Demand arising from offices in departments such as IT, telecom, transportation, customer care, banking and financial sector, educational institutes, and factory/production is offering lucrative opportunities to the overall market. Furthermore, technological advancements thanks to intense R&D by product developers and manufacturers to spearhead a competitive environment are fueling market demand. These developments are attracting consumers to replace their existing products with newer versions. This is expected to drive the overall market at a significant pace over the forecast period.

The office peripherals and products market has been segregated, based on product, into bill counters, coin sorters, counterfeit detectors, safes, deposit boxes, and cash handlers, shredders (paper and plastic), laminators, and printers, scanners, and photocopiers.

The printers, scanners, and photocopiers segment held the largest market share in 2017. These products are widely used in offices across industries and have become essentials for any office setup. They are used in educational institutes and universities, BFSI sector, stock markets and investment firms, and government offices to maintain records and produce these records whenever required. Shredders are used in different offices to shred paper and plastic films. The segment is anticipated to grow considerably from 2018 to 2025.

North America accounted for the largest market share but is projected to lose share to Asia Pacific over the forecast period. Asia Pacific is anticipated to demonstrate the highest growth rate on account of rapid urbanization, growing manufacturing activities in the region, rapid setting up of SMEs, and government programs that require office setups.

HP Development Company, L.P.; Epson America, Inc.; Canon Inc.; Royal Sovereign; Yale (ASSA ABLOY); Brother International Corporation; and Ricoh Company Ltd. are some of the key industry participants. These and others are constantly emphasizing on product innovation and enhancement of their products and solutions portfolios. They have determined lucrative opportunities being offered by various offices in different sectors and are therefore, focusing on providing customized solutions based on consumer requirements.

Office Peripherals And Products Market Report Highlights

- Increasing number of small-scale businesses and start-ups is propelling demand for office products

- Growing concerns associated with penetration and circulation of fake currency in developing nations and necessary measures required to curb the movement of fake currency are driving demand for counterfeit detectors

- The shredders segment is expected to witness increasing demand from government offices, investment and stock market firms, and BFSI offices across the globe

- North America accounted for the largest market share owing to presence of prominent manufacturers

- Asia Pacific is expected to grow at the highest CAGR over the forecast period owing to rising urbanization in the region and increasing number of start-up businesses. Local product manufacturers in the region are targeting consumers by offering customized products at affordable prices

- Key industry participants include; Epson America, Inc.; Canon, Inc.; Zytech; HP Development Company, L.P; ZY Tech Co., Ltd.; Martin Yale Industries, LLC.; Ozone Group; Dahle North America, Inc.; American Shredder, Inc.; Ameri-Shred; Brother;

The leading players in the Office Peripherals and Products market include:

- Epson America, Inc.

- Canon U.S.A., Inc.

- Zytech

- HP Development Company, L.P.

- Martin Yale Industries, LLC.

- American Shredder, Inc.

- Dahle North America, Inc.

- Brother

- Ricoh

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading players in the Office Peripherals and Products market include:- Epson America, Inc.

- Canon U.S.A., Inc.

- Zytech

- HP Development Company, L.P.

- Martin Yale Industries, LLC.

- American Shredder, Inc.

- Dahle North America, Inc.

- Brother

- Ricoh

Table Information

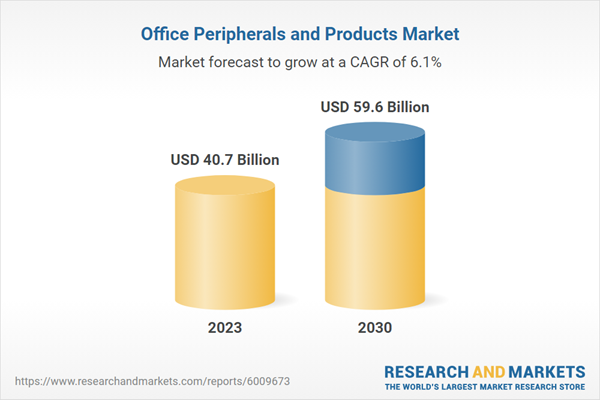

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | September 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 40.7 Billion |

| Forecasted Market Value ( USD | $ 59.6 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |