Growth of the tourism industry is one of the key factors increasing the spending on skiing, which, in turn, is expected to promote the scope of various sports equipment. The World Bank Group revealed that the international tourist arrivals have increased from 1.24 billion in 2016 to 1.33 billion in 2017. Furthermore, emergence of the Indian Himalayas as a snow sports hub as a result of supportive government policies aimed at the development of hill stations, including Auli and Manali, is expected to open new industry avenues.

Product innovation is expected to remain a critical success factor over the next few years. For instance, in 2016, Scott Sports launched Walkable Ski Boot to provide the skiers optimum grip during skiing. Moreover, these boots are designed in such a way that it can be used for normal walking, thereby making them effective and comfortable in nature.

For instance, in 2018, Salmon S.A.S. launched Salomon QST 99, a lightweight ski to provide a better and smooth experience of skiing so that the customer can achieve more speed with less effort. Moreover, in 2018, Oakley Inc. launched Inferno Prizm Goggles. With this new product, the company is providing anti-fogging feature to the customers with the help of an electric heat current to clear the glasses.

Ski Equipment & Gear Market Report Highlights

- Clothing held the dominant share of 32.7% in 2023, owing to the growing acceptance of advanced designs in ski clothing. Headgear is expected to emerge as the fastest-growing segment during the forecast period

- Supermarkets & hypermarkets dominated the market in 2023 as they offer convenient access to ski equipment and gear

- The North America ski equipment and gear market held a share of 42.0% in 2023

The leading players in the Ski Equipment & Gear market include:

- Amer Sports Oyj

- Fischer Beteiligungs Verwaltungs GmbH

- Black Diamond Equipment, Ltd.

- Skis Rossignol S.A.

- The Burton Corporation

- Icelantic LLC

- Marker Volkl (International) Sales GmbH

- Volcom LLC

- Helly Hansen

- Coalition Snow

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading players in the Ski Equipment & Gear market include:- Amer Sports Oyj

- Fischer Beteiligungs Verwaltungs GmbH

- Black Diamond Equipment, Ltd.

- Skis Rossignol S.A.

- The Burton Corporation

- Icelantic LLC

- Marker Volkl (International) Sales GmbH

- Volcom LLC

- Helly Hansen

- Coalition Snow

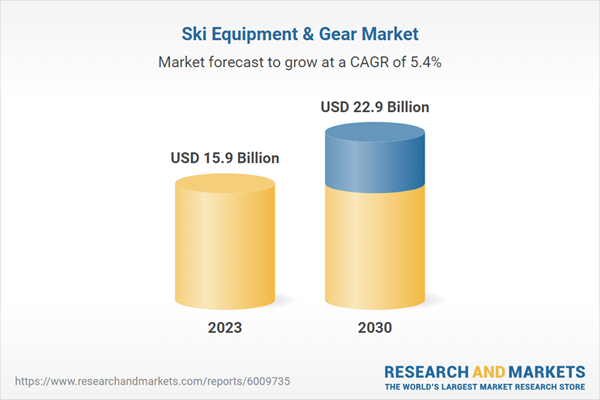

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | September 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 15.9 Billion |

| Forecasted Market Value ( USD | $ 22.9 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |