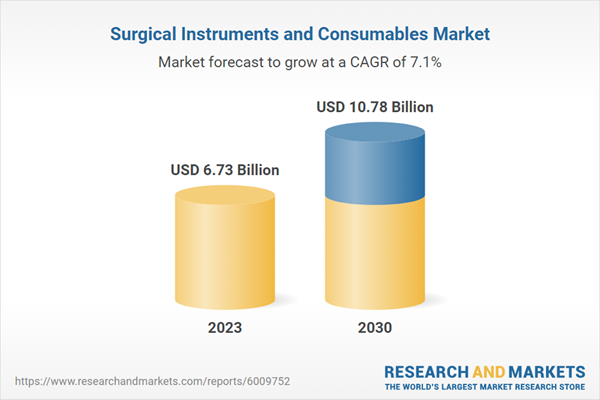

The global surgical instruments & consumables market size is expected to reach USD 10.78 billion by 2030, registering a CAGR of 7.11% from 2024 to 2030. The global rise in chronic diseases, such as cancer, cardiovascular diseases, diabetes, and orthopedic disorders, is a significant contributor to the market growth. These conditions often necessitate surgical interventions, driving demand for specialized instruments and consumables. The global population is aging rapidly, especially in developed countries. As the elderly population grows, the incidence of age-related health conditions, including joint replacements, cataract surgery, and cardiac procedures are fueling the demand for surgical tools.

The popularity of MIS procedures has surged in recent years due to their advantages, such as smaller incisions, reduced pain, and faster recovery times. This shift has created a demand for specialized instruments and consumables designed for minimally invasive techniques., Continuous advancements in materials science, design and manufacturing processes are leading to the development of innovative surgical instruments and consumables. For instance, using advanced materials such as titanium and polymers can improve durability and performance.

Investments in healthcare infrastructure, particularly in developing regions, are increasing the availability of surgical facilities and services. This expansion drives demand for surgical instruments and consumables to equip these facilities. As healthcare spending increases, driven by rising incomes and government policies, there is greater investment in medical equipment and supplies, including surgical instruments and consumables.

The popularity of MIS procedures has surged in recent years due to their advantages, such as smaller incisions, reduced pain, and faster recovery times. This shift has created a demand for specialized instruments and consumables designed for minimally invasive techniques., Continuous advancements in materials science, design and manufacturing processes are leading to the development of innovative surgical instruments and consumables. For instance, using advanced materials such as titanium and polymers can improve durability and performance.

Investments in healthcare infrastructure, particularly in developing regions, are increasing the availability of surgical facilities and services. This expansion drives demand for surgical instruments and consumables to equip these facilities. As healthcare spending increases, driven by rising incomes and government policies, there is greater investment in medical equipment and supplies, including surgical instruments and consumables.

Surgical Instruments And Consumables Market Report Highlights

- Based on the product, the surgical instruments accounted for the largest revenue share of 77.3% in 2023 as there is a rise in the demand for surgical procedures, which in turn is driving demand for surgical instruments.

- Based on the application, general surgery segment accounted for the largest revenue share of 32.6% in 2023 as conditions requiring general surgery, such as appendicitis, gallbladder disease, hernias, and gastrointestinal disorders, continue to be prevalent, driving demand for associated surgical instruments and consumables.

- Based on the end use, the hospitals segment accounted for the largest revenue share of 69.4% in 2023 as hospitals are performing a growing number of surgical procedures due to various factors, including the rising prevalence of diseases, advancements in surgical techniques, and increased access to healthcare.

- In 2023, North America dominated with a share of 40.1% as hospitals are performing more surgical procedures due to various factors, including the rising prevalence of diseases, advancements in surgical techniques, and increased access to healthcare.

The leading players in the Surgical Instruments and Consumables market include:

- Integra Lifesciences Corporation

- B.Braun Melsungen AG

- Medtronic, plc.

- Johnson & Johnson Services, Inc.

- STERIS

- Richard Wolf GmbH

- Stryker

- Aspen Surgical

- Karl Storz Se & Co. Kg

- KLS Martin Group

- Medline Industries

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.1. Segment Definitions

1.1.1. Product

1.1.2. Application

1.1.3. End-Use

1.1.4. Regional scope

1.1.5. Estimates and forecasts timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in North America

1.3.5.2. Data for primary interviews in Europe

1.3.5.3. Data for primary interviews in Asia Pacific

1.3.5.4. Data for primary interviews in Latin America

1.3.5.5. Data for Primary interviews in MEA

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.6.3. Volume price analysis (Model 2)

1.6.4. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.1. Segment Definitions

1.1.1. Product

1.1.2. Application

1.1.3. End-Use

1.1.4. Regional scope

1.1.5. Estimates and forecasts timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in North America

1.3.5.2. Data for primary interviews in Europe

1.3.5.3. Data for primary interviews in Asia Pacific

1.3.5.4. Data for primary interviews in Latin America

1.3.5.5. Data for Primary interviews in MEA

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.6.3. Volume price analysis (Model 2)

1.6.4. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Application outlook

2.2.3. End Use outlook

2.3. Regional outlook

2.4. Competitive Insights

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Application outlook

2.2.3. End Use outlook

2.3. Regional outlook

2.4. Competitive Insights

Chapter 3. Surgical Instruments and Consumables Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increase in prevalence of chronic diseases

3.2.1.2. Rising geriatric population

3.2.1.3. Increasing number of surgical procedures

3.2.1.4. Technological advancements

3.2.2. Market Restraint Analysis

3.2.2.1. Lack of skilled professionals

3.2.2.2. Risk of medical negligence

3.3. Surgical Instruments and Consumables Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic landscape

3.3.2.3. Social landscape

3.3.2.4. Technological landscape

3.3.2.5. Environmental landscape

3.3.2.6. Legal landscape

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increase in prevalence of chronic diseases

3.2.1.2. Rising geriatric population

3.2.1.3. Increasing number of surgical procedures

3.2.1.4. Technological advancements

3.2.2. Market Restraint Analysis

3.2.2.1. Lack of skilled professionals

3.2.2.2. Risk of medical negligence

3.3. Surgical Instruments and Consumables Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic landscape

3.3.2.3. Social landscape

3.3.2.4. Technological landscape

3.3.2.5. Environmental landscape

3.3.2.6. Legal landscape

Chapter 4. Surgical Instruments and Consumables Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Surgical Instruments and Consumables Market: Product Movement Analysis

4.3. Surgical Instruments and Consumables Market by Product Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5. Surgical instruments

4.5.1. Surgical instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1. Open instruments

4.5.1.1.1. Open Instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.2. Forceps

4.5.1.1.2.1. Forceps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.3. Retractors

4.5.1.1.3.1. Retractors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.4. Dilators

4.5.1.1.4.1. Dilators Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.5. Graspers

4.5.1.1.5.1. Graspers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.6. Scalpels

4.5.1.1.6.1. Scalpels Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.7. Cannulas

4.5.1.1.7.1. Cannulas Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.8. Dermatomes

4.5.1.1.8.1. Dermatomes Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.9. Kerrison Rongeurs

4.5.1.1.9.1. Kerrison Rongeurs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.10. Others

4.5.1.1.10.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2. Laparoscopic Instruments

4.5.1.2.1. Laparoscopic Instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.2. Laparoscopic Needle Holders

4.5.1.2.2.1. Laparoscopic Needle Holders Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.3. Laparoscopic Scissors

4.5.1.2.3.1. Laparoscopic Scissors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.4. Laparoscopic Graspers

4.5.1.2.4.1. Laparoscopic Graspers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.5. Laparoscopic Forceps

4.5.1.2.5.1. Laparoscopic Forceps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.6. Laparoscopic Dissectors

4.5.1.2.6.1. Laparoscopic Dissectors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.7. Laparoscopic Retractors

4.5.1.2.7.1. Laparoscopic Retractors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.8. Laparoscopic Trocars

4.5.1.2.8.1. Laparoscopic Trocars Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.9. Others

4.5.1.2.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Consumables

4.6.1. Consumables Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.1. Sterilization Containers

4.6.1.1.1. Sterilization Containers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.1.2. Perforated

4.6.1.1.2.1. Perforated Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.1.3. Non-perforated

4.6.1.1.3.1. Non-Perforated Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.2. Accessories

4.6.1.2.1. Accessories Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.2. Surgical Instruments and Consumables Market: Product Movement Analysis

4.3. Surgical Instruments and Consumables Market by Product Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5. Surgical instruments

4.5.1. Surgical instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1. Open instruments

4.5.1.1.1. Open Instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.2. Forceps

4.5.1.1.2.1. Forceps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.3. Retractors

4.5.1.1.3.1. Retractors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.4. Dilators

4.5.1.1.4.1. Dilators Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.5. Graspers

4.5.1.1.5.1. Graspers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.6. Scalpels

4.5.1.1.6.1. Scalpels Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.7. Cannulas

4.5.1.1.7.1. Cannulas Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.8. Dermatomes

4.5.1.1.8.1. Dermatomes Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.9. Kerrison Rongeurs

4.5.1.1.9.1. Kerrison Rongeurs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1.10. Others

4.5.1.1.10.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2. Laparoscopic Instruments

4.5.1.2.1. Laparoscopic Instruments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.2. Laparoscopic Needle Holders

4.5.1.2.2.1. Laparoscopic Needle Holders Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.3. Laparoscopic Scissors

4.5.1.2.3.1. Laparoscopic Scissors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.4. Laparoscopic Graspers

4.5.1.2.4.1. Laparoscopic Graspers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.5. Laparoscopic Forceps

4.5.1.2.5.1. Laparoscopic Forceps Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.6. Laparoscopic Dissectors

4.5.1.2.6.1. Laparoscopic Dissectors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.7. Laparoscopic Retractors

4.5.1.2.7.1. Laparoscopic Retractors Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.8. Laparoscopic Trocars

4.5.1.2.8.1. Laparoscopic Trocars Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2.9. Others

4.5.1.2.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Consumables

4.6.1. Consumables Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.1. Sterilization Containers

4.6.1.1.1. Sterilization Containers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.1.2. Perforated

4.6.1.1.2.1. Perforated Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.1.3. Non-perforated

4.6.1.1.3.1. Non-Perforated Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6.1.2. Accessories

4.6.1.2.1. Accessories Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Surgical Instruments and Consumables Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Surgical Instruments and Consumables Market: Application Movement Analysis

5.3. Surgical Instruments and Consumables Market by Application Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5. Bariatric Surgery

5.5.1. Bariatric Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Urological Surgery

5.6.1. Urological Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Gynecological Surgery

5.7.1. Gynecological Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. General Surgery

5.8.1. General Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.9. Colorectal Surgery

5.9.1. Colorectal Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.10. Neurosurgery Surgery

5.10.1. Neurosurgery Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.11. Plastic Surgery

5.11.1. Plastic Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.12. Cardiac Surgery

5.12.1. Cardiac Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.13. Others

5.13.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.2. Surgical Instruments and Consumables Market: Application Movement Analysis

5.3. Surgical Instruments and Consumables Market by Application Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5. Bariatric Surgery

5.5.1. Bariatric Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Urological Surgery

5.6.1. Urological Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Gynecological Surgery

5.7.1. Gynecological Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. General Surgery

5.8.1. General Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.9. Colorectal Surgery

5.9.1. Colorectal Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.10. Neurosurgery Surgery

5.10.1. Neurosurgery Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.11. Plastic Surgery

5.11.1. Plastic Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.12. Cardiac Surgery

5.12.1. Cardiac Surgery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.13. Others

5.13.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Surgical Instruments and Consumables Market: End-Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Surgical Instruments and Consumables Market: End-Use Movement Analysis

6.3. Surgical Instruments and Consumables Market by End-Use Outlook (USD Million)

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.5. Hospitals

6.5.1. Hospitals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Clinics

6.6.1. Clinics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Ambulatory surgery centers

6.7.1. Ambulatory Surgical Centers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.8. Others

6.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.2. Surgical Instruments and Consumables Market: End-Use Movement Analysis

6.3. Surgical Instruments and Consumables Market by End-Use Outlook (USD Million)

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.5. Hospitals

6.5.1. Hospitals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Clinics

6.6.1. Clinics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Ambulatory surgery centers

6.7.1. Ambulatory Surgical Centers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.8. Others

6.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Surgical Instruments and Consumables Market: Regional Estimates & Trend Analysis

7.1. Regional Dashboard

7.2. Regional Surgical Instruments and Consumables Market movement analysis

7.3. Surgical Instruments and Consumables Market: Regional Estimates & Trend Analysis by Technology & End-use

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.5. North America

7.5.1. North America Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.2. U.S.

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Regulatory Framework

7.5.2.4. Reimbursement scenario

7.5.2.5. U.S. Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.3. Canada

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Framework

7.5.3.4. Reimbursement scenario

7.5.3.5. Canada Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.4. Mexico

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Framework

7.5.4.4. Reimbursement scenario

7.5.4.5. Mexico Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.5. Europe

7.5.6. Europe Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.7. UK

7.5.7.1. Key Country Dynamics

7.5.7.2. Competitive Scenario

7.5.7.3. Regulatory Framework

7.5.7.4. Reimbursement scenario

7.5.7.5. UK Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.8. Germany

7.5.8.1. Key Country Dynamics

7.5.8.2. Competitive Scenario

7.5.8.3. Regulatory Framework

7.5.8.4. Reimbursement scenario

7.5.8.5. Germany Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.9. France

7.5.9.1. Key Country Dynamics

7.5.9.2. Competitive Scenario

7.5.9.3. Regulatory Framework

7.5.9.4. Reimbursement scenario

7.5.9.5. France Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.10. Italy

7.5.10.1. Key Country Dynamics

7.5.10.2. Competitive Scenario

7.5.10.3. Regulatory Framework

7.5.10.4. Reimbursement scenario

7.5.10.5. Italy Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.11. Spain

7.5.11.1. Key Country Dynamics

7.5.11.2. Competitive Scenario

7.5.11.3. Regulatory Framework

7.5.11.4. Reimbursement scenario

7.5.11.5. Spain Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.12. Denmark

7.5.12.1. Key Country Dynamics

7.5.12.2. Competitive Scenario

7.5.12.3. Regulatory Framework

7.5.12.4. Reimbursement scenario

7.5.12.5. Denmark Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.13. Sweden

7.5.13.1. Key Country Dynamics

7.5.13.2. Competitive Scenario

7.5.13.3. Regulatory Framework

7.5.13.4. Reimbursement scenario

7.5.13.5. Sweden Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.14. Norway

7.5.14.1. Key Country Dynamics

7.5.14.2. Competitive Scenario

7.5.14.3. Regulatory Framework

7.5.14.4. Reimbursement scenario

7.5.14.5. Norway Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Asia Pacific

7.6.1. Asia Pacific Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.2. Japan

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Regulatory Framework

7.6.2.4. Reimbursement scenario

7.6.2.5. Japan Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.3. China

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Framework

7.6.3.4. Reimbursement scenario

7.6.3.5. China Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.4. India

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Regulatory Framework

7.6.4.4. Reimbursement scenario

7.6.4.5. India Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.5. South Korea

7.6.5.1. Key Country Dynamics

7.6.5.2. Competitive Scenario

7.6.5.3. Regulatory Framework

7.6.5.4. Reimbursement scenario

7.6.5.5. South Korea Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.6. Australia

7.6.6.1. Key Country Dynamics

7.6.6.2. Competitive Scenario

7.6.6.3. Regulatory Framework

7.6.6.4. Reimbursement scenario

7.6.6.5. Australia Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.7. Thailand

7.6.7.1. Key Country Dynamics

7.6.7.2. Competitive Scenario

7.6.7.3. Regulatory Framework

7.6.7.4. Reimbursement scenario

7.6.7.5. Thailand Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Latin America

7.7.1. Latin America Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.2. Brazil

7.7.2.1. Key Country Dynamics

7.7.2.2. Competitive Scenario

7.7.2.3. Regulatory Framework

7.7.2.4. Reimbursement scenario

7.7.2.5. Brazil Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.3. Argentina

7.7.3.1. Key Country Dynamics

7.7.3.2. Competitive Scenario

7.7.3.3. Regulatory Framework

7.7.3.4. Reimbursement scenario

7.7.3.5. Argentina Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8. Middle East & Africa

7.8.1. Middle East & Africa Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.2. South Africa

7.8.2.1. Key Country Dynamics

7.8.2.2. Competitive Scenario

7.8.2.3. Regulatory Framework

7.8.2.4. Reimbursement scenario

7.8.2.5. South Africa Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.3. Saudi Arabia

7.8.3.1. Key Country Dynamics

7.8.3.2. Competitive Scenario

7.8.3.3. Regulatory Framework

7.8.3.4. Reimbursement scenario

7.8.3.5. Saudi Arabia Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.4. UAE

7.8.4.1. Key Country Dynamics

7.8.4.2. Competitive Scenario

7.8.4.3. Regulatory Framework

7.8.4.4. Reimbursement scenario

7.8.4.5. UAE Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.5. Kuwait

7.8.5.1. Key Country Dynamics

7.8.5.2. Competitive Scenario

7.8.5.3. Regulatory Framework

7.8.5.4. Reimbursement scenario

7.8.5.5. Kuwait Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.2. Regional Surgical Instruments and Consumables Market movement analysis

7.3. Surgical Instruments and Consumables Market: Regional Estimates & Trend Analysis by Technology & End-use

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.5. North America

7.5.1. North America Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.2. U.S.

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Regulatory Framework

7.5.2.4. Reimbursement scenario

7.5.2.5. U.S. Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.3. Canada

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Framework

7.5.3.4. Reimbursement scenario

7.5.3.5. Canada Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.4. Mexico

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Framework

7.5.4.4. Reimbursement scenario

7.5.4.5. Mexico Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.5. Europe

7.5.6. Europe Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.7. UK

7.5.7.1. Key Country Dynamics

7.5.7.2. Competitive Scenario

7.5.7.3. Regulatory Framework

7.5.7.4. Reimbursement scenario

7.5.7.5. UK Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.8. Germany

7.5.8.1. Key Country Dynamics

7.5.8.2. Competitive Scenario

7.5.8.3. Regulatory Framework

7.5.8.4. Reimbursement scenario

7.5.8.5. Germany Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.9. France

7.5.9.1. Key Country Dynamics

7.5.9.2. Competitive Scenario

7.5.9.3. Regulatory Framework

7.5.9.4. Reimbursement scenario

7.5.9.5. France Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.10. Italy

7.5.10.1. Key Country Dynamics

7.5.10.2. Competitive Scenario

7.5.10.3. Regulatory Framework

7.5.10.4. Reimbursement scenario

7.5.10.5. Italy Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.11. Spain

7.5.11.1. Key Country Dynamics

7.5.11.2. Competitive Scenario

7.5.11.3. Regulatory Framework

7.5.11.4. Reimbursement scenario

7.5.11.5. Spain Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.12. Denmark

7.5.12.1. Key Country Dynamics

7.5.12.2. Competitive Scenario

7.5.12.3. Regulatory Framework

7.5.12.4. Reimbursement scenario

7.5.12.5. Denmark Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.13. Sweden

7.5.13.1. Key Country Dynamics

7.5.13.2. Competitive Scenario

7.5.13.3. Regulatory Framework

7.5.13.4. Reimbursement scenario

7.5.13.5. Sweden Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5.14. Norway

7.5.14.1. Key Country Dynamics

7.5.14.2. Competitive Scenario

7.5.14.3. Regulatory Framework

7.5.14.4. Reimbursement scenario

7.5.14.5. Norway Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Asia Pacific

7.6.1. Asia Pacific Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.2. Japan

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Regulatory Framework

7.6.2.4. Reimbursement scenario

7.6.2.5. Japan Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.3. China

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Framework

7.6.3.4. Reimbursement scenario

7.6.3.5. China Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.4. India

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Regulatory Framework

7.6.4.4. Reimbursement scenario

7.6.4.5. India Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.5. South Korea

7.6.5.1. Key Country Dynamics

7.6.5.2. Competitive Scenario

7.6.5.3. Regulatory Framework

7.6.5.4. Reimbursement scenario

7.6.5.5. South Korea Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.6. Australia

7.6.6.1. Key Country Dynamics

7.6.6.2. Competitive Scenario

7.6.6.3. Regulatory Framework

7.6.6.4. Reimbursement scenario

7.6.6.5. Australia Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6.7. Thailand

7.6.7.1. Key Country Dynamics

7.6.7.2. Competitive Scenario

7.6.7.3. Regulatory Framework

7.6.7.4. Reimbursement scenario

7.6.7.5. Thailand Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Latin America

7.7.1. Latin America Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.2. Brazil

7.7.2.1. Key Country Dynamics

7.7.2.2. Competitive Scenario

7.7.2.3. Regulatory Framework

7.7.2.4. Reimbursement scenario

7.7.2.5. Brazil Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7.3. Argentina

7.7.3.1. Key Country Dynamics

7.7.3.2. Competitive Scenario

7.7.3.3. Regulatory Framework

7.7.3.4. Reimbursement scenario

7.7.3.5. Argentina Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8. Middle East & Africa

7.8.1. Middle East & Africa Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.2. South Africa

7.8.2.1. Key Country Dynamics

7.8.2.2. Competitive Scenario

7.8.2.3. Regulatory Framework

7.8.2.4. Reimbursement scenario

7.8.2.5. South Africa Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.3. Saudi Arabia

7.8.3.1. Key Country Dynamics

7.8.3.2. Competitive Scenario

7.8.3.3. Regulatory Framework

7.8.3.4. Reimbursement scenario

7.8.3.5. Saudi Arabia Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.4. UAE

7.8.4.1. Key Country Dynamics

7.8.4.2. Competitive Scenario

7.8.4.3. Regulatory Framework

7.8.4.4. Reimbursement scenario

7.8.4.5. UAE Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8.5. Kuwait

7.8.5.1. Key Country Dynamics

7.8.5.2. Competitive Scenario

7.8.5.3. Regulatory Framework

7.8.5.4. Reimbursement scenario

7.8.5.5. Kuwait Surgical Instruments and Consumables Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Market Participant Categorization

8.2. Key Company Profiles

8.2.1. Integra Lifesciences Corporation

8.2.1.1. Company overview

8.2.1.2. Financial performance

8.2.1.3. Product benchmarking

8.2.1.4. Strategic initiatives

8.2.2. B.Braun Melsungen AG

8.2.2.1. Company overview

8.2.2.2. Financial performance

8.2.2.3. Product benchmarking

8.2.2.4. Strategic initiatives

8.2.3. Medtronic, plc.

8.2.3.1. Company overview

8.2.3.2. Financial performance

8.2.3.3. Product benchmarking

8.2.3.4. Strategic initiatives

8.2.4. Johnson & Johnson Services, Inc

8.2.4.1. Company overview

8.2.4.2. Financial performance

8.2.4.3. Product benchmarking

8.2.4.4. Strategic initiatives

8.2.5. STERIS

8.2.5.1. Company overview

8.2.5.2. Financial performance

8.2.5.3. Product benchmarking

8.2.5.4. Strategic initiatives

8.2.6. Richard Wolf GmbH

8.2.6.1. Company overview

8.2.6.2. Financial performance

8.2.6.3. Product benchmarking

8.2.6.4. Strategic initiatives

8.2.7. Stryker

8.2.7.1. Company overview

8.2.7.2. Financial performance

8.2.7.3. Product benchmarking

8.2.7.4. Strategic initiatives

8.2.8. Aspen Surgical

8.2.8.1. Company overview

8.2.8.2. Financial performance

8.2.8.3. Product benchmarking

8.2.8.4. Strategic initiatives

8.2.9. Karl Storz Se & Co. Kg

8.2.9.1. Company overview

8.2.9.2. Financial performance

8.2.9.3. Product benchmarking

8.2.9.4. Strategic initiatives

8.2.10. KLS Martin Group

8.2.10.1. Company overview

8.2.10.2. Financial performance

8.2.10.3. Product benchmarking

8.2.10.4. Strategic initiatives

8.2.11. Medline Industries

8.2.11.1. Company overview

8.2.11.2. Financial performance

8.2.11.3. Product benchmarking

8.2.11.4. Strategic initiatives

8.2. Key Company Profiles

8.2.1. Integra Lifesciences Corporation

8.2.1.1. Company overview

8.2.1.2. Financial performance

8.2.1.3. Product benchmarking

8.2.1.4. Strategic initiatives

8.2.2. B.Braun Melsungen AG

8.2.2.1. Company overview

8.2.2.2. Financial performance

8.2.2.3. Product benchmarking

8.2.2.4. Strategic initiatives

8.2.3. Medtronic, plc.

8.2.3.1. Company overview

8.2.3.2. Financial performance

8.2.3.3. Product benchmarking

8.2.3.4. Strategic initiatives

8.2.4. Johnson & Johnson Services, Inc

8.2.4.1. Company overview

8.2.4.2. Financial performance

8.2.4.3. Product benchmarking

8.2.4.4. Strategic initiatives

8.2.5. STERIS

8.2.5.1. Company overview

8.2.5.2. Financial performance

8.2.5.3. Product benchmarking

8.2.5.4. Strategic initiatives

8.2.6. Richard Wolf GmbH

8.2.6.1. Company overview

8.2.6.2. Financial performance

8.2.6.3. Product benchmarking

8.2.6.4. Strategic initiatives

8.2.7. Stryker

8.2.7.1. Company overview

8.2.7.2. Financial performance

8.2.7.3. Product benchmarking

8.2.7.4. Strategic initiatives

8.2.8. Aspen Surgical

8.2.8.1. Company overview

8.2.8.2. Financial performance

8.2.8.3. Product benchmarking

8.2.8.4. Strategic initiatives

8.2.9. Karl Storz Se & Co. Kg

8.2.9.1. Company overview

8.2.9.2. Financial performance

8.2.9.3. Product benchmarking

8.2.9.4. Strategic initiatives

8.2.10. KLS Martin Group

8.2.10.1. Company overview

8.2.10.2. Financial performance

8.2.10.3. Product benchmarking

8.2.10.4. Strategic initiatives

8.2.11. Medline Industries

8.2.11.1. Company overview

8.2.11.2. Financial performance

8.2.11.3. Product benchmarking

8.2.11.4. Strategic initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Global surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 4 Global surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 5 Global surgical instruments and consumables market, by end-use (USD Million) 2018 - 2030

Table 6 North America surgical instruments and consumables market, by region, 2018 - 2030 (USD Million)

Table 7 North America surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 8 North America surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 9 North America surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 10 U.S. surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 11 U.S. surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 12 U.S. surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 13 Canada surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 14 Canada surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 15 Canada surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 16 Mexico surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 17 Mexico surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 18 Mexico surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 19 Europe surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 20 Europe surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 21 Europe surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 22 Europe surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 23 UK surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 24 UK surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 25 UK surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 26 Germany surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 27 Germany surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 28 Germany surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 29 France surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 30 France surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 31 France surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 32 Italy surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 33 Italy surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 34 Italy surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 35 Spain surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 36 Spain surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 37 Spain surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 38 Norway surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 39 Norway surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 40 Norway surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 41 Sweden surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 42 Sweden surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 43 Sweden surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 44 Denmark surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 45 Denmark surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 46 Denmark surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 47 Asia Pacific surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 48 Asia Pacific surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 49 Asia Pacific surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 50 Asia Pacific surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 51 Japan surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 52 Japan surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 53 Japan surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 54 China surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 55 China surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 56 China surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 57 India surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 58 India surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 59 India surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 60 Australia surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 61 Australia surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 62 Australia surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 63 South Korea surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 64 South Korea surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 65 South Korea surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 66 Thailand surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 67 Thailand surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 68 Thailand surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 69 Latin America surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 70 Latin America surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 71 Latin America surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 72 Latin America surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 73 Brazil surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 74 Brazil surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 75 Brazil surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 76 Argentina surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 77 Argentina surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 78 Argentina surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 79 Middle East & Africa surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 80 Middle East & Africa surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 81 Middle East & Africa surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 82 Middle East & Africa surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 83 South Africa surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 84 South Africa surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 85 South Africa surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 86 Saudi Arabia surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 89 UAE surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 90 UAE surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 91 UAE surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 92 Kuwait surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 93 Kuwait surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 94 Kuwait surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 2 List of Abbreviations

Table 3 Global surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 4 Global surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 5 Global surgical instruments and consumables market, by end-use (USD Million) 2018 - 2030

Table 6 North America surgical instruments and consumables market, by region, 2018 - 2030 (USD Million)

Table 7 North America surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 8 North America surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 9 North America surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 10 U.S. surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 11 U.S. surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 12 U.S. surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 13 Canada surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 14 Canada surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 15 Canada surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 16 Mexico surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 17 Mexico surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 18 Mexico surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 19 Europe surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 20 Europe surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 21 Europe surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 22 Europe surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 23 UK surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 24 UK surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 25 UK surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 26 Germany surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 27 Germany surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 28 Germany surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 29 France surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 30 France surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 31 France surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 32 Italy surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 33 Italy surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 34 Italy surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 35 Spain surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 36 Spain surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 37 Spain surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 38 Norway surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 39 Norway surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 40 Norway surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 41 Sweden surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 42 Sweden surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 43 Sweden surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 44 Denmark surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 45 Denmark surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 46 Denmark surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 47 Asia Pacific surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 48 Asia Pacific surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 49 Asia Pacific surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 50 Asia Pacific surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 51 Japan surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 52 Japan surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 53 Japan surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 54 China surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 55 China surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 56 China surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 57 India surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 58 India surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 59 India surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 60 Australia surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 61 Australia surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 62 Australia surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 63 South Korea surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 64 South Korea surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 65 South Korea surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 66 Thailand surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 67 Thailand surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 68 Thailand surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 69 Latin America surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 70 Latin America surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 71 Latin America surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 72 Latin America surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 73 Brazil surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 74 Brazil surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 75 Brazil surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 76 Argentina surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 77 Argentina surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 78 Argentina surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 79 Middle East & Africa surgical instruments and consumables market, by country, 2018 - 2030 (USD Million)

Table 80 Middle East & Africa surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 81 Middle East & Africa surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 82 Middle East & Africa surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 83 South Africa surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 84 South Africa surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 85 South Africa surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 86 Saudi Arabia surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 89 UAE surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 90 UAE surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 91 UAE surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

Table 92 Kuwait surgical instruments and consumables market, by product, 2018 - 2030 (USD Million)

Table 93 Kuwait surgical instruments and consumables market, by application, 2018 - 2030 (USD Million)

Table 94 Kuwait surgical instruments and consumables market, by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Surgical instruments and consumables market segmentation

Fig. 7 Market driver analysis (Current & future impact)

Fig. 8 Market restraint analysis (Current & future impact)

Fig. 9 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 10 Porter’s Five Forces Analysis

Fig. 11 Surgical instruments market, product outlook key takeaways (USD Million)

Fig. 12 Surgical instruments market product movement analysis (USD Million), 2023 & 2030

Fig. 13 Forceps market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 14 Retractors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 15 Dilators market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 16 Graspers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 17 Scalpels market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 18 Cannulas market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 19 Dermatomes market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 20 Kerrison rongeurs market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 21 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 22 Laparoscopic instruments market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 23 Laparoscopic needle holders market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 24 Laparoscopic scissors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 25 Laparoscopic graspers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 26 Laparoscopic forceps market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Laparoscopic dissectors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 28 Laparoscopic retractors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Laparoscopic trocars market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 31 Consumables market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Sterilization containers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 33 Perforated market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 34 Non perforated market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Accessories market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Surgical instruments and consumables market, application outlook key takeaways (USD Million)

Fig. 37 Surgical instruments and consumables market application movement analysis (USD Million), 2023 & 2030

Fig. 38 Bariatric surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 Urological surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 Gynecological surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 41 General surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 Colorectal surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Neurosurgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 Plastic surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 Cardiac surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Surgical instruments and consumables market, end use outlook key takeaways (USD Million)

Fig. 48 Surgical instruments and consumables market end use movement analysis (USD Million), 2023 & 2030

Fig. 49 Hospitals market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 Clinics market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 Ambulatory surgery centers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Surgical instruments and consumables market: Regional key takeaways (USD Million)

Fig. 54 Surgical instruments and consumables market regional outlook, 2023 & 2030, USD Million

Fig. 55 North America surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 U.S. surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 Canada surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 Mexico surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Europe surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 UK surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Germany surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 France surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 63 Spain surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 64 Italy surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 65 Sweden surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 66 Norway surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 67 Denmark surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 68 Asia Pacific surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 69 China surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 70 Japan surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 71 India surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 72 South Korea surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 73 Australia surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 74 Thailand surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 75 Latin America surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 76 Brazil surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 77 Argentina surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 78 Middle East and Africa surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 79 South Africa surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 80 Saudi Arabia surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 81 UAE surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 82 Kuwait surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 83 List of key emerging company’s/application disruptors/innovators

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Surgical instruments and consumables market segmentation

Fig. 7 Market driver analysis (Current & future impact)

Fig. 8 Market restraint analysis (Current & future impact)

Fig. 9 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 10 Porter’s Five Forces Analysis

Fig. 11 Surgical instruments market, product outlook key takeaways (USD Million)

Fig. 12 Surgical instruments market product movement analysis (USD Million), 2023 & 2030

Fig. 13 Forceps market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 14 Retractors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 15 Dilators market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 16 Graspers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 17 Scalpels market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 18 Cannulas market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 19 Dermatomes market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 20 Kerrison rongeurs market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 21 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 22 Laparoscopic instruments market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 23 Laparoscopic needle holders market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 24 Laparoscopic scissors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 25 Laparoscopic graspers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 26 Laparoscopic forceps market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Laparoscopic dissectors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 28 Laparoscopic retractors market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Laparoscopic trocars market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 31 Consumables market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Sterilization containers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 33 Perforated market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 34 Non perforated market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Accessories market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Surgical instruments and consumables market, application outlook key takeaways (USD Million)

Fig. 37 Surgical instruments and consumables market application movement analysis (USD Million), 2023 & 2030

Fig. 38 Bariatric surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 Urological surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 Gynecological surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 41 General surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 Colorectal surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Neurosurgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 Plastic surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 Cardiac surgery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Surgical instruments and consumables market, end use outlook key takeaways (USD Million)

Fig. 48 Surgical instruments and consumables market end use movement analysis (USD Million), 2023 & 2030

Fig. 49 Hospitals market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 Clinics market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 Ambulatory surgery centers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Surgical instruments and consumables market: Regional key takeaways (USD Million)

Fig. 54 Surgical instruments and consumables market regional outlook, 2023 & 2030, USD Million

Fig. 55 North America surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 U.S. surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 Canada surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 Mexico surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Europe surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 UK surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Germany surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 France surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 63 Spain surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 64 Italy surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 65 Sweden surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 66 Norway surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 67 Denmark surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 68 Asia Pacific surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 69 China surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 70 Japan surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 71 India surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 72 South Korea surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 73 Australia surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 74 Thailand surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 75 Latin America surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 76 Brazil surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 77 Argentina surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 78 Middle East and Africa surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 79 South Africa surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 80 Saudi Arabia surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 81 UAE surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 82 Kuwait surgical instruments and consumables market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 83 List of key emerging company’s/application disruptors/innovators

Companies Mentioned

The leading players in the Surgical Instruments and Consumables market include:- Integra Lifesciences Corporation

- B.Braun Melsungen AG

- Medtronic, plc.

- Johnson & Johnson Services, Inc.

- STERIS

- Richard Wolf GmbH

- Stryker

- Aspen Surgical

- Karl Storz Se & Co. Kg

- KLS Martin Group

- Medline Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 230 |

| Published | September 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 6.73 Billion |

| Forecasted Market Value ( USD | $ 10.78 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |