wet floors, construction zones, or heavy traffic areas within facilities. Together, these products form a comprehensive safety net that reduces the likelihood of accidents, enhances awareness, and creates safer environments across multiple sectors. By addressing common hazards at the source, floor safety products ensure that daily activities proceed without the risk of injury.

Why Are Floor Safety Products Critical in High-Traffic and Industrial Areas?

High-traffic and industrial environments, such as warehouses, factories, airports, and retail stores, present unique challenges when it comes to floor safety. The constant movement of people, machinery, and vehicles increases the likelihood of accidents. In such spaces, the use of robust floor safety products is essential to prevent injuries and downtime. Anti-slip floor coatings and sealants are often applied to concrete or tiled surfaces in these environments to provide long-lasting traction, even in areas exposed to moisture, oils, or chemicals. These coatings ensure that forklifts, carts, and employees can move safely without the risk of skidding or slipping, particularly in areas prone to spills or heavy use.In addition to coatings, industrial-grade floor mats are strategically placed at entrances, workstations, and assembly lines to absorb moisture and debris, reducing the chance of slip-related accidents. For example, in a food processing plant, wet and greasy conditions are common, making specialized drainage mats essential for maintaining dry, safe floors. Moreover, industrial workplaces often use modular safety matting systems, which can be customized to fit large areas and withstand extreme weight and wear. These modular systems are designed to provide durability and ease of maintenance, while also enhancing worker comfort.

In high-traffic areas, floor safety extends beyond just preventing slips and falls - it also involves protecting the structural integrity of the floor itself. Floor marking tapes and warning signs guide traffic flow and define hazardous zones, ensuring that both personnel and machinery operate in clearly demarcated, safe spaces. By separating pedestrian walkways from vehicle routes, for example, these products prevent collisions and keep workers safe from moving equipment. In such demanding environments, floor safety products are not just a precaution - they are a necessity for smooth and secure operations.

How Are Floor Safety Products Evolving with New Technologies and Materials?

Technological advancements are driving innovation in the floor safety products market, leading to more effective and durable solutions. One of the most significant trends is the development of advanced anti-slip coatings and treatments that incorporate nanotechnology. These coatings, often applied to tiles, wood, or concrete, create a microscopically rough surface that enhances grip without altering the appearance of the floor. Nanotechnology-based treatments are transparent and long-lasting, making them ideal for both commercial and residential spaces where aesthetics are important. These treatments work by reacting with the surface to form a durable, slip-resistant layer that doesn't wear off easily, even under heavy foot traffic or harsh cleaning procedures.Another exciting development is in smart flooring technology, which integrates sensors into flooring materials to monitor foot traffic and detect potential hazards in real-time. These smart systems can alert building managers to areas that require cleaning or maintenance, such as when spills occur or foot traffic increases, preventing accidents before they happen. In environments like hospitals and airports, this technology is particularly useful in ensuring continuous safety in large, dynamic spaces.

The rise of eco-friendly materials is also influencing the floor safety market, with manufacturers increasingly offering products made from recycled or sustainable materials. Recycled rubber mats, for instance, are commonly used in gyms and industrial spaces for both their slip-resistance and environmental benefits. Moreover, antimicrobial treatments are being applied to safety mats and coatings to prevent the growth of bacteria and fungi, ensuring hygienic surfaces in healthcare and food processing environments. These innovations are not only enhancing safety but are also contributing to the sustainability and cleanliness of modern facilities. As technology and materials science continue to advance, the floor safety industry is evolving to meet the needs of a variety of environments, ensuring both safety and efficiency.

What's Driving the Growth in the Floor Safety Products Market?

The growth in the floor safety products market is driven by several important factors, each contributing to the increasing demand for these solutions in a wide range of industries. One of the most significant drivers is the rising awareness of workplace safety regulations and compliance standards. Governments and regulatory bodies such as OSHA (Occupational Safety and Health Administration) and HSE (Health and Safety Executive) are implementing stricter safety guidelines to reduce the number of workplace injuries related to slips, trips, and falls. This heightened focus on compliance has led businesses to invest more in high-quality floor safety products, as they aim to meet safety standards and avoid costly penalties or legal issues resulting from accidents.Another key driver is the expansion of industries that require high levels of safety and hygiene, particularly in healthcare, food processing, and manufacturing sectors. These industries are increasingly adopting floor safety solutions, not only to prevent accidents but also to maintain clean and sanitary environments. The need for products that can withstand harsh conditions, such as wet or oily floors, is particularly strong in industrial and commercial kitchens, where the risk of slipping is high. The rise in construction activities and urbanization, especially in emerging economies, is also fueling demand for floor safety products as new facilities are built with safety as a core consideration.

The growth of e-commerce and retail sectors, which experience heavy foot traffic daily, is another significant factor boosting the market. As retailers seek to protect both employees and customers, they are increasingly implementing anti-slip mats, safety signs, and slip-resistant coatings in their stores. Additionally, the trend toward automation in workplaces and warehouses is driving the need for clear floor markings and anti-slip products that enhance the safety of both humans and machines operating in these spaces.

Lastly, the growing consumer focus on home safety is contributing to the market's expansion. As awareness of household accidents increases, more individuals are investing in floor safety products, such as non-slip mats for bathrooms, kitchens, and staircases. With technological advancements and the increasing availability of eco-friendly, aesthetically pleasing safety products, the floor safety market is poised for continued growth across both residential and commercial applications, ensuring that safety is prioritized in every step.

Report Scope

The report analyzes the Floor Safety Products market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Safety Mats, Floor Safety Cones & Signage, Anti-Slip Tapes, Other Product Types).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Safety Mats segment, which is expected to reach US$12.1 Billion by 2030 with a CAGR of a 9.3%. The Floor Safety Cones & Signage segment is also set to grow at 8.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.5 Billion in 2024, and China, forecasted to grow at an impressive 12.3% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Floor Safety Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Floor Safety Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Floor Safety Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, American Mat & Rubber Products, Emedco.com, Flooratex Rubber and Plastics Pvt. Ltd., Heskins LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Floor Safety Products market report include:

- 3M Company

- American Mat & Rubber Products

- Emedco.com

- Flooratex Rubber and Plastics Pvt. Ltd.

- Heskins LLC

- INCOM Manufacturing Group

- Jessup Manufacturing Company

- Koruser

- Notrax

- Safe Tread

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- American Mat & Rubber Products

- Emedco.com

- Flooratex Rubber and Plastics Pvt. Ltd.

- Heskins LLC

- INCOM Manufacturing Group

- Jessup Manufacturing Company

- Koruser

- Notrax

- Safe Tread

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

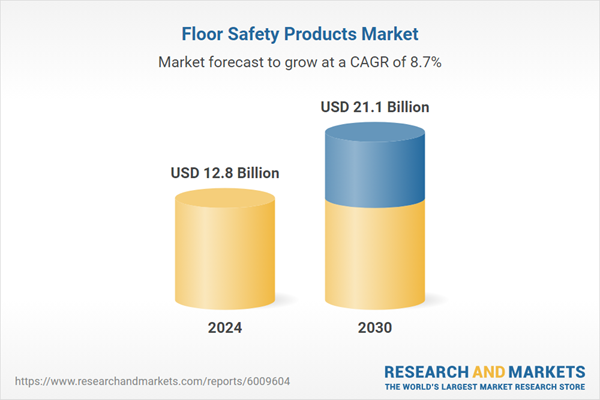

| Estimated Market Value ( USD | $ 12.8 Billion |

| Forecasted Market Value ( USD | $ 21.1 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |