Global Cyber Insurance Market - Key Trends and Drivers Summarized

Why Is Cyber Insurance Becoming Essential in the Digital Age?

Cyber insurance has emerged as a critical component of risk management for businesses in the digital age. As organizations increasingly rely on technology and data, they become more vulnerable to cyberattacks, data breaches, and ransomware. Cyber insurance provides financial protection against the costs associated with these incidents, including legal fees, notification expenses, data recovery, and business interruption. This insurance covers a wide range of industries, from finance and healthcare to retail and manufacturing, all of which are highly susceptible to cyber threats. As the frequency and sophistication of cyberattacks increase, cyber insurance is becoming an indispensable safeguard for businesses looking to mitigate financial and reputational damage.What Are the Segments and Applications in the Cyber Insurance Market?

The cyber insurance market is segmented based on policy type, including first-party coverage, which covers direct losses to the insured organization, and third-party coverage, which protects against claims from customers and partners affected by a breach. Key applications of cyber insurance include data breach response, ransomware mitigation, and business continuity support. The financial services and healthcare sectors are the largest users of cyber insurance due to their vast amounts of sensitive data and strict regulatory requirements. However, industries such as retail, manufacturing, and education are increasingly adopting cyber insurance as they too become frequent targets of cyberattacks. North America dominates the market due to stringent data protection regulations like GDPR and CCPA, but the market in Asia-Pacific is growing rapidly as awareness of cyber risks increases.How Are Regulations and Cybersecurity Trends Shaping the Market?

Regulatory requirements, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., are driving the adoption of cyber insurance. These regulations mandate that organizations take strict measures to protect personal data, and failure to comply can result in hefty fines. As a result, businesses are turning to cyber insurance to mitigate potential regulatory penalties and manage data breach risks. Additionally, the rise of cyber extortion, such as ransomware attacks, is prompting companies to purchase more comprehensive policies. The growing awareness of cybersecurity risks among small and medium-sized enterprises (SMEs) is also expanding the market, as these businesses often lack the resources for robust in-house cybersecurity measures.What Factors Are Driving the Growth in the Cyber Insurance Market?

The growth in the cyber insurance market is driven by several factors, including the increasing frequency and severity of cyberattacks, particularly ransomware and data breaches. Regulatory frameworks like GDPR and CCPA are compelling businesses to adopt cyber insurance as part of their compliance strategies. Additionally, the rise of digital transformation initiatives across industries is exposing more businesses to cybersecurity risks, driving demand for comprehensive coverage. Technological advancements in cybersecurity, combined with the increasing use of cloud services and Internet of Things (IoT) devices, are further fueling market growth. Lastly, the heightened awareness of cyber risks among SMEs and the expansion of cyber insurance offerings tailored to their needs are contributing to the market's rapid growth.Report Scope

The report analyzes the Cyber Insurance market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Format (Standalone Offering, Packaged Offering); End-Use (BFSI End-Use, Retail End-Use, Healthcare End-Use, IT & Telecom End-Use, Manufacturing End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cyber Insurance Solutions segment, which is expected to reach US$12.8 Billion by 2030 with a CAGR of a 9.3%. The Cyber Insurance Services segment is also set to grow at 10.4% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cyber Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cyber Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cyber Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American International Group, Inc., AttackIQ, AXA XL, Axis Capital Holdings Limited, Bitsight Technologies, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Cyber Insurance market report include:

- American International Group, Inc.

- AttackIQ

- AXA XL

- Axis Capital Holdings Limited

- Bitsight Technologies, Inc.

- Check Point Software Technologies Ltd.

- Chubb Corp.

- CNA Insurance Company

- Cyber Indemnity Solutions

- CyberArk Software Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American International Group, Inc.

- AttackIQ

- AXA XL

- Axis Capital Holdings Limited

- Bitsight Technologies, Inc.

- Check Point Software Technologies Ltd.

- Chubb Corp.

- CNA Insurance Company

- Cyber Indemnity Solutions

- CyberArk Software Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 379 |

| Published | February 2026 |

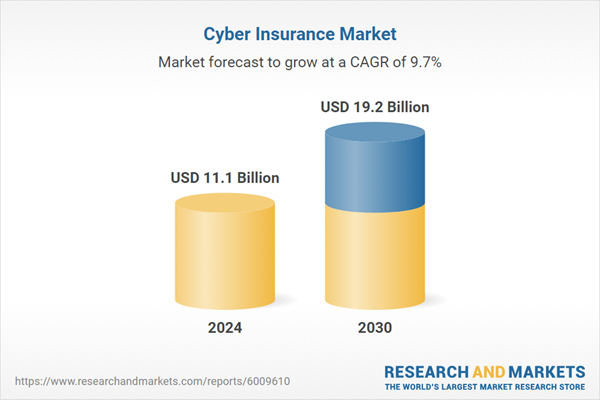

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.1 Billion |

| Forecasted Market Value ( USD | $ 19.2 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |